H2

GLOW GREEN

Xcel CEO: Capital required for green hydrogen production 'could be material' over balance of the decade

Published Oct. 29, 2021

Larry PearlSenior Editor

Adeline Kon/Utility Dive

Dive Brief:

President and CEO Robert Frenzel highlighted Xcel's work on hydrogen, among other issues, on Thursday during the company's Q3 2021 earnings call.

Frenzel said Xcel has updated its base investment plan, "reflecting $26 billion of capital expenditures over the next five years." However, the latest base plan "does not include any capital for green hydrogen production for our [local distribution company] or generation needs, which we believe could be material over the balance of the decade," Frenzel added.

The Department of Energy awarded Xcel $10 million last year to test the production of hydrogen via high temperature steam electrolysis at the company's Prairie Island nuclear plant in Minnesota. FirstEnergy, Exelon and Arizona Public Service have also been selected to test hydrogen production approaches at nuclear power plants.

Dive Insight:

Xcel expects the hydrogen-related work at its Prairie Island nuclear plant to begin in 2023 or early 2024.

"Xcel has long been a leader in renewable energy, and we think the next stage of environmental investment is going be developing hydrogen on a large scale," Morningstar analyst Travis Miller told the Minneapolis Star Tribune.

During Thursday's call, Frenzel briefly detailed Xcel's work on hydrogen and its support for a related federal tax credit, which was included in the latest House version of the budget reconciliation package. In addition to the Prairie Island project, Frenzel said Xcel "is exploring five to eight additional greenfield and brownfield projects." But he did not provide details on those additional projects.

"And with favorable state backdrops in Minnesota and in Colorado, which have passed clean fuel legislation as well as a potential for a federal hydrogen production tax credit, we believe that our favorable renewable generation conditions will help us push beyond pilots and into green hydrogen production resources that can be valuable to a clean energy future," he continued.

With its hydrogen projects, Xcel joins an expanding group of utilities, including NextEra Energy, that are working on the emerging resource.

Looking more broadly, Frenzel said Xcel's resource plans will add nearly 10,000 MW to its system and attain 85% carbon reduction by 2030. "We expect decisions on both the Minnesota and the Colorado resource plans in the first quarter of next year," he said.

Frenzel further noted the potential benefits of proposed changes to tax credits for wind and solar projects as well as the proposed credit for green hydrogen, or hydrogen produced from clean energy generation.

"Proposed tax credit expenses for [investment tax credits] and [production tax credits], including the solar production tax credit, will make future projects even more competitive, providing additional benefit to our customers," Frenzel said.

"A PTC for green hydrogen would also bring significant value and technology advancement and costs. It could help accelerate the time frame in which we could begin incorporating hydrogen into power generation and into our natural gas distribution operations at a cost that's more economic for our customers," he continued.

While noting Xcel's target of being carbon-free by 2050, Frenzel said more needed to be done to reach that goal.

"We need to identify that next generation of generation," he said. "I think what we need is another type of emissions-free generation. And I think the infrastructure bill triples DOE funding for research and development. I think that's critical for the industry to progress past where we expect to be, which is about an 80%, 85% carbon reduction by the end of the decade."

Xcel reported third quarter earnings of $609 million or $1.13 per share compared with $603 million or $1.14 per share in the year-ago period. The results were short of analysts' average expectation of $1.18 per share.

"On a year-to-date basis, our earnings are $0.13 per share ahead of last year," Executive Vice President and Chief Financial Officer Brian Van Abel said during Thursday's call.

"We remain confident we can deliver long-term earnings and dividend growth within the upper half of our 5% to 7% objective range as we continue leading the clean energy transition and keeping bills low for our customers," Abel continued.

High gas prices shift optimal hydrogen production to nuclear, says IAEA

29 October 2021

Nuclear energy will be the most cost-effective means of producing clean hydrogen when natural gas prices are high, according to a new study by the International Atomic Energy Agency (IAEA). The IAEA said the study "underscored the importance of having a diverse mix of low-carbon sources for a successful clean energy transition."

.jpg?ext=.jpg) (Image: Pixabay)

(Image: Pixabay)Using its new FRAmework for the Modelling of Energy Systems (FRAMES), the IAEA found that as gas prices increase, the optimal mix of technologies for producing low-carbon hydrogen shifts in favour of nuclear and renewable energy and away from natural gas with or without carbon capture and storage. While the study focused on a particular country, its results can be generally applied to other energy markets.

