Their Money or Your Life

By Paul Mattick

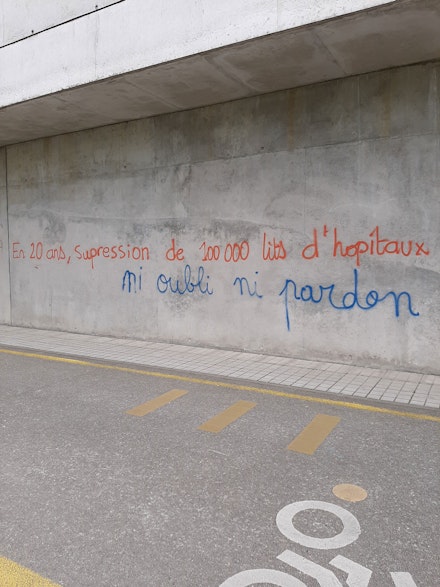

"In 20 years, more than 100,000 hospital beds eliminated. We don't forget, we don't forgive." Photo: Philippe Gonnet AUSTERITY GUTTED HEALTH CARE

The social disruption that has come with the novel coronavirus SARS-CoV-2 has an all too visible side expanding day by day and a more occult one waiting in the near future. First of all, there are the effects of the virus itself: the infection and sickening of millions of people, and then the steps taken to limit these effects. National governments, unprepared for the emergency despite decades of warnings, have reacted, after deadly delays, by limiting social movement to control the infection rate. The economy, thus put into an induced coma, is being kept on life support by way of massive loans to businesses and a small increase in unemployment relief. While the evaporation of stock and bond values is wiping out pensions and nest eggs, along with some percentage of hedge funds, a cascade of business closures is producing mass worklessness on a scale rivaling that of the Great Depression.

SARS-CoV-2 is only the latest in the series of pandemics that have accompanied the development of capitalist agriculture and urbanization since before the Industrial Revolution. Its novelty and the rapidity of its spread in a world of global supply chains, international labor migration, and mass tourism—one path was apparently opened for intercontinental transmission, for example, by the use of low-wage Chinese garment workers by Milanese fashion companies—make it stand out against the background of influenza deaths, cancer fatalities due to environmental and workplace pollution, and such mundane killers as automobile and truck accidents. The new virus, easier for the rich to guard against and to treat when stricken, illuminates the depth of social inequality and the general subordination of everyday life, including the requirements of human and animal health, to “the economy,” as we call the system subordinating the production of goods and services to the need of capitalist investors to accumulate profits.

Apart from some generalities, the longer-term effects of the medical crisis-turned-economic-shutdown are still unknown. The eventual production of a vaccine may well help make COVID-19 a part of normalcy, alongside other social ills like lead poisoning, industrial accidents, drug overdoses, starvation, and warfare. In the official discourse of economic policy, the stimulus and bailout measures decreed by governments and set in motion through the money-creating facilities of central banks are intended as relatively short-term efforts. Once the virus runs its course, businesses will supposedly reopen and workers return to their jobs; in theory, at least some of the trillions of dollars of government loans will eventually be repaid. The normal process of concentration and centralization of capital ownership will have been accelerated, along with the general inequality of wealth, as government largesse flows to the largest companies. In theory at least, capitalism will continue on its merry way, spawning little New Zealands of billionaires amidst a sea of growing impoverishment.

In reality—and this is the second aspect of the crisis, nearly hidden from view by the sudden check to economic activity in response to the medical catastrophe—an economic recession was well on the way before the coronavirus tipped us over the edge. During the last quarter of 2019 Japan’s GDP slumped by 6.3% to a growth rate of -1.6%, while Germany’s GDP growth (and this is the world’s fourth-largest economy) fell to zero. Europe as a whole claimed 1.1% growth in 2019. Among the economically stronger countries, China’s growth rate of 6% was the lowest in 30 years, and U.S. GDP, with flat growth in the last quarter, increased by only 2.3% in 2019, the lowest since 2016, and economists were expecting a fall to below 2% in 2020.1

What made such developments especially meaningful was the fact that the debt load of non-financial companies had reached an all-time high by the end of 2019, attesting to their failure to generate profits sufficient for their needs. And 51% of bonds issued that year were classified as BBB, the lowest rating. 25% were junk bonds, unrated because below investment grade.2 Global finance has increased since the 1980s to four times the value of world production; China’s corporate debt alone grew to $20 trillion. “In the United States, against the backdrop of decades-long access to cheap money, non-financial corporations have seen their debt burdens more than double from $3.2 trillion in 2007 to $6.6 trillion in 2019.”3 Many firms turned from public ownership to private equity to avoid financial regulation; today private equity firms have debts equal to 600% of those firms’ annual earnings. The result is a global economy spectacularly threatened by any freezing up of credit—such as that happening in response to the pandemic.

