Alexander Richter 25 Aug 2021

Pertamina Geothermal Energy (PGE) is looking at the geothermal field of Ulubelu for a pilot project to develop green hydrogen production.

Indonesian state-owned PT Pertamina Geothermal Energy is exploring the developing of green hydrogen production and the extraction of rare earth metals with its geothermal operations, so an article by KataData today.

President Director of PGE Ahmad Yuniarto said that the geothermal operations of PGE have so far focused on the production of electricity, but there are opportunities in expanding the value extraction from geothermal energy and the production of green hydrogen is one of them.

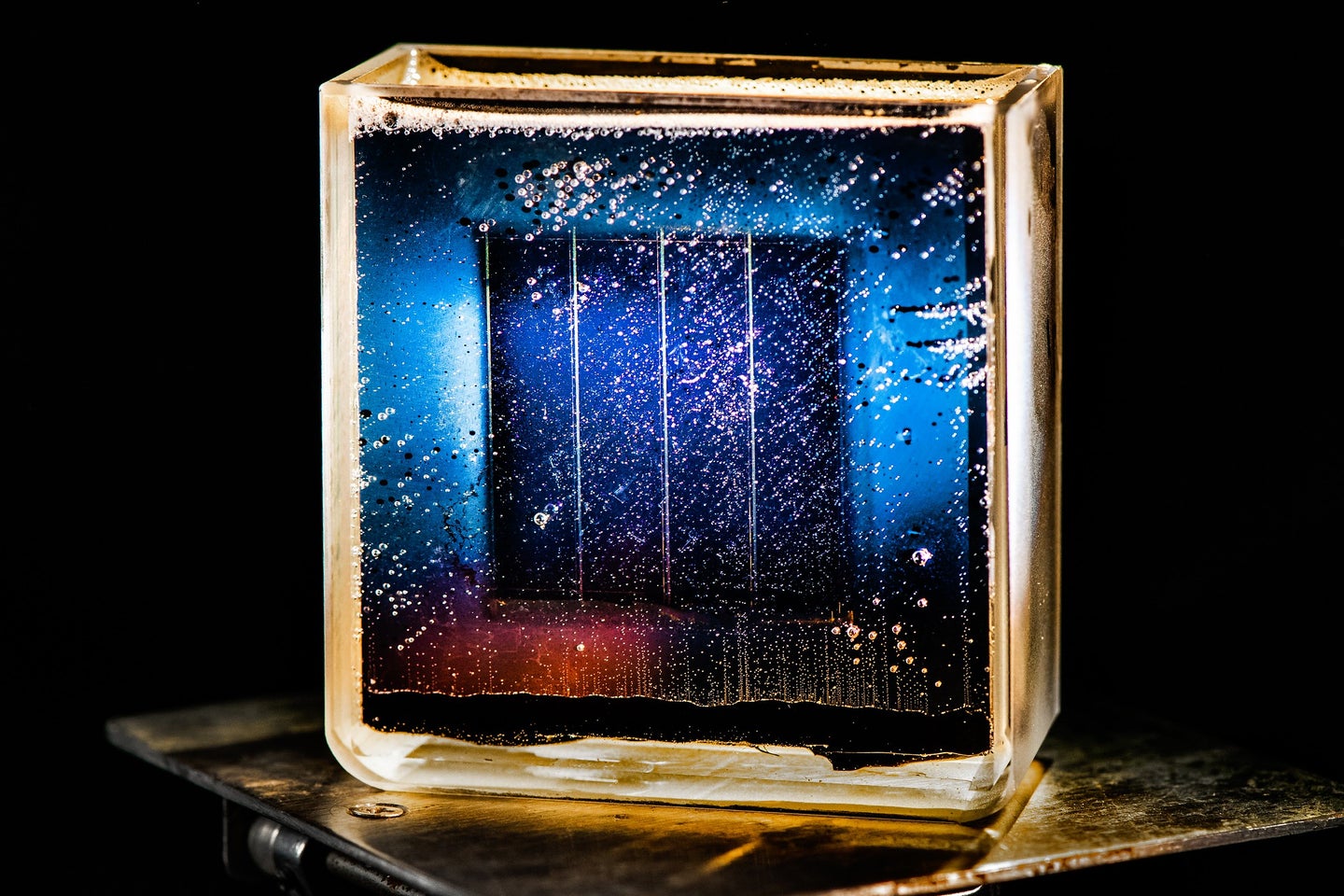

The company is now exploring the Ulubelu geothermal working area (WKP) as the first site for a project researching the development of green hydrogen production. The reason is that the geothermal fluid in the area is still dominated by water and hot steam which is suitable for hydrogen development.

The market potential for green hydrogen is also wide open. Besides being able to be used for fuel in the transportation sector, this energy can also be used for the petrochemical industry which has been using hydrogen produced with a higher emission footprint.

According to him, along with the need to reduce carbon emissions, the need for green hydrogen becomes a necessity. Singapore and Japan, for example, have prepared themselves to enter into the utilization of this energy. “This is certainly an opportunity for our green hydrogen exports,” he said. In addition, Ahmad also talked about the potential for utilizing and increasing the added value of associated mineral resources in geothermal fluids. It is even currently studying the potential of nano silica minerals. “This mineral has added value as well. Can we efficiently extract this nano silica,” he said.

In several places he also talked about the potential of rare earth metals. Even so, Ahmad doesn’t know how big the potential and the economy is to extract it.

Source: KataData

August 25, 2021

In our most recent article, “Energy in ASEAN: Hydrogen in Singapore”, we highlighted some of the key developments in Singapore’s hydrogen sector as the island state moves to implement its “Green Plan” and begins to take its first steps in exploring the potential of hydrogen playing a role in its economy going forward. Now we turn our attention to the wider Asia Pacific region and, in addition, consider how another region, specifically the Middle East, is likely to be critical in the development of the hydrogen economy.

