LITHIUM

SQM cuts 5% of Chile workforce as prices fail to bounce back

The world’s second-biggest lithium miner SQM has begun laying off 5% of its Chilean workforce as it contends with a protracted slump in global prices for the battery metal, according to a company source and a union memo to workers seen by Reuters on Wednesday.

Lithium prices have plunged nearly 90% since their peak in late 2022 due to overproduction in China and slower-than-expected demand for electric vehicles, forcing some miners to slash jobs and halt expansions.

SQM, which missed first-quarter profit estimates, previously said it expects weak prices through the first half of the year. It declined to comment on the layoffs.

A company source said the cuts – to both the lithium and fertilizer units – would not affect core operations and or production guidance. SQM had no immediate plans for further layoffs, the person added.

Reuters could not determine the exact number of dismissals.

SQM employed 8,344 people in Chile and elsewhere at the end of last year, according to its annual report, with three-quarters working at the northern Chile operations where it extracts and processes lithium.

A memo from the Sindicato SQM Salar union, dated Tuesday, said company management had informed the group’s president that 25% to 30% of the layoffs would correspond to “general roles,” and the rest to supervisors. They would take place at SQM’s offices in Santiago, as well as the Atacama salt flat and its lithium processing plant in northern Chile, the memo said.

“As a union we regret the decision taken by the company, which affects our members, and we categorically question the reasons behind it,” the memo said, without providing further details. It also offered support to workers who lost their jobs.

US firm Albemarle, the only other lithium miner in Chile, cut workers last year as part of cost-cutting measures that it said helped to offset low lithium prices.

(By Fabian Cambero and Daina Beth Solomon; Editing by Sarah Morland, Brendan O’Boyle and Aurora Ellis)

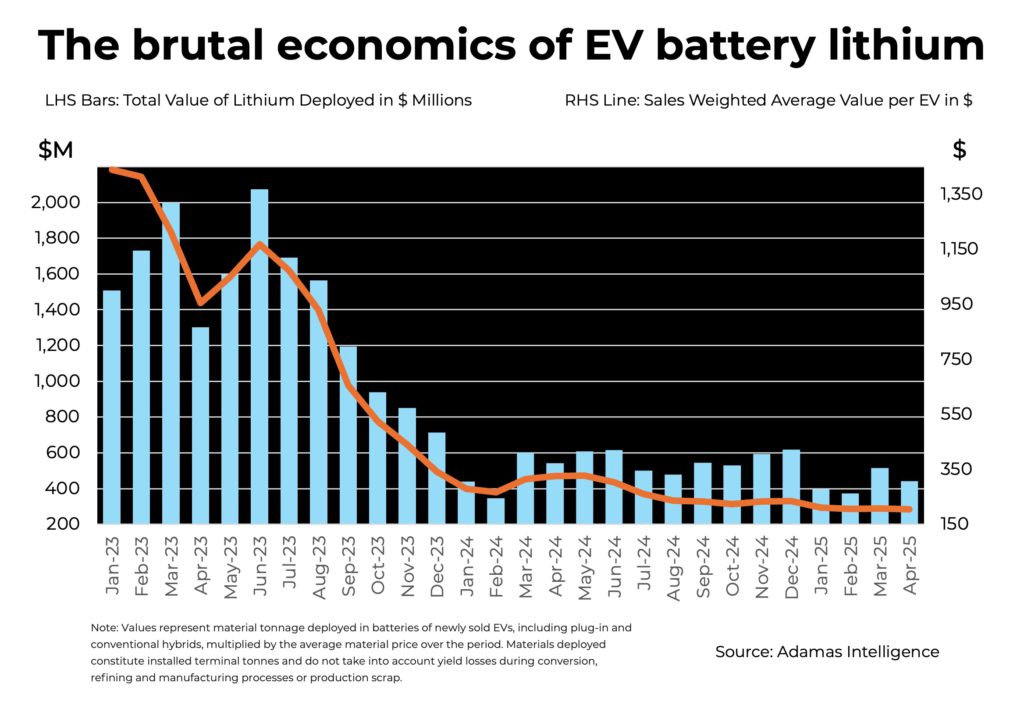

CHART: The brutal economics of EV battery lithium

News this week that the world’s second-biggest lithium miner – SQM – has begun laying off 5% of its Chilean workforce would not come as a surprise to those following the market for the battery raw material.

Battery lithium prices have been decimated since reaching a peak less than three years ago with prices slumping to $8,450 a tonne in June from above $80,000 in November 2022.

A wait and see approach on production cuts by lithium miners, particularly in China where government support keeps loss-making mines on life support, and slower than expected demand growth from the electric vehicle industry provides little prospect for a return to the boom years.

The value of terminal lithium tonnes deployed in EVs, including plug-in and conventional hybrids, sold around the world from January through May totalled $2.15 billion.

The extent of the slump is illustrated by the monthly EV battery nickel tally, which is now higher than that of lithium, despite the significant move towards nickel-free batteries such as lithium iron phosphate chemistries and a cooling of nickel prices at the same time.

The value of the lithium contained in the batteries of EVs sold in December 2022 alone reached $3.2 billion despite the fact that global unit sales were a fraction of what they are now and shipments skewed towards hybrids, which have inherently smaller batteries and therefore less contained metal than full electric cars.

On a per EV basis the economics of lithium carbonate and hydroxide look even worse. From a peak of more than $1,900 per sales weighted average EV in December 2022, the installed lithium so far this year only averages just above $200 per vehicle.

