UK Bioethanol Plant Closure Threatens Thousands of Jobs

- A major bioethanol plant in Yorkshire is at risk of closing due to UK-US trade policies that have removed tariffs on US ethanol, creating an uneven playing field.

- The plant’s owner has warned that wheat purchases will be suspended, jeopardizing thousands of livelihoods in the supply chain, unless the government intervenes.

- Industry leaders are urgently calling for government support and regulatory changes to increase domestic demand for bioethanol and ensure fair competition.

As many as 4,000 livelihoods are at risk after the owner of Britain’s largest bioethanol plant has warned it could shut within days, citing UK-US tariff policy.

ABF, which owns the Vivergo Fuels plant in Yorkshire, has written to farmers warning it planned to suspend purchases of wheat used in the production process unless the government urgently steps in.

The plant is capable of producing up to 420 million litres of bioethanol from over 1 million tonnes of feed grade wheat sourced from thousands of farms mostly across Yorkshire and Lincolnshire. Over 160 skilled workers are employed by the plant with a supply chain supporting around 4,000 livelihoods.

ABF said the plant’s future could become untenable following the UK-US trade deal which removed a 19 per cent tariff on ethanol imports, allowing heavily subsidised US ethanol to undercut British producers.

The leaders of the UK’s two largest bioethanol plants wrote to the Prime Minister on 9 May before meeting Business and Trade Secretary Jonathan Reynolds on 14 May where Reynolds said he would act in “days not weeks” – but the firms claim there has been “little evidence of urgency” from the government since.

Vivergo Fuels Managing Director Ben Hackett said: “This is not a position we ever wanted to be in.

“We have asked government to increase domestic demand for bioethanol through a simple change to regulation, and for the short term and affordable support we need until that demand materialises. So far, nothing has been forthcoming.

“The removal of tariffs on US ethanol, combined with ongoing regulatory obstacles, has left us unable to compete on a level playing field. As a result, we will have to scale back wheat purchasing to meet only our current contractual commitments…time is rapidly running out.”

‘Unbeatable cost advantage’

Last month, ABF CEO George Weston told City AM the plant had been hamstrung by the government’s decision to double-count renewable fuel certificates for overseas producers, which “gives them an unbeatable cost advantage.”

“We don’t believe that the government’s been obliged to do that, they’ve chosen to, and they’ve put this business in an impossible position by the action they’ve taken,” he said.

“We really are doing everything we can to save that plant, we don’t want to mothball or shut it but we may be forced to.”

Problems at the Yorkshire plant, as well as a general downturn in sugar prices, helped push ABF’s sugar division to a loss of £122m for the six months to March, down from a profit of £121m the previous year.

A Government spokesperson said: “We signed a deal with the US in the national interest to secure thousands of jobs across key sectors.

“We are now working closely with the industry to understand the impacts of the UK-US trade deal on the UK’s two bioethanol companies and are open to discussion over potential options for support.

“The Business Secretary has met members of the bioethanol sector and senior officials continue to consider what options may be available to support the impacted companies.”

By CityAM

Shipping Industry Seeks Practical Fuels to Meet Emission Standards

- Biofuels are a viable option for the shipping industry to meet emission standards, but current production capacity is insufficient to meet demand, particularly for sustainable second-generation biofuels.

- While future fuel technologies like ammonia and methanol face challenges, biofuels offer a more practical short-term solution, though shipowners must secure reliable supplies to remain competitive.

- Bio-LNG is identified as a cheaper alternative to biodiesel, especially with government support, making it a promising fuel for the shipping industry's transition to cleaner energy.

