Simulator aids upgrade of Sellafield robots

_20224.jpg)

The Pile Fuel Cladding Silo (PFCS) was built in the 1950s and is based on the simple design of a grain silo. The concrete structure is 29 metres long, 10 metres wide and 18 metres high and is divided into six tall compartments. It contains irradiated cladding materials removed from fuel assemblies used in some of the UK's earliest reactors at Windscale and Chapelcross. It stopped receiving waste in the early 1970s and now holds more than 3200 cubic metres of intermediate-level waste.

The PFCS was originally designed to remain sealed forever, but equipment has now been installed to enable the safe removal of the wastes so the facility can be decommissioned. Within the silo is a Waste Container Handling Facility, a concrete room where robots process waste containers.

One such robot is a large six-axis industrial robot arm, which unbolts empty containers, sends them to be filled with waste, then securely bolts the returning containers for onward transfer. The arm also swabs the outside of the container to check for contamination and puts the swab in a deposit box for analysis.

Executing pre-programmed tasks is routine. However, when physical upgrades are needed, such as adding new swabbing tools to the robot arm, operators have to take the robot out of service, and suit up in full protective gear to make changes. Changes then need multiple test runs, often with several human re-entries to adjust the setup. Each entry creates risks to human health and risk of damaging the robot, whilst trial runs for new setups create downtime. Even pure software upgrades require downtime while the new programme runs on the robot, monitored by cameras and personnel in the facility.

Simulator developed

Through the PFCS Operational Simulator (OpSim) project, a team from the Robotics and Artificial Intelligence Collaboration (RAICo) has developed a simulation that allows these changes to tooling or operational procedures to be tested and validated in the simulation before deployment into the facility. Once validated, software updates can be transferred digitally to the robot with almost no downtime, and physical updates need far fewer entries to make changes.

RAICo is a collaboration between the UK Atomic Energy Authority (UKAEA), Nuclear Decommissioning Authority (NDA), Sellafield Ltd, the University of Manchester and AWE Nuclear Security Technologies aimed at accelerating deployment of robotics and AI to solve shared nuclear decommissioning and fusion engineering challenges.

The PFCS OpSim project harnessed cutting-edge robotics, purpose-built 3D software, and a team that combined RAICo and Sellafield Ltd expertise in digital technologies and nuclear decommissioning environments.

To map the waste handling facility, a robotic quadruped, Spot, entered the silo with a LiDAR scanner, which uses lasers to collect precise positional data of everything in the space. Those data points were converted into 3D CAD assets, which were used to build a precise digital replica of the PFCS. That was done using RAICo's in-house 3D visualisation software platform, RHOVR (Remote Handling Operations Virtual Reality), which harnesses the Unreal Engine - better known for its use in video games - to create hyper-realistic 3D environments.

Next, an off-the-shelf simulator of the robot's hardware and software was acquired, and integrated into the RHOVR setup – the most technically challenging element of the project – so the team could run robot programmes in a photorealistic virtual environment. Finally, the simulator was validated over six months, before being formally demonstrated at RAICo1 in March this year.

The demonstration was successful and a working version has since been established at Sellafield Ltd's Engineering Centre of Excellence, where it is already being used to execute and verify existing robot programmes in the simulation environment, as well as for providing visual demonstrations of how the PFCS facility operates.

Additional applications

Many Sellafield facilities have similar setups, for example the Waste Transfer Route - the pathway of waste to storage and disposal - uses similar robots in similar sealed rooms for bolting and unbolting waste containers. That opens the door to future projects through the RAICo programme that could adapt the simulator to a wide range of use cases across the Sellafield site.

"This collaboration with RAICo has continued to help Sellafield approach complex robotic operations in hazardous environments," said Rav Chunilal, head of robotics and artificial intelligence at Sellafield Ltd. "By working seamlessly together we've developed a simulator that allows us to test and deploy changes virtually, reducing downtime and risk, and making it safer for our operators. It's accelerating our mission and setting a new benchmark for innovation in nuclear decommissioning which can be repeated across Sellafield and other NDA group operating companies."

NDA Head of R&D Kate Canning added: "This is a great example of a solution that can be deployed across the NDA group, bringing even greater benefits. It demonstrates the value of NDA group's participation in the RAICo programme which is accelerating deployment of transformational technologies across our sites and facilities."

The first batch of waste was successfully retrieved from the PFCS in August 2023 and it is expected to take many years to empty the silo.

