SHADOW TRADE

Scrap copper traders redirect metal to sidestep China levies

Some US metal dealers are redirecting China-bound shipments of scrap copper through countries including Canada, Mexico and Vietnam in a risky move to avoid 10% import tariffs, according to people familiar with the matter.

The rerouting underscores growing stress building up in the global metals supply chain due to the trade war between the US and China. US scrap is a vital source of raw material for China’s copper smelters and refiners, which account for about half of the world’s output of the finished metal. Prolonged disruption to that supply threatens to ripple across global markets.

While the full extent of the transshipments remains unclear, the rerouting shows how creative metals dealers are getting to avoid higher costs from trade barriers to find a home for America’s surplus scrap. The US is the world’s largest supplier of waste copper — metal recovered from auto parts, electric wires and electronics — but the domestic market consumes just 40% of that output, according to BMO Capital Markets.

“It’s not surprising that these companies come up with clever ways to move materials around,” said Xiaoyu Zhu, a trader at StoneX Financial Inc. “The 10% tariff has put the scrap companies at a disadvantage in terms of pricing, not to mention the financing pressure from high interest rates.”

China was typically the largest export destination for the US until Washington’s trade war with Beijing disrupted flows. Beijing has imposed 10% counter-tariffs on all American imports, including copper scrap, since May.

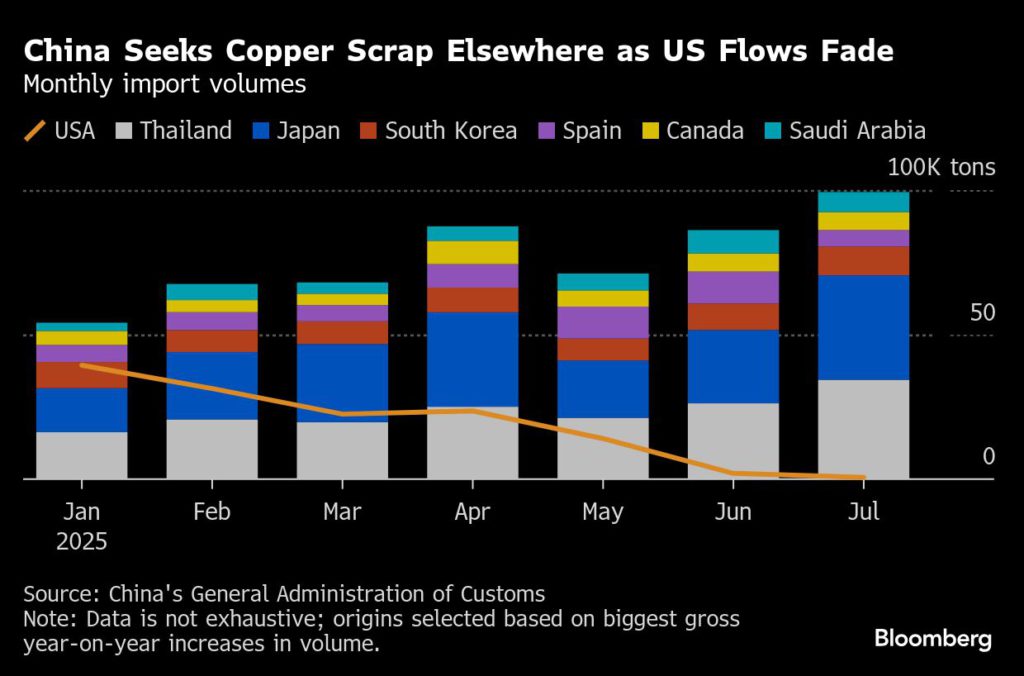

Officially, Chinese imports of copper scrap from the US have plunged this year, falling from 39,373 metric tons in January to below 600 tons in July, the lowest monthly total according to Chinese customs data going back to 2004. Shipments from other nations have largely filled the gap, since China’s overall imports of 190,000 tons last month was little changed from the start of the year. Shipments from Japan and Thailand have more than doubled since January, while imports from Canada climbed 29%.

US export data, meanwhile, shows that Thailand, India and Canada were the top three destinations for American scrap copper in the second quarter.