As a baseline reference for the average natural gas price, the FRAMES study used USD6 per million British thermal units (BTU), which was the approximate price in markets such as Europe as recently as last spring before the recent price surge. That was also the price used in a recent Urenco/Aurora study of the UK market in the year 2050, Decarbonising Hydrogen in a Net Zero Economy, which showed that nuclear energy partnered with renewables can lower the overall system costs of hydrogen production.

"This shift happens at natural gas costs that are substantially lower - around USD10-15 per million British thermal units - than those observed in recent days in the European Union, United Kingdom and parts of Asia," said Francesco Ganda, an IAEA nuclear engineer who conducted the study, referring to recent record high spot prices in these markets of between USD35 and USD40 per million BTU, a globally used measure for the energy content of natural gas.

When natural gas prices rise above USD20 per million BTU, the FRAMES study showed that the optimal method of hydrogen production becomes a mix of electrolysis-produced hydrogen from electricity supplied by a combination of renewables and conventional nuclear power plants and thermal processes that can eventually be supplied by advanced high-temperature reactors.

FRAMES, which is still under development, is currently being used for internal IAEA analyses of integrated energy systems. It provides quantitative analyses on nuclear power's potential benefits to present and future electricity systems, which is of particular interest for countries pursuing or considering nuclear power as part of their solution to meet net-zero goals.

The model evaluates short- and long-term impacts on overall carbon emissions, structure of the generation mix and cost of electricity provision, which helps to inform the economic impacts of achieving various CO2 emission targets. Additionally, FRAMES can support technical analyses involving the optimal grid integration of advanced nuclear technologies - such as small modular reactors, microreactors and fast reactors - as well as non-electric applications of nuclear energy.

The FRAMES study comes ahead of the COP26 climate change conference, where the IAEA will hold several events to underscore nuclear energy's contribution to achieving the goals of the Paris Agreement and Agenda 2030 for Sustainable Development. It said clean hydrogen is increasingly seen as having a key role in the clean energy transition as part of a reliable low-carbon energy mix.

Researched and written by World Nuclear News

BLUE H2

Where does hydrogen fit into Alberta's energy future?

Canada takes the stage at COP26, but will we meet our commitments this time?

Our planet is changing. So is our journalism. This story is part of a CBC News initiative entitled "Our Changing Planet" to show and explain the effects of climate change and what is being done about it.

Canadian policy-makers will meet with other world leaders at the 2021 United Nations Climate Change Conference in Glasgow, starting on Sunday. A big part of their pitch on how Canada can curb its carbon emissions focuses on expanding the country's hydrogen industry, which would have a major impact on Alberta.

About two-thirds of Canada's hydrogen comes from Alberta. The clean burning fuel can be used to power cars and heat homes, but producing it is more environmentally complicated. Right now, most hydrogen that comes out of Alberta is grey. That means greenhouse gases are created during the process that turns natural gas into hydrogen.

Those pollutants can be captured and stored resulting in a cleaner blue hydrogen, but that increases production costs. Green hydrogen is produced using water and renewable electricity — that process is the most expensive but also the cleanest.

Alberta is slated to release its updated hydrogen roadmap in the next few weeks.

- Have questions about COP26 or climate science, policy or politics? Email us: ask@cbc.ca. Your input helps inform our coverage.

Here are two experts in the field offering insight into our hydrogen future. David Layzell is an energy systems architect for the Transition Accelerator, a non-profit focused on moving toward a net-zero future. Assistant professor Sara Hastings-Simon is with the University of Calgary, director of the sustainable development master's program.

- WATCH | Two experts offer thoughts on hydrogen in our energy future, ahead of COP26 this weekend

Q: How will hydrogen help Canada get to net zero by 2050?

David Layzell: If you look at where our greenhouse gas emissions are located in Canada, at least 50 per cent of them come from the combustion of carbon-based energy carriers: gasoline, diesel, jet fuel, natural gas.

We know the most about those. To finally get to net zero, we are going to have to replace those energy carriers with carbon-free or emission-free net-zero energy carriers. That's electricity made without greenhouse gas emissions. Hydrogen is another that, when combusted, it doesn't give emissions. Ammonia, which is made from hydrogen, is another. It's pretty clear, we are down to electricity and hydrogen. They are the key pillars in transition to net zero.

Q: We are phasing out coal, we are bringing more renewables online, but does hydrogen have the biggest potential? Is it a game changer?

