Kroger and Albertsons say their merger will help lower food prices for struggling consumers.

Not everyone is convinced.

Nov. 3, 2022

By Ciara Linnane

By Ciara Linnane

MARKETWATCH

The roughly $25 billion planned merger of Kroger and Albertsons, unveiled in October with much fanfare, promised a new entity that would “serve America with fresh, affordable food.”

The deal would create a company with nearly 5,000 stores reaching about 85 million households across the U.S. and with a share of the U.S. grocery market second only to that of Walmart Inc. WMT, -0.92%.

Food companies have enjoyed record earnings throughout the pandemic thanks to their ability to raise prices, according to a new report from Accountable.US, a liberal-leaning advocacy group. Kroger Inc. KR, -3.00% and Albertsons Cos. ACI, 1.43% have been part of that trend, even as they have generously rewarded shareholders.

“Even before this potential merger, the oligopoly of U.S. grocery giants has been needlessly nickel-and-diming working families — marking up prices over and over despite reporting huge profits,” said Liz Zelnick, spokesperson for Accountable.US.

See: Walmart is still seeing ‘strong’ demand and spending, its U.S. CEO says

As many as 42 million Americans said in January 2022 that they could not afford to buy enough food, according to the Census Bureau’s Household Pulse Survey. That was about double the number who said the same in April 2021, before pandemic-linked stimulus programs ended.

“The industry chose to enrich a small group of investors with generous handouts rather than keep prices stable on everything from bread to baby formula,” said Zelnick. “Even less competition under this proposed deal will only lead to more unfettered corporate greed at the expense of millions of consumers — and that’s why it deserves serious scrutiny from Congress.”

A review of recent earnings from Kroger and Albertsons and of comments from executives on earnings calls shows how the companies have been dealing with the current high-inflation environment.

In December 2021, for example, Kroger Chief Financial Office Gary Millerchip told analysts the following on the company’s third-quarter earnings call: “We are passing along higher costs to the customer where it makes sense to do so.”

In March 2022, Kroger posted record earnings for 2021, chalking up $1.66 billion in net income. The company spent a bigger sum — $2.2 billion — on stock buybacks and dividends that year.

In June of that year, on the company’s first-quarter earnings call, Millerchip said this, according to a FactSet transcript: “We are operating from a position of financial strength and we’ll continue to evaluate opportunities to deploy excess cash to accelerate our growth model and deliver sustainable total shareholder returns.”

In September, Kroger posted roughly $1.4 billion in net income for the first half of the year, a 130% jump over the same period a year earlier. It spent more than $1.28 billion on stock buybacks and dividends in the same period.

Kroger and Albertsons have been raising prices throughout the pandemic while also splurging on stock buybacks and dividends

Consumers may not benefit from the planned merger of grocery giants Kroger and Albertsons.

Consumers may not benefit from the planned merger of grocery giants Kroger and Albertsons.

The roughly $25 billion planned merger of Kroger and Albertsons, unveiled in October with much fanfare, promised a new entity that would “serve America with fresh, affordable food.”

The deal would create a company with nearly 5,000 stores reaching about 85 million households across the U.S. and with a share of the U.S. grocery market second only to that of Walmart Inc. WMT, -0.92%.

Food companies have enjoyed record earnings throughout the pandemic thanks to their ability to raise prices, according to a new report from Accountable.US, a liberal-leaning advocacy group. Kroger Inc. KR, -3.00% and Albertsons Cos. ACI, 1.43% have been part of that trend, even as they have generously rewarded shareholders.

“Even before this potential merger, the oligopoly of U.S. grocery giants has been needlessly nickel-and-diming working families — marking up prices over and over despite reporting huge profits,” said Liz Zelnick, spokesperson for Accountable.US.

See: Walmart is still seeing ‘strong’ demand and spending, its U.S. CEO says

As many as 42 million Americans said in January 2022 that they could not afford to buy enough food, according to the Census Bureau’s Household Pulse Survey. That was about double the number who said the same in April 2021, before pandemic-linked stimulus programs ended.

