There are myriad ways to turn hydrogen into energy, but they aren’t all healthy for the atmosphere.

BY PURBITA SAHA | UPDATED AUG 24, 2021 1

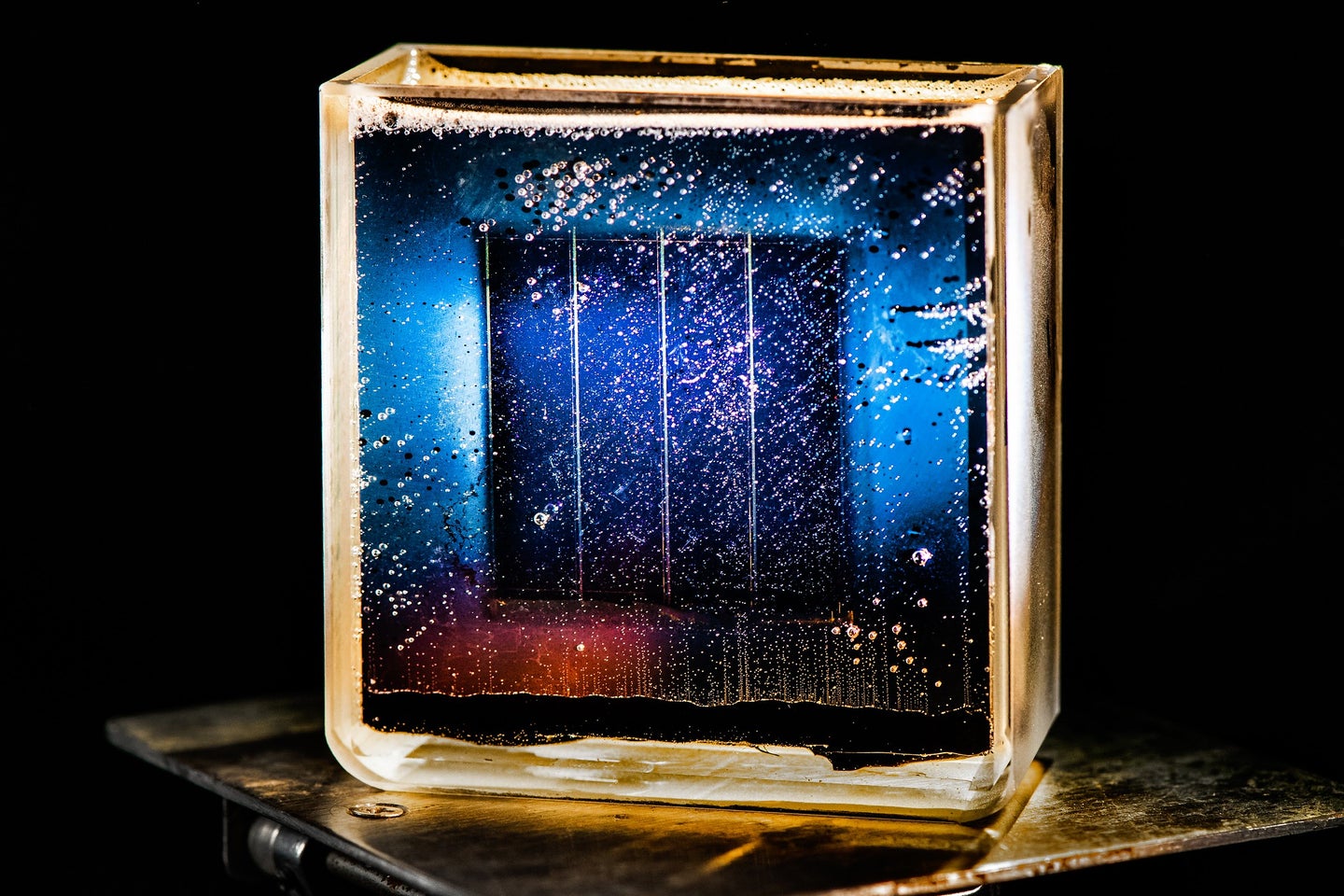

Yellow hydrogen, produced directly by electrolysis from solar cells, is an emerging category on the "rainbow.". U.S. Department of Energy

When the world gives you hydrogen, make juice (a.k.a. electricity).

