Study sheds light on how gold reaches the Earth’s surface

Mike Maharrey - MoneyMetals.com | December 31, 2024 |

A close-up of a gold vein exposed in a mine shaft wall. Stock image.

Did you know gold is more plentiful than lead when you analyze the bulk composition of the Earth?

You’re probably thinking, ‘Wait a minute, I thought gold was rare!’

Well, you’re right!

Confused?

Let me explain.

Most of Earth’s gold is locked up in the mantle, the thick, middle layer of the planet located between the crust and the outer core. Pure gold in the mantle tends to stay there. In other words, the gold is there, but it is inaccessible.

But some of the gold is constantly working its way to the surface where miners can reach it.

This process is something of a mystery, an international team of researchers has used mathematical modeling to reveal the specific conditions that lead to the enrichment of gold-bearing magma.

This information could help mining companies streamline exploration efforts and cut costs.

Exploration accounts for 10 to 20% of the costs associated with mining gold. Startups and junior miners allocate more toward exploration than larger, more established companies. As of the first quarter of 2024, the average cost of mining an ounce of gold was just under $1,500.

Here’s how Forbes summarized the findings:

“A specific kind of sulfur existing under a very specific set of pressures and temperatures as found at a depth of 50 to 80 kilometers (or 30 to 50 miles) beneath active volcanoes causes gold to be transferred from the mantle into magmas that eventually move to the Earth’s surface.”

In a nutshell, when gold in the mantle is exposed to a fluid containing sulfur, the gold bonds to the sulfur molecules, creating a gold-trisulfur complex. This compound is highly mobile in molten sections of the mantle and can be driven to the surface by geological activity such as volcanoes.

This activity is prominent in what are known as “subduction zones,” areas where one tectonic plate is diving under another.

“On all of the continents around the Pacific Ocean, from New Zealand to Indonesia, the Philippines, Japan, Russia, Alaska, the western United States, and Canada, all the way down to Chile, we have lots of active volcanoes. All of those active volcanoes form over or in a subduction zone environment. The same types of processes that result in volcanic eruptions are processes that form gold deposits,” study co-author Adam Simon said.

“These results provide a really robust understanding of what causes certain subduction zones to produce very gold-rich ore deposits. Combining the results of this study with existing studies ultimately improves our understanding of how gold deposits form and can have a positive impact on exploration.”

According to the World Gold Council, an estimated 212,582 tonnes of gold have been mined throughout history. If every ounce of this gold was melted into a cube, it would only measure around 22 meters on each side.

The US Geological Survey estimates there are about 50,000 tonnes of minable gold in the ground.

So, while gold is plentiful in the earth, it is extremely rare at ground level. That scarcity is one of the characteristics that makes gold so valuable.

Mike Maharrey - MoneyMetals.com | December 31, 2024 |

A close-up of a gold vein exposed in a mine shaft wall. Stock image.

Did you know gold is more plentiful than lead when you analyze the bulk composition of the Earth?

You’re probably thinking, ‘Wait a minute, I thought gold was rare!’

Well, you’re right!

Confused?

Let me explain.

Most of Earth’s gold is locked up in the mantle, the thick, middle layer of the planet located between the crust and the outer core. Pure gold in the mantle tends to stay there. In other words, the gold is there, but it is inaccessible.

But some of the gold is constantly working its way to the surface where miners can reach it.

This process is something of a mystery, an international team of researchers has used mathematical modeling to reveal the specific conditions that lead to the enrichment of gold-bearing magma.

This information could help mining companies streamline exploration efforts and cut costs.

Exploration accounts for 10 to 20% of the costs associated with mining gold. Startups and junior miners allocate more toward exploration than larger, more established companies. As of the first quarter of 2024, the average cost of mining an ounce of gold was just under $1,500.

Here’s how Forbes summarized the findings:

“A specific kind of sulfur existing under a very specific set of pressures and temperatures as found at a depth of 50 to 80 kilometers (or 30 to 50 miles) beneath active volcanoes causes gold to be transferred from the mantle into magmas that eventually move to the Earth’s surface.”

In a nutshell, when gold in the mantle is exposed to a fluid containing sulfur, the gold bonds to the sulfur molecules, creating a gold-trisulfur complex. This compound is highly mobile in molten sections of the mantle and can be driven to the surface by geological activity such as volcanoes.

This activity is prominent in what are known as “subduction zones,” areas where one tectonic plate is diving under another.

“On all of the continents around the Pacific Ocean, from New Zealand to Indonesia, the Philippines, Japan, Russia, Alaska, the western United States, and Canada, all the way down to Chile, we have lots of active volcanoes. All of those active volcanoes form over or in a subduction zone environment. The same types of processes that result in volcanic eruptions are processes that form gold deposits,” study co-author Adam Simon said.