Kairos Power installs third test unit reactor vessel

_15696.jpeg)

Kairos is following an iterative approach for the development of its Fluoride Salt-Cooled High-Temperature Reactor (KP-FHR) technology. Its first Engineering Test Unit (ETU 1.0) is a full-scale, electrically heated prototype of the Hermes reactor which carried out more than 2000 hours of pumped salt operations demonstrating the design and integration of key systems, as well as exercising the supply chain and establishing new capabilities, including the production of the high-purity fluoride-lithium-beryllium (FLiBe) salt coolant.

The non-power Engineering Test Unit 2 (ETU 2.0) followed ETU 1.0 and will demonstrate modular construction methods: as part of the project the company is ramping up output of ASME U-stamped pressure vessels, producing specialised reactor components, and gaining proficiency in modular construction methods. Kairos Power has established a dedicated shop in its Albuquerque facility for KP-FHR vessel production.

(Image: Kairos Power)

Kairos has now announced the installation of the 14-foot-tall (4.3 metres) reactor vessel of its third Engineering Test Unit (ETU 3.0). The non-nuclear mockup is being built adjacent to the site of Hermes - a low-power reactor currently under construction to advance the company's commercial KP-FHR reactor.

The ETU 3.0 reactor vessel was fabricated in partnership with Cambridge Vacuum Engineering and the University of Sheffield's Advanced Manufacturing Research Centre, using cutting-edge electron beam welding technology. The ETU 3.0 vessel project allowed Kairos to evaluate the advanced welding technique to enable faster, more cost-effective production of reactor vessels with precise tolerances for future commercial deployments.

(Image: Kairos Power)

The KP-FHR is one of five technologies selected in 2020 to receive federal funding for risk reduction projects under the US Department of Energy's (DOE's) Advanced Reactor Demonstration Program (ARDP), with the department investing up to USD303 million in the Hermes reactor project. Under its agreement with the DOE, Kairos receives fixed, performance-based payments from DOE upon demonstrating the completion of pre-determined project milestones.

"Kairos Power's novel contract with DOE allows us to remain agile while demonstrating continued progress as a responsible steward of public funding," said Kairos Power CEO and co-founder Mike Laufer. "ARDP support is helping us to move quickly through progressively sophisticated iterations, gaining essential learning that will enable commercial deployment of our advanced reactor technology on a meaningful timeline."

(Image: Kairos Power)

The ETU 3.0 building is being constructed around the reactor vessel in a streamlined sequence, which allowed the oversized component to be moved into position before the roof and other elements are in place. Kairos is collaborating with Barnard Construction to build the facility, using it as a proving ground to refine civil construction methods and quality assurance procedures for the Hermes reactor.

In addition to piloting new construction methods and manufacturing processes, ETU 3.0 will ultimately support the Hermes reactor as an operator training centre and test platform for remote handling and maintenance equipment. The facility will help improve operator safety and reduce downtime by prequalifying procedures for maintaining and replacing high-temperature reactor systems and components.

Hermes is the first non-light-water reactor to be permitted in the USA in more than 50 years. It will not produce electricity, but Hermes 2 - a two 35 MWt-unit plant for which the US Nuclear Regulatory Commission issued a construction permit in November - will include a power generation system.

The ETU 3.0 building will also house a Modular Systems Facility where plant equipment modules for ETU 3.0 and the Hermes reactor will be staged, assembled, and tested prior to installation. Kairos said the modular reactor construction methods being piloted with the ETU series and Hermes will be foundational to reducing construction costs and timelines for future plant deployments.

"The ability to test innovative production methods with our non-nuclear iterations is a game-changer for us," said Kairos Power Vice President of Manufacturing Craig Gerardi. "By serving as a vehicle to exercise the supply chain and gain construction proficiency, the ETU programme helps build confidence in our ability to deliver reactors for Kairos Power customers."

The commercial version of the KP-FHR is expected to be deployed in the 2030s.