Nearly 95 percent of the hydrogen-fuel cell centers in the US rely on natural gas to feed their battery-like circuits. They apply a process called steam-method reforming, where methane from the natural gas (and occasionally, biogas) is forced apart by searing-hot water and pressure to produce hydrogen molecules. That means there’s a heavy greenhouse gas footprint on the front end and a few carbon byproducts on the back end.

[Related: The century-old technology that could unlock America’s renewable future.]

That might make hydrogen less appealing in the grand scheme of climate-friendly energy production—unless you add a little nuance to the discussion. Enter the “hydrogen rainbow,” a color-coded system for describing the many ways to convert the lightest element on the periodic table into energy. Steam-methane reforming and other natural gas-based methods are called gray hydrogen. Anything involving coal is classified as brown and black hydrogen. And nuclear gets the great distinction of being deemed pink hydrogen. (There’s also turquoise hydrogen, which tweaks steam-methane reforming by creating heat from electricity. But it still gets its CH4 from natural gas.)

While some of these approaches have been in practice for decades, they’re either too inefficient or difficult to scale to be considered real energy alternatives. Which leaves green and blue hydrogen, the freshest and buzziest categories on the spectrum.

Green hydrogen takes energy from renewables, cyanobacteria, or algae to separate hydrogen molecules from water through electrolysis. Though it ultimately depends on wind turbines, solar panels, biomass, or dams, it’s easier to store and transport and has better geographic range than the original power sources. The method is taking off in the European Union, with a handful of facilities breaking ground in the next year or two, and is just starting to see traction in the US. Materials scientists point out that producing green hydrogen can cost four to six times more than gray hydrogen, but those estimates should fall as reservoirs of renewable energy rise.

Blue hydrogen, meanwhile, is another relatively new concept that’s being tested out by fossil fuel companies in Texas, Canada, and the United Kingdom. It isn’t a distinct method of converting hydrogen to energy, but is rather a cleaned-up version of gray hydrogen. Instead of letting steam-methane reformation emit loads of CO2, blue hydrogen uses retrofitted natural gas plants with carbon capture machines to rein in the CO2 emissions from early in the steam-methane reforming process.

But an analysis released earlier this month by Cornell University climatologists outlines three caveats that make blue hydrogen a bigger polluter than it’s marketed as. First, the authors explain, carbon capture is never 100 percent effective (the technology is still very much in development) and would leave out the byproducts of heating water through combustion. Second, it takes energy to power the machines that trap and pull emissions out of the air: The process itself could produce 25 to 39 percent of the CO2 volume it captures. And third, blue hydrogen only tackles carbon dioxide—leaving out methane gas, another heavyweight when it comes to atmospheric warming.

In all, the analysis found that blue hydrogen produces 75 percent to 82 percent of the same greenhouse gas emissions as gray hydrogen. That contrasts previous claims that it could halve gray hydrogen’s carbon footprint.

The paper also notes that both methods are far less efficient than burning natural gas directly for heat. Much of the fuel piped into US gray hydrogen facilities comes from fracking, which might be responsible for one-third of the increase in global methane emissions over the past decade.

[Related: What companies really mean when they say ‘net-zero’]

“Society needs to move away from all fossil fuels as quickly as possible, and the truly green hydrogen produced by electrolysis driven by renewable electricity can play a role. Blue hydrogen, though, provides no benefit,” the authors wrote in their conclusion. “We suggest that blue hydrogen is best viewed as a distraction, something that may delay needed action to truly decarbonize the global energy economy, in the same way that has been described for shale gas as a bridge fuel and for carbon capture and storage in general.”

So, if you look at the hydrogen rainbow through the filter of sustainability, green is the only color that shines through (with maybe a hint of pink). Other smart solutions could help fill out the spectrum in the future—but if the debate over blue hydrogen makes one point, it’s that you can’t slap a new label on a broken idea and re-sell it.

