CANADA

Government's $50-billion loan program coming due, but many businesses can't payALL CAPITALI$M IS $TATE CAPITALI$M

Story by Ryan Tumilty • POSTMEDIA

Dan Kelly, president and CEO of the Canadian Federation of Independent Business, said the debt is weighing on business owners as the deadline looms.© Provided by National Post

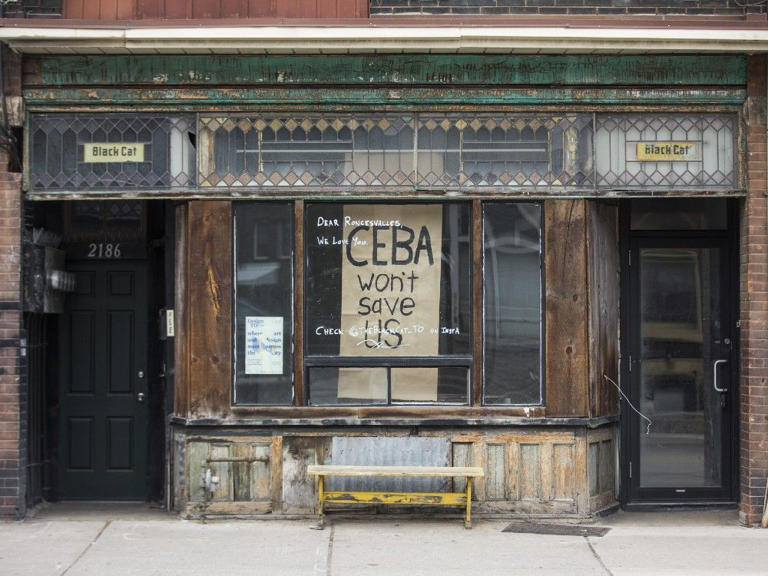

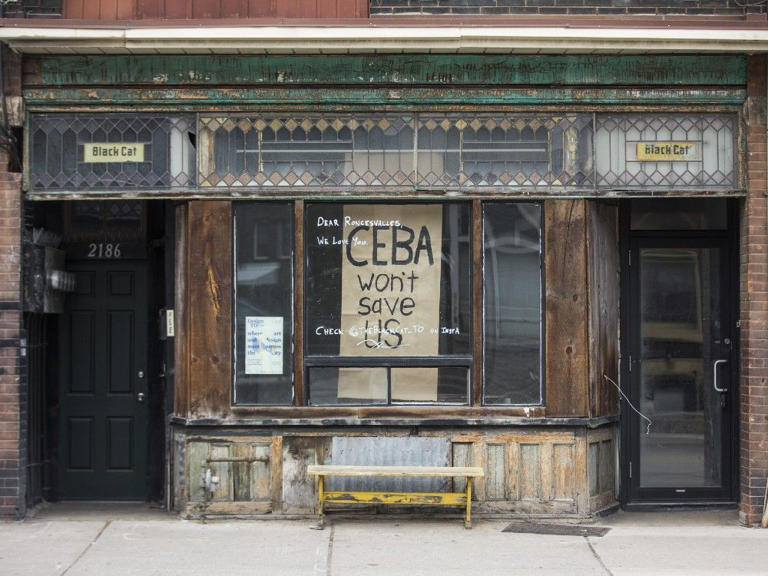

OTTAWA – A $50-billion pandemic loan program is becoming a ticking time bomb for the government and Canadian businesses with six months left before the money is supposed to be repaid.

The government launched the Canada Emergency Business Account during the early months of the pandemic, offering businesses loans up to $60,000. While the loans were processed through regular banks and financial institutions, the federal government backed them leaving the liability on the government’s coffers.

The interest-free loans were designed to help businesses with expenses like patio expansions, personal protective equipment or other pandemic-related needs. They came on top of the wage and rent subsidy programs that offered more specific support to businesses.

If businesses repay the loans by the end of this year, they can receive loan forgiveness on up to a third of the amount they borrowed, but if they don’t they must repay the full amount and will face five-per-cent interest on their remaining balance.

Dan Kelly, president and CEO of the Canadian Federation of Independent Business, said the debt is weighing on business owners as the deadline looms.

“There is near panic on the part of close to half of Canada’s small businesses about the looming deadline that is approaching for CEBA loans,” he said.

