Thu, November 3, 2022

A customer leaves an Albertsons grocery store in Riverside

(Reuters) -A state court in Washington has temporarily blocked Albertsons Companies Inc from paying a $4 billion dividend to shareholders before the grocery chain closes its proposed deal with rival Kroger Co, documents filed said on Thursday.

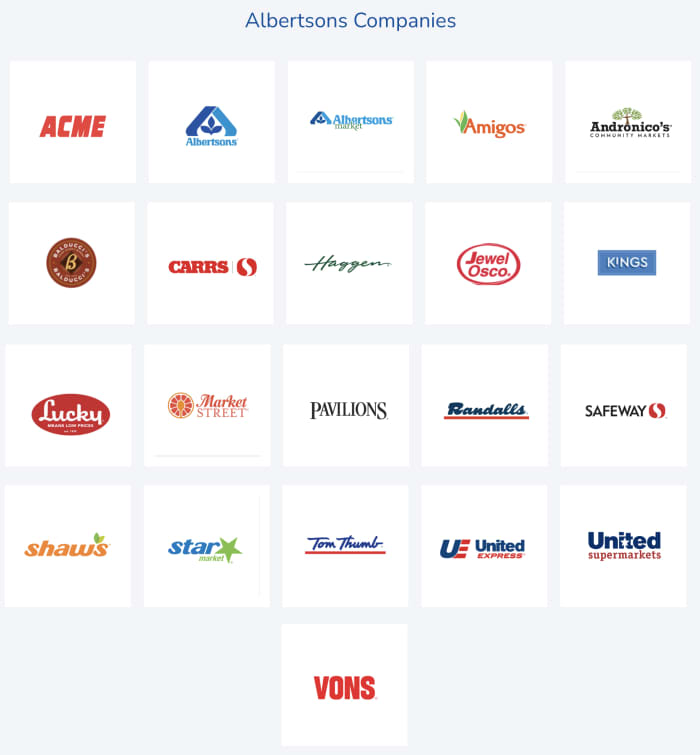

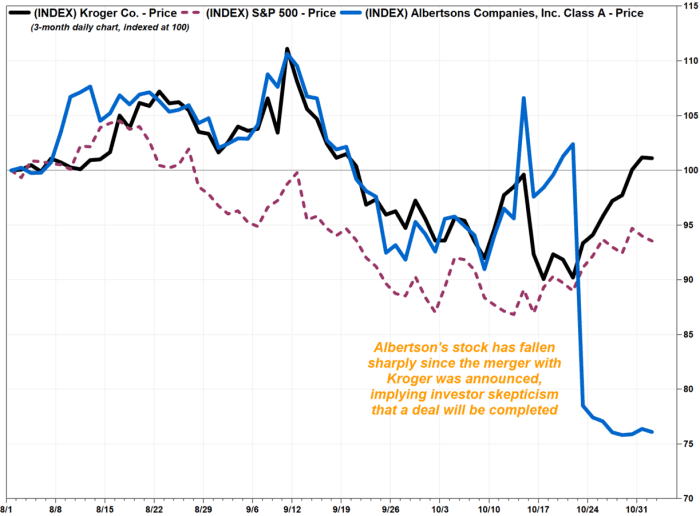

Kroger Co snapped up Albertsons in a $25 billion deal in last month's mega merger between the No. 1 and 2 standalone grocers to better compete against U.S. grocery industry leader Walmart Inc on prices, but it was expected to run into antitrust roadblocks.

Albertsons, which was scheduled to pay the special dividend on Nov. 7 as part of the deal, was also sued by the attorneys general of District of Columbia, California and Illinois, arguing that it would weaken its ability to compete as the antitrust reviews go on.

"By eliminating its cash-on-hand and nearly doubling its debt, Albertsons will be in a weakened competitive position relative to Kroger, thereby harming grocery consumers and workers throughout Washington," State Court Commissioner Henry Judson wrote in issuing the temporary restraining order.

Washington State Attorney General Bob Ferguson called the temporary order a "huge victory".

"Putting the brakes on this $4 billion payment is the right thing for Americans shopping at their local grocery store," he said in a statement.

A hearing on the case is scheduled for Nov. 10.

In its statement, Albertsons said on Thursday the court order was based on the "incorrect assertion" that the dividend payout would weaken its competitiveness while antitrust agencies review the proposed merger.

Albertsons called the lawsuits brought forward by the AGs "meritless," and said the company had limited debt and significant free-cash flow and was in a strong position financially.

The AGs have also raised concerns that a dividend payout would make the retailer strapped for cash, adding that it would hamper the company's ability to price competitively and maintain staffing and staff wages and benefits.

