OPINION – Canada’s tariff plan on Chinese EVs and its implications

The Canadian government is launching a public consultation to see whether Canada should follow the US and EU to adopt tariffs on Chinese-made Electric Vehicles (EVs). However, this trend of Canadian protectionism not only reflects a widespread Western perception of the rising Chinese “economic threat,” but also raises a question of how the influx of Japanese automobiles was eventually tackled in Canada during the 1970s and 1980s.

Finance Minister Chrystia Freeland has announced that the Canadian government on July 2 would trigger a 30-day consultation on the proposed tariffs to protect Canada’s auto workers in their developing EVs industry. There would likely be a surtax on the imports of Chinese EVs under Section 53 of the Customs Tariff Act. The Canadian government will seek public views on the protection of Canada’s national interests and on related Chinese labour and environmental standards.

In recent years, China has become the largest manufacturer and exporter of EVs. The US will raise tariffs on the Chinese EVs from 25 percent to 100 percent in 2024, while the EU will impose tariffs of up to 38 percent on Chinese-made EVs on July 4. China is now negotiating with the EU on the matter of tariffs.

Canadian Finance Minister Freeland said the proposed measures would prevent Canada from becoming “a dumping ground for Chinese oversupply.” Ontario provincial premier Douglas Ford said he hoped the federal government in Ottawa would match or even exceed US tariffs for the sake of protecting jobs in the automobile sector, while Freeland criticised China for flooding the global markets under the policy direction and subsidies of the Chinese government.

The immediate reaction of Canada’s unionists and auto sector is that they support the Canadian government plan due to self-protectionism.

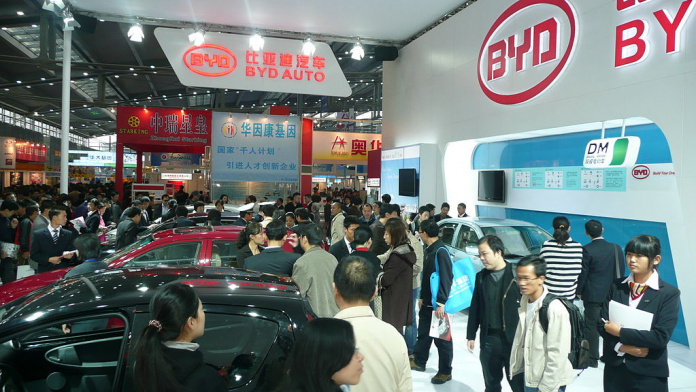

The US, EU, and Canada are all concerned that their own car manufacturers cannot compete with the relatively much cheaper prices of Chinese EVs makers, especially BYD Company Ltd.

The Chinese government said that foreign accusations of Chinese “overcapacity” in EVs is “totally groundless,” and that the Canadian tariff plan would “violate World Trade Organization rules” and “harm Sino-Canadian bilateral economic and trade cooperation.”

In fact, Canada has recently subsidised its own EVs industry. Ottawa, Ontario and Quebec have promised Canadian $50 billion subsidies to encourage foreign auto makers, such as Volkswagen and Honda, to build EVs plants in the country. Imports of EVs were reportedly about Canadian $2.2 billion in 2023 compared with Canadian $84 million in 2022, but actually most EVs imported to Canada are from US auto maker Telsa. The Chinese EVs are making up a growing proportion of the EVs market in Canada.

Some critics of the Canadian plan argue that high tariffs would raise prizes for Canadian customers, and that it should be accompanied by positive policy measures helping local automakers catch up with China and produce their budget-friendly and quality EVs rather than just delaying the transition from gasoline cars to EVs.

Other critics say that the entry of Chinese EVs into Canada is inevitable and that Canada should learn from how it dealt with the rapid increase in the imports of Japanese-made Toyotas, Datsuns and Hondas from 4 percent of the North American market in 1970 to 20 percent in 1980. In 1981, the US and Canada negotiated with Japan on a ceiling of the number of imported Japanese vehicles from each individual company. Most importantly, the Japanese automobile makers were encouraged to open their manufacturing factories in Canada, accelerating the metamorphosis of the Canadian automobile industry and creating a win-win situation.

Other critics have commented that tariffs alone would likely shift the Chinese EVs manufacturing bases to other places, like Mexico and Brazil, where more auto workers will be employed. In other words, the Canadian government should adopt a more proactive and positive approach to making compromises with China. Having a BYD assembly plant in Canada, for example, would generate local employment and also provide more choices to Canadian customers who are interested in buying EVs.

The Canadian tariff plan on Chinese EVs can be attributable to several factors: the tendency of the Canadian government to follow the examples of US and EU in protecting their EVs industry; the self-protective nature of Canadian stakeholders with their own vested interests; the fear of the ruling Liberal Party of losing more votes under the currently unfavourable public opinion and media against the government; and the common trend of perceiving China as an “economic threat” in the eyes of the developed Western world.

In conclusion, the Canadian government’s tariff plan on Chinese EVs has secured the initial support of local stakeholders in the automobile industry amid a general Western perception of the Chinese “economic threat.” Nevertheless, a win-win scenario would be a compromise between Canada and China, allowing perhaps a few Chinese EVs companies to open assembly plants in Canada where local auto workers will be the beneficiaries, where local car customers will have greater freedom of choice, and where the transition from gasoline cars to EVs for the public interest of achieving sustainable development will even be accelerated. It remains to be seen whether such a win-win situation will become a reality.

*Sonny Shiu-Hing Lo is a political scientist, veteran commentator, and author of dozens of books and academic articles on Hong Kong, Macau, and Greater China

No comments:

Post a Comment