The CFIB does regular surveys of its members and Kelly said many of them believe repaying on time is going to be a major challenge.

“About 43 per cent of small businesses are telling us they just don’t have the money to repay their CEBA loans and they’re gonna have to take some pretty drastic action if they are required to repay them by the end of this year.”

He said companies don’t want to miss out on the forgiveness, leaving them to consider some fairly desperate options.

“Some of them are looking at borrowing money in order to repay their loan, if they don’t have it, and so there are all sorts of companies out there right now offering crazy, high-interest loans,” he said.

The government gave out just under $50 billion in CEBA loans to nearly 900,000 individual businesses. The program began as a loan of up to $40,000, but was extended to $60,000 as the pandemic dragged on. The government has already given businesses another year to repay their loans and receive forgiveness.

An order paper question submitted in the House of Commons earlier this year, identified more than 50,000 businesses, owing just over $2 billion, who have already been deemed ineligible and ordered to pay back their loans immediately.

The National Post asked the finance department for updated numbers on how many businesses have paid back the loans, how many the government forecast could default and how much is still outstanding, but they provided none of those figures.

With no interest on the loans, Martin Bégin, a spokesperson for the finance department, said they expect many businesses will wait until the end of the year before repaying.

“We will have a more clear indication of a business’s ability to repay closer to the deadline. It’s expected many businesses, even those that are in a position to repay now, will only do so closer to Dec. 31, 2023.”

Dan Kelly, president and CEO of the Canadian Federation of Independent Business, said the debt is weighing on business owners as the deadline looms.© Provided by National Post

OTTAWA – A $50-billion pandemic loan program is becoming a ticking time bomb for the government and Canadian businesses with six months left before the money is supposed to be repaid.

The government launched the Canada Emergency Business Account during the early months of the pandemic, offering businesses loans up to $60,000. While the loans were processed through regular banks and financial institutions, the federal government backed them leaving the liability on the government’s coffers.

The interest-free loans were designed to help businesses with expenses like patio expansions, personal protective equipment or other pandemic-related needs. They came on top of the wage and rent subsidy programs that offered more specific support to businesses.

If businesses repay the loans by the end of this year, they can receive loan forgiveness on up to a third of the amount they borrowed, but if they don’t they must repay the full amount and will face five-per-cent interest on their remaining balance.

Dan Kelly, president and CEO of the Canadian Federation of Independent Business, said the debt is weighing on business owners as the deadline looms.

“There is near panic on the part of close to half of Canada’s small businesses about the looming deadline that is approaching for CEBA loans,” he said.

The CFIB does regular surveys of its members and Kelly said many of them believe repaying on time is going to be a major challenge.

“About 43 per cent of small businesses are telling us they just don’t have the money to repay their CEBA loans and they’re gonna have to take some pretty drastic action if they are required to repay them by the end of this year.”

He said companies don’t want to miss out on the forgiveness, leaving them to consider some fairly desperate options.

“Some of them are looking at borrowing money in order to repay their loan, if they don’t have it, and so there are all sorts of companies out there right now offering crazy, high-interest loans,” he said.

The government gave out just under $50 billion in CEBA loans to nearly 900,000 individual businesses. The program began as a loan of up to $40,000, but was extended to $60,000 as the pandemic dragged on. The government has already given businesses another year to repay their loans and receive forgiveness.

An order paper question submitted in the House of Commons earlier this year, identified more than 50,000 businesses, owing just over $2 billion, who have already been deemed ineligible and ordered to pay back their loans immediately.

The National Post asked the finance department for updated numbers on how many businesses have paid back the loans, how many the government forecast could default and how much is still outstanding, but they provided none of those figures.

With no interest on the loans, Martin Bégin, a spokesperson for the finance department, said they expect many businesses will wait until the end of the year before repaying.

“We will have a more clear indication of a business’s ability to repay closer to the deadline. It’s expected many businesses, even those that are in a position to repay now, will only do so closer to Dec. 31, 2023.”

Businesses that miss this year’s deadline will lose the debt forgiveness and will begin paying five-per-cent interest for two years, before the full loan becomes due at the end of 2025.

Bégin said the government intends to take a cautious approach to collections, as it has with the wage subsidy and Canada Emergency Response Benefit overpayments.