The sudden, large increases in Chinese imports from countries other than the US suggests at least some rerouting, according to the people familiar with the workaround, who asked not to be identified because they weren’t authorized to publicly discuss the practice.

To dodge Chinese tariffs, US scrap copper is put in containers, tagged with the owner’s name, and shipped out to a third country, the people said. When the cargo reaches its stopover, the owner tag is switched with another carrying a different name and country of origin, and the container then continues its journey to China, they said.

Risky business

Reloading shipments en route and changing the origin is fraud, as is importing into a country and declaring it the origin before sending on to the final destination, according to Emmanouil Xidias, managing director at ship-broking firm Ifchor North America LLC. The party involved in changing the origin and re-exporting is liable, he said.

“Whether the buyer or the seller shoulders the risk depends on the contract terms,” Xidias said. For example, if terms cover cost of goods, insurance and freight, the risk is transfered to the buyer when goods are unloaded at their destination. “If it’s Free on Board, then the buyer takes the risk the moment the materials are loaded to the container.”

Chinese importers caught engaging in illegal transshipping or origin fraud — across a range of goods — have faced hefty fines and criminal charges in the past decade. During US President Donald Trump’s first term, when China also imposed tariffs on US goods, some copper scrap importers were fined when Chinese customs detected their efforts to buy rerouted cargoes.

For American scrap traders, they’re left with a choice between sitting on the material or shipping it overseas to get cash. Some choose to take their chances on foreign buyers, though moving the metal is slow and traders still face so much secondary copper they can’t find a market for.

The situation is reflected in the price of so-called No. 2 copper — a grade of recycled material that can be cheaper substitute for the primary metal — which at the end of July touched the largest discount relative to futures contracts in data going back to 2015, according to Fastmarkets. The discount has faded this month after Trump’s copper tariffs excluded cathode and caused the Comex contract to plunge, narrowing the price differential. The discount was 47.50 cents a pound as of Wednesday, according to Fastmarkets.

“The disruptions in mined supply and loss-making processing fees makes scrap more valuable, so I wouldn’t be surprised if the industry is getting creative on trade routes,” Bloomberg Intelligence analyst Grant Sporre said.

Sandvik to supply 32-unit underground equipment fleet for Botswana copper mine

Chinese mining contractor JCHX has selected Sandvik Mining to supply a 32-unit underground equipment fleet at MMG’s Khoemacau copper mine (KCM) in Botswana.

The order includes 12 Toro TH663i trucks, 10 Toro LH621i loaders, eight Sandvik DD422i development drills, one Sandvik DL432i longhole drill, and one Sandvik Rhino 100 raise borer. Deliveries will continue through the second quarter of 2026.

The contract also includes remote monitoring service, providing critical information to improve fleet performance.

Located in Botswana’s Kalahari copper belt, Khoemacau is a major underground operation with significant expansion underway. Since acquiring the mine in March 2024, operator MMG has advanced plans to increase annual copper production from current levels to 60,000 tonnes within two years, leveraging the existing 3.7 million t/y process plant and targeting higher-grade zones through improved mine access and flexibility.

Longer term, MMG aims to increase total output to 130,000 tonnes of copper in concentrate per year by constructing a new 4.5 million t/y process plant, expanding Zone 5 production and developing nearby deposits. Early works for the expansion project have commenced, with construction expected to begin in 2026 and first concentrate anticipated in 2028.

“We’re proud to partner with Sandvik for this important contract,” said Xiancheng Wang, chair of JCHX. “Sandvik’s reputation for high-performance equipment and strong aftermarket support was key in our decision. This fleet will play a vital role in helping us deliver operational excellence and meet the ambitious production targets set for the Khoemacau site.”

“Our advanced underground technologies and digital solutions will help enable efficiency and performance as the site ramps up production in the coming years,” Mats Eriksson, president of Sandvik, said in a news release.

Clockwise from upper left: Skobelev, Sparta, Vice Admiral Kulakov, HMS Trent (Royal Navy)

Clockwise from upper left: Skobelev, Sparta, Vice Admiral Kulakov, HMS Trent (Royal Navy)