Canadian carbon tax impacts: carbon capture, utilization and storage (CCUS) & environmental, social and governance (ESG) reporting

CANADA’S CLIMATE PLAN

As part of Canada’s plan to reduce emissions and combat climate change, the Pan-Canadian Framework on Clean Growth and Climate Change was developed to meet emission reduction targets, grow provincial economies, and adapt to climate challenges. According to the Government of Canada: “In 2018, the Greenhouse Gas Pollution Pricing Act came into effect, ensuring there is a price on carbon pollution across the country. A well-designed price on carbon pollution provides an incentive for climate action and clean innovation while protecting business competitiveness. It is efficient and cost effective because it allows businesses and households to decide for themselves how best to reduce the emissions that cause climate change.”

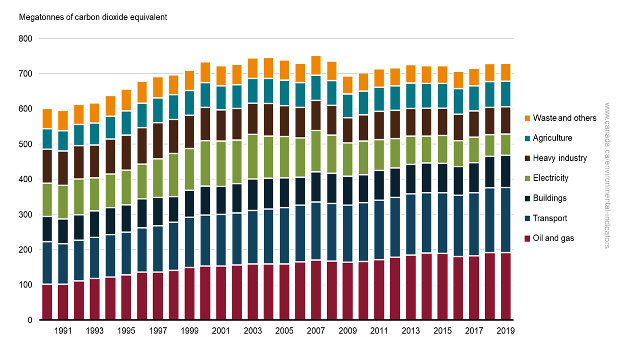

Canada has committed to reduce Greenhouse Gas (GHG) emissions by 30% from 2005 levels by 2030. GHG emissions from 1990 to 2019 by economic sector is summarized in Figure 1.

Figure 1: GHG emissions by economic sector, Canada, 1990 to 2019.

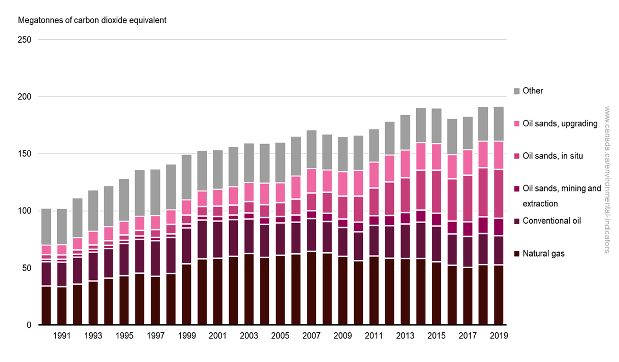

As it relates to the oil and gas sector, data from the Government of Canada suggests that GHG emissions from oil and gas production have gone up 23% between 2000 and 2019 (Figure 2), largely from increased oil sands production, particularly in-situ extraction.

Figure 2: Oil and gas sector GHG emissions, Canada, 1990 to 2019.

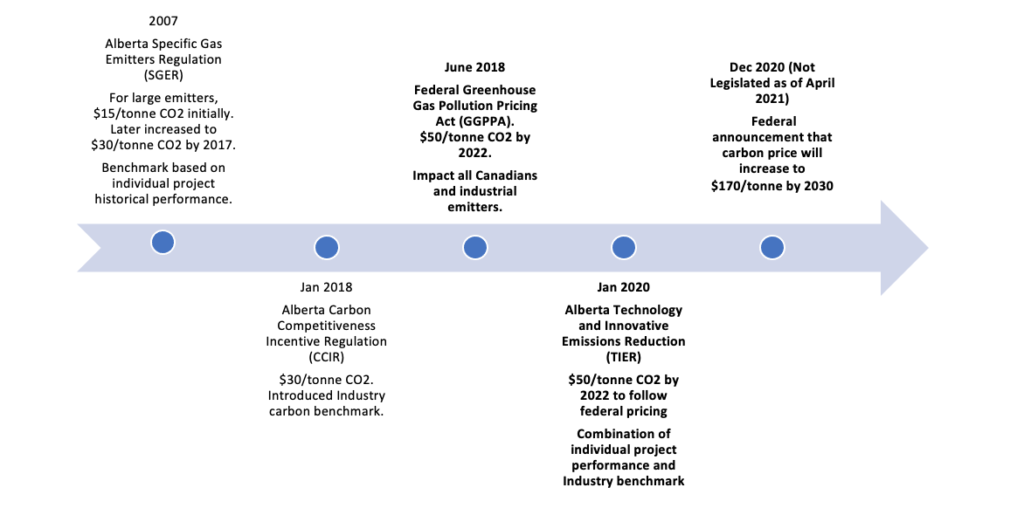

Over the last 4 years, there have been many changes and updates to the Canadian legislation at the federal and provincial levels, with Canada attempting to achieve emissions neutrality by 2050.