“The industry chose to enrich a small group of investors with generous handouts rather than keep prices stable on everything from bread to baby formula,” said Zelnick. “Even less competition under this proposed deal will only lead to more unfettered corporate greed at the expense of millions of consumers — and that’s why it deserves serious scrutiny from Congress.”

A review of recent earnings from Kroger and Albertsons and of comments from executives on earnings calls shows how the companies have been dealing with the current high-inflation environment.

In December 2021, for example, Kroger Chief Financial Office Gary Millerchip told analysts the following on the company’s third-quarter earnings call: “We are passing along higher costs to the customer where it makes sense to do so.”

In March 2022, Kroger posted record earnings for 2021, chalking up $1.66 billion in net income. The company spent a bigger sum — $2.2 billion — on stock buybacks and dividends that year.

In June of that year, on the company’s first-quarter earnings call, Millerchip said this, according to a FactSet transcript: “We are operating from a position of financial strength and we’ll continue to evaluate opportunities to deploy excess cash to accelerate our growth model and deliver sustainable total shareholder returns.”

In September, Kroger posted roughly $1.4 billion in net income for the first half of the year, a 130% jump over the same period a year earlier. It spent more than $1.28 billion on stock buybacks and dividends in the same period.

SOURCE: KROGER

Kroger responded to a request for comment by noting its long track record of investing to lower prices following previous mergers and acquisitions while maintaining strong financial performance. It pointed to its recent merger with Harris Teeter as an example.

“Our ability to deliver value to customers, communities and shareholders is rooted in our business model that emphasizes lowering prices to expand our customer base,” a spokesperson wrote in emailed comments.

“We intend to build on this track record following our proposed merger with Albertsons and are committed to investing $500 million to reduce prices and $1.3 billion to enhance the customer experience.”

In total, those investments would equal about half of what the company has given back to shareholders over the past 18 months.

Albertsons, which did not respond to a request for comment, has admitted to price hikes more than once since late 2021.

In its fourth-quarter 2021 earnings call, for example, CFO Sharon L. McCollam credited “retail price inflation” as contributing to strong results.

In April 2022, Albertsons posted record net income for 2021 of $1.6 billion. “Our strategy is working, and we are executing well against industry-wide pressures,” Chief Executive Vivek Sankaran said in a statement.

In July 2022, Albertsons had first-quarter net income of $484 million, up 9% from the same period the previous year. At the same time, it raised dividends by 35% to $63 million, with Sankaran praising a “strong operating and financial performance across all key metrics.”

Kroger responded to a request for comment by noting its long track record of investing to lower prices following previous mergers and acquisitions while maintaining strong financial performance. It pointed to its recent merger with Harris Teeter as an example.

“Our ability to deliver value to customers, communities and shareholders is rooted in our business model that emphasizes lowering prices to expand our customer base,” a spokesperson wrote in emailed comments.

“We intend to build on this track record following our proposed merger with Albertsons and are committed to investing $500 million to reduce prices and $1.3 billion to enhance the customer experience.”

In total, those investments would equal about half of what the company has given back to shareholders over the past 18 months.

Albertsons, which did not respond to a request for comment, has admitted to price hikes more than once since late 2021.

In its fourth-quarter 2021 earnings call, for example, CFO Sharon L. McCollam credited “retail price inflation” as contributing to strong results.

In April 2022, Albertsons posted record net income for 2021 of $1.6 billion. “Our strategy is working, and we are executing well against industry-wide pressures,” Chief Executive Vivek Sankaran said in a statement.

In July 2022, Albertsons had first-quarter net income of $484 million, up 9% from the same period the previous year. At the same time, it raised dividends by 35% to $63 million, with Sankaran praising a “strong operating and financial performance across all key metrics.”

ALBERTSONS

The issue has caught the attention of a bipartisan group of attorneys general, who are urging Albertsons to hold off on a nearly $4 billion special dividend payment until regulators complete a review of the proposed merger with Kroger.

