Chancellor maxes out with morally bankrupt budget that is anything but mini

Casino faith-based economics on which he’d bet the bank. The biggest tax giveaway – primarily to the rich – in 50 years while increasing government borrowing to record levels. Time was when Labour used to get it in the neck for uncosted public borrowing. That’s now so last month.

All you have to do now is believe and everything will be OK. It’s the new economics for Brexit Britain. You want growth, you get growth. And if you don’t, then it will be everyone else’s fault for talking Britain down. The country has just been turned into a laboratory experiment for a plan dreamed up by the rightwing Institute of Economic Affairs. Kwarteng does believe. Primarily in himself. His self-confidence is remarkable for a man of relatively ordinary talents. Someone who had always got by with a few glib words. Who could talk the talk but had never been asked to walk the walk. Now was his time to put up. To throw the country on the sacrificial altar and keep his fingers crossed he hadn’t blown it. To boldly go where no man had gone before. Primarily because it was so obviously disastrous.

But this is the brave new world of Trussonomics.It’s like turning on all the taps at once and being surprised when you flood the house.

The Commons was still packed but this was no normal budget statement. There were no flourishes, no long buildup of how brilliant the government had been. And no loud cheering from the Tory benches. Most MPs looked sick. Apprehensive even. Unsure of how they were going to sell this latest Tory iteration to their constituents. Half of the personal tax cuts going to the richest 5% might not be quite the policy to win the hearts and minds of “red wall” voters.

Kwarteng got straight to business. So much to announce, so little time to do it. Tax was too high! Growth was too low! The government had let the economy stagnate. He wasn’t sure what the government had been in the past 12 years, but he and Librium Liz had definitely played no part in it. Which was odd, as most of us could remember them both having been cabinet ministers who had voted for measures they were now trashing. And who had several times made a point of highlighting the dangers of government debt.

Like Truss, Kwasi is a tabula rasa. Free to reinvent himself, unmoored to the past. “We are at the beginning of a new era,” he said. Weirdly, he even sounded as if he believed it. That people really are ready to forgive and forget. To consider this government as Year Zero rather than the continuation of the several failed ones that preceded it. No one else in the chamber seemed to share this view. Some Tories had the grace to look embarrassed. Librium Liz just looked blank. Then she often does. Maybe she too couldn’t quite accept she was getting away with it.

The chancellor moved on to the remedies. First up was loads more borrowing. He couldn’t say how much. And it would be rude to ask. Then on to deregulation. It must be easier to treat workers worse. After all, if people weren’t earning enough it was entirely their own fault for not having a better-paid job. And what about the poor bankers? They hadn’t been able to afford their second homes while their bonuses had been capped. Time to free the Goldman Sachs elite.

Then Kwarteng got on to tax. There was far too much of it. If he had his way no one would be paying a penny. It would be up to everyone to either sink or swim. There were far too many people idling around, relying on schools and the NHS. But he couldn’t bring himself to cut taxes completely. So he was just going to do so for the most well off. Because that was obviously the fair thing to do.

This was a budget devoid of moral purpose. Even Boris Johnson hadn’t sunk this low. It’s come to something when Kwarteng now finds himself lower on the ethical balance sheet to The Convict. Though it’s all of a piece. Every time you think the government couldn’t possibly sink any lower it finds new, creative ways of doing so.

Labour’s Rachel Reeves put in a decent reply – her highlight was chucking the six previous failed Tory growth plans across the dispatch box and asking why the new one should be any better – but she lacked a bit of edge. Almost as if her whole speech had been pre-written and she wasn’t able to grasp just how reckless the Tories were being. A little more ad-libbing wouldn’t have gone amiss.

For the Tories, only John Redwood and Richard Drax were wholly enthusiastic. This was all their wet dreams come at once. Others, such as Mel Stride and John Glen, were openly sceptical. Of Johnson, Rishi Sunak and Michael Gove, there was no sign. They are now non-people. Long before the end, every Tory MP had melted away and Kwarteng was left to take questions from opposition backbenchers.

The chancellor looked increasingly lost and lonely. His self-confidence had definitely taken a hit over the past two and a half hours. Not least because the markets had responded to his mini-budget with a resounding thumbs down. Not even Kwasi could wholly convince himself now that he knew something no other financial analyst did. Though give him a day or so …

Banks among biggest beneficiaries of Kwarteng’s mini-budget

From scrapping the cap on bonuses to slashing red tape, the chancellor unveils a raft of policies he says will boost economic growth

@kalyeenaFri 23 Sep 2022

Banks will be among the biggest beneficiaries of Kwasi Kwarteng’s mini-budget after he announced a raft of policies to help costs, boost profits, lure staff, fuel house prices and slash red tape.