In contrast with Singapore’s more cautious approach, other countries in the Asia Pacific region are already betting big on hydrogen. Japan, the first country to adopt a focused approach to the development of its hydrogen economy when the government released its “Basic Hydrogen Strategy” in 2017, continues to lead the way in the sector. The latest example of Japan’s commitment to hydrogen can be seen in its prominent role at the Tokyo 2020 Olympics. Billed as the “Hydrogen Olympics,” Tokyo 2020 has seen hydrogen being used to fuel the Olympic Cauldron during the opening ceremony. Moreover, the Olympic Village is being used as a demonstration of how hydrogen technology can be used in practice by having hydrogen fueled athlete buses and vehicles (using hydrogen fuel cells) and heated water in the cafeterias, dormitories and training facilities. In total, approximately 500 hydrogen-powered fuel cell vehicles were utilized during the Olympics. Japan is also aiming to construct 1,000 hydrogen refueling stations for fuel-cell vehicles across the country by 2030.

In another interesting development, Tokyo recently announced plans to launch a new initiative aimed at assisting the Association of Southeast Asian Nations (ASEAN) members in becoming decarbonized societies. Japan’s Ministry of Economy, Trade and Industry (METI) is making arrangements to reach an agreement with the ASEAN nations on the new initiative which will involve preparation of a roadmap to decarbonization, as well as the provision of a public and private investment and loan facility of up to US$10 billion1. Dubbed the Asia Energy Transition Initiative (AETI), one of its aims is to encourage thermal power generation that reduces carbon dioxide emissions by mixing coal with ammonia—the developing nations of Southeast Asia remain heavily reliant on coal as a fuel source. In addition, Japan has also suggested that ASEAN countries could share their technological development and deployment support for offshore wind power generation, ammonia and, of course, hydrogen2. If the AETI is successful, it could help to secure supply of the vast quantities of hydrogen and ammonia that Japan will require in order to fuel its developing hydrogen society.