“This approach emphasizes fairness and empathy, and the CRA will work with the businesses to help them resolve their debts based on their ability to pay,” he said.

While the government could not provide numbers, financial statements from Export Development Canada, which housed the program, priced the cost to the government at $13.1 billion, estimating that is how much of the initial $50 billion would be forgiven.

“The full potential impact of the COVID‐19 pandemic on the assumptions such as credit quality and probability of default used to measure the allowance for credit losses is unknown as it will depend on future developments that are uncertain,” the financial statements said.

In the CFIB’s surveys, nine out of 10 businesses said they had taken some CEBA money and 78 per cent said they had not made any payments on their loan so far.

Kelly said they expect as many as 250,000 businesses in Canada could risk closing their doors over the issue. He is encouraging Ottawa to extend the repayment deadline by at least another year.

“If the business goes down Ottawa won’t get even the $40,000 back, so we could end up cutting off our nose to spite our face,” he said. “I do believe that there are some serious risks to Ottawa getting its money back, if this doesn’t happen, if they’re not patient.”

Bégin said the government intends to take a cautious approach to collections, as it has with the wage subsidy and Canada Emergency Response Benefit overpayments.

“This approach emphasizes fairness and empathy, and the CRA will work with the businesses to help them resolve their debts based on their ability to pay,” he said.

While the government could not provide numbers, financial statements from Export Development Canada, which housed the program, priced the cost to the government at $13.1 billion, estimating that is how much of the initial $50 billion would be forgiven.

“The full potential impact of the COVID‐19 pandemic on the assumptions such as credit quality and probability of default used to measure the allowance for credit losses is unknown as it will depend on future developments that are uncertain,” the financial statements said.

In the CFIB’s surveys, nine out of 10 businesses said they had taken some CEBA money and 78 per cent said they had not made any payments on their loan so far.

Kelly said they expect as many as 250,000 businesses in Canada could risk closing their doors over the issue. He is encouraging Ottawa to extend the repayment deadline by at least another year.

“If the business goes down Ottawa won’t get even the $40,000 back, so we could end up cutting off our nose to spite our face,” he said. “I do believe that there are some serious risks to Ottawa getting its money back, if this doesn’t happen, if they’re not patient.”

Tourism businesses in a ‘dire’ state, with debt mounting and demand meager: industry

The head of the Tourism Industry Association of Canada says businesses are struggling to stay afloat under a pile of debt and a dearth of overseas visitors.

In a poll of tourism operators, some 45 per cent said they were likely or somewhat likely to shut down within three years unless the government steps in to adjust their loan conditions.

“Unless there's some change to the payback system and the payback requirements, they're in danger of closing in the next three years,” said Beth Potter, CEO of the trade organization.

“Everything from campgrounds to hotels to amusement parks to outdoor adventure,” Potter said.

"Festival events oftentimes are run by non-profit organizations, and they're really challenged right now in paying back these loans," she said.

“It’s dire."

Many businesses surveyed said they will not be able to make debt payments that are slated to come due in the next two years. The loans include those taken out through federal pandemic relief programs such as the Canada Emergency Business Account (CEBA) as well as the Regional Relief and Recovery Fund and the Highly Affected Sectors Credit Availability Program.

The tourism association is calling on the federal government to extend the zero-interest repayment deadline for CEBA loans to Dec. 31, 2025, two years past the current deadline.

It is also asking Ottawa to boost the forgivable portion of fully repaid loans to 50 per cent, from up to 33 per cent, and to extend the qualifying deadline for that forgiveness to the end of 2024, rather than by the end of this year.

About 30 per cent of survey respondents, mainly small- and medium-sized operations, reported more than $250,000 in outstanding debt. One in five claimed debt between $100,000 and $250,000.

One reason for revenue struggles weighing on repayment efforts is a lack of tourists from abroad compared with 2019.

In March, the combined number of visitors to Canada and returning residents sat at 77 per cent of March 2019 levels, according to the most recent figures from Statistics Canada.

Potter said business travel in particular remains down relative to pre-pandemic totals. “Not only business events like conferences and trade shows and that kind of thing, but also transient business travel, with somebody flying into Toronto for a meeting and then flying back out again.”

Americans have “cocooned within their own country,” Potter said, adding that she remains hopeful they will return in force soon.