“These results provide a really robust understanding of what causes certain subduction zones to produce very gold-rich ore deposits. Combining the results of this study with existing studies ultimately improves our understanding of how gold deposits form and can have a positive impact on exploration.”

According to the World Gold Council, an estimated 212,582 tonnes of gold have been mined throughout history. If every ounce of this gold was melted into a cube, it would only measure around 22 meters on each side.

The US Geological Survey estimates there are about 50,000 tonnes of minable gold in the ground.

So, while gold is plentiful in the earth, it is extremely rare at ground level. That scarcity is one of the characteristics that makes gold so valuable.

Bloomberg News | December 31, 2024

Bullion bar and coins. (Reference image by Bullion Vault, Flickr.)

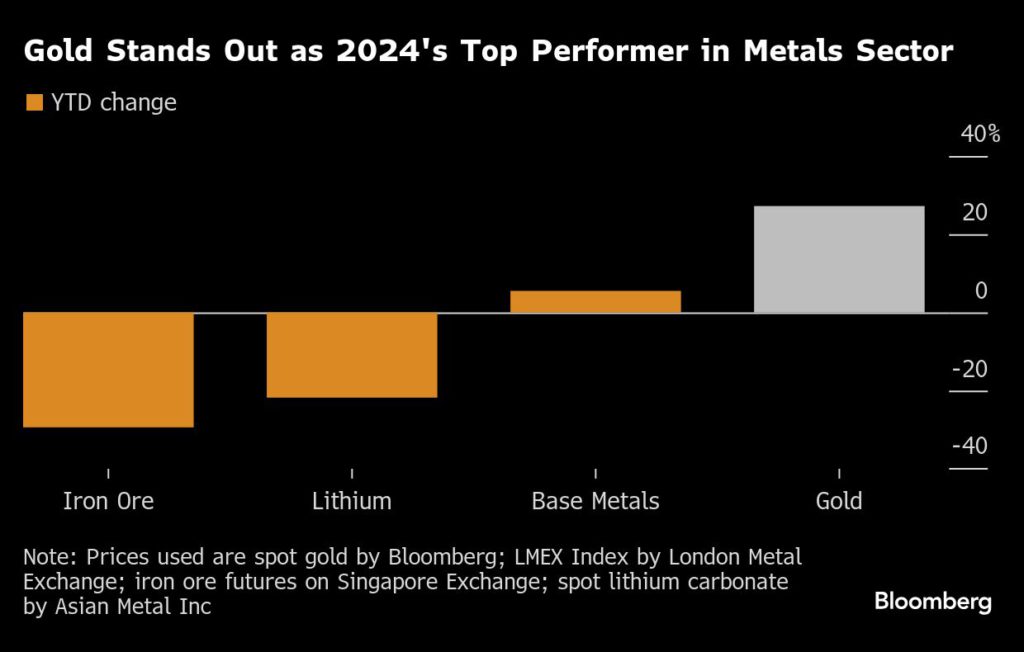

Gold is heading for its biggest gain in 14 years, with a 27% advance fueled by US monetary easing, sustained geopolitical risks and a wave of purchases by central banks.

While bullion has ticked lower since Donald Trump’s sweeping victory in November’s US presidential election, its gains over 2024 still outstrip most other commodities. Base metals have had a mixed year, while iron ore has tumbled and lithium’s woes have deepened.

The varied performances over 2024 highlight the absence of a single, overriding driver that’s steered the complex’s fortunes, while also putting the spotlight on how metals, both base and precious, may fare next year. For 2025, investors are focused on uncertainty around US monetary policy, potential frictions from Trump’s presidency and China’s efforts to revive growth.

Gold’s strong gains this year — which have seen the metal set a succession of records — may signal a possible shift in the market’s dynamics given they have come despite a stronger US dollar and rising real Treasury yields, both typically headwinds.

The precious metal has been “as remarkable as it’s been relentless, making it my biggest market surprise of 2024,” David Scutt, an analyst at StoneX Group Inc. said in a note. “The gold game looks to have changed.”

Other metals have struggled in large part because of China’s prolonged economic slowdown.The LMEX Index of six metals on the London Metal Exchange is on track for a modest annual gain, with softer Chinese demand offset by flashes of supply stress — especially in copper and zinc — that may linger into 2025.

Iron ore has slumped as weak construction activity plunged China’s steel industry into crisis mode, with little relief in sight. Futures in Singapore fell about 28% this year, the biggest annual drop since 2015.

Lithium — used to make batteries — is on track for a second steep annual decline as a serious and ongoing global supply glut was compounded by turbulence for the electric-vehicle industry.

In Tuesday’s trading, spot gold rose 0.7% to $2,623.97 an ounce as of 10:40 a.m. in New York, compared with an October peak above $2,790; iron ore futures settled 0.4% higher at $100.97 a ton; and LME copper fell 1.1% to $8,814.00 a ton in London.

No comments:

Post a Comment