Geopolitics to shape mining’s future: TNMG president

At the CentralMinEX conference held last week in Newfoundland, The Northern Miner Group (TNMG) president Anthony Vaccaro delivered a compelling address on the critical importance of geopolitics in shaping the future of mining, investment, and mineral extraction.

His talk urged industry stakeholders to view resource development through a global lens, emphasizing that shifting geopolitical dynamics will be a defining force in how metals are taken from the ground over the coming decades.

“We need to look at our industry through the lens of what’s going on in the world through geopolitics,” Vaccaro told attendees. “Then we’re going to bring it down into Canada, then into Newfoundland and Labrador, because that will be the most defining factor in investing and how we extract metals for many decades.”

Spheres of influence

In his opening remarks, the TNMG president outlined a world increasingly fractured into what he called not just “spheres of influence,” but more accurately “spheres of control” dominated by the US, China and Russia. These blocs are competing to secure control over global trade and, critically, the production and processing of strategic minerals.

In this landscape, countries such as Canada, Australia, Japan, South Korea, and Western Europe are emerging as a “coalition of the willing” that aim to pursue resource autonomy rather than fall under the dominion of authoritarian-aligned spheres.

“Why would we go along with that? We have the populations and the economies where we don’t have to,” Vaccaro said, referencing the recent Canadian federal election as evidence of public alignment with this view.

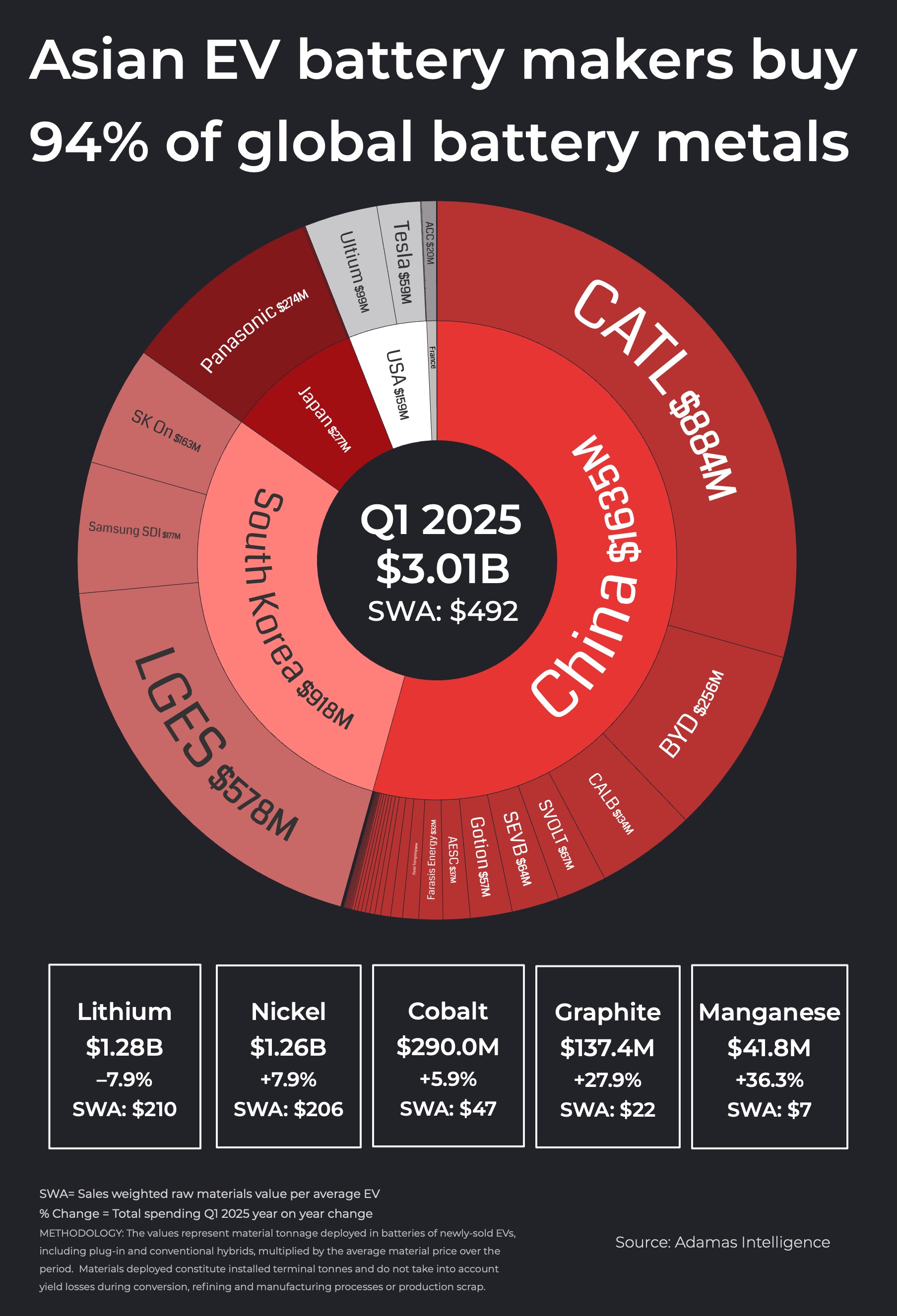

China’s dominance

Using copper as a case study, he noted about 50% of the world’s copper extraction takes place in jurisdictions aligned with the US sphere, thanks largely to South American producers like Chile and Peru. China, having recognized its own resource deficiencies, aggressively pursued Belt and Road investments in Africa, enabling it to secure roughly 30% of copper extraction through ties with Congo and Zambia.

However, the advantage shifts in the downstream. China currently dominates copper refining, processing over 50% of the world’s supply. In contrast, the US and allied nations lag behind, with North America having only nine copper refineries compared to China’s 60-plus.

“We’ve been a bit sleepy on this,” Vaccaro noted. “There’s going to have to be a government piece in this to get the capital flowing.”

This theme recurred as Vaccaro turned to rare earths. While the West may hold some resources, China controls over 90% of global refining capacity. He emphasized that Canada must work with governments to attract investment and build strategic capacity: “We need to get our act together… to shape the world or at least have a voice in it.”

Canadian opportunities

According to the TNMG president, Canada’s own copper production is showing signs of decline, with its global share falling from nearly 3% to 2%, and reserves not keeping pace with extraction. Nevertheless, he highlighted opportunities in Newfoundland and Labrador, particularly in new projects emerging alongside legacy producers like Voisey’s Bay.

Vaccaro also celebrated local achievements such as the Long Harbour Hydromet facility, calling it “a shining beacon” and an example of how North America can process critical minerals in a cleaner, more environmentally responsible way than China.

Strategic investments

However, the tide may be turning, said Vaccaro, as evident in the recent international funding flows, including US Department of Defense support for Canadian critical mineral projects. “Money is already flowing into Canada. These are Canadian assets receiving American money,” he said.

Vaccaro concluded with a warning and a call to action centered on the Beaver Brook antimony mine, a strategic asset currently owned by a Chinese company and held in care and maintenance. Antimony is critical to military applications, and Vaccaro urged scrutiny over foreign ownership.

“It might be a case study going forward,” he warned, citing previous Canadian government interventions to force Chinese divestments.

“The theme is set: geopolitical spheres,” Vaccaro said. “How do we in North America, how does the coalition of the willing, stay strong? What are the next strategic steps to do it?”