For a fuller analysis of the battery metals market check out the latest issue of the Northern Miner print and digital editions.

* Frik Els is Editor at Large for MINING.COM and Head of Adamas Inside, providing news and analysis based on Adamas Intelligence data.

CAPITALI$M 101

Lithium industry bemoans ‘paradox’ of low prices, rising demand

An ongoing slide in lithium prices even as demand for the battery metal continues to climb is a frustrating “paradox” not likely to be resolved before at least 2030, the world’s largest producers told a major industry conference this week.

Once a niche metal used primarily in greases, ceramics and pharmaceuticals, lithium’s use in electric vehicles, large-scale battery storage and other electronic applications has grown rapidly, with demand up 24% last year and likely to grow 12% annually for the next decade, according to data from consultancy Fastmarkets.

Oversupply from China, however, has dragged prices down more than 90% in the past two years, fueling layoffs, corporate buyouts and project delays across the globe.

“We’ve got market pain, but on the other side is the strategic gain. That is the lithium paradox,” Dale Henderson, CEO of Australian lithium miner Pilbara Minerals, told the Fastmarkets Lithium and Battery Raw Materials Conference in Las Vegas.

One long-time conference attendee described the mood at this year’s conference using the stages of grief as a metaphor. Last year’s conference reflected denial, with the sentiment in 2025 one of acceptance, he said.

Despite the price drop, attendance at the conference – considered the world’s largest annual gathering of lithium investors, executives and consumers – fell only 9% from last year to roughly 1,000, according to organizers.

“It’s quite hard to imagine a future where lithium doesn’t play a central role in the global economy,” said Paul Lusty, head of battery raw materials research at Fastmarkets.

Chinese miners have stockpiled supply that likely will only come down later this decade and lessen the market imbalance, he added.

Others have seen an even longer timeframe. Project Blue, another minerals consultancy, does not expect lithium demand to exceed supply until 2033 at the earliest.

“Lithium has no chill mode. It really is more volatile than a lot of other markets out there,” said Peter Hannah, head of pricing at Albemarle, the world’s largest lithium producer, which has cut staff and delayed expansion projects in response to the price drop.

Much of the conference side chatter focused on efforts to curb spending, with various lithium projects – especially direct lithium extraction (DLE) projects – touting efforts to lower costs.

“The issues with lithium are which mines can produce the highest quality product at the lowest cost,” said Ken Hoffman, a commodity strategist with mining investment bank Red Cloud Securities.

EnergyX, a DLE developer backed by General Motors, unveiled a study showing it could produce the metal in northern Chile with operating costs below $3,000 per metric ton. The estimates are preliminary, but underscore the industry’s push to spend less.

“Innovation is the solution to building a resilient battery supply chain,” said Chris Doornbos, CEO of E3 Lithium, which is developing a DLE project in Alberta.

Adding to the market tension, SQM – the world’s second-largest lithium producer – laid off 5% of its workforce this week.

“We do have other factors impacting the behavior of the market participants than just pure economics,” Andres Fontannaz, commercial vice president of SQM’s international lithium division, told the conference, a reference to how electric vehicles have become a political target in some countries.

The tension is even higher for lithium projects under construction and hoping prices rise by the time they open.

“This is a really tough industry to be in,” said Jon Evans, CEO of Lithium Americas, which is building North America’s largest lithium mine in Nevada. “It’s periods of euphoria followed by periods of pain and suffering, which we’re in now.”

(By Ernest Scheyder, Daina Beth Solomon and Fabian Cambero; Editing by Marguerita Choy)

Russia captures village in eastern Ukraine near lithium deposit

Russian troops have taken control of a village in eastern Ukraine which is close to a lithium deposit after fierce resistance from Ukrainian forces, a Russian-backed official said on Thursday.

The village of Shevchenko is located in Donetsk, one of four Ukrainian regions – in addition to Crimea – that Moscow has claimed as its own territory in annexations that Kyiv and Western powers reject as illegal.

The Russian Defence Ministry announced earlier on Thursday that Shevchenko had been taken along with another settlement called Novoserhiivka.

Reuters could not independently confirm the battlefield report and there was no immediate comment from Ukraine. Open source mapping from Deep State, an authoritative Ukrainian military blogging resource, showed Shevchenko under Russian control.

Soviet geologists who discovered the lithium deposit there in 1982 suggested it could be significant. It sits at a depth that would allow commercial mining, and Russian-backed officials have suggested it will be developed when the situation permits.

“The village of Shevchenko, which is located on the border with the Dnipropetrovsk region, is another settlement that has a lithium deposit. This was one of the reasons why the Ukrainian armed forces sent a huge number of their soldiers to hold it,” Igor Klimakovsky, a Russian-appointed official in Donetsk, was cited by the state TASS news agency as saying on Thursday.

The Ukrainian Geological Survey says the deposit is located on Shevchenko’s eastern outskirts and covers an area of nearly 40 hectares.

Parts of the Russian press incorrectly claimed in January that the Shevchenko deposit had already been captured, confusing it with the seizure of another settlement of the same name elsewhere.

Lithium is a coveted global resource because of its use in a host of industries and technologies from mobile phones to electric cars. Ukraine has reserves of about 500,000 tons, and Russia has double that, according to US government estimates.

(By Andrew Osborn; Editing by Mark Trevelyan)