Reactor vessel installed at Xudabao 1

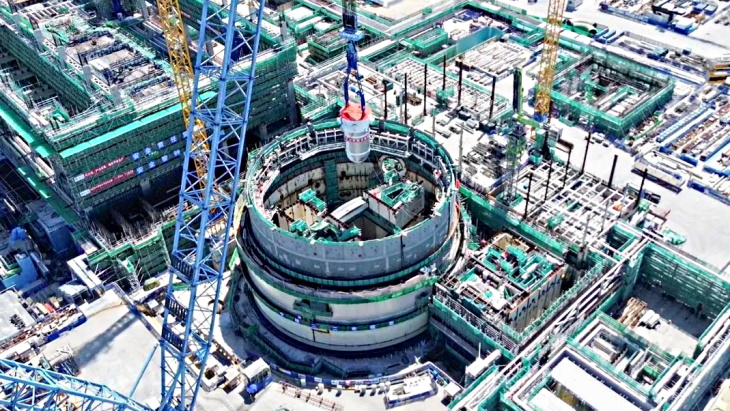

_94679.jpg)

The vessel - weighing more than 300 tonnes - was hoisted into position within the reactor building on 13 July. The vessel will house the nuclear reactor and is the core of a nuclear power plant.

"The successful installation of the pressure vessel not only provides sufficient space and technical preparation for the subsequent installation of key equipment such as steam generators, main pipelines, pressurisers, and reactor internals, but also marks the steady progress of Xudabao nuclear power plant unit 1 from the civil construction stage to the equipment installation stage," China National Nuclear Corporation (CNNC) said.

(Image: CNNC)

On 6 November 2023, the Ministry of Ecology and Environment announced that the National Nuclear Safety Administration had decided to issue a construction licence for Xudabao units 1 and 2, which will both feature 1250 MWe CAP1000 reactors - the Chinese version of the Westinghouse AP1000. A ceremony was held later that month at the Xudabao site near Xingcheng City, Huludao, to mark the start of construction of unit 1.

The Xudabao project was originally expected to comprise six CAP1000 reactors, with units 1 and 2 in the first phase. Site preparation began in November 2010. The National Development and Reform Commission gave its approval for the project in January 2011. CNNC noted that the total investment in units 1 and 2 exceeds CNY48 billion (USD6.6 billion).

However, with a change in plans, construction of two Russian-supplied VVER-1200 reactors as Xudabao units 3 and 4 began in July 2021 and May 2022, respectively.

The Xudabao plant is owned by Liaoning Nuclear Power Company Ltd, in which CNNC holds a 70% stake with Datang International Power Generation Company holding 20% and State Development and Investment Corporation owning 10%. The general contractor is China Nuclear Power Engineering Company Ltd, a subsidiary of CNNC.

Two further CAP1000 reactors are proposed for units 5 and 6 at the Xudabao plant.

Site named for first SOLO microreactor in US

_13696_74338.jpg)

The memorandum of understanding (MoU) foresees the Rock City site - a six-million square-foot industrial park in Illinois in the USA - becoming the site for the first-of-a-kind SOLO micro-modular reactor with an option to deploy up to 50 on the site in the future.

The reactor(s) would supply power to the businesses operating at the park.

Alessandro Petruzzi, Co-founder and CEO of Terra Innovatum, said: "Rock City is the perfect location for our first deployment as it showcases the massive real-world application potential of our micro-modular reactors and is in close proximity to a hotbed of nuclear research and talent."

Joe Koppeis, Founder and Board Director of Admiral Parkway, said: "We are excited to partner with Terra Innovatum’s team to bring their innovative energy technology to the world. Once SOLO secures regulatory approval, we will be honoured to host the first-of-a-kind and take the next steps towards wider commercialisation."

Special purpose acquisition company GSR III Acquisition Corp, which is listed on the Nasdaq stock exchange, is in the process of a business combination with Terra Innovatum which, when it closes, would see the micro reactor developer becoming a public company listed on Nasdaq.

The MoU says that, pending US Nuclear Regulatory Commission (NRC) and other necessary approvals, Terra Innovatum will supply power via the initial unit for a 15-year term, with an option to extend to 45 years.

Background

Terra Innovatum is developing its SOLO micro modular reactor design, intended to form the basis for a scalable modular energy platform from MWe to GWe-class. A SOLO unit is designed to deliver approximately 1 MWe. The design features a solid heterogeneous composite moderator and is intended to accommodate both traditional zircaloy-clad low-enriched uranium (LEU) fuel or, when available, LEU+ and high-assay low-enriched uranium (HALEU) fuels. Heat removal is accomplished by helium gas which eliminates the need for water from the reactor coolant system.

The reactor is intended to feature autonomous operation, on-line safeguards-by-design, and a defence-in-depth structure of radiological barriers with the intent to minimise or eliminate emergency planning zone requirements beyond the operational boundary.

The NRC is currently engaged in pre-application activities with Terra Innovatum.

