Bloomberg News | May 7, 2025 |

Gold replacing dollar as key reserve asset. Stock image.

Waratah Capital Advisors Ltd. is betting on gold to lift its returns this year as investors pile into the asset to shelter their wealth during the global trade war.

“We now live in a world that is losing faith in the US dollar,” Co-Founder Brad Dunkley said in a letter to investors seen by Bloomberg News. “Central banks and ordinary citizens, particularly in India, China and developing markets, have increasingly turned to gold to preserve their purchasing power.”

Dunkley said he expects gold will “do much of the heavy lifting” for the firm’s funds in 2025. Still, two flagship funds, Waratah One and Waratah One X, lost 3.3% and 5% in the first quarter, respectively. The firm’s long-biased fund gained about 2% and its thematic fund climbed 4.5%.

Waratah, founded in 2010 by Dunkley and Blair Levinsky, manages about C$3.8 billion ($2.8 billion) for wealthy individuals, family offices, foundations and pension funds. The long-biased fund, which is named Waratah Special Opportunities and is managed by Dunkley, has produced average annual returns of more than 11%.

Gold has surged to new records this year as investors and traders take a dimmer view of the US dollar amid President Donald Trump’s shifting trade and economic policies. The price of gold touched $3,500 for the first time last month, and the metal’s value is up by more than 45% over the past year.

Toronto-based Waratah expects the prices of copper, natural gas, and electricity to continue rising as the use of artificial intelligence proliferates, but remains skeptical that AI processing will ever be a good business. “There are just too many competitors lacking meaningful differentiation,” Dunkley wrote.

“The trillions of dollars being spent on quickly depreciating capital reminds me of the rollout of high-speed fiber optics: consumers and businesses are going to be the beneficiaries, not the capital spenders,” he said.

Waratah’s long-short equity fund, which has C$247 million in assets as of the end of February, increased its exposure to Canadian stocks — particularly engineering and construction companies — ahead of the country’s April 28 election. The firm expects higher infrastructure spending — a promise made by Prime Minister Mark Carney — as Canada responds to tariff threats, portfolio manager Jason Landau wrote in the same letter.

Other stock holdings include Nexgen Energy Ltd., a Canadian company with assets in Saskatchewan that has the potential to become a large uranium producer. The company is awaiting its final federal permit, which Landau said may be expedited after the election.

(By Layan Odeh)

Bloomberg News | May 7, 2025 |

China’s central bank. Credit: Adobe Stock

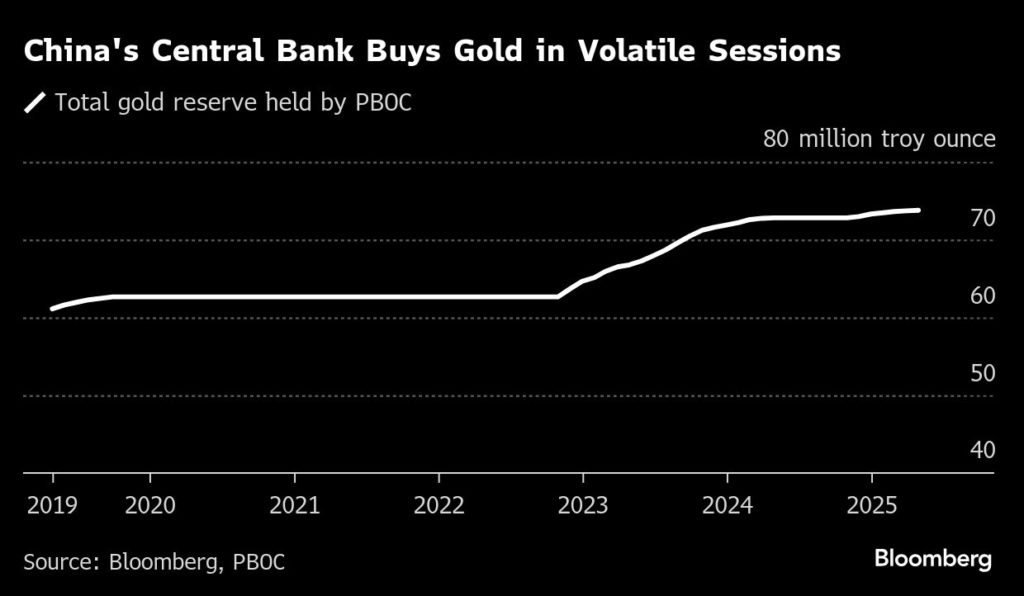

China expanded its gold reserves for a sixth straight month in April, underlining its push to boost holdings of the precious metal as prices trade near a record and the trade war rumbles on.

Bullion held by the People’s Bank of China rose by about 70,000 troy ounces last month, according to data on Wednesday. In the latest six-month span, volumes have climbed by close to 1 million ounces, or about 30 tons.

Gold has rallied to successive records this year, supported by concerted central-bank buying as authorities seek to diversify holdings away from the US dollar. Bullion’s upswing — with prices up nearly 30% higher this year — has also been aided by rising investment demand as the US-led trade war unsettles financial markets, raises concern about US assets, and drives haven demand.

In China, there have been signs investors are piling into gold, with volumes on the Shanghai Futures Exchange surging to a record in recent weeks. The voracious onshore appetite has also seen the PBOC issuing fresh quotas for commercial banks to import bullion.

At the same time, the Chinese authorities have moved to shore up support for the economy, and set the stage for trade talks with senior US officials later this week. On Wednesday, Beijing reduced its policy rate and lowered the amount of cash lenders must keep in reserve, highlighting efforts to buttress growth.

Central banks have increased their gold purchases roughly five-fold since 2022, after a freeze on Russian reserves, according to Goldman Sachs Group Inc., which has been among the most vocal bullion bulls in recent months. The trend is likely “a structural shift in reserve-management behavior, and we do not expect a near-term reversal,” analysts said in a March note.

At that time, the bank estimated that the PBOC held around 8% of its reserves in gold, below the global average of about 20%, and also far lower than the elevated share seen in some developed economies. If Beijing were targeting an allocation of 20%, and maintained an average pace of about 40 tons a month, it would take about three years to reach a that level, the analysts said.

“The modest volumes bought over the last few months suggest that while they are buyers, they will only do so if the price is attractive,” said Ross Norman, chief executive officer at Metals Daily. “Likely we will see ongoing purchases of gold by PBoC, as they scale back on US dollar denominated assets such as Treasuries.”

(By Yihui Xie)