Purbita Saha

is the senior editor at PopSci. She was formerly an editor at Audubon magazine and formerly formerly an editor at the UConn paper The Daily Campus. Contact the author here.

Hydrogen hype: Climate solution or dead-end highway?

Fossil fuel-based hydrogen power is expensive, but "green" hydrogen can stimulate investment and growth in renewables

Around the turn of this century, hydrogen was big, especially in B.C. We were testing hydrogen fuel cell buses. Then-premier Gordon Campbell promised a “hydrogen highway” with a series of fuelling stations between Vancouver, Victoria and Whistler to enable zero-emissions bus transport – possibly extending to California by 2010.

There is no hydrogen highway. What happened? And why is hydrogen in the news again?

Much has to do with how hydrogen is produced and used as fuel or to “carry” energy. Although it’s the simplest, most abundant element in the universe, on earth it’s only found in nature combined with other elements. It must be unlocked from sources like water (H2O = two parts hydrogen, one part oxygen) or methane (CH4 = one part carbon, four parts hydrogen). Separating hydrogen from water leaves oxygen. Separating it from methane leaves carbon and carbon dioxide.

Most commercial hydrogen is obtained from fossil fuels using chemicals and heat, but water can be split into hydrogen and oxygen using electrolytic processes (with or without electricity from renewable energy). Researchers are also studying ways to split water with light or solar energy, and to use microbes such as bacteria and microalgae to produce hydrogen.

As a fuel, hydrogen requires substantial new infrastructure, whereas electric vehicle charging can be facilitated easily anywhere there’s a grid. As an energy “carrier” – that is, it’s used to store or deliver energy produced from primary sources – it must be compressed or liquefied to be transported and used, which requires energy.

Despite its drawbacks, the amount of hydrogen in methane has industry eyeing it as a potential lifeline and a way to appear “green.” Methane is a byproduct of oil and coal extraction, and “natural” gas is almost entirely methane. Industry and advocates have campaigned to convince governments and the public that fossil fuel-derived hydrogen is as good as that split from water using renewables – if carbon is removed and stored.

That’s led to a distinction between “brown,” “grey,” “blue” and “green” hydrogen. The first is from coal. Grey is from fossil fuels without carbon capture and storage, which creates CO2 emissions. Blue is from fossil fuels with CCS. Green is split from water using renewable energy.

Grey – mostly obtained with “steam methane reforming” – accounts for about 95 per cent of all commercially produced hydrogen worldwide. It’s inexpensive and relatively easy to produce and can use gas that would otherwise be wasted. It could become blue if the technology to store carbon byproducts were feasible and economically viable without creating additional ecological damage.

On a large scale, electrolysis is known as “power-to-gas,” as electricity produced by renewable sources like wind and solar or fossil fuels is converted to hydrogen gas for transport and use. If renewable energy is used, only oxygen is emitted, making it green.

Why is hydrogen used for?

Hydrogen has many applications – including energy-intensive long-haul freight, mining and industrial processes – and will likely be a key component in a decarbonized future. But we need to shift the dynamic so most or all is green.

Even blue hydrogen is not emissions-free, as carbon capture doesn’t entirely eliminate emissions, and they’re also produced during fossil feedstock extraction, processing and transportation.

Grey hydrogen offers no climate benefit. Hydrogen linked to costly and unproven small modular nuclear is problematic on many levels and would drive costs up.

Green hydrogen can be produced at the renewable electricity generation site, or closer to end uses with grid infrastructure. It doesn’t require pipelines or carbon capture infrastructure, so hydrogen electrolysis plants can often be built quickly and cost-effectively. It can be used to channel large amounts of renewable energy from the power sector into those where electrification is difficult, such as transport, buildings and industry. And it can stimulate investment and growth in renewables for electrolysis and improve energy storage capabilities.

Green hydrogen is also a better financial bet. Blue hydrogen’s costs are tied to expensive carbon capture facilities. Analysis by banking giant Morgan Stanley found plummeting wind energy prices could make government-supported green hydrogen more cost-competitive than fossil-dependent grey hydrogen by 2023.