China has also been ramping up its activity in the hydrogen sector. The recently released a 14th Five-Year Plan (2021-2025) (“Five Year Plan”) that specifically highlights hydrogen as a sector that China intends to advance. Although China has yet to develop a national hydrogen strategy or roadmap, 16 provinces and cities have launched supplementary five-year plans that specifically feature hydrogen. Beijing’s five-year plan, for example, includes efforts to promote electric and intelligent vehicles and accelerate the planning and construction of hydrogen refueling stations. The intention is for two million new-energy vehicles (NEVs) to run on the streets of Beijing by 20253. Beijing is also planning to develop five to eight world-leading hydrogen companies before 2023 and aims to grow the city's hydrogen market to at least CNY 100 billion ($15.4 billion) over the course of the next four years.

These announcements come at a time when hydrogen projects in China are drawing interest from overseas investors, as well as major local players (e.g. Shanghai Electric Power, a subsidiary of the State Power Investment Corporation, which recently announced it had signed an agreement with energy major Shell to develop hydrogen and other clean energy projects in and outside China4). Air Liquide, for example, is currently working to develop the Daxing hydrogen station which, with a capcity of nearly 5 tonnes per day, is the world’s largest. The site, owned and operated by Beijing Hypower Energy Technology Ltd, can refuel 600 hydrogen fuel cell vehicles per day.5

China undoubtedly represents a potentially huge market for hydrogen. The China Hydrogen Alliance, a state-supported industry body, predicts that the output value of the China’s hydrogen energy industry will reach 1 trillion yuan ($152.6 billion) by 2025 and that, by 2030, demand for hydrogen will reach 35 million tons, accounting for at least 5 percent of China’s energy system6. However, in order for China’s fledging hydrogen sector to develop, the country faces a similar set of obstacles as those other nations promoting the use of hydrogen, namely, the cost of production, storage, transportation and delivery.

The cost of hydrogen production is currently the subject of much debate in Australia, which has, along with Japan and South Korea, been at the forefront of the development of the hydrogen economy in Asia Pacific. Currently, one of the major obstacles to the development of “green” hydrogen production (i.e., hydrogen produced through water electrolysis powered by renewable energy sources such as wind and solar) is cost. In both Australia and the United States, most of the focus on hydrogen production has been in the “blue” space or hydrogen produced by splitting natural gas through steam methane or auto thermal reforming, where the other byproduct, carbon dioxide is captured and stored through carbon capture and storage (CCS).

The Australian government, for example, is promoting cheaper “blue” hydrogen projects fueled by Australia’s vast natural gas reserves and a number of Australia’s key oil and gas players, including Origin Energy, Woodside Petroleum, BP Australia and APA Group, see the emerging hydrogen sector as a route towards evolving their respective businesses7. In 2020, Australia’s Commonwealth government set a target price of AU$2 ($1.46) per kilogram for hydrogen production and has moved to expand funding for projects utilizing CCS technology. Currently, blue or “brown” hydrogen (i.e., produced by gasification of coal), coupled with CCS, costs approximately $1.80-$2.40 per kilogram. By contrast, green hydrogen ranges between $3 and $6 per kilogram as the technology remains under development.8

Australia intends to be major player on the hydrogen stage and it has been the setting for a number of significant projects to date, including the Hydrogen Energy Supply Chain project in Victoria’s Latrobe Valley. The sector recently suffered a setback, however, with the Commonwealth government’s rejection of the proposed $36 billion wind, solar and hydrogen mega project in Western Australia, citing “clearly unacceptable impacts” on “international recognized wetlands and migratory bird species,”9 as well as highlighting concerns in relation to the proposed expansion of the project. The Asian Renewable Energy Hub (AREH) proposes to initially construct 15 GW of renewable capacity (expanding to 26 GW) and produce green hydrogen and ammonia for export to Asian markets. The AREH consortium (which comprises privately owned InterContinental Energy, renewable energy developer CWP Energy Asia, wind turbine manufacturer Vestas and a Macquarie Group fund) has indicated that it will engage with the government in order to better understand the environmental concerns but the decision certainly comes as a blow to Australia’s nascent hydrogen industry.

