Tanker Risk Response to Iran-Israel Is The Real Oil Chokepoint

- Tanker operators avoid Gulf routes, driving freight rates up over 20% due to heightened Iran-Israel tensions.

- Market stability remains fragile, as tanker companies' route shifts, insurance hikes, and operational caution signal ongoing volatility despite the absence of direct attacks.

- A surge in premiums or new route warnings signal that tanker risk is structural, and this could create a situation of ongoing volatility even if tanker attacks remain unrealized.

Global tanker operators and shipping authorities have taken decisive action, even without an official closure of the Strait of Hormuz, amid escalating tension between Israel and Iran. Their public statements, route shifts, and risk assessments are reshaping freight scheduling, insurance premiums, and–most significantly–energy market sentiment in real time.

Oil shippers may have walked back some of their panic expressed during the weekend, which led oil to jump 7%, but this isn’t over, and the volatility will be high.

Reuters reported on Monday that VLCC bookings for Middle East-to-Asia routes plunged this past Friday, with freight rates surging more than 20% to around Worldscale 55 by Monday—signal enough for tanker owners to adopt a “wait and see” posture. Analysts at LSEG noted that while ships remain available in the Gulf for outbound charters, new contracts are drying up, underscoring a sudden market-wide caution.

Reuters also reports that smaller shipowners are similarly holding back vessel offers, with export charters now largely priced out of the Gulf unless risk terms are adjusted. Clean-product tanker rates are showing signs of pressure too: once $3.3–3.5 million per voyage, brokers now expect quotes near $4.5 million.

Related: OPEC Oil Output Increase Falls Short of Target

At the center of this shift is Frontline, the world’s largest oil tanker company. Its CEO Lars Barstad confirmed to the Financial Times that the firm has suspended new bookings for Gulf voyages altogether. “We’re not contracting to go into the Gulf,” he said. Barstad explained that vessels already in the region would leave under naval convoy, adding poignantly: “Trade is going to become more inefficient and, of course, security has a price.”

Bloomberg corroborates that other major tanker firms have also rooted out Gulf contracts, citing growing alarm over potential retaliatory moves by Iran after recent Israeli strikes against its energy sites. Clients and charterers now face shrinking capacity—a trend that may ripple into regional and global fuel price pressures.

The tightening of tanker willingness flows directly into insurance markets. Brokers calculate that tankers traversing Gulf waters now require an additional $3–$8 per barrel in war-risk insurance, significantly inflating transport costs. That added cost alters the economics of crude trades, nudging pricing models upwards.

Ports and maritime agencies are publicizing precautionary measures. The Greek shipping ministry has instructed Greek-flagged vessels to report travel through high-risk zones like the Gulf of Aden or Hormuz, mandating detailed voyage logs. Similarly, the UK Maritime Trade Operations advises minimal crew deployment on deck and strict reporting protocols. Each advisory signals that national flags are treating the waters as low-grade conflict zones.

Maritime-security experts point to non-traditional threats as well.

A recent CIMSEC analysis, cited by Capt. Harifidy A. Alex Ralaiarivony of Mauritius’s RMIFC, highlights that the Western Indian Ocean now faces a “diversifying threats” portfolio—from naval shadowing and electronic jamming to state-linked disruptive tactics. He emphasizes that escalating threats demand broader resilient responses, recognizing shipping firms as first responders in a complex threat environment.

Recent GPS spoofing and navigational interference events flagged by LSEG analysts also point to more danger beyond missiles. These “electronic ambushes” are also alarming insurers and shippers.

Now, as of June 16 at 10:40am ET, Brent is down over 4%, reflecting a partial unwinding of that initial fear trade as no tankers have yet been directly targeted and core shipping lanes remain technically open. In effect, the market initially reacted to perceived shipping risk, but as the weekend passed without a direct incident, some of that risk premium has been pulled back, even though the underlying vulnerabilities remain. This is not over for the tanker sector.

Refined-product tankers have also felt the squeeze. According to Reuters, freight brokers report that clean-product tanker voyages from the Gulf to Asia, which previously cost around $3.3 to $3.5 million per voyage, are now being quoted as high as $4.5 million. The sharp rise reflects mounting war-risk premiums and growing owner reluctance to take on Middle Eastern routes as tensions escalate. These higher freight costs directly impact product supply chains, narrowing refinery margins and putting additional upward pressure on consumer fuel prices.

Even the IMO has echoed red-light conditions. It flagged an uptick in diverted routes, with vessels avoiding the Red Sea and Suez Canal and instead skirting the African southern coast, more willing to risk shipments to piracy.