The dividend could become a “massive improper giveaway to certain shareholders,” said Karl Racine, attorney general for the District of Columbia, in an interview on CNBC’s “Squawk Box” on Wednesday. Paying that to shareholders could weaken Albertsons’ ability to compete in a “very, very tough marketplace” should the merger fail to go through, Racine added.

On Wednesday, the attorneys general of California, Illinois and the District of Columbia sued Albertsons to stop the payout, the Associated Press reported. The lawsuit, filed Wednesday in U.S. District Court in Washington, D.C., is the second this week seeking to delay the dividend payment. The state of Washington’s Attorney General Bob Ferguson filed a similar lawsuit in state court Tuesday.

Boise, Idaho-based Albertsons said Wednesday that both lawsuits are without merit.

To be sure, Kroger and Albertsons are facing obstacles to their deal, not least of which is persuading regulators that the merger will increase competition even as it further consolidates the market.

The companies have said they are willing to sell stores to rivals to ease concerns about stifling competition.

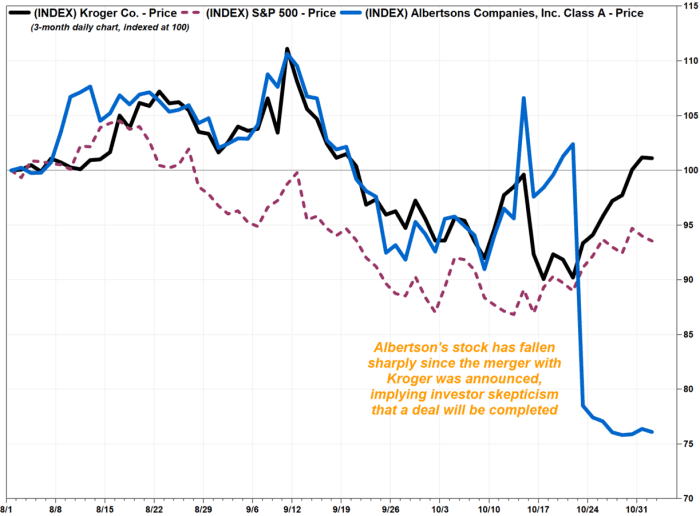

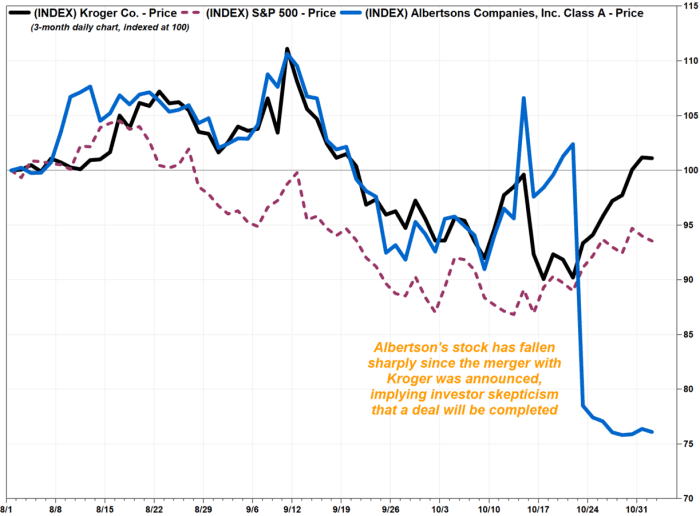

Albertsons stock has tumbled nearly 30% since the merger was announced, implying skepticism among investors that a deal will be completed.

FACTSET, MARKETWATCH

FACTSET, MARKETWATCH

But the companies have already been aggressive and active acquirers of smaller retailers, with at least $19.5 billion in deals since 1998, according to data crunched by the New York Times. The biggest deal was Albertsons’ $9.4 billion takeover of Safeway in 2014.

Those moves have already consolidated the sector, irking consumer advocates and drawing criticism from Sens. Elizabeth Warren of Massachusetts and Bernie Sanders of Vermont.

