Critical mineral boron the best supporting actor of US magnet supply chain – 5E CEO

5E Advanced Materials (NASDAQ: FEAM) (ASX: 5EA), the only publicly traded pure play on critical mineral boron, has released an SK-1300 preliminary feasibility study on its Fort Cady project in California.

The PFS reports a $724.8 million pre-tax net present value (at 7% discount), a 19.2% internal rate of return and an initial 39.5-year mine life. Total mineral reserves are about 5.4 million tons in boric acid with a grade of 8.03% B2O3 (boron trioxide).

Boron is designated as a critical mineral by the US Homeland Security. Although a smaller market and not as near the mainstream radar as rare earths, boron is crucial to onshore US defense supply chains, decarbonization and food security

Turkey’s state-owned Eti Maden and Australian mining giant Rio Tinto (ASX: RIO) control roughly 85% of the 4.5-million-ton annual supply globally. China holds a near monopoly on downstream processing.

As with many other critical minerals, efforts are underway to re-shore supply to the US.

While Rio Tinto, through its subsidiary US Borax, mines and refines boron in the namesake town in California, the refined borates are shipped to various locations, including Asian markets.

Fort Cady, located in the Mojave Desert near the town of Newberry Springs, represents one of the world’s largest new conventional (colemanite) boron deposits globally outside of Turkey.

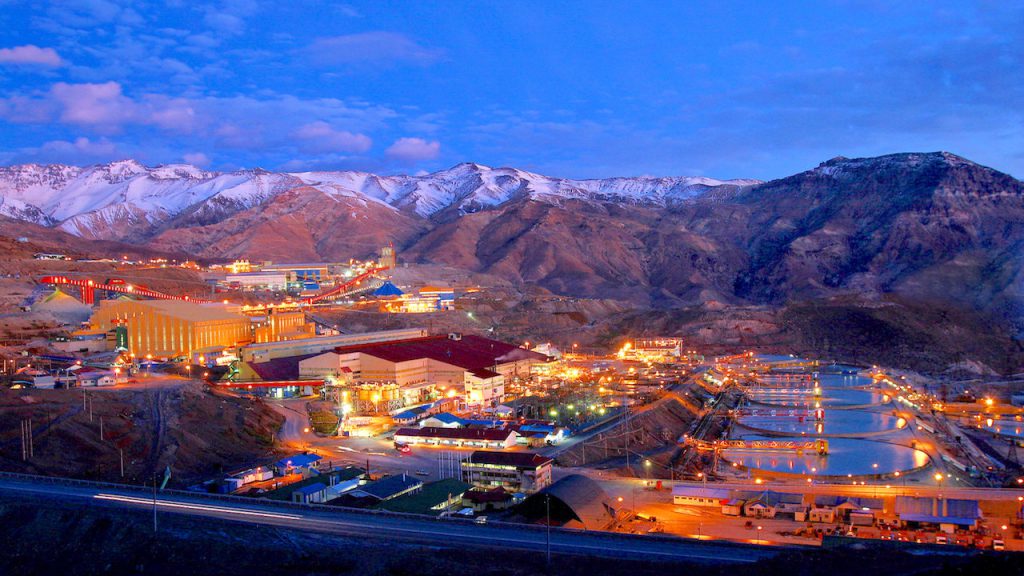

E3’s initial facility, the 5E Boron Americas (Fort Cady) complex, is fully commissioned and is currently producing boric acid. The initial production plans are for 2,000 tons of boric acid per annum, with the ability to scale with minimal investment.

When 5E Advanced Materials CEO Paul Weibel first started at the company as CFO, he researched the deposit, ultimately finding a USGS report in the Library of Congress on the property.

“There’s been exploration going back to the 30s, you’re really starting to get back into that gold rush era and it’s a really cool history. This deposit was discovered in the 60s by Duval and Pennzoil – they were drilling for oil and gas up in the high desert and at 1,300 to 1,500 feet they ended up hitting an interesting layer of mineralization, not oil and gas, and that ended up being really a very multi-generational large deposit of colemanite,” Weibel told MINING.com in an interview.

“Four different types of minerals in which boron is found, you have tincal (borax), colemanite, kernite and ulexite colemanites. Colemanite is like the Mercedes-Benz of mineralization for boron.”

“The boron market is every bit an oligopoly. We get asked so often, what is boron? It’s the fifth element on the periodic table. It’s light, heat resistant, energy dense, microbial, and has great thermal properties. And I use the analogy that if Tony Stark were to build an Iron Man suit, it’s a boron-based suit,” Weibel said.

“Every TV, high-end display device, iPhone, Tesla, the screens all require boron to make,” Weibel said.

Boron – “the best supporting actor”

Boron is also used in US space and military industries, specifically to make Kevlar and tank armor. In 2022, 5E entered an agreement with aerospace engineering firm Estes Energetics to collaborate in producing boron advanced materials for solid rocket motors.

While rare earths are most reported for its use in powerful magnets that power EVs, NdFeB – the type made from an alloy of neodymium, iron and boron – have the highest magnetic strength.

Weibel believes boron to be an unsung hero of the magnet supply chain.

“You cannot make those magnets without the boron,” he said. “Rare earths won the Oscar – we are the best supporting actor on the magnet supply chain.”