Canada’s Hydrogen Strategy identifies a “clean hydrogen economy” as “a strategic priority.” It’s time to recognize our competitive advantage and kick-start innovation and investment in green hydrogen. Fossil fuel-based hydrogen is an expensive dead end.

David Suzuki is a scientist, broadcaster, author and co-founder of the David Suzuki Foundation. Written with contributions from David Suzuki Foundation Senior Writer and Editor Ian Hanington.

JOHN TIMMER - 8/5/2021,

Enlarge / A Coradia iLint hydrogen fuel-cell powered prototype railway train, manufactured by Alstom SA, travels in Salzgitter, Germany.

If you were paying attention at the start of this century, you might remember the phrase "hydrogen economy," which was shorthand for George W. Bush's single, abortive attempt to take climate change seriously. At the time, hydrogen was supposed to be a fuel for vehicular transport, an idea that still hasn't really caught on.

But hydrogen appears to be enjoying a revival of sorts, appearing in the climate plans of nations like the UK and Netherlands. The US government is investing in research on ways to produce hydrogen more cheaply. Are there reasons to think hydrogen power might be for real this time?

A new report by research service BloombergNEF suggests that hydrogen is set for growth—but not in transport. And the growth has some aspects that don't actually make sense given the current economics.

A gas that’s not really for cars

There are currently two primary ways of producing hydrogen. One involves stripping it from a hydrocarbon such as the methane in natural gas. CO2 is a byproduct of these reactions, and at present, it is typically just released into the atmosphere, so the process is anything but carbon neutral. That carbon can be captured and stored relatively easily, however, so the process could be clean if the capture and storage are done with renewable or nuclear power. The same caveat applies to producing hydrogen by water electrolysis: It needs to be done with low-carbon power to make sense for climate goals.

Until recently, very few countries have had enough renewables installed to regularly produce an excess of carbon-free electricity to power climate-friendly hydrogen production. That situation is now starting to change, so governments are beginning to include hydrogen in their climate plans.

But something else has changed since the early talk of a hydrogen economy: Battery prices have plunged, and widespread electric vehicle use is a viable option for decarbonizing a lot of transportation. There are still some types of vehicles, like trains, for which batteries aren't a great option and hydrogen could play a role. But looking out to the end of the decade, BloombergNEF sees transportation generating only about 10 percent of the total demand.

Instead, BloombergNEF foresees countries using hydrogen as part of a larger integrated plan to reach national climate goals. If things go according to these plans, carbon-neutral hydrogen will be used in segments of the economy that are difficult to decarbonize otherwise.

One option for hydrogen is to supplement renewable power during periods of low productivity. BloombergNEF suggests that fossil fuels will outcompete hydrogen economically unless there's a price on carbon high enough to drive capturing the emissions of fossil fuel plants. Batteries will also be cheaper for shorter periods (three hours or less). So while renewal power is expected to be a major source of demand, it will be heavily reliant on carbon pricing to make economic sense.

Perhaps more promising are industrial uses like oil refining and ammonia production, which already use a lot of hydrogen produced from fossil fuels. Some additional processes, like metal production, don't currently use hydrogen but could switch to it to decarbonize. Again, making hydrogen attractive at current hydrogen prices will require a price on carbon. Canada and EU members will likely implement these practices first, and EU countries have some of the most concrete roadmaps for hydrogen use.Advertisement

Volume production

For many countries, economical hydrogen production depends on policies that aren't yet in place. However, BloombergNEF foresees a short-term boom in our ability to produce it. Based on announced plans, manufacturers of hydrogen-producing hardware will produce an additional 10 GW of hardware annually by the end of next year. (Hydrogen-producing equipment is rated based on the electricity it consumes.) In contrast, Bloomberg predicts a demand of under 2 GW of hardware at that time.

Some of the production expansion appears to be a response to China's announced plan to be carbon neutral by 2060. While China hasn't detailed its roadmap to get there, industries in the country seem to be acting in anticipation of what the pathway might look like. BloombergNEF also acknowledges that the plans of companies in China are often opaque, and they'll sometimes announce facility openings only as they are happening. So there's a chance that Bloomberg is underestimating demand.