“Americans don’t need another mega-grocer,” said Stacy Mitchell, co-director of the Institute for Local Self-Reliance, a nonprofit organization that advocates against corporate control, in a statement following the deal announcement.

“Kroger and Albertsons together would control nearly 20 percent of grocery sales in the U.S. That’s on par with Walmart, whose power in food retailing has done widespread damage to communities, farmers, food workers and local grocers,” Mitchell said.

The new company would also have more clout in dealing with suppliers, allowing it to strike deals that would push up costs for independent grocers, she said.

“If it’s allowed to go through, this deal would almost certainly put more rural towns and Black and Latino neighborhoods in cities at risk of becoming ‘food deserts’ as more local grocers are driven out of business,” Mitchell said in the statement.

Albertsons shares are down about 18% in the last month. Kroger shares have gained about 8%, matching the S&P 500’s SPX, 0.29% gain.

The issue has caught the attention of a bipartisan group of attorneys general, who are urging Albertsons to hold off on a nearly $4 billion special dividend payment until regulators complete a review of the proposed merger with Kroger.

The dividend could become a “massive improper giveaway to certain shareholders,” said Karl Racine, attorney general for the District of Columbia, in an interview on CNBC’s “Squawk Box” on Wednesday. Paying that to shareholders could weaken Albertsons’ ability to compete in a “very, very tough marketplace” should the merger fail to go through, Racine added.

On Wednesday, the attorneys general of California, Illinois and the District of Columbia sued Albertsons to stop the payout, the Associated Press reported. The lawsuit, filed Wednesday in U.S. District Court in Washington, D.C., is the second this week seeking to delay the dividend payment. The state of Washington’s Attorney General Bob Ferguson filed a similar lawsuit in state court Tuesday.

Boise, Idaho-based Albertsons said Wednesday that both lawsuits are without merit.

To be sure, Kroger and Albertsons are facing obstacles to their deal, not least of which is persuading regulators that the merger will increase competition even as it further consolidates the market.

The companies have said they are willing to sell stores to rivals to ease concerns about stifling competition.

Albertsons stock has tumbled nearly 30% since the merger was announced, implying skepticism among investors that a deal will be completed.

FACTSET, MARKETWATCH

FACTSET, MARKETWATCHBut the companies have already been aggressive and active acquirers of smaller retailers, with at least $19.5 billion in deals since 1998, according to data crunched by the New York Times. The biggest deal was Albertsons’ $9.4 billion takeover of Safeway in 2014.

Those moves have already consolidated the sector, irking consumer advocates and drawing criticism from Sens. Elizabeth Warren of Massachusetts and Bernie Sanders of Vermont.

“Americans don’t need another mega-grocer,” said Stacy Mitchell, co-director of the Institute for Local Self-Reliance, a nonprofit organization that advocates against corporate control, in a statement following the deal announcement.

“Kroger and Albertsons together would control nearly 20 percent of grocery sales in the U.S. That’s on par with Walmart, whose power in food retailing has done widespread damage to communities, farmers, food workers and local grocers,” Mitchell said.

The new company would also have more clout in dealing with suppliers, allowing it to strike deals that would push up costs for independent grocers, she said.

“If it’s allowed to go through, this deal would almost certainly put more rural towns and Black and Latino neighborhoods in cities at risk of becoming ‘food deserts’ as more local grocers are driven out of business,” Mitchell said in the statement.

Albertsons shares are down about 18% in the last month. Kroger shares have gained about 8%, matching the S&P 500’s SPX, 0.29% gain.

Column: That big Albertsons-Kroger merger will enrich millionaire insiders at your expense

Michael Hiltzik

Thu, November 3, 2022

A Ralphs supermarket in Los Angeles is part of a chain owned by Kroger, which is planning to merge with another supermarket giant, Albertsons. (Jason Armond / Los Angeles Times)

It should be obvious by now that the driving force of many corporate mergers, if not most or even all mergers, is the goal of enriching insiders. The pending merger of supermarket giants Albertsons and Kroger, however, injects that impulse with steroids.