The situation presses home the evolving logic of tanker risk. You don’t need bullets or missiles; uncertainty is enough. Shortened tanker routes, higher war-risk premiums, and stricter fill levels can render oversupply fragile. As one market observer noted, higher oil prices in such contexts reflect the narrowing of physical glut, not just headline supply figures.

For both governments and carriers, the key indicators now are freight rates, insurance clauses, and official advisories. A surge in premiums or new route warnings signal that tanker risk is structural, and this could create a situation of ongoing volatility even if tanker attacks remain unrealized.

If Iran or its proxies begin targeting tankers, the industry may retreat. For example, MSC rerouted container vessels away from drone threats in the Indian Ocean days ago, a move costing 10–14 days in transit delays. BIMCO’s Jakob Larsen predicted for Reuters that Western-linked ships may avoid entire zones, prompting capacity crunches.

National navies may respond, but shipping firms act first. That cascade—operators opting out, insurers hiking rates, HPC freight indices jumping—understands strategic shock as much as a direct hit. It makes tanker pullback today more consequential than headline diplomacy.

India, China, and other major refining nations are closely watching. Even minor signs of maritime unrest can trigger bunker price swings, eroding purchasing power and supply predictability measured in the millions of barrels per day.

While the G7 and U.S. may work behind the scenes, markets now pivot on what tanker companies do, not necessarily what policymakers promise. As markets track de-escalation or naval deployments, tanker behavior is what will really predict a supply shock.

By Charles Kennedy for Oilprice.com

How Will the Israel-Iran Conflict Affect the Tanker Market?

In the early hours of Friday, June 13, Israel launched several waves of airstrikes on Iran, targeting command-and-control centers, ballistic-missile bases and air-defense batteries as well as nuclear installations. The attacks also killed several Iranian military commanders and nuclear scientists. Israel indicated that this is only the beginning of a campaign that can last for days or even weeks. The question is, what will happen next? How will Iran respond? Will the United States get involved? What will be the impact on the oil and tanker markets? We don’t have any answers, but we can discuss a few scenarios and look back at what happened during previous conflicts in the region.

In an immediate response, Iran launched a drone attack on Israel, but that was largely ineffective. Most of them were shot down and no significant damage was reported. Since then, Iran has started firing ballistic missiles towards Israel. Analysts do expect a forceful response from Tehran, not least because the regime has to save face with their domestic population. However, their options are limited. The Israeli attacks have reduced Iran’s ability to reach Israel and inflict significant damage. The capabilities of Iran’s proxies in the region, Hamas, Hezbollah, the militias in Iraq and the Houthi’s have been diminished and the Assad regime in Syria has been toppled.

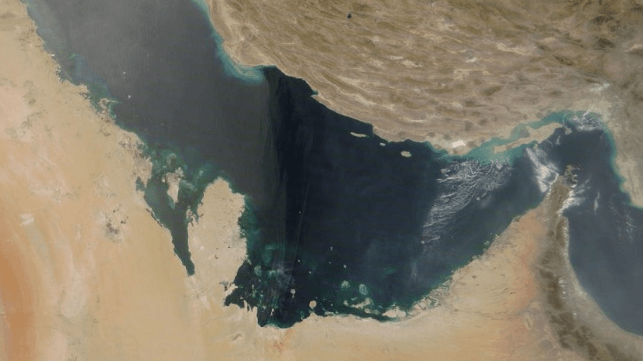

Iran does have options to retaliate. They could try to close the Strait of Hormuz or disrupt shipping at this chokepoint through which more than 20% of global oil supplies are shipped. They could attack oil installations in neighboring countries or target U.S. military bases in the region.

However, all of these potential actions carry significant risks. Closing the Strait of Hormuz or attacking energy infrastructure in the region will spike energy prices, turn all their neighbors into adversaries and more likely than not draw the U.S. military, which has a large presence in the region, into the conflict. Closing the Straits of Hormuz may also hamper Iran’s own export capabilities and give the Israelis and/or Americans an incentive to attack their energy infrastructure (refineries, pipelines, export terminals, etc.). Losing the income from energy exports would quickly exhaust Iran’s resources and ability to fight back.

In the immediate aftermath of the Israeli attacks, both oil prices and tanker rates moved up. This was to be expected and is a normal reaction to a spike in geopolitical tensions and an increased risk of significant disruptions to global energy supplies. Where oil prices will go over the next few days and weeks, will depend on whether there will be actual disruptions to oil supply. Overall, the global oil markets are well supplied, and inventories are at healthy levels worldwide.