Still (and this is our analysis, not BloombergNEF's), the situation echoes what happened with solar panels. China had invested in production capacity that outstripped the present demand, leading to low-priced exports that helped stimulate demand in a number of other countries and set off a cycle of price drops and demand expansion.

This could potentially work for hydrogen-production equipment as well, but there's a key difference here. While solar panels help offset carbon emissions whenever they're put to use, hydrogen production hardware will do so only when it's paired with renewable or nuclear power. And it's unlikely that there will be a lot of excess power in three years after all that equipment production is online. So while the expected overproduction could stimulate hydrogen production, it could also be meaningless before the end of the decade, when other pieces of policy are in place.

BLUE HYDROGEN

U.K. Chemicals Giant Looks at Hydrogen to Cut Carbon Emissions

, Bloomberg News

(Bloomberg) -- Ineos Group, operator of a major U.K. refining and chemicals complex, is looking at hydrogen to cut its carbon emissions.

Just a few months after announcing a partnership with Hyundai Motor Co. on the supply of hydrogen to fuel cell vehicles, Ineos has outlined plans to invest in cleaner forms of the fuel across refining and chemicals at its main U.K. site at Grangemouth. The company is looking at an initial spend of more than 500 million pounds ($686 million), it said in an email, but has yet to take a final investment decision.

Grangemouth is located just east of Glasgow, Scotland, where the major United Nations climate conference, known as COP26, will be held in two months time and it’s one of the region’s biggest emitters. The chemicals industry is among the most difficult to decarbonize and Ineos met last week’s hydrogen strategy from the U.K. government with calls for financial support for the industry.

“The development of the hydrogen economy is the U.K.’s best chance of reaching its carbon reduction targets and Ineos stands ready to play its part,” said Tom Crotty, corporate affairs director. “The government must start to commit to investment,” he said, with the U.K. lagging massively behind Europe.

The straightest route to net-zero emissions uses hydrogen produced by renewable electricity and water -- known in the industry as green hydrogen -- and Ineos said it sees that as its priority. As a first step, however, it will look at cheaper blue hydrogen, which is produced using natural gas and where carbon emissions are captured and stored. It is aiming to start supply in 2027.

The U.K. government says that Scotland has a key role to play in the developing a nation-wide hydrogen economy. A Hydrogen Action Plan for the region is expected later this year.

Still, blue hydrogen technology has been criticized because it will still rely on fossil fuels. It has the backing of the oil and gas industry, which has clout in London government circles, said David Toke, reader in energy politics at the University of Aberdeen in Scotland.

“Even if blue hydrogen overcomes its technical obstacles, there will still be real question marks about how low-carbon it will actually be,” Toke said.

©2021 Bloomberg L.P.

OPINION: Oil majors must tread carefully on blue hydrogen

UK business & energy secretary sees key role for natural gas in buildout of clean hydrogen, but the industry must do more to reassure critics

Proposed blue H2: Teesside industry in north-east England, site of BP's proposed H2Teesside blue hydrogen facility

OPINION: There is nothing new about hydrogen. French novelist Jules Verne forecast its future in his book Mysterious Island, published nearly 150 years ago.

And 20 years ago, Shell opened a first hydrogen vehicle filling station in Iceland while BP was running experimental hydrogen-fuelled buses around London.

That early impetus was largely lost, but hydrogen is now firmly back in the limelight as governments grapple with meeting their UN climate targets.

The US has underlined its commitment by including hydrogen in the first of a series of “energy earthshots” funded by public money.

Canada and Australia are also keenly pursuing projects that would allow hydrogen to cut their CO2 pollution.

Last week, the UK government unveiled its first-ever hydrogen strategy along with plans for a subsidy regime to speed up the buildout.

'Home-grown clean energy'

“This home-grown clean energy source has the potential to transform the way we power our lives and will be essential for tackling climate change and reaching net zero (carbon emissions),” claimed Business & Energy Secretary Kwasi Kwarteng.

The plans envisages similar “contracts for difference” subsidies to those that have helped the UK build a major offshore wind industry.