Who else is looking at hydrogen?

Looking elsewhere in Asia Pacific, the development of hydrogen projects and initiatives is moving at a much slower pace. In ASEAN, incentives may be required from more developed hydrogen players (such as Japan through the AETI, for example) in order to encourage developing nations to increase investment in the hydrogen sector. Key to the success of the development of a hydrogen economy in ASEAN will be engagement of the three major national oil companies in the region: Petronas (Malaysia), Pertamina (Indonesia) and PTT (Thailand), or the “3 Ps”. Indeed, both Petronas and Pertamina have already announced plans to invest in the hydrogen space. Pertamina has set a target of 10 GW of additional clean power generation capacity by 2026, with 1 GW to be derived from initiatives such as the development of an electric vehicle ecosystem and hydrogen10. Meanwhile Petronas, which produces blue hydrogen as a byproduct of its liquefied natural gas (LNG) production process, recently announced that it was exploring the commercial production of green hydrogen11. The Malaysian state-owned producer has also announced that it has teamed up with Japanese trading house Itochu Corp. and an unnamed Canadian pipeline company to study the feasibility of constructing a $1.3 billion petrochemical plan in Alberta province with the goal of exporting hydrogen to Asian markets through the production of ammonia12. In Thailand, PTT has established the “Hydrogen Thailand Group” to “vigorously promote it as a new alternative energy of the future for a low-carbon circular economy in Thailand.”13

Despite the apparent lack of developments elsewhere in ASEAN, there are certainly opportunities in the region. Vietnam, for example, continues to experience rapid growth in its renewable energy sector, particularly in solar and offshore wind. These renewable energy projects could present an ideal opportunity to establish green hydrogen production facilities in Vietnam. This is not lost on the Vietnamese government, which has declared an interest in the development of hydrogen resources with Resolution 55-NQ/TW of the Politburo, issued in February 2020, which set the task of “conducting technology research and develop plans for piloting electricity generation using hydrogen and encouraging the use of hydrogen consistent with the global trends.” It will be interesting to see whether Vietnam’s much anticipated Power Plan VIII (which is currently in draft form) is updated to incorporate any hydrogen-related initiatives.14

Looking to the West, there is another region that is likely to be critical to the development of the hydrogen economy in Asia Pacific: the Middle East. The hydrocarbon dependent economies of the Gulf Cooperation Council (GCC) are ramping up efforts to diversify away from oil and gas, with hydrogen expected to play a key role. The GCC countries see an opportunity in exporting both hydrogen and ammonia to the emerging hydrogen economies of the Far East, Japan and South Korea in particular, and a number of agreements have already been executed. With extensive experience of exporting liquid fuel, Saudi Arabia, the United Arab Emirates (UAE), Qatar and the Sultanate of Oman are all well placed to ramp up their involvement in the hydrogen sector.

In the UAE, Abu Dhabi National Oil Company (ADNOC) has entered into agreements with GS Energy of South Korea and Inpex Corp. and Jera Co. of Japan to explore commercial opportunities in hydrogen and ammonia15. ADNOC has also entered into an agreement with Itochu Corp. to sell its first cargo of blue ammonia. ADNOC will produce ammonia in a joint venture with OCI NV of the Netherlands. The joint venture, known as Fertiglobe16, is installing carbon capture units at its production sites, with the intention that the carbon will subsequently be transported to ADNOC’s oil fields and injected for use in enhanced oil recovery (EOR).17

Meanwhile in Saudi Arabia, much of the focus has been on Neom, the $500 billion zero-carbon city, which is currently under development in the northwest of the country. Neom has formed a joint venture with New York-listed Air Products and Saudi power developer, ACWA Power, to establish a $5 billion green hydrogen project. Currently the world’s largest green hydrogen project under construction, it is expected to produce approximately 1.2 million metric tons per year of ammonia by 2025.

