H2 TRANSPORTATION LOGISTICS

Great Wall Motor delivers 100 hydrogen trucks in China

© FTXT Energy Technology

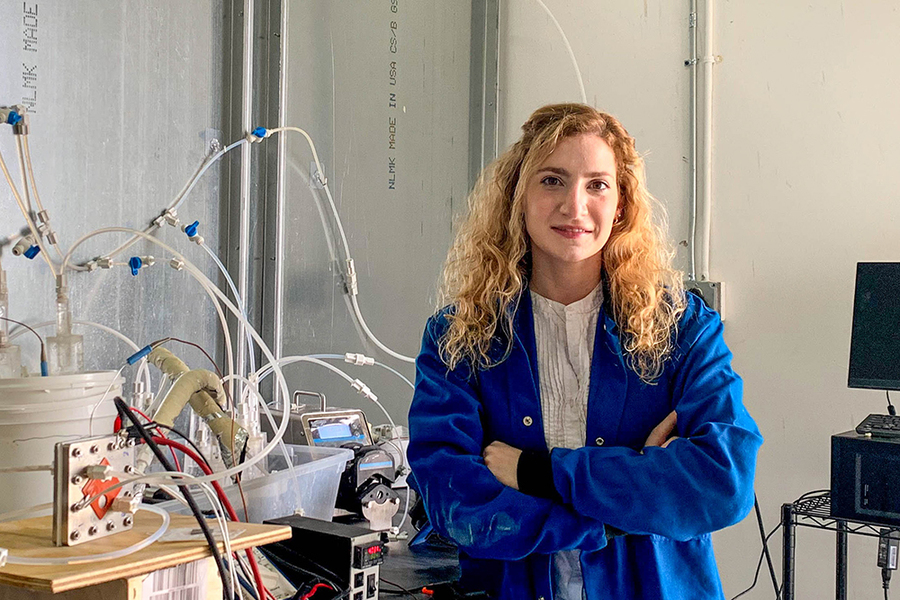

By Molly Burgesson Aug 23, 2021

AVL List GmbH - Official Sponsors of H2 View's Mobility Content

A fleet of 100 hydrogen-powered trucks have been delivered for the Xiong’an New Area construction project in Hebei Province, China.

FTXT Energy Technology, a subsidiary of Great Wall Motor (GWM), along with partners Dayun, Dongfeng and Foton, today (August 23) handed over the fleet to help promote a green hydrogen transportation network nationwide.

Each of the trucks are fitted with 111kW hydrogen fuel cell engines, hydrogen stacks and hydrogen storage – all of which was boasted when the vehicles were unveiled the Great Wall Technology Centre.

Once operational the trucks will be refuelled at ten already developed service stations that are fitted with hydrogen stations.

It’s not just how green the vehicles are that is a bonus, however, the vehicles are thought to be approximately 28% cheaper than its diesel alternatives due to them featuring locally sourced components.

As H2 View heard earlier this year during an exclusive interview, GWM will roll out its first hydrogen-powered SUV this year, and deploy its hydrogen-powered cars during the Winter Olympics in China next year.

On this, Zhang Tianyu, Head of FTXT Energy, said “The technological breakthroughs we have achieved till now, in many ways have helped us to significantly reduce the costs of the final product, as well as ensure high performance, durability, and overall efficiency.”

Great Wall Motor wants to be among the top three hydrogen powertrain suppliers by 2025

© Great Wall Motor

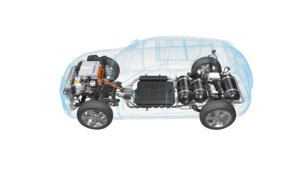

Great Wall Motor (GWM) wants to become a major hydrogen fuel cell vehicle manufacturer globally. The Chinese automaker is planning to launch the world’s first hydrogen-powered sport utility vehicle and produce 100 hydrogen-powered heavy-duty trucks in 2021 – and it’s exactly these medium and large passenger vehicles where GWM sees the most potential for hydrogen fuel cell technology.

“It will be quite difficult for them [battery electric vehicles] to effectively tackle medium and heavy-duty commercial applications in the medium and long-term, and this is where hydrogen has its strong potential as a clean energy carrier,” Will Zhang, Chairman of FTXT Energy, GWM’s hydrogen subsidiary, told H2 View.

GWM, the first Chinese Hydrogen Council member, has already invested ¥2bn ($309m) in hydrogen product and business development, and intends to invest another ¥3bn ($463.6m) over the next three years. By 2025, GWM is aiming to be among the top three hydrogen powertrain suppliers in the world.