Importantly for the oil and gas sector, Kwarteng made clear he sees a major role for “blue” hydrogen (made from fossil fuels coupled with carbon capture) as well as for renewables-derived “green” hydrogen.

This endorsement should accelerate pilot studies by the likes of Shell, BP and Equinor for hydrogen to be used for heating homes and fuelling heavy trucks.

Protest over natural gas role

But the strategy has also raised criticism from the renewable energy sector that it fails to “focus nearly enough” on green hydrogen.

That argument was accentuated by the resignation of Chris Jackson, the head of a UK hydrogen lobby group, in protest at the major role for natural gas.

“Blue hydrogen is at best an expensive distraction and at worst a lock-in for fossil fuel use that guarantees we will fail to meet our decarbonisation goals,” argued Jackson (who also runs a renewables company).

The debate has also heated up after the publication of a landmark study from American academics which raises some deeper concerns.

How green is blue H2?

“How green is blue hydrogen”, by Robert Howarth from Cornell University and Mark Jacobson from Stanford, claims “the greenhouse gas footprint of blue hydrogen is more than 20% greater than burning natural gas or coal for heat”.

The study highlights the huge risks of methane emissions around natural gas coupled with carbon capture and storage (CCS) technology.

Equinor has strongly rejected the study findings, saying the assumptions used are incorrect.

But arguments will continue over the cost and efficacy of different ways of creating hydrogen.

Many countries with natural gas reserves can be expected to fight to keep blue hydrogen at the forefront of energy debates.

The oil and gas majors themselves still have the ear of ministers but face public scepticism after years of mixed messaging over carbon dioxide.

The fossil fuel industry must tread carefully and cleverly if it is to win a debate on which its future partly depends.

What is positive is that clean hydrogen has moved from the minds of fiction writers to the desks of government ministers.

(This is an Upstream opinion article.)

World science community watching as natural gas-hydrogen power plant comes to Hannibal, Ohio

Ohio Capital Journal

There are not a lot of people living in Hannibal, Ohio. It is a tiny port stop on the Ohio River, with just 1,000 people living in Ohio Township, and just about 14,000 in Monroe County. About 35 miles upstream is Wheeling, West Virginia, and about 45 miles downstream is Marietta, Ohio.

But this tiny place in what is considered the Appalachian part of Ohio, a new power plant that is gaining the notice of the scientific world is about to open here at the end of August. Long Ridge Energy, which sits on 1,600 acres of property where an aluminum smelter closed about a decade ago, will be producing electricity that will mix natural gas and hydrogen as the power source.

Hydrogen is being “rediscovered” as a environmentally friendly energy source, though it is more simple than complicated: It is the simplest and most abundant element on earth, consisting of only one proton and one electron. But there is a catch. It doesn’t typically exist by itself in nature and must be produced from compounds that contain it.

“What we are doing is very important to the renewable energy industry, and we have somewhat flown under the radar as to being a leader in some big changes that are coming for the energy industry,” Robert “Bo” Wholey, the president of Long Ridge Energy and Pittsburgh native, said to Ohio Capital Journal.

“There have been some plants that have opened in Europe and Australia recently that are using more hydrogen, and plans to do other such plants in the U.S. in coming years, but we think this is the first operation in America to combine hydrogen and natural gas for clean energy,” he continued. “What we are doing is using what is here in this part of Ohio now — water and natural gas wells — and using them to reduce and ultimately eliminate carbon emissions.”

Some analysts are skeptical about whether these combo-plants are a viable path to decarbonization, but Wholey is optimistic Long Ridge can get a larger and larger mix of hydrogen into the energy production over the long run, perhaps even to 100%.

In effect we are saying let’s keep our local advantages here for our economic benefits, and not ship them out for other people to take advantage of.

This is no small project being done in small town Ohio. It will produce 485 megawatts annually (which can power about 400,000 households), and it has raised $599 million in financing. And given the plant will use just a fraction of the 1,600 acres of property it sits on, plans call to draw big national companies who want clean energy at a good price to locate there.

