Bloomberg News | September 24, 2024 | 1

Narrabri coal mine. Credit: Whitehaven Coal

Australia approved the expansion of three coal mines, sparking criticism of Prime Minister Anthony Albanese’s administration and its efforts to keep emissions in check.

The government cleared an extension of operations at Whitehaven Coal Ltd.’s Narrabri, MACH Energy Australia Pty’s Mount Pleasant and Ashton Coal Operations Pty’s Ravensworth thermal coal mines in New South Wales. The Narrabri underground mine was granted permission to operate until 2044 and Mount Pleasant to 2048.

Australia, one of the world’s biggest exporters of fossil fuels, has been criticized for continuing to support massive coal and natural gas projects while pursuing more ambitious cuts to domestic emissions. Miners argue that their fuel is cleaner than supplies from other nations and that delays to approvals risk jobs and Australia’s reputation as a reliable partner.

“Whitehaven’s high quality thermal coal has an important role to play in supporting global energy security during the multi-decade energy transition, particularly in Asia where there continues to be strong demand for its use in high-efficiency, low-emissions, coal-fired power stations,” the Sydney-listed company said Wednesday.

The three mines will emit about 1.4 billion tons of carbon dioxide over their lifetime, according to the Australia Institute, about three times national annual emissions. They take the total number of coal projects approved by Albanese’s government to seven.

“These are not new projects,” but extensions of existing operations, said Environment Minister Tanya Plibersek. “The emissions from these projects will be considered by the Minister for Climate Change and Energy under the government’s strong climate laws.”

Australia’s thermal coal exports are set to fall to about A$28 billion ($19 billion) in the year through June 2026, from A$37 billion in the 2023-2024 period, according to government forecasts. Volumes are likely to be stable.

(By Stephen Stapczynski)

US backs Australian lithium, rare earths projects for up to $786 million

Reuters | September 23, 2024 |

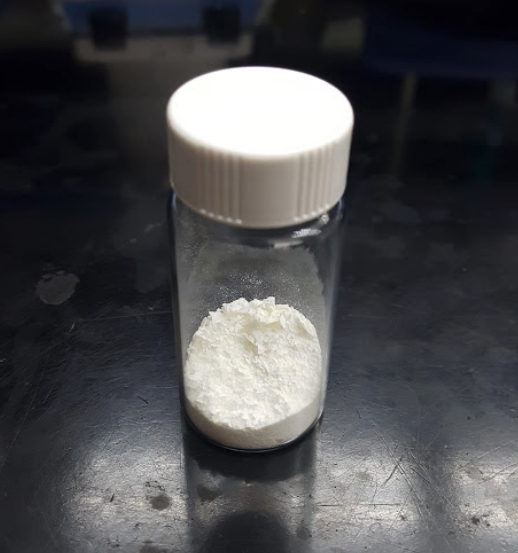

Anson Resources’ first vial of lithium hydroxide product from its Paradox project in Utah. (Image courtesy of Anson Resources.)

The United States has backed an Australian lithium and a rare earths project with up to $786 million in debt funding as Western countries seek to build supply chains for critical minerals.

Australia’s American Rare Earths said on Tuesday it had received a letter of interest for a debt funding package of up to $456 million from the Export-Import Bank of the United States (EXIM) to support construction of the Cowboy State Mine area at its Halleck Creek project in Wyoming.

“We are hopeful that it will serve as an anchor to help attract private funding into the project,” said Melissa Sanderson, a member of the company’s board of directors.

The bank has also offered $330 million to finance the construction of Anson Resources’ lithium production plant in the Paradox Basin, Utah, the Australian company said on Tuesday.

Earlier this year, the bank backed two Australia-listed listed rare earths projects by Australian Strategic Materials and Meteoric Resources with up to $850 million of funding.

The United States and Australia established a critical minerals taskforce last year as Australia seeks to attract investment in minerals processing from allied countries, aiming to reduce reliance on China, which currently controls more than 80% of the global supply.

(By Roshan Thomas; Editing by Mohammed Safi Shamsi and Subhranshu Sahu

No comments:

Post a Comment