Not surprisingly, inequality reigns among corporations as it does in society at large. The top 10% (in terms of revenue) of non-financial corporations have led in downsizing while increasing shareholder wealth; the bottom 90%, facing stiffer competition than the big firms, still need capital investment to stay in business while satisfying their shareholders.4 The result is large numbers of “zombie” firms, with low or negative profits, maintaining a simulacrum of life thanks to constant infusions of debt via the junk bond market. “Zombies now account for 16 percent of all the publicly traded companies in the United States, and more than 10 percent in Europe, according to the Bank for International Settlements, the bank for central banks.”5 These firms face extinction as credit dries up or becomes expensive.

This row of dominoes was not set up in a year, or in four years. The recession of the early 1970s brought an end to the 30 years of post-war prosperity that had seemed to promise a henceforth crisis-free economy. Since then, through the ups and downs of the business cycle, each recovery has been weaker, and rates of investment in plant and equipment declined. It was this that led to the steady increase of debt, which had tripled by the eve of the collapse of 2008, to keep the world economy growing after 1980. Central banks responded to the Great Recession with an especially large flood of newly-created money, to replace the debt vaporized in the crash. This easy money went, however, not into an expansion of production—in fact, large firms increasingly downsized—but into buying stocks, bonds, and other speculative assets.

Government borrowing grew alongside private debt, in efforts to contain the damage done by recurrent recessions and financial crises. The inability of the economy to grow as a productive mechanism did not, however, inspire governments to step into the workboots left empty by the private sector, with infrastructure projects, say, or the expansion of health-care facilities or low-income housing. Instead, government money flowed through financial institutions to corporations which recycled it, via stock buybacks and acquisitions, into fortifying the income and wealth of their owners.

Though the stock and bond values vaporized in periodic crashes like the present one can be replenished by central banks, what keeps capitalist society going over time is the steady production of goods and services that can be sold to yield profits reinvested in plant, equipment, and labor able to generate yet more value and profit. Financial instruments represent claims on the profits of future production; for those claims to be realized, goods must be produced and sold. That investors understand this on some level, however much they may believe in the magic of creative finance, shows in the collapse of the stock and bond markets in response to the economic freeze.

It might be asked: when is the perpetually postponed reckoning coming due? The answer is that it has been coming due for decades, with the steady worsening of working and living conditions of the world’s wage workers, allowing for the concentration of wealth—real and fictitious—in a diminishing percentage of hands, despite a stagnant economy. The coming depression will simply be an acceleration of this tendency, even as some of the money generated in the last go-round is burned off. The new trillions poured out by the state will be intended as an accompaniment to austerity, not an alternative to it.

Despite official optimism, there has already been talk in Washington about a jobs program, no doubt intended to evoke the New Deal Works Progress Administration. That such a thing is even discussed testifies to the fear, felt by the more rational among the ruling elite, of economic collapse and social unrest, already on view in the many small strikes and sick-outs over hazardous working conditions and disappearing paychecks. It was, of course, the Democrats who floated this idea, with its redolence of the glorious past along with its difficulty of realization under present circumstances, a day or so after Trump dismissed talk of invoking the War Powers Act to compel corporations to produce ventilators and other needed equipment by reminding us that “you know, we’re a country not based on nationalizing our business. Call a person over in Venezuela, ask them how did nationalization of their businesses work out? Not too well.” European elites have historically been less squeamish about nationalization, but they, too, are mainly concerned to support private companies with public funds.

It should be remembered that the WPA and related programs (just like Hitler’s similar efforts) did not do much to bring the American economy out of the depression; full employment (at least a lowering of the unemployment rate to 4.7%) came only with the onset of full-scale war production in 1942. To deal with what is shaping up to be an even deeper crisis, and certainly one affecting a larger portion of the world’s population than that of the 1930s, would take government intervention on a scale actually amounting to nationalization of the economy. At the moment, a government busy using the coronavirus months to finish the gutting of the weak environmental protections still in place is more likely to try to save the oil and coal industries, home to many zombie firms. Even the Democrats admit the jobs program talk was more an electoral-season stunt than a serious proposal, and have turned their attention to making sure that the airline companies, fresh from enhancing their stock values with buybacks, can participate fully in the federal bailout program.

In addition to the immediate effects of the coronavirus and the underlying economic weakness, there is a third aspect to the ongoing disruption of social order, potentially the most significant. The coincident health emergency and economic shutdown have transformed daily life with a previously unexperienced suddenness and scale. Millions who went to work every day find themselves at home; children unregimented by schools must, with the adults around them, learn to occupy their own time. The consumer activities that are the normal compensation for the stresses of middle-income working life—the going to restaurants, bars, concerts, gyms, shopping of all sorts—are mostly unavailable. Those who were already dependent on food banks for survival are finding them overwhelmed from one day to the next. Everyone is forced to rethink what life is about, not to mention how to keep it going. The question, for instance, whether housing is some kind of a right even when there is no money to pay the rent has suddenly become a practical one for millions not used to thinking about the conflict between human needs and private property. People have been thrown out of accepted patterns onto their own resources.