Hydrogen is also gaining traction elsewhere in the GCC. In the Sultanate of Oman, OQ, the state-owned integrated energy company, recently announced its intention to develop a 25 GW renewable solar and wind project which, when operating at full capacity, will have the potential to produce 1.8 million tonnes of green hydrogen per annum, as well as up to 10 million tonnes of green ammonia. OQ has formed a consortium with Hong Kong-based renewable hydrogen developer InterContinental Energy and Kuwait-based energy investor Enertech to develop the project in the Al Wusta governorate on the Arabian Sea. With construction due to commence in 2028 (and reaching full capacity by 2038), the $30 billion project has the potential to be one of the largest green hydrogen projects in the world, with most of the hydrogen produced likely to be exported to Europe and Asia.18

Conclusion

It is evident, from the increasing frequency of new projects being announced and collaboration among key market players, that the emergence of hydrogen is gathering pace. The Asia Pacific region, which saw the first significant developments in this sector, continues to lead the way, with Japan and South Korea taking the greatest strides towards becoming hydrogen societies. However, with a stream of new hydrogen initiatives being announced by the likes of China and Singapore, it is clear that other nations in the region are also beginning to see its potential. While interest in the rest of ASEAN appears, at this stage, to be relatively lukewarm, both Pertamina and Petronas are taking significant steps to explore opportunities in the hydrogen space. The initiatives being rolled out by the petro-economies of the GCC can be seen as significant steps in the development of the hydrogen economy. With the GCC looking to a future beyond oil, hydrogen and ammonia present real opportunities for the region to retain its position as a major exporter of energy after hydrocarbon resources are depleted. The question will be whether the future market for exporting hydrogen is large enough to support this.

The challenges associated with hydrogen remain, but with an ever increasing focus on research and development (R&D) in hydrogen and ammonia-related technologies, there is a real possibility that some (if not all) of these may be overcome in the short to medium term as countries around the globe ramp up efforts to decarbonise their economies.

1 https://asia.nikkei.com/Spotlight/Environment/Climate-Change/ASEAN-to-receive-10bn-decarbonization-support-from-Japan.

2 https://www.spglobal.com/platts/en/market-insights/videos/market-movers-asia/080221-tanker-attack-china-petchems-lng-steel.

3 https://asia.nikkei.com/Spotlight/Caixin/China-s-hydrogen-roadmap-4-things-to-know.

4 https://www.h2-view.com/story/china-set-for-huge-hydrogen-boost-with-agreement-between-shell-china-and-shanghai-electric/

5 https://www.airliquide.com/mainland-china/air-liquides-technology-chosen-worlds-largest-hydrogen-station-beijing-china

6 http://h2cn.org.cn/en/index.

7 https://asia.nikkei.com/Business/Energy/Australia-s-hydrogen-dreams-colored-by-blue-vs.-green-divide.

8 Ibid.

9 https://www.reuters.com/business/sustainable-business/australia-rejects-36-bln-wind-solar-hydrogen-project-2021-06-21/.

10 https://www.argusmedia.com/en/news/2231095-indonesias-pertamina-eyes-hydrogen-to-meet-2026-goal.

11 https://www.forbes.com/custom/2021/07/08/petronas-gearing-up-for-the-future-with-cleaner-and-renewable-energy/.

12 https://financialpost.com/commodities/energy/petronas-eyes-1-3b-petrochemical-project-in-alberta-to-export-hydrogen-to-asia.

13 https://www.pttplc.com/en/Media/News/Content-22250.aspx.

14 https://en.vietnamplus.vn/green-hydrogen-development-associated-with-offshore-wind-power-experts-say/203982.vnp.

15 https://www.adnoc.ae/en/news-and-media/press-releases/2021/adnoc-and-three-japanese-companies-to-explore-hydrogen-and-blue-ammonia-opportunities

16 https://www.fertiglobe.com/.

17 https://www.rigzone.com/news/wire/adnoc_sells_trial_cargo_of_blue_ammonia_to_itochu-03-aug-2021-166099-article/.

18 https://oq.com/en/news-and-media/newsroom/20210518-green-fuels-mega-project.