European Commission urges heavy industry to back 'Made in Europe' manufacturing - leak

The European Commission is asking business leaders to "support and sign" a French-led initiative to increase the share of European industrial production, according to a letter seen by Euronews. The EU executive's call comes a few days before the Industrial Accelerator Act is presented.

The European Commission is seeking support from heavy industry representatives, like the steel or aluminium sectors, to back a 'Made in Europe' component in upcoming legislation, a letter seen by Euronews shows.

The aim is to revive a struggling industry in the face of competition from China and the United States.

The call comes in the run-up to the EU executive's announcement of the Industrial Accelerator Act (IAA). Its purpose is to boost the decarbonisation of energy-intensive industries while keeping European production competitive.

A similar bill was adopted by the European Union in 2024 to prioritise the production of domestic clean technologies as the bloc races to reach net neutrality by 2050.

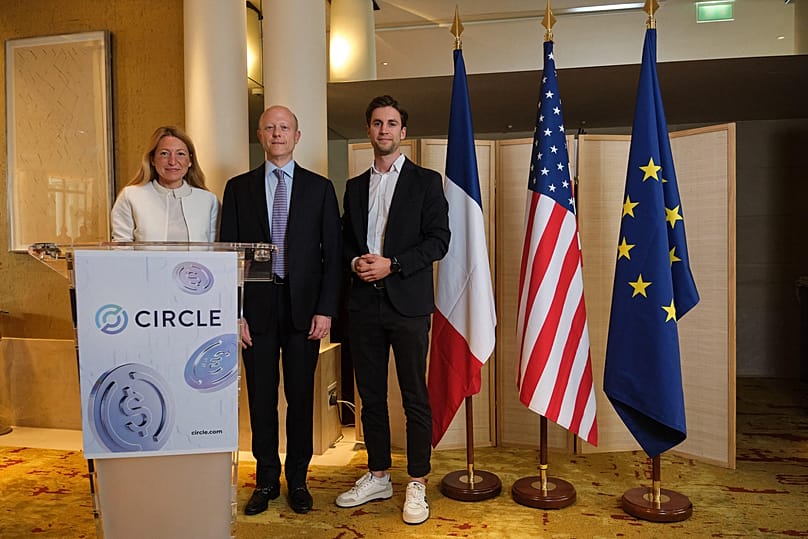

"The return of power-based economic relations — through customs duties, massive subsidies, export restrictions and unfair competition — leaves Europe with a clear choice: either we equip ourselves with an ambitious, pragmatic industrial policy, or we accept a gradual erosion of our industrial base, know-how and economic sovereignty," the letter sent by the French Executive Vice-President Stéphane Séjourné states.

Analysts say the IAA can significantly bolster the EU’s industrial competitiveness, as both historically energy-intensive sectors, such as cement and steel production, and innovative net-zero technologies struggle with low demand and damaging international competition.

However, critics argue that the future lawcould have the adverse effect of undermining competitiveness within the EU's single market, particularly given the more advanced industrial frameworks in countries such as France and Germany.

"Whenever European public money is used, it must contribute to European production," reads the letter, which seeks to ensure that "Europe remains an industrial power" rather than a "passive market".

Technical equipment for the electrolyser of a hydrogen production plant is located on the EWE premises in the Huntorf district in Elsfleth, Germany. Hauke-Christian Dittrich/(c) Copyright 2020, dpa (www.dpa.de). Alle Rechte vorbehalten

Technical equipment for the electrolyser of a hydrogen production plant is located on the EWE premises in the Huntorf district in Elsfleth, Germany. Hauke-Christian Dittrich/(c) Copyright 2020, dpa (www.dpa.de). Alle Rechte vorbehalten

A group of nine countries — including Czechia, Estonia, Finland, Ireland, Latvia, Malta, Portugal, Sweden and Slovakia — warned in December that the Commission's future law could have “consequences for effective competition, price and quality levels, and effects on businesses”.

Meanwhile, Poland and the Netherlands are backing calls for an impact assessment.

The European Commission is seeking support from heavy industry representatives, like the steel or aluminium sectors, to back a 'Made in Europe' component in upcoming legislation, a letter seen by Euronews shows.

The aim is to revive a struggling industry in the face of competition from China and the United States.

The call comes in the run-up to the EU executive's announcement of the Industrial Accelerator Act (IAA). Its purpose is to boost the decarbonisation of energy-intensive industries while keeping European production competitive.

A similar bill was adopted by the European Union in 2024 to prioritise the production of domestic clean technologies as the bloc races to reach net neutrality by 2050.

"The return of power-based economic relations — through customs duties, massive subsidies, export restrictions and unfair competition — leaves Europe with a clear choice: either we equip ourselves with an ambitious, pragmatic industrial policy, or we accept a gradual erosion of our industrial base, know-how and economic sovereignty," the letter sent by the French Executive Vice-President Stéphane Séjourné states.

Analysts say the IAA can significantly bolster the EU’s industrial competitiveness, as both historically energy-intensive sectors, such as cement and steel production, and innovative net-zero technologies struggle with low demand and damaging international competition.

However, critics argue that the future lawcould have the adverse effect of undermining competitiveness within the EU's single market, particularly given the more advanced industrial frameworks in countries such as France and Germany.