- An Albertsons grocery store is seen in Boise, Idaho, on Oct. 14, 2022. The attorneys general of California, Illinois and the District of Columbia are suing Albertsons in an effort to stop the grocery chain from paying a nearly $4 billion dividend to its shareholders, according to a lawsuit filed Wednesday, Nov. 2, 2022. (Sarah A. Miller/Idaho Statesman via AP, File)

DEE-ANN DURBIN

ASSOCIATED PRESS

November 3, 2022,

The attorneys general of California, Illinois and the District of Columbia are suing Albertsons in an effort to stop the grocery chain from paying a nearly $4 billion dividend to its shareholders.

The lawsuit, filed Wednesday in U.S. District Court in Washington, D.C., asks the court to block the payment until the attorneys general have reviewed Albertsons’ proposed merger with Kroger Co.

The lawsuit is the second this week seeking to delay the dividend payment. The state of Washington's Attorney General Bob Ferguson filed a similar lawsuit in state court Tuesday.

Boise, Idaho-based Albertsons said Wednesday that both lawsuits are without merit.

Kroger announced its plan to buy Albertsons for $20 billion last month. The deal is expected to close in early 2024 if it’s approved by the Federal Trade Commission and the Department of Justice and survives any court challenges.

The merger agreement included a special dividend of up to $4 billion __ or $6.85 per share __ that Albertsons is scheduled to pay its shareholders Monday.

The Democratic attorneys general of California, Washington, Illinois and the District of Columbia, as well as the Republican attorneys general of Arizona and Idaho, sent a letter to Albertsons last week asking the company to delay the payment.

RELATED STORIES

Attorneys general say Albertsons should delay $4 billion shareholder payout

North Bay stores could be part of $25 billion Kroger–Albertsons merger

The attorneys general say the dividend __ which equals nearly one-third of Albertsons’ $11 billion market value __ would deprive the company of cash it needs to operate while regulators review the merger.

“Albertsons’ rush to secure a record-setting payday for its investors threatens District residents’ jobs and access to affordable food and groceries in neighborhoods where no alternatives exist,” D.C. Attorney General Karl Racine said in a statement.

The attorneys general also say it’s unclear if the deal will be approved, since federal and state laws forbid mergers that substantially lessen competition. Together, Albertsons and Cincinnati-based Kroger would control around 13% of the U.S. grocery market.

Albertsons said the dividend was approved by its board and should be paid whether or not regulators approve the merger. The company denied that the dividend will hamper its ability to invest in its stores. It had nearly $29 billion in assets at the end of September, including $3.4 billion in cash and cash equivalents.

“Given our financial strength and positive business outlook, we are confident that we will maintain our strong financial position as we work toward the closing of the merger,” Albertsons said in a statement.

The Albertsons logo is seen on an Albertsons grocery store in Rancho

Wed, November 2, 2022

By Siddharth Cavale

NEW YORK (Reuters) -The attorneys general of Washington D.C., California and Illinois filed a lawsuit on Wednesday in a federal court seeking to block grocer Albertsons' $4 billion dividend payout to shareholders before the closing of its proposed merger with rival Kroger Co.

"(The lawsuit) is seeking a temporary restraining order to stop a nearly $4 billion payout to Albertsons’ shareholders - a payout 57 times greater than the historic dividends Albertsons has provided — until a full review of their proposed merger is complete," Karl Racine, the attorney general for Washington D.C., said in a statement.

The lawsuit was filed under seal in the U.S. district court for the District of Columbia, he said.

Kroger snapped up Albertsons in a $25 billion deal last month, to better compete against U.S. grocery industry leader Walmart Inc on prices.

As part of the deal, Albertsons announced a payout of a "special cash dividend" of up to $4 billion to its shareholders, funded by $2.5 billion in cash on hand and borrowing the rest, with a payment date of Nov. 7.

But Wednesday's lawsuit alleged that the proposed dividend was in violation of federal and state antitrust laws by rendering Albertsons less able to compete effectively with other supermarkets.

The attorneys general also raised concerns that it would make the retailer strapped for cash after the payout, which they noted was equivalent to more than two years of profit for the company and also represented a third of its market value. They added that it would hamper the company's ability to price competitively and maintain staffing and staff wages and benefits.

"Albertsons' rush to secure a record-setting payday for its investors threatens District residents' jobs and access to affordable food and groceries in neighborhoods where no alternatives exist," Racine said.

An Albertsons spokesperson said the the lawsuits brought by the attorneys general were "meritless" and provided "no legal basis" for canceling or postponing the dividend.

"The special dividend ... is not contingent on our merger with Kroger and is not in any way a condition to Albertsons Cos’ or Kroger’s obligation to consummate the proposed merger. It will be paid regardless of whether the merger is completed," the spokesperson added.

A Kroger spokesperson said the decision to issue a special dividend was solely Albertsons' and was independent of the merger transaction.

The case filed on Wednesday is District of Columbia office of attorney general et al v. Kroger co. Et al with the case number 1:22-cv-03357.

FACTSET, MARKETWATCH

FACTSET, MARKETWATCH