CANADIAN CARBON TAX IMPACT ON COMPLIANCE CREDIT GENERATION

Canada’s Climate Plan includes an Output-Based Pricing System (OBPS) on large industrial emitters and, more recently, the proposed Clean Fuel Regulation (CFR) on primary suppliers of fossil fuels.

Canada’s OBPS and proposed CFR will create an economic opportunity for developing technologies that reduce carbon intensity of liquid fossil fuels. In the oil and gas industry, CCUS is a considerable mitigation option that can be applied to reduce anthropogenic CO2 emissions that offsets other industries where emissions reductions are not cost-effectively achievable. Sequestered CO2 is compressed and transported to be used in enhanced oil recovery (EOR) projects, obtaining incremental oil recovery through an enhanced oil recovery scheme, or through direct injection into deep geological formations (saline aquifers or depleted oil and gas reservoirs). Revenue streams relate directly to CO2 emission reductions that are captured from the point source to the portion that is permanently stored within the geological formations.

These policies will establish and provide a financial incentive for companies to capture, utilize and/or store CO2 while aligning development with a reduction in Canada’s GHG emissions.

OUTPUT-BASED PRICING SYSTEM

According to the Government of Canada: “A price on carbon pollution is an essential part of Canada’s plan to fight climate change and grow the economy. It is one of the most efficient ways to reduce greenhouse gas emissions and stimulate investments in clean innovation. It creates incentives for individuals, households, and businesses to choose cleaner options.”

The Greenhouse Gas Pollution Pricing Act (GGPPA) establishes a carbon pollution pricing system — a regulatory trading system known as the Output-Based Pricing System (OBPS). It will allow for covered facilities who are below their emission limits to receive surplus credits. Those credits can be used as compliance units or sold to other facilities in the OBPS through a public registry. Under this legislation, permanently stored CO2 would be eligible to receive a credit market value of $50/tonne by 2022 and up to $170/tonne by 2030 under the recently proposed accelerated national OBPS.

MULTI-BILLION DOLLAR OBPS COMPLIANCE CREDIT OPPORTUNITY

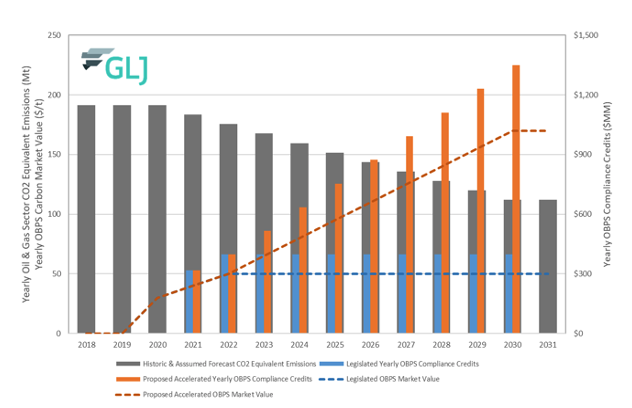

Based on the details in Figure 2, even a marginal reduction in greenhouse gas (GHG) emissions from the oil and gas sector has a material compliance credit value potential that companies could achieve through CCUS strategies. This takes the form of reduced operating costs and/or additional revenue through the OBPS credit market. If companies can reduce the 2019 CO2 equivalent emissions of 191Mt by 10% (19.1Mt), a 2022 OBPS market price of $50/tonne equates to $955 million in compliance credits. At an accelerated 2030 OBPS market price of $170/tonne, the same 10% reduction equates to $3.2 billion in compliance credits.

In actuality, Canada has committed to reduce all GHGs by 30% from 2005 levels by 2030. Looking closely at the oil and gas sector in 2005, CO2 equivalent emission levels were approximately 160Mt. A 30% reduction in GHG from this level would lead to an emissions target of 112Mt for 2030, equating to a GHG reduction of 79Mt from 2019 levels. As shown in Figure 3 below, assuming the 79Mt will be reduced linearly over 10 years (7.9Mt/year) from 2021 to 2030, the potential compliance credit value generation could range from $3.9 billion to $8.2 billion under the current and proposed accelerated OBPS market prices, respectively.

Figure 3: Oil and gas sector greenhouse gas emission reductions from 2005 levels by 2030 and associated compliance credit generation.

PROPOSED CLEAN FUEL REGULATIONS

Another leg of Canada’s Climate Plan is the Clean Fuel Regulations (CFR). First proposed in late 2020, the CFR is complementary to the OBPS. According to the Government of Canada: “The goal of the Clean Fuel Standard is to significantly reduce pollution by making the fuels we use everyday cleaner over time. The Clean Fuel Standard will require liquid fuel suppliers to gradually reduce the carbon intensity of the fuels they produce and sell for use in Canada over time, leading to a decrease in the carbon intensity of our liquid fuels used in Canada by 2030.”

