From Trump's administration until today, U.S, as one of the core nations, has felt threatened by the rise of China with its emerging and breakthrough industrialization reform.

BY MUWALLIHA SYAHDANI

JANUARY 12, 2024

From Trump’s administration until today, the United States of America, as one of the core nations, has felt threatened by the rise of China with its emerging and breakthrough industrialization reform. China–as the United States’s longstanding trade partner–has grown massively in a way that the United States perceived as unfair trade practices. From Bush to Biden, the Potus has grown concerned about China’s involvement in the global trading chain. It can’t be denied that the U.S in 1979 helped China reform its domestic economy under Deng Xiaoping by inviting the country to join the World Trade Organization–formerly known as GATT–to spread democracy and capitalism to mainland China. This amities move means the establishment of the U.S.-China trade relations with the founding of the U.S.-China Joint Commission on Commerce and Trade (JCCT) in 1983.

An assertive move was shown primarily in Trump’s administration even though the concerns have risen since George W. Bush’s era. It is being recorded that in 2004, the U.S., for the first time, sued a case against China in WTO over discriminatory taxes (USTR, 2004b). This discriminatory tax was given to home-based semiconductor companies, while the U.S. perceived this preferential treatment disadvantaged the U.S. companies in China. China was the market of $2.02 billion in 2003 to U.S. semiconductor producers like Qualcomm and Intel (USTR, 2004b). China has not lived up to its commitment after joining the WTO in December 2001. The U.S. case filing was the first time any country had filed a lawsuit against China in WTO Dispute Settlement. However, Bush still saw China as supporting the U.S.’s foreign policy at that time–the Global War on Terrorism in the Middle East–making the U.S. take a wishy-washy step towards China.

The same skeptical move toward China was made by George H.W. Bush in 1990. Through the Committee on Foreign Investment in the United States (CFIUS), Bush senior began taking a prejudiced step towards China domestically. Bush ordered the CFIUS to divestate the U.S. aerospace manufacturer–MAMCO Molding–stocks owned by China’s National Aero Technology Import and Export Corporation–CATIC (Schaus, 2016). Continuing to Obama’s Era, through CFIUS, the trade animosity also cracked down on China’s goods. Obama made a string–but not that massive compared to Trump’s era–decisions towards China, especially in terms of divestated, tariff imposement and arranged a mega trade deal across transpacific. Two significant moves through CFIUS by Obama First, in 2012, Obama ordered the divestiture of several wind farm companies in the U.S. from a firm called Ralls, which is owned by two Chinese nationals. In 2016, for the second time through CFIUS, Obama canceled the transaction from China’s Fujian Grand Chip Investment Fund (FGC) to acquise Aixtron–a joint company between the U.S. and Germany (Reuters, 2016).

In the matters of tariff imposement, Obama has been imposing added tariff on Chinese goods especially the tires. This policy took effect on 26 September 2009 under an anti-dumping scheme. The tariff imposed on the tire from China is 4 per cent but will cost an additional 35 per cent for one year. Rates will be reduced to 30 per cent in the second year and 25 per cent in the third year (N.Y. Times, 2009). This safeguard policy comes after pressure from domestic “United Steelworkers” as the union feels threatened by the state’s subsidies to automobile and light-truck tires imported from China’s manufacturers. The imposition of tariff barriers to goods from China became the first done by the U.S since China joined the WTO in 2001. This hallmark is the first decade-long trade war between the U.S. and China.

Apart from the tariff measurements, Obama’s era also showed a significant milestone in balancing the economic revival of China. Obama has negotiated a mega trade deal called the Trans-Pacific Partnership (TPP) to contain China’s growing ascendancy in terms of trade. At that time, in the conclusion of the agreements, the signed countries consisted of 12 countries across the Pacific–United States, Australia, Brunei Darussalam, Chile, Japan, Canada, Malaysia, Mexico, Peru, New Zealand, Singapore and Vietnam through the United States withdrew from the deals in 2017. TPP once was the world’s largest free trade deal, accounting for 40 per cent of the global economy in Gross Domestic Product (GDP). It is interesting that China is not even invited to talks and to be a part of TPP, seeing that this country is the second largest economy in the world and its proximity across the Pacific (Asia-Pacific). Obama walked the talk of his campaign to take more assertive action towards China.

Trump is one of the POTUS who heightened the tension towards China, a ploy that looks so different from his predecessor. For the first time in U.S. history, on 6 July 2018, Trump began enacting a 25 per cent tariff on US$34 billion worth of imports from China, including cars, hard disks and aircraft parts. This tariff enactment was based on Section 301 of 197the 4 Trade Act of the United States. China retaliates by imposing a 25 per cent tariff on 545 goods originating from the U.S. worth US$34 billion, including agricultural products, automobiles and aquatic products. The amount of the tariff and the product being imposed to enter the U.S. varies over time. This has led to a continuous tariff and non-tariff war–including the research and development between Huawei and Intel cooperation–even until today. Both countries also have agreed on a trade deal even if the deal is perceived as a failure by the United States (SCMP, 2022).

