Bloomberg News | October 29, 2023 |

London Metal Exchange. (Image by HM Treasury, Flickr.)

Nearly two years since the invasion of Ukraine, a handful of western banks and traders from Citigroup Inc. to Trafigura Group are increasingly willing to enter new deals for Russian metals, seizing opportunities for profit while competitors hold back.

The deals show how some traders are navigating the thicket of sanctions and other restrictions on Russia in order to keep its natural resources flowing, amid conflicting messages from western capitals about whether they want companies to handle Russian commodities. At a time when many are struggling to make money in metals trading, deals involving Russian supplies are one of the few areas where it’s possible to make a solid profit, according to the head of one trading house, speaking privately.

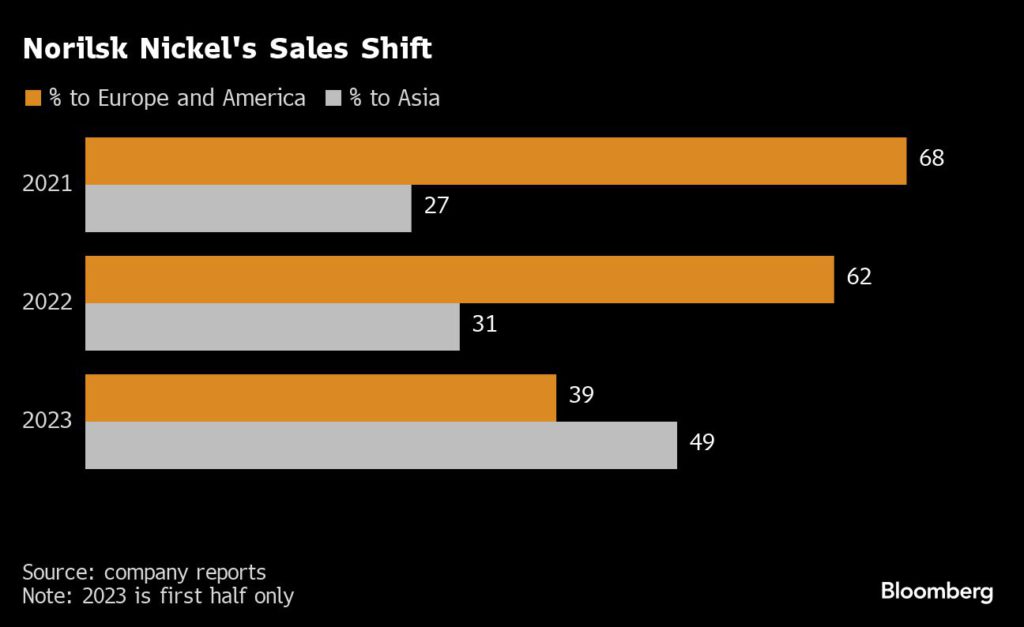

There are no blanket restrictions from western governments on trading Russian metal, and the deals don’t involve those companies that are under US or European sanctions. However, the status of Russian material has been a fraught subject in the metals world, as many western buyers pulled back — resulting in a sharp increase in sales to Asia — while rival producers lobbied unsuccessfully to have even non-sanctioned supplies banned by the LME.

Now, a period of uncertainty over the legal and moral status of dealing in Russian metal is giving way to greater stability 20 months after the invasion of Ukraine.

Among the trading houses, Trafigura has actively sought new deals to buy and sell Russian metal, according to people familiar with the matter, as it moves to steal a march on rival Glencore Plc — which remains a major buyer of Russian aluminum but has said it won’t do new business in the country.

And on the London Metal Exchange, financial firms including Citi and Squarepoint Capital LLP have been buying large volumes of the Russian aluminum that now dominates the exchange’s stockpiles.

The top metal traders have adopted varying stances. Glencore said in March 2022 that it would “not enter into any new trading business in respect of Russian origin commodities,” although it retains a large long-term contract to buy aluminum from United Co. Rusal International PJSC. The company has also continued to buy copper from Russia and to supply alumina to Russia since the war broke out, according to trade data.

“These transactions form part of contracts that were in place before the war in Ukraine broke out and is in line with our policy regarding Russian business activities that was put in place at the end of March 2022,” a spokesman said. “Glencore has undertaken no new business activities with Russian companies since the outbreak of the war.”

London Metal Exchange. (Image by HM Treasury, Flickr.)

Nearly two years since the invasion of Ukraine, a handful of western banks and traders from Citigroup Inc. to Trafigura Group are increasingly willing to enter new deals for Russian metals, seizing opportunities for profit while competitors hold back.

The deals show how some traders are navigating the thicket of sanctions and other restrictions on Russia in order to keep its natural resources flowing, amid conflicting messages from western capitals about whether they want companies to handle Russian commodities. At a time when many are struggling to make money in metals trading, deals involving Russian supplies are one of the few areas where it’s possible to make a solid profit, according to the head of one trading house, speaking privately.

