Bloomberg News

Credit: CATL

The world’s biggest maker of electric-vehicle batteries, China’s Contemporary Amperex Technology Co. Ltd., is considering a third factory in Europe, the company’s president in the region said.

“We are thinking about this, but currently there is no clear decision or activity,” Matthias Zentgraf told Bloomberg News in an interview, saying internal discussions are already underway.

The Ningde, Fujian-based company last month announced plans to build a second European EV battery plant in Hungary, investing 7.3 billion euros ($7.2 billion) in partnership with Mercedes-Benz Group AG. The facility has a planned output of 100 gigawatt hours and will also supply Volkswagen AG, BMW and Stellantis NV. CATL expects it to be ready within five years.

“We will not build a third plant if there is no prospect for the demand volume,” Zentgraf said in a video call from the IAA Transportation conference in Hanover, Germany.

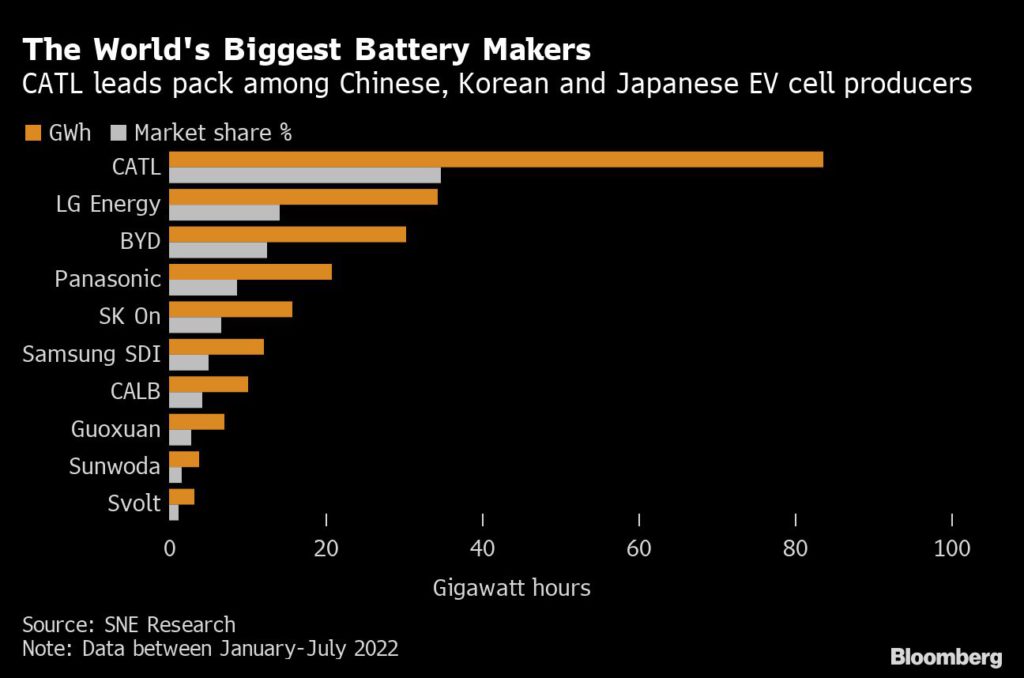

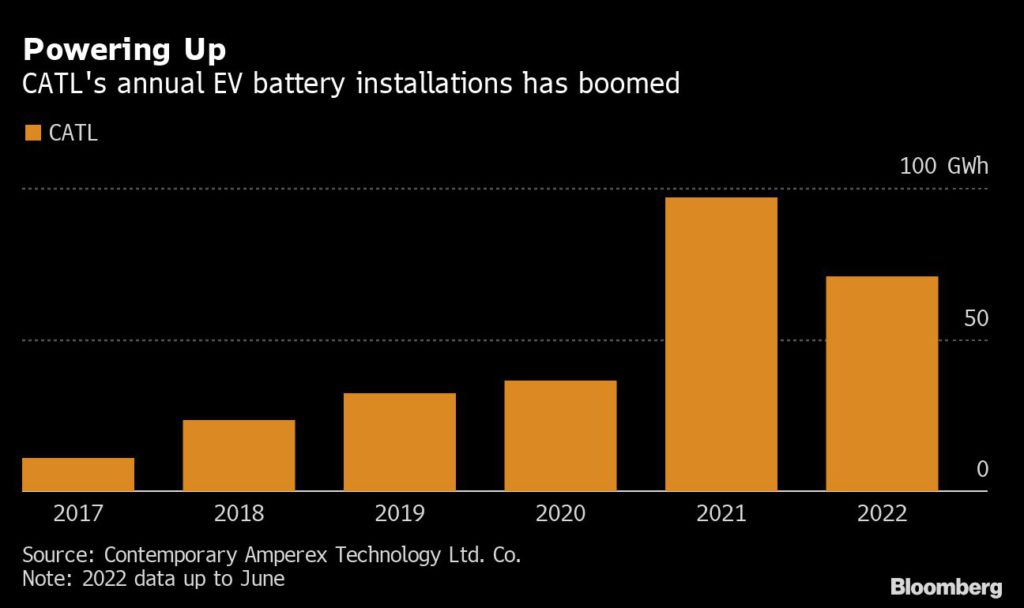

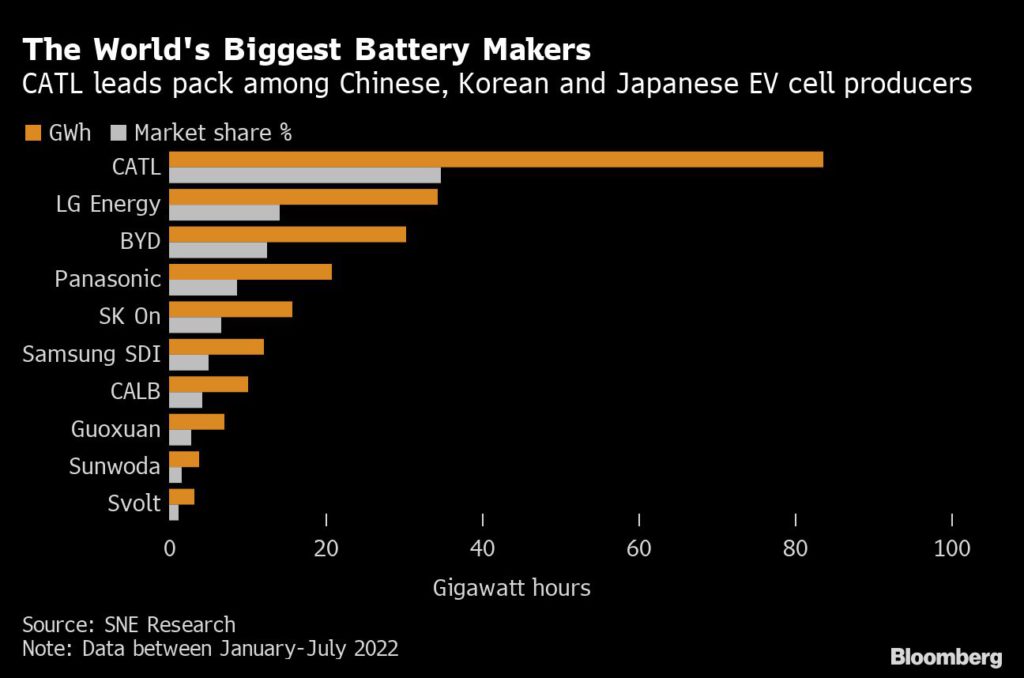

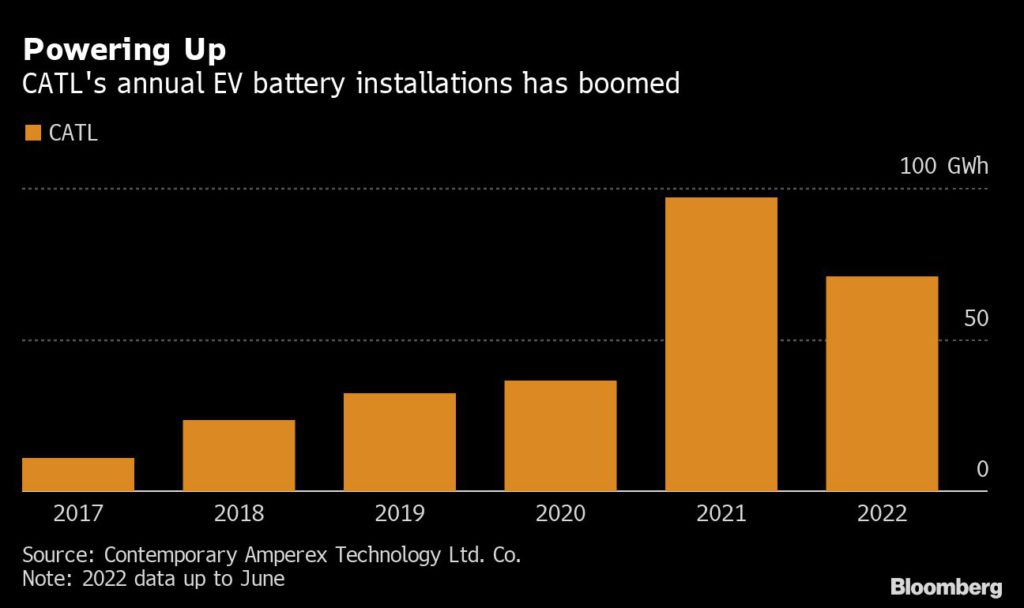

CATL has maintained a lead over rivals, including the world’s second-biggest cell producer LG Energy Solution Ltd. The company rebounded from its sharpest-ever drop in quarterly earnings at the start of 2022, with first-half net income rising 82% from a year earlier and revenue jumping 156%.

CATL has established several production bases in China and subsidiaries in the US, Japan and Europe. It is spending 27 billion yuan ($3.8 billion) on two battery projects in China’s Shandong and Fujian provinces. Zentgraf declined to comment on whether CATL would supply batteries to Tesla Inc.’s new factory in Berlin.