Scrapping the banker bonus cap

One of the more controversial announcements on Friday was the decision to scrap the EU banker bonus cap, which has limited payouts to two-times workers’ salaries since 2014.

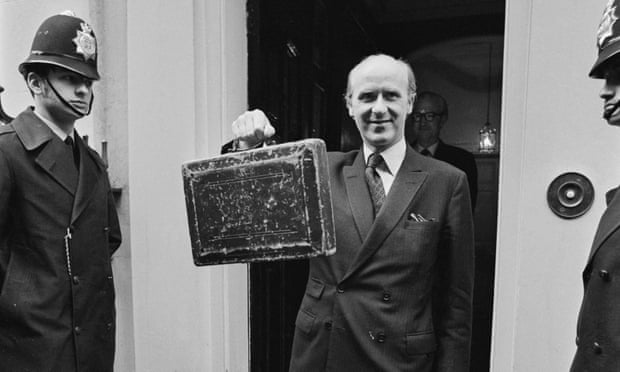

The rules were meant to end a bonus culture that prioritised short-term profits over longer-term stability in the run-up to the financial crisis. But Conservative politicians, including then chancellor George Osborne, railed against the cap from the start, warning it would harm competitiveness and increase banks’ fixed costs.

The new government is taking advantage of Brexit to scrap the cap, in a move likely to be be welcomed by employers who use variable pay to slash costs in slower years.

However, headhunters warn the effect will be marginal and unlikely to create more jobs or lure many high-earning bankers to the UK, given European staff tend to enjoy the reliability of salary-focused income, while US bankers are unlikely to leave New York for the same pay in London.

The decision to lift the cap perplexed some bank bosses who said they had not lobbied for the change, nor were they consulted on the proposals.

In the meantime, high-earning City bankers will still have an income tax reduction to look forward to.

Cutting stamp duty to prop up the housing market

Rising interest rates will boost banks’ net interest margins – which are a key measure of profitability and account for the difference between what is charged for loans and paid out for deposits. Lenders have been accused of being slow to pass on rate rises to savers while increasing mortgage rates for borrowers.

Liz Truss’s team’s decision to incentivise prospective homebuyers by doubling the threshold at which they start paying stamp duty to £250,000 will also prop up the housing market, which has showed signs of slowing. They have also increased that figure from £300,000 to £425,000 for first-time buyers.

Lloyds Banking Group, which owns Halifax and is the UK’s largest mortgage lender, said in July that it expected its rate of lending to grow by single digits over the next 12-18 months in light of forecasts of a soaring interest rate.

However, a cut to stamp duty is likely to push lenders’ forecasts higher when they release third-quarter results in October and increase profit expectations.

Slashing red tape

The chancellor also trailed “an ambitious package of regulatory reforms” that he said would be revealed this autumn. It is unclear whether this will be in addition to the financial services bill, which will essentially repeal EU financial regulations.

Some of the biggest changes already in train involve forcing regulators to consider the “competitiveness” of firms when applying UK regulations, rather than just whether they are treating consumers fairly or holding enough capital to cushion against potential risks. That is despite economists warning it is an inappropriate throwback to pre-crisis conditions.

And despite Kwarteng stressing that he considers the independence of the Bank of England to be “sacrosanct”, the government is still planning to give itself powers “to direct a regulator to make, amend or revoke rules where there are matters of significant public interest” – a move that could also benefit the City firms lobbying for changes to UK rules.

Cancelling corporation tax hikes

Kwarteng also confirmed the government would hold corporation tax at 19%, rather than raising it to 25% as originally planned by the former chancellor Rishi Sunak.

That move alone is expected to save City firms a combined bill of £4.5bn between 2023 and 2025, according to analysis compiled by the House of Commons Library.

However, Kwarteng is cancelling a planned reduction in the additional bank surcharge that was meant to offset the corporation tax rise, meaning it will stay at 8%, rather than dropping to 3% next year. Smaller lenders including the Co-operative Bank will still benefit from a higher threshold, with the chancellor promising the surcharge will only apply to lenders earning at least £100m, rather than £25m.

The combined rate of tax for most banks and building societies, however, will stay at 27%.

Bills freeze to keep companies afloat

Fears of widespread corporate failures among business borrowers were growing, with companies more exposed to price fluctuations than households since they do not benefit from the UK’s energy cap.

But Truss’s decision to cut the unit price of energy for businesses for at least six months means banks will be less worried about businesses going under, shielding them from a potential sharp increase in defaults.