China's largest uranium mining project enters production

_37300.jpg)

China National Nuclear Corporation (CNNC) broke ground for the project on 12 July 2024. The project integrates automation, remote centralised control and big data analysis. It uses CO2 and O2 in-situ recovery (also known as in-situ leaching), where uranium is extracted through a closed-loop circulation of the uranium solution without lifting the ores to the surface for processing - a technique said to avoid water, gas and solid wastes and minimise carbon emissions.

CNNC has now announced that the project successfully produced the first barrel of uranium products on 12 July.

(Image: CNNC)

"As the largest natural uranium production capacity project in China's nuclear and mining industry in the past 70 years, the successful production of the first barrel of uranium marks that China's uranium resource development has officially entered a new era of green, safe, intelligent and efficient," CNNC said. "After completion, it will provide a solid resource guarantee for national energy security and nuclear industry development, and will also greatly enhance the international competitiveness of China's natural uranium industry."

CNNC noted that in the past, China's uranium development was mainly concentrated in volcanic and granite uranium mines in the south. However, over the past two decades, major breakthroughs have been made in the prospecting of sandstone uranium mines in the north. In 2023, China released the top ten uranium prospecting results, predicting more than 2.8 million tonnes of uranium resources. The main uranium resources are concentrated in the sandstone uranium mines in the north, among which the Ordos Basin has become the country's largest uranium resource base.

The technology used at the National Uranium No.1 project will be "fully applied and accelerated to the development of uranium resources in China's northern basins such as Songliao, Erlian, Ordos, and Yili, supporting the construction of a number of new uranium mining bases and fully guaranteeing the demand for uranium resources for nuclear energy development," CNNC said. "In the future, the National Uranium No.1 technology will 'go abroad' and be promoted to uranium mines around the world to ensure the safe and orderly development of global nuclear power."

"This demonstration project is a major achievement in China's third-generation uranium mining and processing technology," said Yuan Xu, chairman of CNNC subsidiary China National Uranium Corporation.

The project is part of China's nuclear energy development plan, with natural uranium being the basis of the nuclear fuel cycle, and with demand forecast to increase as nuclear energy capacity expands across the world.

China currently has 58 operable reactors providing capacity of 56.93 GWe. There are a further 32 reactors under construction which will provide a further 34.2 GWe of capacity and there are dozens more at the planning or proposed stage. According to World Nuclear Association's information paper on China's nuclear fuel cycle, China aims to produce one-third of its uranium domestically, obtain one-third through foreign equity in mines and joint ventures in other countries and to purchase one-third on the open market.

Inner dome hoisted into place at Lufeng 6

_44516.jpg)

The steel dome - measuring 45 metres in diameter and almost 14 metres in height, and weighing about 238 tonnes - was raised some 60 metres above ground level using a crawler crane and lowered into position on top of the walls of the double containment structure. An outer dome will subsequently be installed over the inner one.

"The project construction team accurately predicted the difficulties of hoisting through simulation and deduction of the whole process, and comprehensively used 3D laser simulation and real-scene replication technology, finite element analysis, real-time meteorological monitoring and other technical means to ensure that the dome was successfully hoisted into place in one go," said Zhang Weixiao, the person in charge of the dome hoisting operation.

(Image: CGN)

The main function of the dome is to ensure the integrity and leak tightness of the reactor building, and it plays a key role in the containment of radioactive substances.

China General Nuclear (CGN) said the installation of the dome "marks the successful capping of the reactor building of the Hualong One nuclear power unit, and the project construction officially shifted from the civil construction stage to the equipment installation stage".

The construction of Hualong One reactors as units 5 and 6 at the Lufeng plant was approved by the State Council in April 2022. First concrete for unit 5 was poured on 8 September 2022, with that for unit 6 following on 26 August 2023. Units 5 and 6 are expected to be connected to the grid in 2028 and 2029, respectively.

The proposed construction of four 1250 MWe CAP1000 reactors (units 1-4) at the Lufeng site was approved by China's National Development and Reform Commission in September 2014. However, the construction of units 1 and 2 did not receive State Council approval until 19 August last year. The first safety-related concrete for the nuclear island of unit 1 was poured on 24 February this year. Approval for units 3 and 4 is still pending. The CAP1000 design is the Chinese version of the Westinghouse AP1000.

According to CGN, once all six units are in operation, the Lufeng plant will generate about 52 TWh, which will reduce standard coal consumption by almost 16 million tonnes and reduce carbon dioxide emissions by more than 42 million tonnes