The battery maker has also been looking at sites in Mexico and the US to supply Tesla Inc., Ford Motor Co. and others, though that process has been delayed in part due to political tensions between China and the US, Bloomberg reported in August.

European energy crisis

CATL is due to start producing batteries at its first European plant, in the central German city of Erfurt, later this year. One challenge is the continent’s energy crisis and rising gas prices following Russia’s invasion of Ukraine. More than half of Germany’s gas imports came from Russia before the war.

“We are affected with the shortage of natural gas, which is very important for the cell production process because we need a lot of energy,” Zentgraf said. Gas accounts for about half of the German plant’s energy needs.

“We are working on substitutions for this intensively,” said Zentgraf, who joined CATL in 2015. “We already have a very, very promising idea to replace natural gas to buy renewables.”

Contingency plans will enable the plant to stay operational through winter if gas supplies fall short or prices are too high, he said.

Zentgraf called for the EU to offer more flexible state aid to help localize and expand the EV-battery supply chain and complement billions of dollars of investment from battery makers.

“Concentrate that subsidy money into building up the supply chain for battery businesses overall,” he said.

(By Danny Lee)

The world’s biggest maker of electric-vehicle batteries, China’s Contemporary Amperex Technology Co. Ltd., is considering a third factory in Europe, the company’s president in the region said.

“We are thinking about this, but currently there is no clear decision or activity,” Matthias Zentgraf told Bloomberg News in an interview, saying internal discussions are already underway.