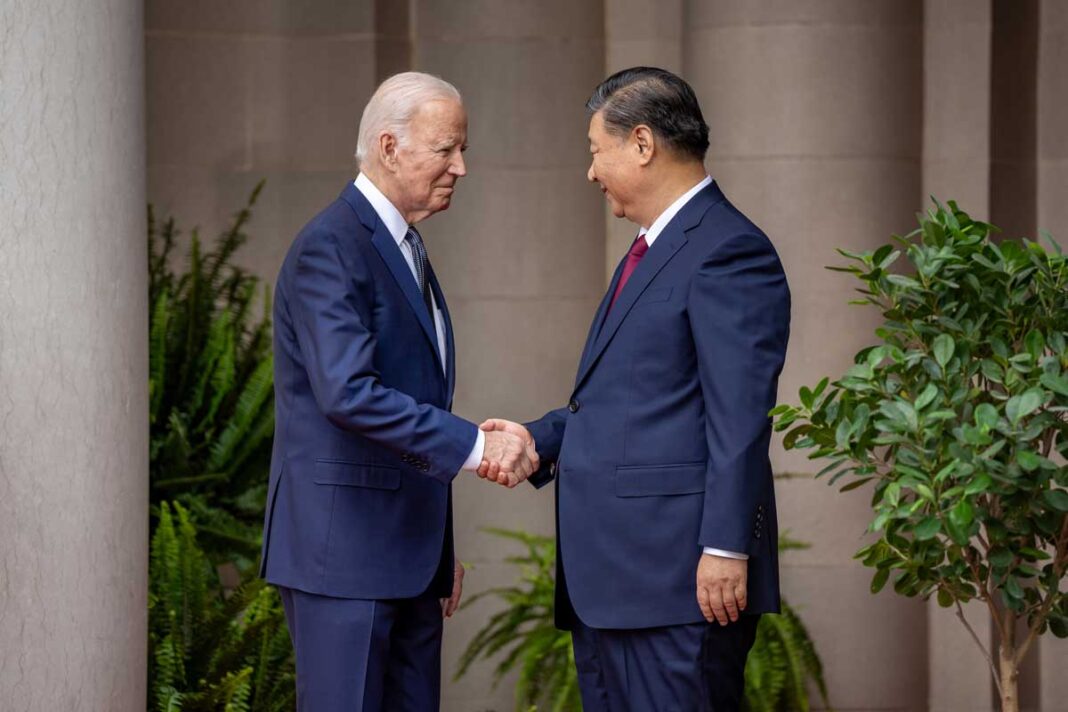

Going through Biden’s administration, the trade war escalation has gone unpleasant. Biden–although he comes from the Democratic Party–has treated China similarly in a way that sees China’s goods and maneuvers as unfair trade practices. His administration has not only kept those tariffs towards China with some $360 billion tariffs but also imposed export controls and visa limits as well as restrictions on investment flows from U.S. companies to China (Forbes, 2022). In 2022, his administration implemented stringent export controls on computer chips to restrict China’s advanced manufacturing sector, especially semiconductors. The export control was introduced by the CHIP for America Act of 2022. Also, in 2023, Biden signed an executive order that restricts some U.S. investment in Chinese high-tech industries. Biden has a vision of making the U.S. a leading manufacturing country of semiconductor plants, 5G advancement and electric vehicles.

The introduction of the CHIP Act of 2022 has mounted the previously known trade war to the next phase of a tech war between two countries, the U.S. and China. Under the Act, billions of dollars are offered as incentives to manufacture semiconductors across the United States. The U.S. once again intended to revive its semiconductor industry to compete against South Korea and Taiwan. Just a decade ago, the United States was a world-leading semiconductor manufacturer, accounting for 40% of sales, while today, the United States only produces 10% of the global chip supply (CNBC, 2023). It creates geopolitical tension where the U.S. restrains Taiwan Semiconductor Manufacturing (TSMC) from supplying the chips to China’s giant telecommunications company, Huawei. The United States found a close relationship with Taiwan, especially under Tsai Ing-wen, who came from the Democratic Progressive Party.

With the restraining of chips from Taiwan to China, Huawei, one of the world’s leading smartphone manufacturers, is teetering to produce a global-friendly smartphone. Since Google blocked Huawei from using Android due to spying concerns, Huawei also can’t use the chips made by Qualcomm–a Snapdragon–or any U.S. chip manufacturer. However, Huawei is still able to produce Mate 60 Pro, which uses a Kirin 9000S processor in the phone that is powered by Huawei’s 7 nanometers (N+2) chip model, designed by Huawei’s chip division–HiSilicon–and manufactured by China’s largest chip vendor–SMIC (TheDiplomat, 2023). Huawei manufactures its chip architecture through its own subsidiary–HiSilicon–called ThaiSen based on ARMv8. Though Huawei is the leading 5G technology manufacturer, admit it or not, China still lags in producing seamless, high-end microchip technology compared to Samsung, TSMC and Qualcomm (Ijiwei, n.d).

Huawei’s breakthrough 7-nanometer chips introduction has provoked the United States, could trigger more scrutiny, and would enlarge the dimension of its retaliation and export and investment control towards China. These variables make the outcome of Huawei, especially China’s moves and how the United States responds, uncertain. With all the countries becoming more inward-looking by producing all their country needs in a self-help way, it provokes an academic-worth scrutinized question: Are the era of global free trade becoming more and more utopic amidst the world welcoming the age of mega trade deals?

No comments:

Post a Comment