“It is basic economics to combine the leading science with the resources available in this location,” Wholey said. “In effect we are saying let’s keep our local advantages here for our economic benefits, and not ship them out for other people to take advantage of.”

Mario Azar, president of Black & Veatch’s power business, one of the partners in the project, emphasized how the energy industry in paying attention to Long Ridge as it starts up: “Balanced energy portfolios that maximize the use of next-generation, emissions-free fuel sources such as hydrogen will be critical to managing the energy transition and `repowering the power industry,’” Azar said in a recent statement. “The first-of-a-kind Long Ridge project represents a significant step for the U.S. power industry and reflects the growing place for hydrogen as an important pillar of the global decarbonization effort.”

In order to understand the importance of this project to this economically challenged part of Ohio, one needs to go back in time a bit. The site of the plant was at one time the location of the Ormet Aluminum Corp, which started in the late 1950s and employed about 1,000 people when it closed in 2013. Before it closed, the Ormet Aluminum Corp. in Monroe County was using the same amount of power in a day that the city of Pittsburgh did.

And that was the problem, as the high electricity use made the smelter economically obsolete. The company appealed to the Public Utilities Commission of Ohio to grant rate relief Ormet said it needed for electricity use, but they were turned down. The plant’s closing soon followed putting about 1,000 people out of work.

The closing also happened at a time when southeast Ohio communities were getting hit with both the property foreclosure mess and opioid drug addiction.

“That closure really impacted the local economy, it took a hit,” noted Ed Looman, project manager of the Appalachian Partnership for Economic Growth, around the time in 2017 when the property was sold to the Long Ridge consortium for $30 million.

But the more interesting and more complicated issue is how this odd mix of technology will be used to create renewable energy with little pollution. In some respects, it is, as Wholey notes, about the old real estate adage about “location” being the most important factor when assessing land value.

There are two type of hydrogen production, and this Hannibal location has cheap access to both. Being on the Ohio River means it can pull water from the river, and “green” hydrogen is produced by splitting the water into hydrogen and oxygen by electrolysis. The hydrogen is used by burning it with other components like natural gas (or by itself) and the oxygen is vented in to the atmosphere with no negative impact.

The location is also in the middle of the Marcellus and Utica shale areas in both Pennsylvania and Ohio. “Blue” hydrogen occurs when the chemical element is split off from natural gas by using very high temperatures. Green hydrogen is two to three times more expensive than blue hydrogen, according to recent reports.

These types of proposals have not yet shown a path to a deeply decarbonized gas system.

That cost could come down as the technology adapts with more use. However, on a practical basis, Long Ridge has an advantage over others around the country as natural gas pipelines are close by.

After the startup at the end of August with just natural gas as the electricity producing component, hydrogen will be added into the production mix some time in November, Long Ridge says. In the beginning, it will be just 5% hydrogen, but over time, using a specialized GE combustion turbine, it will be burning between 15-20% hydrogen by volume initially, with the capability to transition to 100% hydrogen over time.

A lot of the reasons for doing this state-of-the-art and futuristic energy plant in such an out-of-the-way place were very practical, and came to the surface when looked at with a critical eye.

“The infrastructure situation was good,” Wholey said. “We thought, this will be a good place to have a power plant, given that the transmission lines are already in place.”

Shortly after construction began, they learned that the plant’s GE gas turbine could also burn up to 20% hydrogen without modification. That made economic sense for future growth.

“The second thing we learned,” Wholey said, “was that a lot of potential customers, like data centers, wanted green energy.” That why it made sense, he said, “because the market is changing so that these changes are not being seen as economically not an environmental novelty. It’s what the customer base is asking for.”

For some renewable energy experts, using hydrogen for energy production hasn’t met the requirements that make it more “decarbonized” that what it is replacing. Technology will have to advance further to burn hydrogen as a viable fuel rather than just as a small percentage of a natural gas blend, particularly because of nitrogen oxygen emissions from hydrogen burning, they point out.