There are no blanket restrictions from western governments on trading Russian metal, and the deals don’t involve those companies that are under US or European sanctions. However, the status of Russian material has been a fraught subject in the metals world, as many western buyers pulled back — resulting in a sharp increase in sales to Asia — while rival producers lobbied unsuccessfully to have even non-sanctioned supplies banned by the LME.

Now, a period of uncertainty over the legal and moral status of dealing in Russian metal is giving way to greater stability 20 months after the invasion of Ukraine.

Among the trading houses, Trafigura has actively sought new deals to buy and sell Russian metal, according to people familiar with the matter, as it moves to steal a march on rival Glencore Plc — which remains a major buyer of Russian aluminum but has said it won’t do new business in the country.

And on the London Metal Exchange, financial firms including Citi and Squarepoint Capital LLP have been buying large volumes of the Russian aluminum that now dominates the exchange’s stockpiles.

The top metal traders have adopted varying stances. Glencore said in March 2022 that it would “not enter into any new trading business in respect of Russian origin commodities,” although it retains a large long-term contract to buy aluminum from United Co. Rusal International PJSC. The company has also continued to buy copper from Russia and to supply alumina to Russia since the war broke out, according to trade data.

“These transactions form part of contracts that were in place before the war in Ukraine broke out and is in line with our policy regarding Russian business activities that was put in place at the end of March 2022,” a spokesman said. “Glencore has undertaken no new business activities with Russian companies since the outbreak of the war.”

Trafigura, on the other hand, has actively sought new deals in the Russian metals industry, according to several people familiar with the matter, who asked not to be identified as the discussions are sensitive. It struck a term deal to buy over 100,000 tons of copper from MMC Norilsk Nickel PJSC and has also been buying significant quantities of nickel from the Russian company, making it one of the mining giant’s largest customers, the people said.

Trafigura struck an agreement to buy nearly 200,000 tons of aluminum from Rusal this year, in a direct challenge to Glencore, separate people familiar with the matter said.

The trader also is bidding to win a long-term contract to buy the zinc ore that will be produced by the vast Ozernoye mine in Siberia, which is due to start production in the next few months and set to be one of the world’s largest zinc mines once it is producing at full capacity, other people said. Other companies seeking to buy from the mine include Swiss trading house Open Mineral, as well as two Chinese companies, one of the people said.

IXM, the third-largest metals trader behind Glencore and Trafigura, does not do any business inside Russia, chief executive Kenny Ives said in a recent interview. “Do we buy Russian metal outside of Russia? Yes we do. And I plan on continuing buying Russian metal outside of Russia provided we’re able to and our competitors are doing the same,” he said.

Meanwhile, Red Metal AG, a Swiss trading company that had been a significant buyer of Russian copper, has now wound down that business, according to Managing Director Milan Popovic. “Red Metal AG has completely terminated all contracts with Russian suppliers and the last delivery we received was on September 6, 2023,” he said, adding that the company would now focus on other countries including Serbia, Uzbekistan, Mongolia, China and Kazakhstan.

There is a similar variation in policies in the banking industry. Very few banks are willing to finance the purchase of Russian metals directly from a Russian company, according to traders and bankers, out of concerns ranging from potential exposure to sanctions to logistical difficulties and ethical and reputational issues.

But once Russian metal has been delivered on to the LME, some banks have in recent months been increasingly willing to buy it — arguing that there is a difference between financing a trade involving a Russian entity and buying metal via the world’s main exchange.

For example, Citi has been one of the most active buyers of Russian aluminum on the LME in recent months. The bank had until recently been avoiding metal produced by Rusal, Bloomberg reported in August, but is now happy as a major participant on the LME to take delivery of Russian metal if it comes via the exchange.

Other major banks in the metals markets that have adopted a similar stance include ICBC Standard Bank Plc and Macquarie Group Ltd., both of which are willing to finance Russian metal if it has been delivered on to the LME, according to people familiar with the matter.

It’s not just banks that are buying Russian metal on the LME: hedge fund Squarepoint bought about 50,000 tons of aluminum, the large majority of it Russian, as a bet on the market, Bloomberg reported earlier this month.

The purchases are underpinning the market for Russian aluminum, at a time when some of Rusal’s competitors had warned that the LME risked being flooded by Russian metal that nobody would buy. In a consultation a year ago, the LME considered and rejected that argument: it ultimately decided to keep accepting Russian metal.

Still, some banks are taking a more cautious stance. Bank of Montreal, for example, won’t finance Russian metal at all, according to a person familiar with the matter. If the bank’s traders are allocated warrants for Russian metal in the LME’s settlement system, they immediately re-sell them, the person said.

The press services for Rusal, Norilsk Nickel and the Ozernaya Mining Company did not respond to requests for comment. Spokespeople for Trafigura, Citi, ICBC Standard Bank, Macquarie and BMO all declined to comment. Open Mineral, which is backed by United Arab Emirates sovereign wealth fund Mubadala, does its Russian business through an entity in the UAE, according to a person familiar with the matter.

No comments:

Post a Comment