At the heart of the $20-billion deal announced Oct. 14 is a $4-billion dividend that was scheduled to be paid Monday to Albertsons stockholders until it was temporarily blocked by a Washington state court.

Who are these stockholders? Six of them are corporate insiders, defined as holders of more than 5% of Albertsons shares each.

The big dog among them is the private equity firm Cerberus Capital Management, which owns nearly 30% of the shares and holds two seats on the company's board of directors. The other five are investment and real estate funds that hold a total of an additional three board seats.

The six investors control about 75% of Albertsons shares. Combined with the three current and former Albertsons executives on the board, they hold a majority of seats. In other words, they voted themselves a multibillion-dollar handout.

A state judge in Washington issued a temporary restraining order late Thursday blocking Monday's dividend payout, in response to a lawsuit by Washington state Atty. Gen. Bob Ferguson. The dividend also has been challenged in federal court by the attorneys general of California, Illinois and Washington, D.C.

The temporary restraining order issued by the Washington court after a hearing conducted via Zoom is subject to a further hearing scheduled for Nov. 10, according to Ferguson's office. That hearing will cover whether the state court should issue a permanent injunction blocking the dividend.

As of this writing, Albertsons, which is based in Boise, Idaho, hasn't filed an answer to the lawsuits in court. Late Thursday, the company said it would seek to overturn the Washington court order "as quickly as possible" and termed the lawsuits "meritless."

Regardless of how the motions to block the dividend ultimately fare, the payout deserves special scrutiny for what it says about the structure of this deal and what its effect will be on Albertsons as the merger moves toward closing next year. The message is a dark one.

We've already reported on the likelihood that the Albertsons-Kroger merger will drive prices higher at the supermarkets' cash registers.

The deal will bring together the largest and second-largest supermarket companies. In California, Kroger owns Food4Less and Ralphs; Albertsons owns Safeway, Vons and Pavilions. The two companies control 38 other retail market brands nationwide.

The merger should be a prime target for antitrust officials at the Federal Trade Commission and Department of Justice.

Before we get further into the implications of the $4-billion payout, it's proper to note that Albertsons apparently has been less than candid about how it came about. Way less than candid.

After receiving an Oct. 26 letter from the attorneys general of California, Illinois, Washington state, Idaho, Arizona and the District of Columbia asking Albertsons and Kroger to put the dividend on hold, Albertsons asserted that the payout had nothing to do with the merger.

The proposed merger of Kroger and Albertsons would create a nationwide supermarket behemoth. Will consumers see any benefits? (krogeralbertsons.com)

In a letter responding to the request, an Albertsons lawyer, Ted Hassi of the firm Debevoise & Plimpton, said "the special dividend ... is part of Albertsons' long-term strategy for growth," which was "determined well before Albertsons' discussions with Kroger began."

Is that so? The companies' own merger announcement stated explicitly that the $4-billion dividend is "part of the transaction." It also counted the dividend as part of the merger price, accounting for $6.85 per share of the $34.10 per share payable to Albertsons shareholders.

According to the merger agreement, moreover, the special dividend was voted on by the Albertsons board at the same meeting at which they approved the merger deal itself.

Hassi, the Albertsons lawyer, told the states that the dividend will be paid whether or not the merger actually takes place. That points to the main issue raised by the plaintiffs in the lawsuits, which is that a $4-billion payout to shareholders will leave Albertsons as a floundering shell of itself in financial terms.

The dividend will sap Albertsons' ability to function as an independent company, the plaintiffs assert. They have a point.

According to the company's most recent financial disclosure, Albertsons had only $3.4 billion in cash on hand, among $9.3 billion in assets, most of which was tied up in inventory.

The company will have to borrow to raise funds for the special dividend, and that borrowing won't come cheap — the company's current outstanding debt is rated as junk grade by both Moody's Investors Service and Standard & Poor's.

