Bloomberg News | October 30, 2023 |

(Image: Kazatomprom)

Several hedge fund managers have started ratcheting up their exposure to uranium stocks, as they bet on significant price gains.

Terra Capital’s Matthew Langsford, Segra Capital’s Arthur Hyde, Argonaut Capital Partners’ Barry Norris and Anaconda Invest’s Renaud Saleur are among managers building bets on uranium companies such as Cameco Corp., Energy Fuels Inc., Ur-Energy Inc. and NexGen Energy Ltd.

Langsford, who runs a A$175 million ($110 million) natural resources fund at Sydney-based Terra Capital, says the outlook for uranium prices means “the equities could see dramatic upside, 50%, 100%, possibly more.”

More than a decade after the shock of Fukushima led a number of countries to review their reliance on nuclear power, it’s cemented itself as a vital plank in the transition toward a low-carbon future. That’s driven up uranium valuations, with prices having risen 125% since 2020.

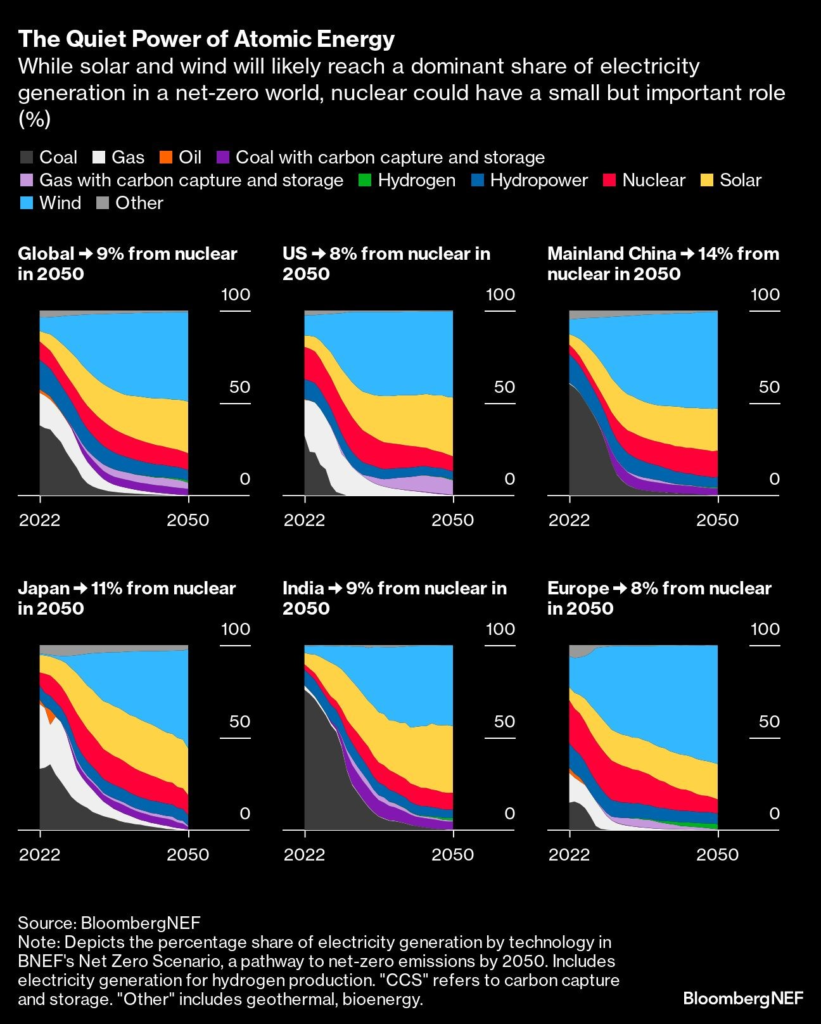

The International Energy Agency estimates that global nuclear capacity needs to double by mid-century from 2020 levels, to help the world meet net zero commitments.

That target is underpinned by demand in Europe, Asia and Africa for nuclear reactors. Old facilities are getting their lifespans extended, while China is continuing to build out its nuclear fleet, all of which is fanning demand for the uranium needed to power those plants.

Such investments remain controversial. Germany famously wound down its nuclear energy program after 2011, as then Chancellor Angela Merkel responded to the global trauma caused by the Fukushima meltdown. That decision has since drawn criticism, with Germany subsequently finding itself deeply reliant on high-emitting fossil fuels supplied by Russia.

Uranium’s appeal has grown as Europe works to wean itself off Russian gas. However, with Russia sitting on roughly 8% of the world’s recoverable conventional uranium resources, the West has found itself needing to perform an even bigger energy-supply pivot.

“We’re most focused on uranium miners in public markets,” Hyde, a portfolio manager at Segra Capital, said in an interview. “For the supply and demand of this market to balance, we need new assets to come online.”

He added that, “if you’re going to insulate the US, Europe and Canada from the global fuel cycle, which is heavily dependent on Russia and China, the best way to do that is to build new mines, new conversion capacity, new enrichment capacity.”

Nuclear power doesn’t emit carbon dioxide, and has even been defined as green in the European Union’s taxonomy of sustainable assets. But it comes with a number of risks.

“There are two main barriers to it being considered a serious contender in the race to net zero: skepticism around the safety of reactors and radioactive waste disposal, and cost,” said Nilushi Karunaratne of BloombergNEF. That skepticism is part of the reason why “the number of reactors in operation today has changed little since the immediate fallout of the 2011 Fukushima accident, as retirements have outpaced new facilities coming online,” she said.

Uranium goes through several stages of processing before it’s ready to use as fuel in nuclear power stations. After it’s mined and milled, the uranium ore is converted into a fluorine gas, which is then enriched and made into fuel rods. These get loaded into reactors, after which the fission that releases energy occurs.

The whole process, called the nuclear fuel cycle, can take years and may rely on supply chains that stretch across several countries. Hyde says political sensitivity around those supply chains is set to drive the West to look for new ways to achieve independence.

Norris, who’s the founder and chief investment officer of Argonaut, says he bought shares in Cameco and Kazatomprom this year. “Once governments wake up to how useless weather-dependent power is, they will go next to nuclear,” said Norris, who has shorted solar, wind and hydrogen stocks.

Not all uranium stocks are equal, though, and a nearly 30% gain in the Global X Uranium ETF this year has some hedge fund managers looking for opportunities to short companies they think are less likely to do well. Saleur of Anaconda, for example, says he’s now looking into shorting Cameco Corp. as a hedge, after it gained more than 70% this year. But he’s long miners including Energy Fuels Inc. and Ur-Energy Inc., he said.

Segra’s Hyde says there’s some “relatively lazy capital investing in a compelling macro story without doing much company level work.” And as the number of buyers grows, some will target the wrong stocks, he said. “Many of the nuances of the nuclear fuel markets remain misunderstood,” Hyde said.

“Nuclear may become the key driving force in the decades-long energy transition. New demand in Europe, Asia and Africa for nuclear reactors and old reactor life-time extensions aligned to net-zero aspirations from governments — and the continued build-out of China’s nuclear fleet — have driven spot uranium prices 125% higher since 2020.”Mike Dennis, Bloomberg Intelligence

Langsford at Terra has been adding to positions in NexGen Energy Ltd. and Denison Mines Corp. NexGen is exploring a new uranium mine in Canada with the potential to produce 25% of global supply.

That would make it “very important for the nuclear industry in the 2030s, which could end up being the golden age of nuclear power,” Langsford said.

(By Sheryl Tian Tong Lee)

No comments:

Post a Comment