Even in the United States, whose travel industry rebounded more quickly than Canada's, business and international travel remain below 2019 levels — "and business travel appears to have stalled at current levels," said TD Cowen analyst Helane Becker in a note to investors on May 30.

Labour shortages remain another problem, hobbling business owners’ capacity to fill skilled positions, market and promote, serve customers at scale and manage their teams.

“We were in a challenging position with labour before the pandemic hit, and the pandemic has just accentuated it,” Potter said.

The exit of many baby boomers from the workforce hasn't helped, she added: "They've said, ‘Nope, we're out, we're retiring, we're moving to the cottage.’ We have lost a huge amount of leadership within the industry.”

After several program extensions and top-ups, the government says on its CEBA website that all “repayment deadlines are now final and cannot be changed.”

The CEBA program funded more than 898,000 small businesses and not-for-profits with $49.2 billion in interest-free loans of up to $60,000 after the COVID-19 pandemic set in, according to the government.

Conducted by Nanos, the online survey polled 149 financial controllers and accountants of businesses in the tourism sector between April 28 and May 12.

This report by The Canadian Press was first published June 20, 2023.

Christopher Reynolds, The Canadian Press

The head of the Tourism Industry Association of Canada says businesses are struggling to stay afloat under a pile of debt and a dearth of overseas visitors.

In a poll of tourism operators, some 45 per cent said they were likely or somewhat likely to shut down within three years unless the government steps in to adjust their loan conditions.

“Unless there's some change to the payback system and the payback requirements, they're in danger of closing in the next three years,” said Beth Potter, CEO of the trade organization.

“Everything from campgrounds to hotels to amusement parks to outdoor adventure,” Potter said.

"Festival events oftentimes are run by non-profit organizations, and they're really challenged right now in paying back these loans," she said.

“It’s dire."

Many businesses surveyed said they will not be able to make debt payments that are slated to come due in the next two years. The loans include those taken out through federal pandemic relief programs such as the Canada Emergency Business Account (CEBA) as well as the Regional Relief and Recovery Fund and the Highly Affected Sectors Credit Availability Program.

The tourism association is calling on the federal government to extend the zero-interest repayment deadline for CEBA loans to Dec. 31, 2025, two years past the current deadline.

It is also asking Ottawa to boost the forgivable portion of fully repaid loans to 50 per cent, from up to 33 per cent, and to extend the qualifying deadline for that forgiveness to the end of 2024, rather than by the end of this year.

About 30 per cent of survey respondents, mainly small- and medium-sized operations, reported more than $250,000 in outstanding debt. One in five claimed debt between $100,000 and $250,000.

One reason for revenue struggles weighing on repayment efforts is a lack of tourists from abroad compared with 2019.

In March, the combined number of visitors to Canada and returning residents sat at 77 per cent of March 2019 levels, according to the most recent figures from Statistics Canada.

Potter said business travel in particular remains down relative to pre-pandemic totals. “Not only business events like conferences and trade shows and that kind of thing, but also transient business travel, with somebody flying into Toronto for a meeting and then flying back out again.”

Americans have “cocooned within their own country,” Potter said, adding that she remains hopeful they will return in force soon.

Even in the United States, whose travel industry rebounded more quickly than Canada's, business and international travel remain below 2019 levels — "and business travel appears to have stalled at current levels," said TD Cowen analyst Helane Becker in a note to investors on May 30.

Labour shortages remain another problem, hobbling business owners’ capacity to fill skilled positions, market and promote, serve customers at scale and manage their teams.

“We were in a challenging position with labour before the pandemic hit, and the pandemic has just accentuated it,” Potter said.

The exit of many baby boomers from the workforce hasn't helped, she added: "They've said, ‘Nope, we're out, we're retiring, we're moving to the cottage.’ We have lost a huge amount of leadership within the industry.”

After several program extensions and top-ups, the government says on its CEBA website that all “repayment deadlines are now final and cannot be changed.”

The CEBA program funded more than 898,000 small businesses and not-for-profits with $49.2 billion in interest-free loans of up to $60,000 after the COVID-19 pandemic set in, according to the government.

Conducted by Nanos, the online survey polled 149 financial controllers and accountants of businesses in the tourism sector between April 28 and May 12.

This report by The Canadian Press was first published June 20, 2023.

Christopher Reynolds, The Canadian Press

No comments:

Post a Comment