Nor is the size of the dividend anything like normal for Albertsons. Its most recent quarterly dividend was 12 cents per share, to be paid to shareholders Nov. 14. The company paid out only $207.4 million in shareholder dividends in fiscal 2021, the company says, and spent nothing on share buybacks, the other way that corporations reward shareholders.

The special dividend, the states assert in court, would "reduce Albertsons' ability to compete effectively with Kroger" if the merger doesn't close, leaving it spavined as a rival if it remains independent — say because regulators have blocked the merger.

The orphaned Albertsons would have less money to spend on keeping its stores maintained, much less upgraded, and less to pay in wages and employee benefits.

The dividend, in other words, is a straitjacket.

It's hard to avoid the impression that the $4-billion payout is a cynical money grab by Albertsons' insiders, who will effectively be cashing out even if the merger fails to happen. Calling it part of a "long-term strategy for growth," as Hassi did in his letter to the attorneys general, sounds like some sort of a joke.

It's not especially easy for a company to invest in growth when it has deprived itself of $4 billion in capital and pumped up its debt merely to funnel loan proceeds to shareholders. Hassi acknowledged in his response to the attorneys general that the virtue of the $4-billion dividend is that it "provides near-term liquidity to all of its shareholders."

In an annual report Hassi quoted, Albertsons said that its capital allocation strategy aimed to balance "investing for the future, strengthening our balance sheet and returns to shareholders." Payouts to shareholders were separate and distinct from investing for the future. In other words, the $4 billion is a benefit to Cerberus and its fellow investment firms.

It hobbles, rather than empowers, Albertsons' investing for the future. Whether the merger takes place or not, Albertsons customers are going to feel the consequences and they won't be pretty.

This story originally appeared in Los Angeles Times.

Michael Hiltzik

Thu, November 3, 2022

A Ralphs supermarket in Los Angeles is part of a chain owned by Kroger, which is planning to merge with another supermarket giant, Albertsons. (Jason Armond / Los Angeles Times)

It should be obvious by now that the driving force of many corporate mergers, if not most or even all mergers, is the goal of enriching insiders. The pending merger of supermarket giants Albertsons and Kroger, however, injects that impulse with steroids.

At the heart of the $20-billion deal announced Oct. 14 is a $4-billion dividend that was scheduled to be paid Monday to Albertsons stockholders until it was temporarily blocked by a Washington state court.

Who are these stockholders? Six of them are corporate insiders, defined as holders of more than 5% of Albertsons shares each.

The special dividend...is part of Albertsons' long-term strategy for growth

Albertsons lawyer Ted Hassi

The big dog among them is the private equity firm Cerberus Capital Management, which owns nearly 30% of the shares and holds two seats on the company's board of directors. The other five are investment and real estate funds that hold a total of an additional three board seats.

The six investors control about 75% of Albertsons shares. Combined with the three current and former Albertsons executives on the board, they hold a majority of seats. In other words, they voted themselves a multibillion-dollar handout.

A state judge in Washington issued a temporary restraining order late Thursday blocking Monday's dividend payout, in response to a lawsuit by Washington state Atty. Gen. Bob Ferguson. The dividend also has been challenged in federal court by the attorneys general of California, Illinois and Washington, D.C.

The temporary restraining order issued by the Washington court after a hearing conducted via Zoom is subject to a further hearing scheduled for Nov. 10, according to Ferguson's office. That hearing will cover whether the state court should issue a permanent injunction blocking the dividend.

As of this writing, Albertsons, which is based in Boise, Idaho, hasn't filed an answer to the lawsuits in court. Late Thursday, the company said it would seek to overturn the Washington court order "as quickly as possible" and termed the lawsuits "meritless."

Regardless of how the motions to block the dividend ultimately fare, the payout deserves special scrutiny for what it says about the structure of this deal and what its effect will be on Albertsons as the merger moves toward closing next year. The message is a dark one.