DL: From an Alberta perspective, you can make hydrogen from natural gas, from oil even, and we can capture the carbon dioxide produced when you make it, and put it back underground. We have the technology. We are doing it already in parts of Alberta.

We can extract the energy from fossil fuels, put it in hydrogen, essentially, and put the carbon back in the ground. That creates a significant opportunity in Alberta, in Canada.

We are internationally recognized as one of the lowest cost places in the world to make hydrogen without carbon emissions.

Q: But it still requires carbon intensive energy to do that? Is that the right path?

Sara Hastings-Simon: There are two questions. What do we need to do in Alberta to address our own footprint? And also thinking about having a strong economy in a net-zero future.

Many of the oil and gas products we export to the rest of the world are carbon intensive when they are burned, and everyone else is looking for ways to transition away from those fuels.

When we talk about reducing emissions in Alberta, we already produce a fair amount of hydrogen today, so decarbonizing the production of that hydrogen is really important.

As far as replacing oil and gas that we export today, there can be some market for hydrogen, but it won't be anywhere near large enough to replace oil and gas.

We need to broaden what we are thinking about beyond hydrogen. The future will be highly electrified.

Q: Our neighbour B.C. often exports hydro electricity to the U.S. We take a bit of it. Why should we not take more of that, rather than go with hydrogen?

DL: It's not an either/or, I think we need to do both.

We have a program that is about getting the provinces with large hydro resources to start co-operating with provinces that have large wind and solar resources.

When the wind is blowing and the sun is shining, we might make more electricity, and we can send it to provinces next door, and store it in hydro reservoirs and get it back later.

It's about a more sensible, balanced way to manage electricity. We envisage a doubling or even 2½-fold increase in electricity demand in 30 years that will be part of the greening process.

In the national hydrogen strategy that came out a year ago, hydrogen is in the 25-30 per cent of our overall energy mix. At that scale, it's a significant economic driver and tool for decarbonizing the parts of our energy system which are hard to electrify.

Q: Canada has fallen short on previous commitments. Expectations are high. Is Canada going to make a difference this time around?

SHS: I think we are going to make a difference. Canada has a plan and policies that can enable it to reach its targets, that we have never had before.

But one consequential thing for Canada heading into COP is what the whole world is doing, and what that means for oil and gas demand.

We are seeing scenarios showing a decline in demand, and that's something new and has a big impact on Canada.

DL: I see an opportunity to start shifting the oil and gas sector to, instead of producing carbon-based energy carriers, producing net-zero energy carriers. We can sell them for more per unit of energy than our existing resources, like crude oil. The overall economic benefit can be approaching what we are now getting from the oilsands.

With files from CBC Calgary News at 6

Hydrogen fuel cell Toyota Mirai. (Reference image by National Renewable Energy Lab, Flickr.)

Researchers at Curtin University have identified an electrocatalyst that, with added nickel and cobalt, makes green hydrogen from water in a cheaper and more efficient way compared to traditional methods.

Green hydrogen is a zero-carbon fuel made by electrolysis using renewable power to split water into hydrogen and oxygen.

Typically, scientists have been using precious metal catalysts, such as platinum, to accelerate the reaction to break water into hydrogen and oxygen but the Curtin team found that by adding the battery metals to cheaper catalysts, they were able to enhance their performance, which lowers the energy required to split the water and increases the yield of hydrogen.

“Our research essentially saw us take two-dimensional iron-sulfur nanocrystals, which don’t usually work as catalysts for the electricity-driven reaction that gets hydrogen from water, and add small amounts of nickel and cobalt ions,” lead researcher Guohua Jia said in a media statement.

“When we did this it completely transformed the poor-performing iron-sulfur into a viable and efficient catalyst.”

According to Jia, using these more abundant materials is cheaper and more efficient than the current benchmark material, ruthenium oxide, which is derived from ruthenium element and is expensive.

“Our findings not only broaden the existing ‘palette’ of possible particle combinations but also introduce a new, efficient catalyst that may be useful in other applications,” Jia said. “They also open new avenues for future research in the energy sector, putting Australia at the forefront of renewable and clean energy research and applications.”

At present, 21% of Australia’s energy is produced from renewables, a reality that is seen as an opportunity by many, including mining tycoon Andrew Forrest.

Forrest aims to make his Fortescue Metals Group carbon-neutral by 2030, with green hydrogen at the forefront of the company’s efforts.

The billionaire believes that green hydrogen could supply a quarter of the world’s energy by 2050 and he has been travelling the world to promote this idea.

