NTSB: Not Following Maintenance Recommendations Led to Cruise Ship Fire

An explosion and fire aboard the coastal cruise ship Ocean Navigator in October 2023 was likely caused by not following maintenance recommendations and infrequent changes of lube oil and oil filters concluded the National Transportation Safety Board. One crewmember was seriously injured in an explosion and fire in the engine room of the ship when one of its auxiliary engines failed and parts were ejected during an explosion followed by a fire.

The Ocean Navigator, which was built in 2001 as a modern version of an American coastal cruise ship, was operating at the time for Hornblower’s American Queen Voyages and had just docked in Portland, Maine on its next to last scheduled cruise when the explosion occurred. Earlier in the year, AQY announced it would be removing the ship and her sister ship from service at the conclusion of the Canadian cruise season.

Engineers reported that the machinery was working properly as they navigated into the port and docked around 0630. There was a total of 210 people aboard, 128 passengers and 82 crewmembers. After shutting down the propulsion system, the third engineer and a motorman were assigned to troubleshoot a high exhaust temperature issue in the no. 1 auxiliary engine while the vessel was using its no. 2 auxiliary engine to provide electric power for the ship.

The third engineer reported smelling oil and found a small lube oil leak from a crankcase cover door on the running no. 2 auxiliary engine. He went to tighten a bolt, but before he could there was an explosion and fire along with low lube oil pressure and oil filter plugged alarms. Both the engineer's and motorman’s overalls were on fire with the motorman more seriously injured.

NTSB commends the quick response of the crew in sealing the engine room by closing watertight doors, shutting off ventilation fans, closing dampers, and activating quick-closing fuel valves to effectively starve the fire of fuel and oxygen. They prevented the spread of the fire and the fire self self-extinguished.

The captain saw thick smoke coming from the funnel and immediately returned to the bridge. The passengers were mustered and evacuated without injury. Local fire crews responded but found the situation controlled.

Fire damage to the no. 2 auxiliary (NTSB report)

The subsequent investigation found that the no. 2 engine was damaged beyond repair. The engine block had cracked, and investigators found a 10-inch high and 16-inch wide hole and reported one of the connecting rods had been ejected. There was damage to the no. 1 auxiliary engine from the fire as well as the turbocharger, piping, cables, and electrical wires and lighting in the engine room. The NTSB reports the cost of the casualty at $2.4 million.

The NTSB investigators concluded that the engine failure was caused by debris in the engine’s lube oil system—possibly due to the crew exceeding manufacturer-recommended intervals for changing the lube oil and oil filter elements—which caused catastrophic mechanical damage to the engine and subsequent fire from the ignition of atomize lube oil released through the engine’s ruptured crankcase.

The crew had last changed the entire quantity of lube oil for the no. 2 auxiliary engine in September 2022—about 13 months before the engine failure—but the engine had operated more than 5,000 hours with this lube oil in the engine, five times longer than the manufacturer’s recommendation. Additionally, since the last change of the lube oil filter elements in May 2023, the engine had run over 3,000 hours. The engine manufacturer’s recommendation is to replace filter elements at every oil change or after the filter elements had been used for 1,000 hours.

“Manufacturers provide maintenance recommendations and intervals (schedules) to ensure equipment operates safely, optimally, and reliably throughout its service life,” the NTSB writes in its report. “By regularly reviewing equipment manufacturer manuals and guidance, operators can ensure conformance with recommended maintenance plans and mitigate the risk of equipment malfunction or failure.”

The analysis of the lube oil in the no. 2 engine identified abnormally high levels of aluminum and iron. It had increased significantly since the last in-service sample was taken in September. There was also an increase in lead and tin.

The vessel was sold during the bankruptcy of American Queen Voyages and Hornblower. The subsequent survey for the repairs showed that the engine block, crankshaft, several main bearings, connecting rod bearings, and the no. 14 fuel injector were all damaged during the explosion and fire with the plunger of the no. 14 fuel injector broken off, pistons and pins and other components from the nos. 13 and 14 cylinders “totally destroyed.” They also observed “heavy local wear” in main bearings and signs of cavitation that were not typical and also suggested oil quality or other lube oil issues.

NTSB concluded that debris in the system would have caused scratching or scoring of the inner layer of the bearings as the debris circulated. The wear would have permitted more lube oil to flow out the sides of the bearings, reducing pressure, and generating excessive heat. The lack of changing out the filter elements made the filter less effective or it could have clogged and a bypass value would have permitted more debris into the system.