We've already reported on the likelihood that the Albertsons-Kroger merger will drive prices higher at the supermarkets' cash registers.

The deal will bring together the largest and second-largest supermarket companies. In California, Kroger owns Food4Less and Ralphs; Albertsons owns Safeway, Vons and Pavilions. The two companies control 38 other retail market brands nationwide.

The merger should be a prime target for antitrust officials at the Federal Trade Commission and Department of Justice.

Before we get further into the implications of the $4-billion payout, it's proper to note that Albertsons apparently has been less than candid about how it came about. Way less than candid.

After receiving an Oct. 26 letter from the attorneys general of California, Illinois, Washington state, Idaho, Arizona and the District of Columbia asking Albertsons and Kroger to put the dividend on hold, Albertsons asserted that the payout had nothing to do with the merger.

The proposed merger of Kroger and Albertsons would create a nationwide supermarket behemoth. Will consumers see any benefits? (krogeralbertsons.com)

In a letter responding to the request, an Albertsons lawyer, Ted Hassi of the firm Debevoise & Plimpton, said "the special dividend ... is part of Albertsons' long-term strategy for growth," which was "determined well before Albertsons' discussions with Kroger began."

Is that so? The companies' own merger announcement stated explicitly that the $4-billion dividend is "part of the transaction." It also counted the dividend as part of the merger price, accounting for $6.85 per share of the $34.10 per share payable to Albertsons shareholders.

According to the merger agreement, moreover, the special dividend was voted on by the Albertsons board at the same meeting at which they approved the merger deal itself.

Hassi, the Albertsons lawyer, told the states that the dividend will be paid whether or not the merger actually takes place. That points to the main issue raised by the plaintiffs in the lawsuits, which is that a $4-billion payout to shareholders will leave Albertsons as a floundering shell of itself in financial terms.

The dividend will sap Albertsons' ability to function as an independent company, the plaintiffs assert. They have a point.

According to the company's most recent financial disclosure, Albertsons had only $3.4 billion in cash on hand, among $9.3 billion in assets, most of which was tied up in inventory.

The company will have to borrow to raise funds for the special dividend, and that borrowing won't come cheap — the company's current outstanding debt is rated as junk grade by both Moody's Investors Service and Standard & Poor's.

Nor is the size of the dividend anything like normal for Albertsons. Its most recent quarterly dividend was 12 cents per share, to be paid to shareholders Nov. 14. The company paid out only $207.4 million in shareholder dividends in fiscal 2021, the company says, and spent nothing on share buybacks, the other way that corporations reward shareholders.

The special dividend, the states assert in court, would "reduce Albertsons' ability to compete effectively with Kroger" if the merger doesn't close, leaving it spavined as a rival if it remains independent — say because regulators have blocked the merger.

The orphaned Albertsons would have less money to spend on keeping its stores maintained, much less upgraded, and less to pay in wages and employee benefits.

The dividend, in other words, is a straitjacket.

It's hard to avoid the impression that the $4-billion payout is a cynical money grab by Albertsons' insiders, who will effectively be cashing out even if the merger fails to happen. Calling it part of a "long-term strategy for growth," as Hassi did in his letter to the attorneys general, sounds like some sort of a joke.

It's not especially easy for a company to invest in growth when it has deprived itself of $4 billion in capital and pumped up its debt merely to funnel loan proceeds to shareholders. Hassi acknowledged in his response to the attorneys general that the virtue of the $4-billion dividend is that it "provides near-term liquidity to all of its shareholders."

In an annual report Hassi quoted, Albertsons said that its capital allocation strategy aimed to balance "investing for the future, strengthening our balance sheet and returns to shareholders." Payouts to shareholders were separate and distinct from investing for the future. In other words, the $4 billion is a benefit to Cerberus and its fellow investment firms.

It hobbles, rather than empowers, Albertsons' investing for the future. Whether the merger takes place or not, Albertsons customers are going to feel the consequences and they won't be pretty.

This story originally appeared in Los Angeles Times.

No comments:

Post a Comment