The Ningde, Fujian-based company last month announced plans to build a second European EV battery plant in Hungary, investing 7.3 billion euros ($7.2 billion) in partnership with Mercedes-Benz Group AG. The facility has a planned output of 100 gigawatt hours and will also supply Volkswagen AG, BMW and Stellantis NV. CATL expects it to be ready within five years.

“We will not build a third plant if there is no prospect for the demand volume,” Zentgraf said in a video call from the IAA Transportation conference in Hanover, Germany.

CATL has maintained a lead over rivals, including the world’s second-biggest cell producer LG Energy Solution Ltd. The company rebounded from its sharpest-ever drop in quarterly earnings at the start of 2022, with first-half net income rising 82% from a year earlier and revenue jumping 156%.

CATL has established several production bases in China and subsidiaries in the US, Japan and Europe. It is spending 27 billion yuan ($3.8 billion) on two battery projects in China’s Shandong and Fujian provinces. Zentgraf declined to comment on whether CATL would supply batteries to Tesla Inc.’s new factory in Berlin.

The battery maker has also been looking at sites in Mexico and the US to supply Tesla Inc., Ford Motor Co. and others, though that process has been delayed in part due to political tensions between China and the US, Bloomberg reported in August.

European energy crisis

CATL is due to start producing batteries at its first European plant, in the central German city of Erfurt, later this year. One challenge is the continent’s energy crisis and rising gas prices following Russia’s invasion of Ukraine. More than half of Germany’s gas imports came from Russia before the war.

“We are affected with the shortage of natural gas, which is very important for the cell production process because we need a lot of energy,” Zentgraf said. Gas accounts for about half of the German plant’s energy needs.