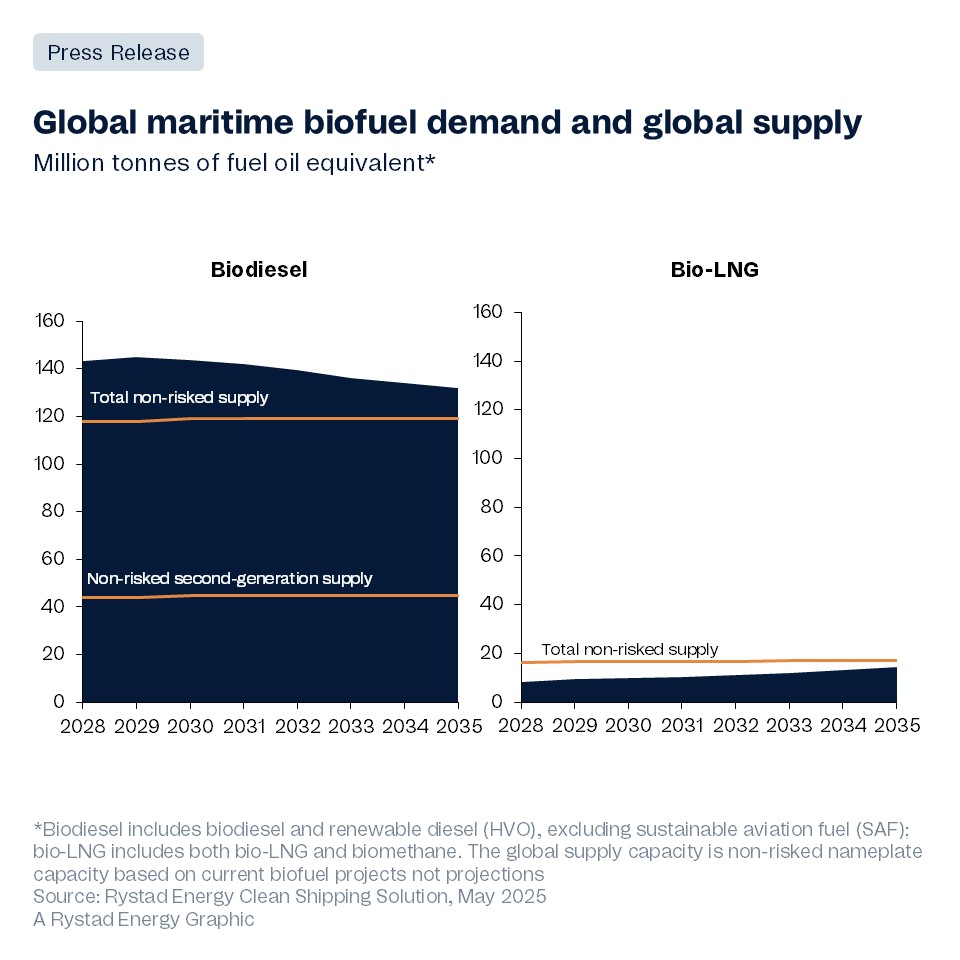

The shipping industry’s target of net-zero carbon emissions has boosted demand for biofuels, which are compatible with existing ship engines and therefore can be adopted relatively easily. However, Rystad Energy analysis shows that the capacity to produce biofuels—such as biodiesel and bio-liquefied natural gas (bio-LNG)—is not keeping up. Unconstrained biodiesel demand exceeds total supply and the outlook for bio-LNG is equally restricted, in both allocation and production.

Biofuels could be a more cost-effective alternative to traditional marine fuels such as very low-sulfur fuel oil (VLSFO), particularly when aligned with the low-emission thresholds established by the International Maritime Organization’s Greenhouse Gas Fuel Intensity (GFI) standard. In a scenario without supply constraints, global demand for biodiesel in shipping could exceed 140 million tonnes of fuel oil equivalent by 2028. However, even under ideal conditions, total biofuel production capacity is expected to peak at around 120 million tonnes. When sustainability criteria are applied—prioritizing cleaner, second-generation biofuels—this potential supply drops sharply to just 40 million tonnes. Taking into account production risks, actual output levels, and competition from other sectors, the volume of biofuels realistically available for shipping diminishes even further.

As new technologies emerge and regulations tighten, the pressure on the shipping industry to innovate and invest wisely has never been greater. That urgency sets the stage for the upcoming Rystad Talks Energy: Full Steam Ahead – LNG, Biofuels, and the Future of Maritime Energy on 28 May. Rystad Energy CEO Jarand Rystad will join DNV Maritime CEO Knut Ørbeck-Nilssen to explore how maritime leaders can chart a course toward net-zero emissions. With global shipping racing to decarbonize, the conversation will focus on the search for cleaner, scalable fuel solutions that can power the industry’s future.

Register here to join the conversation.

Demand for biodiesel, if unrestricted, outstrips the total supply. The situation with bio-LNG is also constrained, with challenges for both production and allocation capacity. While projected demand is a relatively modest at 16 million tonnes in fuel oil equivalent by 2028, the apparent surplus in supply is misleading. Over 84% of global biomethane is already committed to electricity generation, with an additional 10% allocated to road transport. This leaves only 6% available for all other sectors, including maritime, making actual access far more limited than the numbers suggest.

