World’s Biggest Solar Firm Sees Profits Cut by Power Price Hike

, Bloomberg News

(Bloomberg) -- Longi Green Energy Technology Co., the world’s largest solar company, said its profits will be cut by higher power costs at one of its key manufacturing hubs in China.

Yunnan province, home to 54% of the company’s wafering capacity, canceled the preferential electricity prices it had been offering Longi since 2016, the firm said in an exchange filing Tuesday. Wafers are the ultra-thin slices of polysilicon that get wired up and assembled into solar panels, and Longi is the world’s biggest producer of them, according to BloombergNEF.

Longi didn’t say how much higher its power bill will be now that it has to pay market rates in the province. Electricity accounts for about 12% of wafer productions costs, and Longi enjoyed a 50% discount on power prices over one of its main rivals, BNEF said in a March 2020 report.

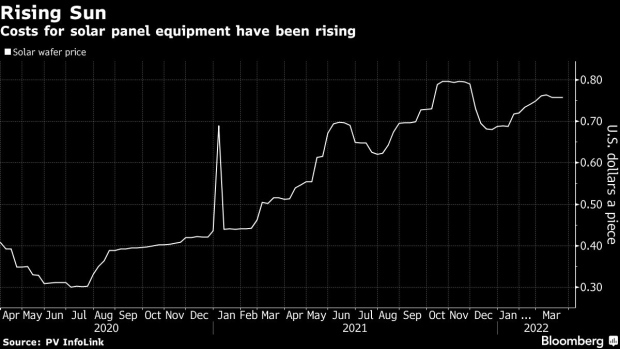

Higher costs for Longi are coming in the midst of a rare period of inflation for the solar supply chain. Wafers are about 76 cents a piece, up from 30 cents in the middle of 2020. Still, solar power cost increases have been small compared to ballooning coal and gas prices, and new solar installations in China tripled in January and February compared to last year.

Electricity prices in China have been under pressure since last year, when a shortage of coal forced grids to curtail power to industrial users throughout most of the country. The government used the crisis to push through market reforms that allows utilities to charge more to large factories when coal prices rise.

Longi also said that Yunnan’s decision on power rates risks changing the company’s plans for expansion in the province.

©2022 Bloomberg L.P.

No comments:

Post a Comment