Iranian supplies are increasingly at risk, however. Even before Israel’s attack, most oil market forecasts already assumed a decline in Iranian production over the coming months, leading to a decrease in Iranian exports of around 400-500 kb/d. This figure will likely increase if the conflict escalates. Chinese independent refiners, which buy almost all Iran’s oil, will need to look for alternative sources of crude, and they could try to buy more discounted crude from Russia or look for alternative barrels in the Middle East.

Tanker rates also rose after the attacks, in particular for VLCCs, the main vessel class for Arabian Gulf exports. Similar to the reaction of oil prices, this is a normal development under the circumstances. Rates for the benchmark Arabian Gulf (AG)-East VLCC route increased from WS43 to W55. However, while the increase is significant in percentage terms, the tanker market remains in the summer doldrums. Further rate increases are possible over the next few days, depending on how the conflict evolves, but it is also possible that the market weakens again after the weekend. In previous conflicts, charterers sometimes panicked and, in an attempt to access additional cargoes, fixing activity would rise dramatically. At the same time, shipowners would become increasingly reluctant to enter high risk areas such as the Arabian Gulf. This combination of factors would push tanker rates much higher very quickly. We are not in this scenario at the moment. According to our tanker brokers, fixing activity has not surged so far and most owners are still willing to bring their tankers into the AG. However, this can change quickly. Stay tuned.

Erik Broekhuizen is the manager of marine research and consulting at Poten & Partners.

This update appears courtesy of Poten & Partners, and it may be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

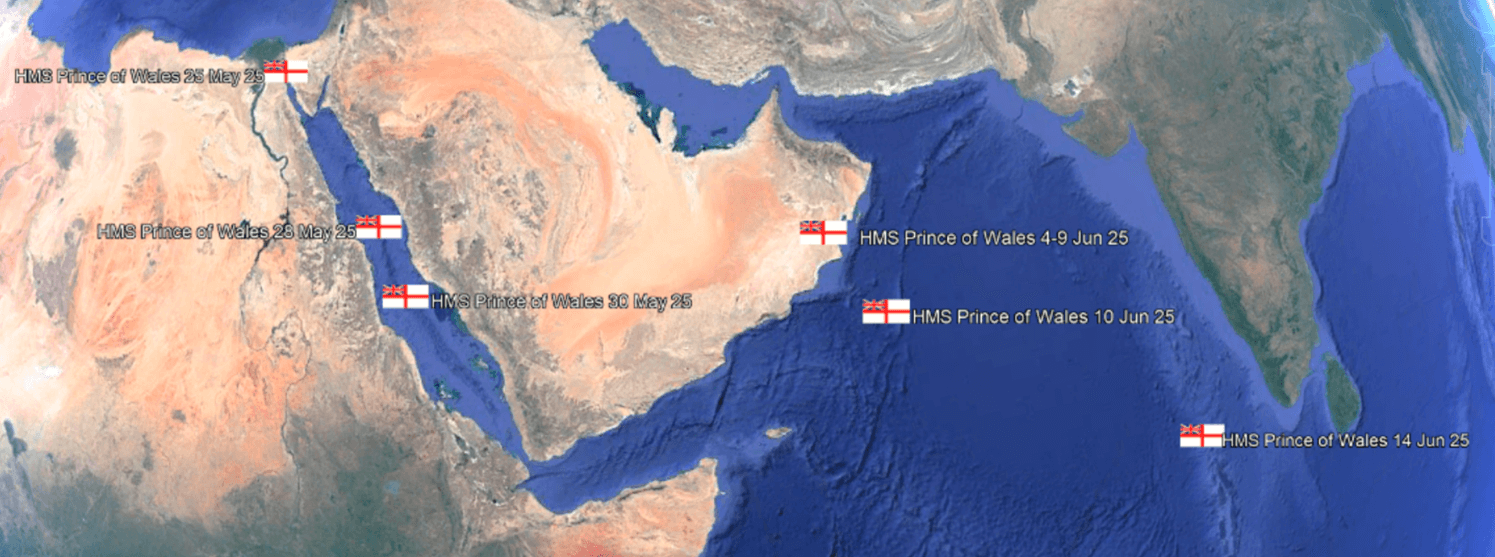

Progress of HMS Prince of Wales (R09) across the Indian Ocean (CJRC)

Progress of HMS Prince of Wales (R09) across the Indian Ocean (CJRC)