These factors they believe contributed to the failures and catastrophic mechanical damage to the engine. The hot oil spewing out started the fire.

Repairs were made to the ship and it returned to service under its new owners in April 2025. The complete report is available online.

Cruise Ship Boom Fuels New Records for Port Canaveral

The continuing strong growth in the cruise ship industry has helped Florida’s Port Canaveral to set new records in its current fiscal year. The port had its busiest month ever in March with a 16 percent year-over-year increase in passenger volumes coming after a record winter season and new, larger ships scheduled to homeport at the Central Florida port.

“It wasn’t long ago when we exceeded 500,000 guests in a single month. Now, with numbers like this approaching nearly a million, it’s not just remarkable, it demonstrates the strong demand for sailings from our Port. We’ve been predicting it, and we were ready for it,” stated Capt. John Murray, Port Canaveral CEO.

In March 2025, the port handled 925,994 passengers coming and going from the cruise ships. That was up 16 percent compared to a year earlier and was the second record month in the port’s nearly completed winter season. The Orlando Sentinel highlights another record in December 2024 when Port Canaveral handled 837,900 passengers.

Port officials reported to its board of directors that for the six-month period in FY 2025 they have already handled 4.42 million passengers and they are projecting the port will reach 8.4 million passengers for the full year. That is up from 7.6 million last year and in FY 2019, Port Canaveral hosted nearly 4.6 million revenue cruise passengers.

The strong passenger counts were driven by a record 16 cruise ships sailing from the port during the peak winter months. The port says that cruise ships are now operating more than 1,000 trips annually from Port Canaveral, with many being the shorter 3- and 4-day trips to the Bahamas. The port however slipped back into second place in the passenger counts after briefly topping PortMiami as the cruise industry restarted after the pandemic.

The port also reported that it was ahead of forecast for each of the first six months in the current fiscal year. That has also helped it to generate a record of just over $23 million in operating revenue in March. For the first six months of the year, the port achieved over $111 million in operating revenue.

Port Canaveral reports it has grown in popularity as a homeport, particularly for cruise guests who prefer to drive to their port. Also with its proximity to the Central Florida theme parks and attractions, the port highlights that just over a quarter of the passengers stay in the local area for pre- or post-cruise stays fueling the hotels, restaurants, and tourism industry.

Murray highlights that the port is investing millions of dollars to make sailing from the Central Florida region even more accessible and convenient. Its projects include expanded terminals, updated parking facilities, and updated technology that allows guests to get to and from their cruise faster than ever. Previously he also highlighted their early planning which made Port Canaveral the first in North America to homeport an LNG-fueled cruise ship.

While several of the ships move to other markets during the summer months, the port is preparing this weekend to welcome the new Norwegian Aqua, and this summer it will become homeport to Star of the Seas, which will be the largest cruise ship in the world. Carnivale Cruise Line recently announced it would position its newest ship, Carnival Festivale in the port in 2027 and MSC also announced that its new giant, MSC World Atlantic will be positioned in the port. MSC, Princess Cruises, Celebrity Cruises, and Norwegian Cruise Line will all deploy newer ships to Port Canaveral this winter.

Near term, the port is looking to expand one of its existing cruise terminals. It is also working on plans to build one or more new terminals to accommodate additional growth in the cruise business while also balancing with the needs of the cargo business and its operations to support the space industry.

China Floats Second Large

Domestically-Built Cruise Ship

China’s Shanghai Waigaoqiao Shipbuilding Co., part of CSSC, marked the floatout of its second, large domestically-built cruise ship. It comes as Chian continues to invest in the sector and looks to become a competitor in the market dominated by a few European shipbuilders.

The second ship which was named Adora Flora City for its ties to Guangzhou, the southern city near Hong Kong, was floated overnight between April 27 and 28. According to the shipyard officials, it demonstrates China’s increasing proficiency and improved efficiency in cruise ship construction as the vessel is nearly 70 percent completed. Steel cutting began in August 2022 and the ship which is larger than the first cruise ship reached this point a month earlier in construction. Also, this project is being supervised by domestic Chinese teams where the first project was in cooperation with Italy’s Fincantieri and RINA class society. RINA continues to participate while emphasizing China’s large investments in developing the sector.