Fort Cady development

With US President Donald Trump’s tariffs roiling global markets, Weibel sees an opportunity to disrupt the boron market by ramping up production at Fort Cady to supply the US at lower costs.

“Costs are going up. And what has been in this market has been a classic prisoner’s dilemma, where on one side of the world, you have Turkey. And then on the other side of the world, you have Rio,” he said.

“Turkey’s boron goes to Europe, Middle East, Africa, and then they’ll hit the Eastern seaboard of the United States. Pricing has been driven off of cost to serve and logistics. And so now what is happening is that Rio has actually gone out and they’ve increased prices and their revenue has gone up every year.”

“We know that our biggest competitor and the number two player in the market has to go sell at higher prices in Asian markets – that’s where Rio’s competing.”

Uncle Sam’s land

An historic deposit, Fort Cady has permits going back to the 1990s. Weibel said the company has secured three major permits for 400 acres of real property.

“We got a mining and reclamation permit, and conditional use permit in 1994,” Wiebel said.

“What was in that permit is really how we operate today. All around us is Uncle Sam’s land – BLM. We got a record decision in 1994. And then given we’re going to inject a very dilute 5% hydrochloric acid solution underground, we needed an underground injection control permit with the United States EPA.

“Having those permits is really hard to do. But we have them.”

Weibel said the plan, as production ramps up, is to build a much bigger plant.

“We built a small scale facility that’s been operating for 14 months, and we’ve been mining for 18 months. And all that data has been incorporated into our PFS and design for the bigger plant,” he said.

“We probably have the second largest deposit in the world. We just did our reserve statement, and we’ll produce 130,000 tons a year of boric acid. This market’s not all that big – so that has an upstream impact on CAGR. We see this market growing at about five and a half to six percent on average.”

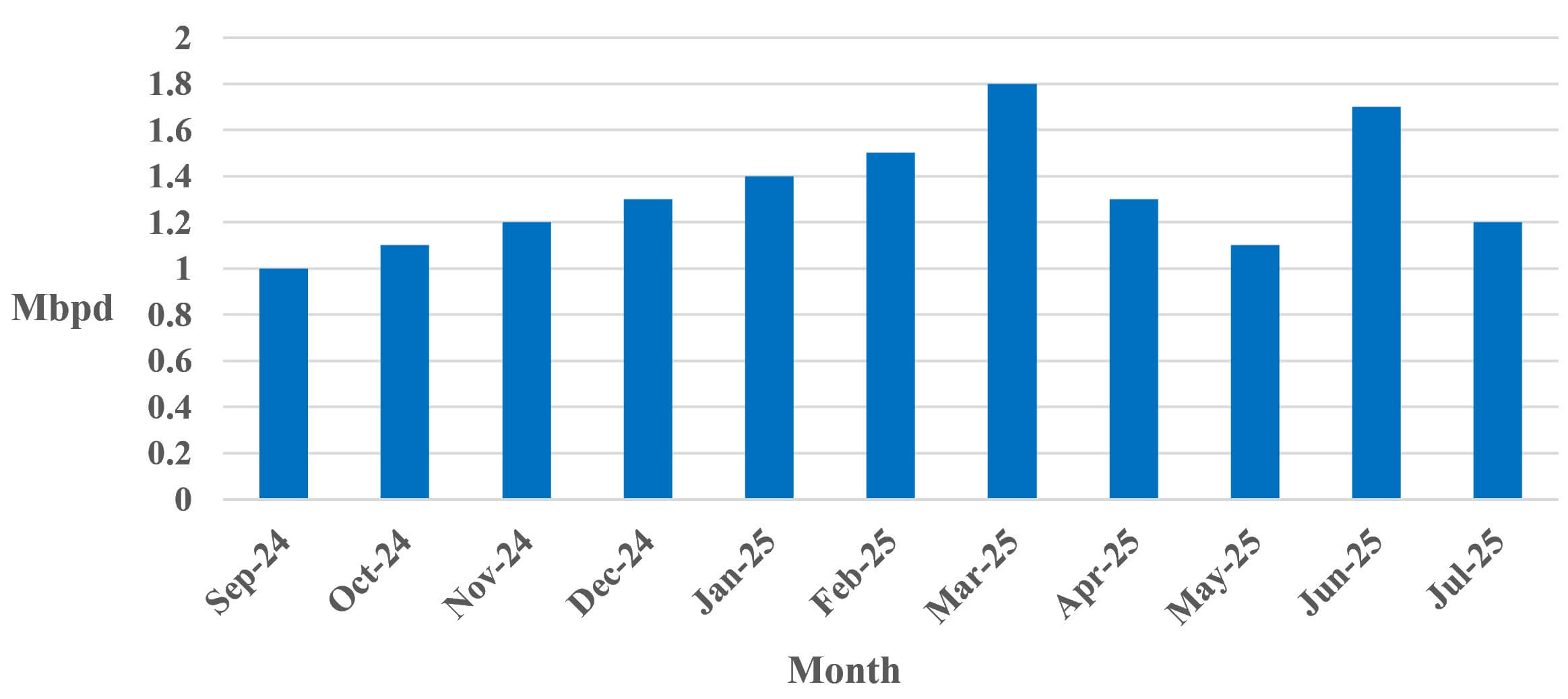

Iranian crude exports to China derived from Kpler and Vortexa analysis (CJRC)

Iranian crude exports to China derived from Kpler and Vortexa analysis (CJRC)