Junlin Yu, Senior Data Analyst, Shipping, Rystad Energy

This is a supply crunch that the shipping industry cannot afford to overlook. While future-facing fuels such as ammonia and methanol offer long-term promise, they come with high costs and infrastructure challenges, leaving many shipowners hesitant and waiting for clearer market signals.

In the meantime, biofuels stand out as the most practical route to meet the IMO’s tightening emissions standards. However, this transitional solution is fragile. Without careful planning and proactive action, the bridge to compliance could quickly erode.

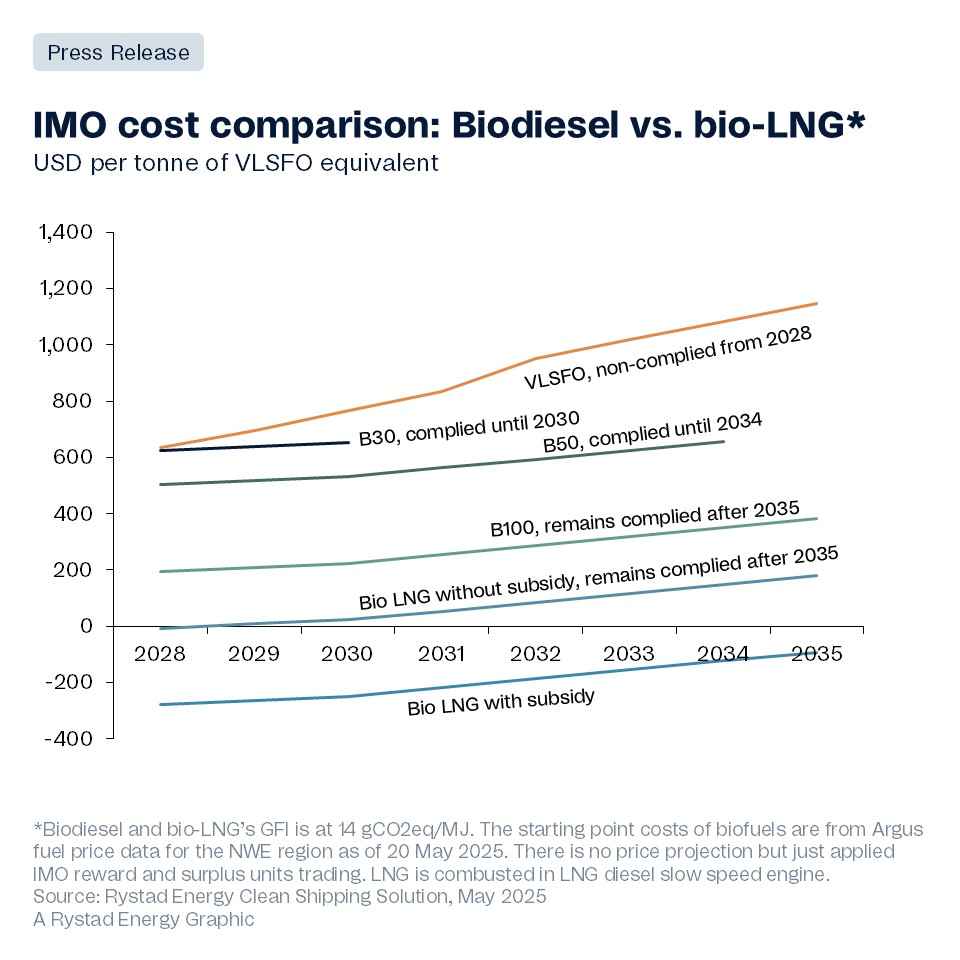

Biodiesel and bio-LNG can be cost-effective under the IMO Net-Zero Framework, but only if their lifecycle greenhouse gas (GHG) emissions are low enough to qualify for IMO incentives. However, demand for bio-LNG in maritime transport far exceeds current production, revealing a significant supply gap. To navigate the changing regulatory landscape, shipowners must act quickly, securing dependable biofuel supplies and aligning with GFI targets. In the race for cleaner shipping, success hinges not just on choosing the right fuel, but on securing it ahead of competitors.

Junlin Yu, Senior Data Analyst, Shipping, Rystad Energy

Biofuels are currently more cost-effective than traditional marine fuels, especially when they meet strict low-carbon standards. While blending biofuels at 30% or 50% can help meet emission targets in the short term, fully switching to 100% low-emission biofuels offers the greatest long-term savings and rewards. Notably, bio-LNG stands out as a cheaper option than biodiesel, particularly when supported by government subsidies, making it a promising fuel for the shipping industry’s transition to cleaner energy.