“We are working on substitutions for this intensively,” said Zentgraf, who joined CATL in 2015. “We already have a very, very promising idea to replace natural gas to buy renewables.”

Contingency plans will enable the plant to stay operational through winter if gas supplies fall short or prices are too high, he said.

Zentgraf called for the EU to offer more flexible state aid to help localize and expand the EV-battery supply chain and complement billions of dollars of investment from battery makers.

“Concentrate that subsidy money into building up the supply chain for battery businesses overall,” he said.

(By Danny Lee)

General Motors invests in Canadian lithium-ion battery recycler

Cecilia Jamasmie |

GM is launching at least 20 new all-electric vehicles by 2023.

Covered

GM says the binding agreements it has in place guarantee that all its battery raw material need will be met, allowing it to reach annual planned of 2 million battery-powered cars a year by 2025. That’s when GM will be ramping up production of about 30 electric models globally.

As the company moves forward, it will work to increasingly localize its battery materials supply chain to North America, it said.

Lithion will launch its first commercial recycling operations in 2023. The opening of this facility, with a capacity of 7,500 tonnes per year of lithium-ion batteries, will be followed in 2025 by the launch of Lithion’s first hydrometallurgical plant.

Cecilia Jamasmie |

GM is launching at least 20 new all-electric vehicles by 2023.

(Image courtesy of General Motors.)

General Motors (NYSE: GM) is boosting efforts to secure lithium supply, a crucial ingredient for electric vehicle (EV) batteries, by investing in Canadian battery recycling company Lithion Recycling Inc.

The move, which financial details were not disclosed, creates a partnership between the world’s second largest automaker and the Québec-based company to pursue a circular battery ecosystem using Lithion’s technology.

The companies said that third-party lifecycle analysis show that Lithion’s technology has a recovery rate of over 95%. As it uses green energy, the company’s technology and operations will reduce greenhouse gas emissions by over 75% and water usage by over 90% compared to mining battery materials, they said.

Unfazed by the slowing global economy, buyers of key components in the powering of EVs are stepping up efforts to lock in supplies.

GM is aggressively scaling battery cell and EV production in North America to reach its target of more than one million units of annual capacity by 2025. The automaker also aims to eliminate tailpipe emissions from all its new light-duty vehicles by 2035.

“We are building a supply chain and recycling strategy that can grow with us,” Jeff Morrison, GM vice president, global purchasing and supply chain said in the statement.

In August, Ultium Cells, GM’s joint venture with LG Energy Solution, opened its first US. battery cell plant, with two additional plants under construction.

A fourth planned battery cell plant will bring GM’s projected total US battery capacity to 160 GWh.

General Motors (NYSE: GM) is boosting efforts to secure lithium supply, a crucial ingredient for electric vehicle (EV) batteries, by investing in Canadian battery recycling company Lithion Recycling Inc.

The move, which financial details were not disclosed, creates a partnership between the world’s second largest automaker and the Québec-based company to pursue a circular battery ecosystem using Lithion’s technology.

The companies said that third-party lifecycle analysis show that Lithion’s technology has a recovery rate of over 95%. As it uses green energy, the company’s technology and operations will reduce greenhouse gas emissions by over 75% and water usage by over 90% compared to mining battery materials, they said.

Unfazed by the slowing global economy, buyers of key components in the powering of EVs are stepping up efforts to lock in supplies.

GM is aggressively scaling battery cell and EV production in North America to reach its target of more than one million units of annual capacity by 2025. The automaker also aims to eliminate tailpipe emissions from all its new light-duty vehicles by 2035.

“We are building a supply chain and recycling strategy that can grow with us,” Jeff Morrison, GM vice president, global purchasing and supply chain said in the statement.

In August, Ultium Cells, GM’s joint venture with LG Energy Solution, opened its first US. battery cell plant, with two additional plants under construction.

A fourth planned battery cell plant will bring GM’s projected total US battery capacity to 160 GWh.

Covered

GM says the binding agreements it has in place guarantee that all its battery raw material need will be met, allowing it to reach annual planned of 2 million battery-powered cars a year by 2025. That’s when GM will be ramping up production of about 30 electric models globally.

As the company moves forward, it will work to increasingly localize its battery materials supply chain to North America, it said.

Lithion will launch its first commercial recycling operations in 2023. The opening of this facility, with a capacity of 7,500 tonnes per year of lithium-ion batteries, will be followed in 2025 by the launch of Lithion’s first hydrometallurgical plant.

No comments:

Post a Comment