"Whenever European public money is used, it must contribute to European production," reads the letter, which seeks to ensure that "Europe remains an industrial power" rather than a "passive market".

A group of nine countries — including Czechia, Estonia, Finland, Ireland, Latvia, Malta, Portugal, Sweden and Slovakia — warned in December that the Commission's future law could have “consequences for effective competition, price and quality levels, and effects on businesses”.

Meanwhile, Poland and the Netherlands are backing calls for an impact assessment.

Quotas, supply and demand, state aid

Political discussions on the criteria, incentives, and permitting for domestic products are still underway, an EU diplomat speaking on the condition of anonymity told Euronews.

The same goes for financing, as the EU executive is exploring ways to link EU funding to the latest initiative. The bloc's multiannual budget (MFF) and the EU's Competitiveness Fund are slated to assist European industries.

The Commission hasn't yet agreed on a percentage for the share of European products to be produced under the upcoming law, but figures ranging from 60% to 80% have been floated as possibilities, the EU diplomat said.

"When decided, this figure will come with specific distinctions to address imports and exports," the EU diplomat said, noting that the output from non-European companies producing in the EU could be considered 'Made in Europe'.

Europe is already a leader when it comes to setting stricter environmental standards for businesses, which has resulted in higher production prices, and the new law could see these further increase.

The Commission is looking into "creating the conditions to align supply and demand", the EU diplomat said. To that end, the EU executive plans to create so-called "lead markets" to drive demand for sustainable, low-carbon industrial products within Europe.

The approach seeks to create a predictable market for clean technologies and their outputs, such as green steel and hydrogen, through demand-side policy measures.

Financial support via state aid — referring to a government using public money to give loans, grants or tax breaks to specific companies or industries — is likely to suffer some modifications under the IAA.

"Member states will likely be exempted from notifying the European Commission when it comes to funding decarbonisation projects," the EU diplomat said.

Political discussions on the criteria, incentives, and permitting for domestic products are still underway, an EU diplomat speaking on the condition of anonymity told Euronews.

The same goes for financing, as the EU executive is exploring ways to link EU funding to the latest initiative. The bloc's multiannual budget (MFF) and the EU's Competitiveness Fund are slated to assist European industries.

The Commission hasn't yet agreed on a percentage for the share of European products to be produced under the upcoming law, but figures ranging from 60% to 80% have been floated as possibilities, the EU diplomat said.

"When decided, this figure will come with specific distinctions to address imports and exports," the EU diplomat said, noting that the output from non-European companies producing in the EU could be considered 'Made in Europe'.

Europe is already a leader when it comes to setting stricter environmental standards for businesses, which has resulted in higher production prices, and the new law could see these further increase.

The Commission is looking into "creating the conditions to align supply and demand", the EU diplomat said. To that end, the EU executive plans to create so-called "lead markets" to drive demand for sustainable, low-carbon industrial products within Europe.

The approach seeks to create a predictable market for clean technologies and their outputs, such as green steel and hydrogen, through demand-side policy measures.

Financial support via state aid — referring to a government using public money to give loans, grants or tax breaks to specific companies or industries — is likely to suffer some modifications under the IAA.

"Member states will likely be exempted from notifying the European Commission when it comes to funding decarbonisation projects," the EU diplomat said.

Business leaders' reactions

European industry leaders appear receptive to the Commission's call to intensify domestic production, citing the "record trade deficit of €350 billion" with China in 2025, according to a second letter seen by Euronews.

Industry leaders say the IAA represents "an act of economic independence" responding to the Draghi report. In this report, the former president of the European Central Bank, Mario Draghi, urged the EU27 to close the gap with China and other competitors or risk "slow agony".

"The Chinese have 'Made in China', the Americans have 'Buy American', and most other economic powers have similar schemes that give preference to their own strategic assets. So why not us?" reads the letter, which is set to be signed by EU businesses.

Because of the increased production expected by European manufacturers, industry leaders are asking for financial support through "public auction, direct state aid, or another form of financial support".

"Now is the time for Europe to produce more, and above all, more strategically. To ensure our economic security, we must support and de-risk our key value chains," the letter reads.

After being postponed in December, the IAA is slated to be presented on 29 January, but could suffer further delays, sources close to the file say.

European industry leaders appear receptive to the Commission's call to intensify domestic production, citing the "record trade deficit of €350 billion" with China in 2025, according to a second letter seen by Euronews.

Industry leaders say the IAA represents "an act of economic independence" responding to the Draghi report. In this report, the former president of the European Central Bank, Mario Draghi, urged the EU27 to close the gap with China and other competitors or risk "slow agony".

"The Chinese have 'Made in China', the Americans have 'Buy American', and most other economic powers have similar schemes that give preference to their own strategic assets. So why not us?" reads the letter, which is set to be signed by EU businesses.

Because of the increased production expected by European manufacturers, industry leaders are asking for financial support through "public auction, direct state aid, or another form of financial support".

"Now is the time for Europe to produce more, and above all, more strategically. To ensure our economic security, we must support and de-risk our key value chains," the letter reads.

After being postponed in December, the IAA is slated to be presented on 29 January, but could suffer further delays, sources close to the file say.