“Our intent to invest substantial amount of resources in the development of the hydrogen business vests on our belief that hydrogen energy will indeed occupy a significant share in certain application niches,” Zhang continued.

Continue reading here.

Hyzon Motors has begun shipping hydrogen fuel cell trucks to customers

Image Credits: Hyzon Motors(opens in a new window)

Hydrogen-powered heavy-duty truck company Hyzon Motors said Wednesday it is ramping up operations in the wake of its merger with blank-check firm Decarbonization Plus Acquisition Corp., including shipping its first trucks to European customers.

The company, which reported second-quarter earnings Wednesday, said it is also preparing to start its first customer trials in the United States.

Like other transportation companies that have gone public via a merger with a special purpose acquisition fund, Hyzon doesn’t yet have any revenue to speak of. Instead, Hyzon is banking on the huge injection of capital from the transaction — more than $500 million — and growing customer orders to take it to positive cash flow.

As of now, the company reported a net loss for the quarter of $9.4 million, including $3.5 million in R&D expenses. It had a negative adjusted EBITDA of $9.1 million. The company has $517 million in cash on hand, enough to reach free cash flow by 2024 without having to sell additional equity, Hyzon CFO Mark Gordon said during a second-quarter earnings call.

In addition to manufacturing hydrogen fuel cell powertrains, Hyzon is also investing in hydrogen fuel production hubs, a key piece of infrastructure for technology uptake. In April, the company signed an MOU for a joint venture with renewable fuels company Raven SR for up to 100 hydrogen production hubs. Gordon confirmed the first two will be in the Bay Area.

He also said that the company is on track to deliver 85 fuel cell vehicles by the end of this year, with the company’s first revenue coming next quarter. Orders and memoranda of understanding under contract has grown to $83 million from $55 million as of April, but many of the MOUs are non-binding. An agreement with Austrian grocer MRPEIS for 70 trucks next year is one such example. Similarly, Hyzon faces a slightly uphill battle in terms of technological adoption, as many of their customers have never seen or used a hydrogen fuel-cell vehicle.

“Many customers are getting their hands on the first fuel cell vehicles they’ve ever seen in the next six to 12 months,” CEO Craig Knight said during the call. That is a genuine kind of technology validation process and the customers need to feel comfortable the vehicles function well in their use case.”

While many of Hyzon’s sales are for a small number of trucks, Knight said he sees the purchasing timeline from initial sale to fleet conversion growing shorter — at least in Europe, where there is significantly more hydrogen availability. “Whereas, earlier I would have said, it’s a 12-to-18 month process to go from getting your first fuel cell truck and trying it out and then maybe getting a few more and figuring out what fleet conversion would look like over time, and then kicking off that fleet conversion process — I actually think that’s compressing,” Knight said.

The company is focused mostly on back-to-base operations rather than long-haul freight haulage, as the latter requires a more extensively built-out hydrogen refueling network. The U.S. customer trial with logistics company Total Transport Services Inc. is a high-utilization (trucks can run up to 18-20 hours per day) use case, but the truck will only ever need to access the single refueling station in Wilmington, California. “It’s a good application for hydrogen, and we’re not introducing the complication of having to find hydrogen stations across the country,” Knight said.

Article content

LARBERT, Scotland, Aug. 27, 2021 (GLOBE NEWSWIRE) — (TSX: NFI, OTC: NFYEF) NFI Group Inc. (“NFI” or the “Company”), a leading independent bus and coach manufacturer and a leader in mobility solutions, today announced that NFI subsidiary Alexander Dennis Limited (“ADL”) has been selected by the Liverpool City Region Combined Authority as supplier for 20 zero-emission hydrogen double deck buses following a competitive tendering process. This is the first order for ADL’s H2.0 second-generation hydrogen double deck bus, or ADL Enviro400FCEV.

The 20 ADL Enviro400FCEV buses are being directly purchased through the Liverpool City Region’s Transforming Cities Fund and will be owned by the people of the City Region. The buses will initially serve the City Region’s busiest route, the 10A between St Helens and Liverpool city centre.

The Enviro400FCEV has been developed on the next-generation H2.0 platform and will be powered by a Ballard fuel cell power module through the efficient Voith Electrical Drive System. With hydrogen tanks and key components intelligently packaged by the engineers that developed the market’s widest range of clean buses, the integral vehicle perfectly balances weight and maximises saloon space.

The hydrogen bus project is a key part of Liverpool City Region Metro Mayor Steve Rotheram’s ‘Vision for Bus’, which commits to using the powers available through devolution to build a better, more reliable and affordable bus network for the City Region. Broader plans also include the building of hydrogen refuelling facilities, which will be the first of their kind in the North West, due to begin later in the year.