The proposed CFR is not yet resolved; however, regulations are expected to be finalized and published in the Canada Gazette, Part II by late 2021. This is another regulatory approach with the aim of reducing Canada’s greenhouse gas (GHG) emissions through increased use of lower-carbon fuel sources.

A new regulatory credit market for compliance credits will be established under the proposed CFR, where producers/importers who surpass the minimum clean fuel standard are rewarded with credits which may then be purchased by other producers/importers to achieve compliance. This regulation works by upping the carbon intensity reduction target every year between 2022 – 2030.

Canadian average lifecycle carbon intensity was defined by using a model developed by Environment and Climate Change Canada (ECCC). In 2016, the Canadian Government’s calculations indicated that GHG emission reductions will be achieved at a central estimated net societal cost of carbon (SCC) of $94/tonne. More recently published literature estimates the net SCC value in 2020 that ranges between $135 and $440/tonne.

Under the proposed CFR, primary suppliers of fossil fuels (including refineries, upgraders, and fuel importers) create or acquire compliance credits to satisfy their emissions reductions. Optionally, primary suppliers can pay into a compliance fund to acquire credits at a price of $350/tonne. Although, credits acquired from the compliance fund can only be used to satisfy a maximum of 10% of their annual reduction obligation. The CFR also considers a credit clearance mechanism (CCM) to assist the exchange of credits whereby a credit seller may pledge their available credits to be sold at or below a price ceiling of $300/tonne pursuant to the CCM.

Given that the CFR is not currently legislated and is not expected to be finalized until late 2021, the CFR compliance credit market value remains uncertain. However, the future market value will be directly correlated to the implementation of projects that generate or utilize these credits, CCUS included, and may mirror the OBPS value to some degree.

CANADIAN CARBON TAX IMPACTS TO RESERVES & ESG REPORTING

In practice, carbon taxes and compliance credits based on existing legislation ought to be included in all economic evaluations to understand the commercial impact on existing and future projects within the energy industry.

In a reserves evaluation report, carbon tax burdens are included as an operating cost ($/boe) within the economic cash flows and is quantified from the carbon taxes defined in the corporate and property lease operating statements. Carbon tax burdens will consider existing legislation surrounding the carbon market value through the OBPS scheme and incorporating the proposed accelerated OBPS and CRF compliance obligations when legislated. Carbon credits associated with approved CCUS projects are determined on a project phase basis, based on the emissions reductions from permanently storing CO2 within geological formations. This is summarized in a reserves report as a reduced operating cost or, in the case of excess compliance credits, as an “Other Income” stream within the economic cash flows related to a CCUS project.

In ESG reporting of emissions, both the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB), the two most widely used frameworks for reporting, require reporting gross emissions before any offsets, credits, trades or any other mechanisms that have reduced or compensated for emissions. A disclosure available in the GRI framework, 305-5, reduction of GHG emissions, requires GHG emissions reduced as a direct result of reduction initiatives, specifically calling for any reduction from carbon offsets to be reported separately.

Where carbon offsets and credits are often discussed in ESG reporting is in scenario analysis, as required for SASB reporting and as part of the recommendations from the Task Force on Climate-related Financial Disclosures (TCFD) reporting. SASB specifically requires reporting the sensitivity of hydrocarbon reserve levels to future price projection scenarios that account for a price on carbon emissions. The TCFD recommends undertaking scenario analysis as a method for developing strategic plans and positioning a company to address climate-related risks and opportunities. Companies, as part of their scenario analysis, may consider how they will address increases in carbon price through use of carbon credits and other programs.

For more information, visit our website: www.gljpc.com

GLJ Ltd. is a leading energy resource consulting firm. With comprehensive industry expertise and client-focused philosophy, GLJ provides technical excellence to a global client base. The company’s long-term record of success comes from an experienced team of professionals who have an absolute commitment to delivering high-quality results for their clients. For more information visit www.gljpc.com

WRITTEN BY SCOTT QUINELL, GLJ LTD.

Scott is a Senior Engineer at GLJ and has over fifteen years of experience in reserves evaluations and reservoir studies. He has extensive involvement in oil reservoirs and is one of the leading experts at GLJ in the evaluation of enhanced oil recovery (EOR) projects with a focus on Polymer and CO2 tertiary recovery schemes. More recently he has been involved in providing guidance to GLJ’s clients on the economic impact of carbon taxes and carbon market value surrounding carbon capture, utilization and storage (CCUS) projects in Canada.

No comments:

Post a Comment