New hydrogen storage material steps on the gas

Hydrogen is increasingly viewed as essential to a sustainable world energy economy because it can store surplus renewable power, decarbonize transportation and serve as a zero-emission energy carrier. However, conventional high-pressure or cryogenic storage pose significant technical and engineering challenges.

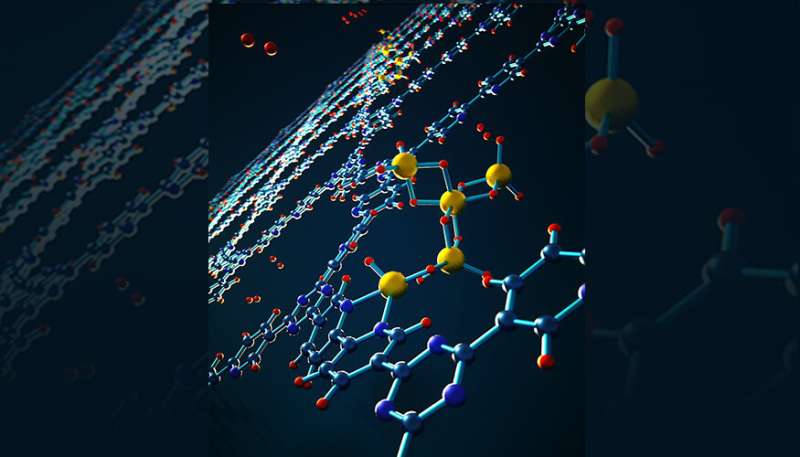

To overcome these challenges, Lawrence Livermore National Laboratory (LLNL) and Sandia National Laboratories researchers have turned to metal hydrides because they provide exceptional energy densities and can reversibly release and uptake hydrogen under relatively mild conditions. The research appears as a hot paper and back cover in the journal Angewandte Chemie.

Solid-state metal hydrides with high volumetric and gravimetric hydrogen densities are attractive alternatives to gas-phase hydrogen storage. However, many high-capacity metal hydrides suffer from poor thermodynamics of hydrogen uptake after initial release, which necessitates extreme hydrogen pressures to regenerate. Such a limitation is often tied to their metastable nature and hinders their real-world applications.

In the recent research, the scientists found a new way to ease the thermodynamic limitation. The team focused on one typical metastable metal hydride called alane. Alane, or aluminum hydride, has a volumetric hydrogen density twice that of liquid hydrogen. However, converting bulk metallic aluminum into alane was long thought to be impossible except under extreme conditions with more than 6,900 atmospheres of dihydrogen (H2) pressure.

The team developed a nanoconfined material with improved thermodynamics of alane regeneration. They found that alane situated within the nanopores of a highly porous bipyridine-functionalized covalent triazine framework can be regenerated at a H2 pressure of only 700 bar (690 atmospheres), which is tenfold lower than that required for its bulk counterpart. This pressure is readily achievable in commercial hydrogen fueling stations, although further improvements are necessary to achieve rapid fueling.

"The work paves the way for developing composite materials suitable for real-world hydrogen storage applications, including onboard vehicular hydrogen storage," said LLNL materials scientist Sichi Li, who serves as co-first author of the paper.

Through a combination of sophisticated spectroscopic and microscopic experiments, as well as first-principles modeling by Li, they found a surprising and nonintuitive mechanism for the stabilization of alane. The mechanism involves formation of intrinsically stable radicals and tiny alane clusters that interact chemically with the nanopores of the confining framework, giving rise to thermodynamics that are completely different from the bulk material.

"Nanoconfinement is a really interesting approach for stabilizing metastable hydrogen-storage materials, particularly given the wide palette of potential host materials," said LLNL materials scientist and co-author Brandon Wood, who leads the LLNL team on materials-based hydrogen storage. "Beyond hydrogen storage, this work also could have implications for tuning properties of other energy-generation and storage materials, including batteries and catalysts."

Other LLNL co-authors include Maxwell Marple and Harris Mason.A solid pathway toward hydrogen storage

More information: Vitalie Stavila et al, Defying Thermodynamics: Stabilization of Alane Within Covalent Triazine Frameworks for Reversible Hydrogen Storage, Angewandte Chemie International Edition (2021). DOI: 10.1002/anie.202107507

Journal information: Angewandte Chemie , Angewandte Chemie International Edition

Provided by Lawrence Livermore National Laboratory

No comments:

Post a Comment