With the Metro Mayor having set a target for the Liverpool City Region to become net zero carbon by 2040 at the latest – at least a decade before national targets – the hydrogen buses will be an important addition to the region’s existing fleet, which is already more than 70% low emissions.

“82% of all journeys on public transport in our region are taken by bus and this new fleet will give people a clean, green and comfortable way to get about. Reforming our bus network is a massive part of my plan for an integrated London-style transport network that makes traveling around our region quick, cheap and reliable,” said Steve Rotheram, Metro Mayor of the Liverpool City Region. “We want to be doing our bit to tackle climate change and improve air quality across the region too. These buses will be a really important part of making that happen. Alongside the hydrogen refuelling facilities we’re building and some of the other exciting green projects we’re investing in, our region is leading the Green Industrial Revolution.”

“It is an honour to support the Liverpool City Region’s ‘Vision for Bus’ program and its evolution to net zero carbon,” said Paul Soubry, President & Chief Executive Officer, NFI. “NFI and ADL have a history of innovation, and the next generation H2.0 is a showcase of our continued focus on developing the world’s best buses that incorporate clean, connected technology to drive sustainable transportation.”

“With its investment in this new fleet of hydrogen buses, the Combined Authority has chosen the latest in clean technology for the Liverpool City Region. We are delighted they have put their confidence in ADL to deliver their green agenda,” said Paul Davies, ADL President & Managing Director. “Our next generation H2.0 platform builds on 25 years of experience in hydrogen fuel cell technology. Designed and built in Britain, these buses will help to secure skilled jobs and apprenticeships across the bus manufacturing industry which is hugely important as we continue the decarbonisation journey.”

NFI is a leader in zero-emission mobility, with electric vehicles operating (or on order) in more than 80 cities in five countries. Today, NFI supports growing North American cities with scalable, clean, and sustainable mobility solutions through a four-pillar approach that includes buses and coaches, technology, infrastructure, and workforce development. It also operates the Vehicle Innovation Center (“VIC”), the first and only innovation lab of its kind dedicated to advancing bus and coach technology and providing workforce development. Since opening late 2017, the VIC has hosted over 300 interactive events, welcoming 3,000 industry professionals for EV and infrastructure training. For more information, visit newflyer.com/VIC.

About NFI

Leveraging 450 years of combined experience, NFI is leading the electrification of mass mobility around the world. With zero-emission buses and coaches, infrastructure, and technology, NFI meets today’s urban demands for scalable smart mobility solutions. Together, NFI is enabling more livable cities through connected, clean, and sustainable transportation.

With 8,000 team members in nine countries, NFI is a leading global bus manufacturer of mass mobility solutions under the brands New Flyer® (heavy-duty transit buses), MCI® (motor coaches), Alexander Dennis Limited (single and double-deck buses), Plaxton (motor coaches), ARBOC® (low-floor cutaway and medium-duty buses), and NFI Parts™. NFI currently offers the widest range of sustainable drive systems available, including zero-emission electric (trolley, battery, and fuel cell), natural gas, electric hybrid, and clean diesel. In total, NFI supports its installed base of over 105,000 buses and coaches around the world. NFI common shares are traded on the Toronto Stock Exchange under the symbol NFI. News and information is available at www.nfigroup.com, www.newflyer.com, www.mcicoach.com, www.arbocsv.com, www.alexander-dennis.com, and www.nfi.parts.

About Alexander Dennis

Alexander Dennis Limited (“ADL”) is a global leader in the design and manufacture of double deck buses and is also the UK’s largest bus and coach manufacturer. ADL offers single and double deck vehicles under the brands of Alexander Dennis and Plaxton, and has over 31,000 vehicles in service in the UK, Europe, Hong Kong, Singapore, New Zealand, Mexico, Canada and the United States. Further information is available at www.alexander-dennis.com.

Forward-Looking Statements

This press release may contain forward-looking statements relating to expected future events and financial and operating results of NFI that involve risks and uncertainties. Although the forward-looking statements contained in this press release are based upon what management believes to be reasonable assumptions, investors cannot be assured that actual results will be consistent with these forward-looking statements, and the differences may be material. Actual results may differ materially from management expectations as projected in such forward-looking statements for a variety of reasons, including market and general economic conditions and economic conditions of and funding availability for customers to purchase buses and to purchase parts or services, customers may not exercise options to purchase additional buses, the ability of customers to suspend or terminate contracts for convenience and the other risks and uncertainties discussed in the materials filed with the Canadian securities regulatory authorities and available on SEDAR at www.sedar.com. Due to the potential impact of these factors, NFI disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by applicable law.