WHO OWNS THE U$A

Wall Street Is Gaming Out Global Spillover Threat From BOJ ShockMichael Mackenzie and Katie Greifeld

Tue, August 1, 2023

(Bloomberg) -- Seven years since Japan embarked on a highly unorthodox monetary experiment that helped pin down borrowing costs on Wall Street and beyond, the nation’s central bank is loosening its vice-like grip on domestic bond yields — with potentially profound consequences for high finance and households across the US.

Think higher interest rates for Corporate America, more expensive mortgages for home buyers and lower demand for risky assets including stocks, in the event that Japanese buyers bring their huge pools of overseas investments back home for higher returns.

“The key risk is a major asset allocation out of US financial markets and into Japanese financial markets, driven by higher yields on JGBs,” said Torsten Slok, chief economist at Apollo Global Management.

Any repatriation of capital could take months, if not years, to play out and so far global markets have taken the tentative shift toward higher borrowing costs in their stride. While the Bank of Japan has signaled it will let yields to trade toward 1% from roughly 0.5% now, its decision to step into the market on Monday suggests that won’t happen anytime soon.

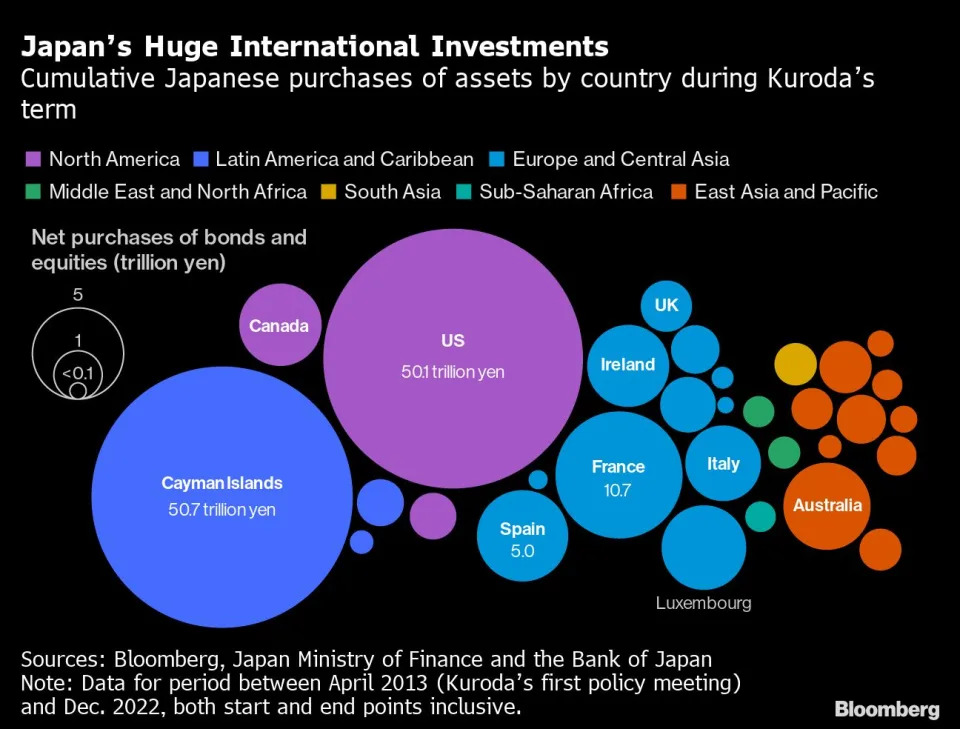

Still, with domestic investors holding around $2.5 trillion of US stocks, bonds and credit, the very idea that Japan will one day join the developed world in retreating from zero rates has Wall Street sizing up a volatile fallout that could add fuel to the higher-for-longer interest rate era.

BlackRock Investment Institute, for one, says investors will now demand more to hold longer-dated government debt. That, in turn, threatens to ripple through the global economy, by hurting rate-sensitive market corners from highly leveraged currency trades to richly valued stocks.

Japan’s yield-curve control move back in 2016 capped the domestic 10-year yield, in order to help the nation escape decades of deflation and economic malaise. That, in turn, spurred domestic investors to bid up higher-returning assets overseas in a boost to global liquidity. A cheap Japanese yen also became a prime funding vehicle to back investments into higher-yielding currencies, especially in emerging markets.

Early signs suggest traders aren’t betting on a big repatriation of flows anytime soon, with the yen falling and shares of exporters rising in the aftermath of the BoJ’s move. But it’s early days yet.

Any pullback of flows into US Treasuries and company debt would be a big deal. Back in March, Deutsche Bank AG strategists estimated that a BOJ normalization scenario could spur a $600 billion rebalancing push into Japanese government bonds from domestic investors, among other transmission channels.

Japan remains the largest foreign holder of US Treasuries, at $1.1 trillion as of May, though rising hedging costs have diminished the relative appeal of the asset class of late. Meanwhile holdings of long-term US corporate debt have jumped to a record in April at $333 billion.

“The impact of the BoJ’s YCC tweak could be to add to the quantitative tightening which is taking place in the US and Europe,” said Peter Chatwell, head of global macro strategies trading at Mizuho International Plc.

“Japanese investor flows into foreign assets — government debt, liquid credit and equities — has, by the reckoning of my macro models, been a significant driver of lower term premia in govies, tighter credit premia in liquid credit and a lower equity risk premia,” he said.

Wall Street research suggests Japanese stimulus has helped reduce the so-called term premium in global bond markets. That’s the compensation investors receive for parking their money in, say, Treasuries over the coming decade relative to what they get for buying short-dated obligations.

For all the hand-wringing over big losses in developed global bonds since inflation broke the bull market, the premium for owning a 10-year US bond remains below zero, according to a widely followed model from the Federal Reserve Bank of New York. That looks harder to justify, if the likes of Japanese life insurance funds get to enjoy higher marginal yields at home.

A higher 10-year yield that aligns closer to Federal Reserve’s current overnight policy rate would constitute a material tightening of financial conditions, through higher borrowing costs for new home owners and corporations while testing buoyant valuations for frothy corners of stock and credit markets.

Not so fast, according to Vanguard Asset Management. The global asset manager expects an orderly and modest rise in 10-year JGB yields towards 0.7%, limiting cross-border spillovers. At the same time, Japanese bonds already pay more than the likes of European counterparts after hedging for currency risk, while any enduring hawkish shift in Tokyo could take years.

The BOJ tweaking “is not a game changer for global term premium yet,” said Roger Hallam, global head of rates at Vanguard Asset Management.

That’s not stopping bond bears just yet. A scenario whereby Japanese policymakers tighten in earnest if inflation gathers pace while their big-name peers also maintain a restrictive stance — a big if — would stoke market gyrations, according to Sonal Desai, chief investment officer for fixed income at Franklin Templeton.

“Absolutely it has an impact on US Treasuries, especially if the Fed is not in a position to start cutting,” the money manager told Bloomberg TV.

Then there’s the potential unwinding of so-called carry trades that leveraged trillions of yen at rock-bottom rates to finance higher-returning investments abroad.

“To the extent that the carry trade begins to unwind, the natural implication should be that of higher volatility in rates and currencies, both of which should put some pressure on the appetite for risk assets,” said Apollo’s Slok.

--With assistance from Liz Capo McCormick, Masaki Kondo, Ruth Carson and Cormac Mullen.

Most Read from Bloomberg Businessweek

No comments:

Post a Comment