The new ship will operate under the colloquial name of Aida Huacheng and is due to enter service at the end of 2026 from Guangzhou. It is based on the same design as Adora Magic City (Aida Modu) which was introduced at the start of 2024. Both ships are based on a Fincantieri design for Carnival Corporation, although the new ship has been lengthened 17.4 meters (57 feet) to an overall length of 341 meters (1,18 feet). It will be 141,900 gross tons with a total passenger capacity of 5,232 passengers.

Adora Cruises, which is owned by CSSC, highlights that the interior design is being adapted to be “more beautiful, more technological, more Chinese.” The interior décor will be a combination of Art Nouveau style, the Maritime Silk Road, and Lingnan cultural elements. They are emphasizing the ship will provide a “more Chinese” cruise experience versus the first ship which more closely followed the Carnival designs or the Adora Mediterranea, which was acquired from Costa Cruises.

Among the changes the main atrium is doubled in size, the fitness area is being optimized, new suites are added, and there are upgrades to the dining and shopping areas. A new outdoor multifunctional space is also being created to host entertainment performances, leisure and healing activities, social interaction, and the coffee culture of its namesake city.

The construction timeline calls for the cruise ship to start sea trials in May 2026.

Adora was conceived as a partnership between CSSC and Carnival Corporation but Carnival later sold shares to become a minority investor. The brand launched focused on the domestic Chinese market with the acquired cruise ship. Adora reports so far it has carried over 620,000 passengers. It looks to expand its operations with the new ship and increase the number of foreign passengers.

China highlights its developing efficiency and skills in cruise ship construction. It looks to compete for future projects against Fincantieri, Chantiers de l’Atlantique, and the Meyer yards in Germany and Finland, which are the leaders in building nearly all large cruise ships.

The Wawi Indigenous territory borders a soybean plantation in the state of Mato Grosso, Brazil. Agricultural expansion has long put pressure on the Amazon forest and its traditional communities (Image: Flávia Milhorance / Dialogue Earth)

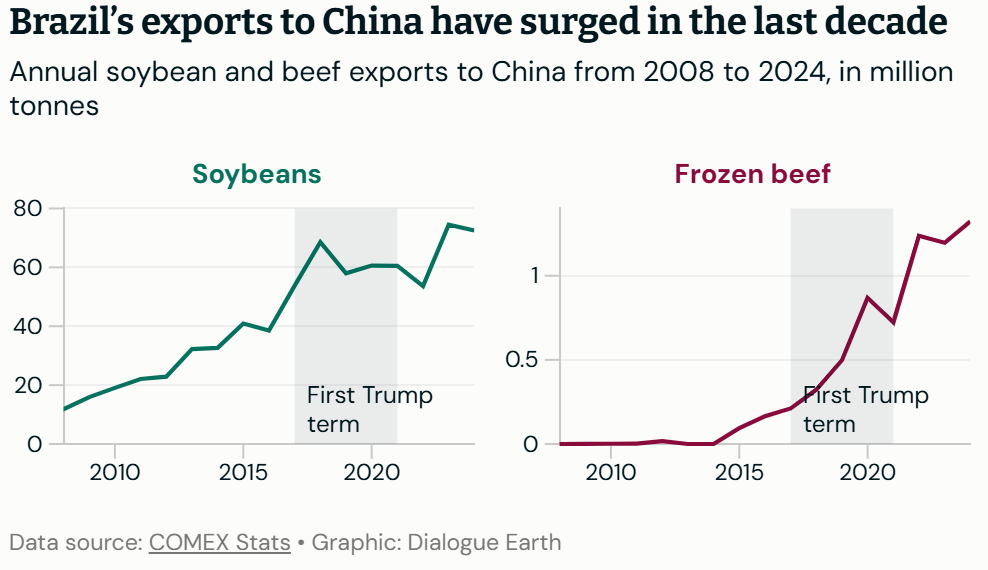

The Wawi Indigenous territory borders a soybean plantation in the state of Mato Grosso, Brazil. Agricultural expansion has long put pressure on the Amazon forest and its traditional communities (Image: Flávia Milhorance / Dialogue Earth) Analysts believe the tariffs will cause Brazilian exports to grow less this time around, due to Brazil’s already consolidated position in the Chinese market. “The impact of this trade war on Brazil will not be as great as under the first Trump administration,” says Camila Amigo.

Analysts believe the tariffs will cause Brazilian exports to grow less this time around, due to Brazil’s already consolidated position in the Chinese market. “The impact of this trade war on Brazil will not be as great as under the first Trump administration,” says Camila Amigo.