Indonesia cites lack of forestry permits in land seizures from nickel miners

An Indonesian task force has seized plots spanning hundreds of acres from miners PT Weda Bay Nickel and PT Tonia Mitra Sejahtera for lack of relevant forestry permits, officials said on Friday.

The world’s largest producer of nickel products is cracking down on illegal exploitation of natural resources, with President Prabowo Subianto saying last week that more than 1,000 such mining operations were identified.

The crackdown boosted nickel prices, with benchmark three-month nickel on the London Metal Exchange up 1.32% at $15,350 a metric ton by 0801 GMT.

The most-traded contract on the Shanghai Futures Exchange closed daytime trade up 1.28% at 121,800 yuan a ton.

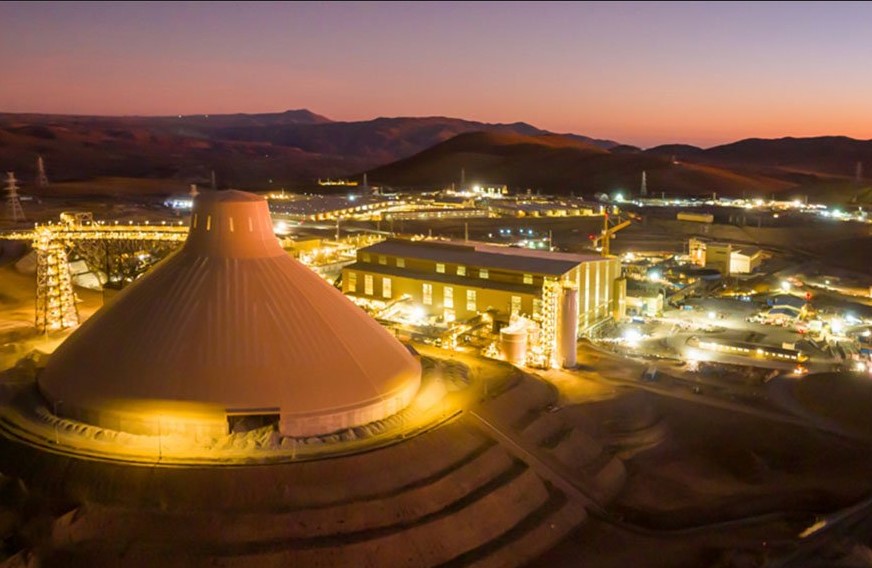

A 148-hectare (366-acre) area at PT Weda Bay Nickel’s concession has been seized for the lack of a forestry licence needed to exploit the plot, mining ministry official Rilke Jeffri Huwae said.

“They have the mining permit, but they don’t have the borrow-to-use permit for the forest,” Rilke said.

Weda Bay Nickel, controlled by China’s Tsingshan Holding Group, France’s Eramet SA and Indonesia’s Aneka Tambang, spans 45,000 hectares (111,000 acres) on Indonesia’s island of Halmahera.

Weda Bay is trying to seek clarification from the task force, said a company source who sought anonymity in the absence of authorization to speak to media.

Eramet Indonesia said it was fully committed to comply with all applicable rules, while assessing the situation.

“We respect the decisions of the Indonesian authorities and fully support PT WBN in working closely with the authorities to ensure all activities undertaken meet the required legal and regulatory standards,” it said in a statement.

The seized plot was a rock quarry for construction material and did not cover the mining extraction site, Eramet said, adding that it did not expect significant impact on Weda Bay’s operation.

Images from a regional news channel showed authorities, some in military uniform, putting up a sign showing the area was now under government control. The government had closed off the area, Eramet said.

The task force has also seized an area of 173 hectares (427 acres) managed by PT Tonia Mitra Sejahtera in Southeast Sulawesi, said Febrie Adriansyah, a senior prosecutor at the attorney general’s office.

Tonia’s mining permit covers nearly 5,900 hectares (14,580 acres), ministry data showed.

The task force has identified a total of 4.2 million hectares (10 million acres), managed by 51 companies, as lacking proper forestry permits, Febrie added.

(By Bernadette Christina Munthe, Fransiska Nangoy and Amy Lv; Editing by David Stanway and Clarence Fernandez)

Nickel price gains after Indonesia seizes part of giant mine

Nickel rose after Indonesia seized part of a giant mine semi-owned by top Chinese producer Tsingshan Holding Group Co., underlining risks to ore output in the world’s largest supplier.

A government task force on Thursday took control of about 148 hectares of the operation owned by PT Weda Bay Nickel — the world’s largest mine for the battery metal — over an alleged permit violation. France’s Eramet SA, one of the company’s shareholders, has said it sees no impact on operations at this stage.

Still, the seizure highlights ongoing challenges to reliable supply from Indonesia, which accounts for well over half of global nickel output. President Prabowo Subianto, who has outlined bold and costly plans for the nation, has also promised a crackdown on illegal mining, which may disrupt the flows of ore to local processors.

Smelters in Indonesia have been dealing with a tight ore market all of this year, due to high rainfall and low issuance of government mining quotas. At the same time, LME nickel prices have spent months range-trading at low levels, held back by disappointing demand from the electric vehicle battery sector.

Nickel futures advanced 1.6% to settle at $15,391 a ton on the LME. Copper added 0.2% and aluminum rose 0.6%.

(By Eddie Spence)