“These types of proposals have not yet shown a path to a deeply decarbonized gas system,” Julie McNamara, senior energy analyst for the Union of Concerned Scientists, said in a recent interview. “Clean hydrogen will be constrained in supply for the foreseeable future. Blending it at a low level into a gas pipeline that should be transitioned to electrification is just not the right pathway to be taken today.”

The power plant in Hannibal, Ohio, will be “fully operational” with natural gas only in early September, with hydrogen to be introduced in November, Wholey said. A recent Moody’s Investor Service report indicated Long Ridge has long-term economic potential, especially if national and state policies such as carbon taxes are enacted. By 2035, the report says, “hydrogen is likely to play an important role in U.S. efforts to eliminate carbon emissions from the power sector.”

By Renée Jean rjean@willistonherald.com

Aug 25, 2021 Updated Aug 26, 2021

A recent study out from Stanford and Cornell universities claims that blue hydrogen production releases more greenhouse gases than simply burning natural gas. But the study looks at an out-dated process for producing blue hydrogen, the CEO of a company that plans to start a blue hydrogen hub in North Dakota says.

“Not many companies that are actually intending to do clean hydrogen from natural gas want to use steam methods,” Bakken Energy CEO Mike Hopkins told the Williston Herald’s Energy Chaser. “It’s a very old process. It does have absolute limitations as to just how much carbon you can capture. And it’s quite energy inefficient. So it’s got the two burdens of being energy efficient and very limiting in the ability to capture carbon.”

North Dakota’s hydrogen hub, on the other hand, will use an entirely different and newer process, auto thermal reforming.

“It’s not commonly used for the production of clean hydrogen because of the capital costs,” Hopkins explained. “It’s not so much the capital cost of the authothermal reforming. It’s the fact that you’d need an air separation unit. In the case of the Dakota Gasification plant, because of how it has operated as a gasification plant, it already has a perfectly good air separation unit.”

Once operational, the company estimates it will be capturing 95 percent of carbon emissions for its blue hydrogen — taking 6 million tons of carbon out of the annual emissions stream or the equivalent of removing a million cars from the road.

(It’s) absolutely comparable to what would be done with renewables,” Hopkins said.

The process will also be very cost effective as well, thanks to the pre-existing air separation unit and the other infrastructure.

“It’s going to be, I’ll call it 1/6 of the cost of hydrogen produced from renewables,” Hopkins said. “Much lower than if we were just using the traditional steam methane reforming process, which is less efficient and more limiting when it comes to carbon.”

Blue hydrogen has a place in the grand scheme of things, Hopkins believes, when it comes to decarbonizing the economy.

“People are seeing that there are real limits to just how far you can go, how quickly you can go, how big you can go, if the only way you can decarbonize is to keep bringing renewables and energy storage onto the grid,” Hopkins said.

Battery-stored power won’t work well for energy intense operations like airplanes, trucking, the cement industry, and shipping containers, because it would require too many batteries.

“(A) tanker would be nothing but batteries,” Hopkins said. “There’d be nothing for the actual containers.”

Clean hydrogen can help those industries decarbonize, but the cost of “green” hydrogen produced solely through renewables is very expensive right now. It won’t likely be ready for widespread adoption for years.

Blue hydrogen, meanwhile, offers a way to more quickly and cost-effectively start moving the needle on carbon emissions. And the necessary hydrogen infrastructure can be built alongside it, in ways that are economically feasible, which is also vital if the goal is to make a quick shift.

“I am certainly a supporter of clean hydrogen made using an electrolyzer from water using renewable power. It’s certainly not carbon free, but it’s extremely low carbon,” Hopkins said. “So it’s good in that sense. I think it’s practical limitation is that, at this point in time, it’s so expensive to produce hydrogen that way.”

Using low-cost, clean, blue hydrogen sooner, rather than later, will also spur innovations, Hopkins believes, which will ultimately build a stronger future for everyone.

“To me it’s an opportunity to actually get it going, like, get people to adopt it and get people innovating, not just to like use this clean hydrogen instead of conventional hydrogen, but start thinking well, if it’s really that low cost, if you can make it that low cost, what are all the other things that you can do with it that people haven’t even thought about?”

No comments:

Post a Comment