Those resources, as always in times of disaster, are shared. There has been an explosion of mutual aid in myriad forms, from amateur mask-making to bringing food to health workers to something as complex as improvising a computerized health-care system (in Cape Town, South Africa). In Spain 200 taxi drivers, many of them from Pakistan, organized themselves to provide free transportation for doctors and other medical workers.6 As George Monbiot put it concisely, “All over the world, communities have mobilized where governments have failed.”7 Unusual (in the US) forms of action have reappeared, as groups of workers—from delivery drivers and postal workers to doctors and nurses—strike or take other actions, often in defiance of union efforts to tamp things down, to demand some consideration for their health and welfare from their employers. In the words of Josh Eidelson, “By giving workers something bigger to fear than their boss, and rechristening often-forgotten workers as essential, the coronavirus has laid the groundwork for a new worker rebellion.”8 One of the most striking examples was the protest by General Electric workers in Lynn, Massachusetts, due to be laid off, who asked that the company, instead of firing them as planned, convert its jet engine factories to make ventilators.9 This raised the idea of mutual aid to a level threatening the institution of corporate property itself, with workers demanding to control not just the pay for and the conditions of their work, but its goal. In a neighborhood of Marseilles, France, workers at a McDonald’s restaurant took this step by occupying the premises—of course, against the protests of the company—to prepare meals for local people, using supplies donated by shopkeepers, residents, and food banks.10

The shutdown of business as usual has had other positive effects: blue skies over Beijing; dolphins in the canals of Venice; a relatively traffic- and smog-free Los Angeles. Due to the decrease of pollutants usually produced by various industries, many thousands of lives statistically doomed to what is called “premature death” have already been saved. According to the World Health Organization, “Air pollution kills an estimated seven million people worldwide every year.”11 Within China alone, calculates Marshall Burke, a professor in Stanford’s Earth-system science department, “a pandemic-related reduction in particulate matter in the atmosphere—the deadliest form of air pollution—likely saved the lives of 4,000 young children and 73,000 elderly adults . . . over two months this year.”12

The businesspeople and policymakers dreaming of a swift revival of the economy once the medical emergency has come under control no doubt do not specifically regret the longer lives of Chinese and other children. In the weird, upside-down world of economic theory, such matters can be considered unsentimentally, in terms of dollars and cents: Economist Michael Greenstone of the University of Chicago has calculated—on the basis of EPA estimates of the monetary value of human life—that the value of lives saved from COVID-19 by the shutdown “amounted to $7.9 trillion, or roughly $60,000 per U.S. household.”13 Unfortunately, these trillions, unlike those manufactured by the Federal Reserve Bank, will remain purely imaginary. To make real money, industry will have to grind into action again; cars, trucks, ships, and planes will have to move. Fossil fuels will be extracted and burned. (The Canadian shale-oil company behind the XL Keystone project has not even waited for the end of the emergency to recommence building the pipeline.) To the extent that the economy recovers, the death rates from pollution will return to normal and the catastrophe of climate change will get back up to speed.

Most people who have to work for a living are understandably eager to get back to being paid for their time, whatever the ecologically destructive byproducts of their labor. But it is not unthinkable that if the economic breakdown is deep and long enough people may be inspired or even forced to invent new social arrangements for meeting the requirements of existence, when waged labor has become hard to come by. After all, even if jobs are scarce, work still needs to be done, and the resources to do it with still exist. Without the pressure of wealth preservation and profitability, decisions favoring the survival of humanity rather than that of corporate capital might get the upper hand. Perhaps a lasting disruption of business as usual will open ways to considering the long-term welfare of humanity even while people fight for day-to-day survival.

The workplace actions that have responded to the sudden shock of societal semi-collapse and the incompetence demonstrated by those who currently dominate social decision-making demonstrate people’s capacity to grasp when their lives are in danger and to understand the weapons at hand for defending them. Whatever their views on the coming presidential election, those GE workers understood clearly the importance of turning their skills to the building of ventilators. If, as seems likely, the slow-moving depression we have gotten used to calling a stagnant economy speeds up and deepens even as the medical emergency comes under control, such experiences can provide the basis for further-reaching responses to the social crisis that lies ahead.

Phillip Inman, “Japan's Economy Heading for Recession, and Germany Wobbles,” The Guardian, February 17, 2020, https://www.theguardian.com/business/2020/feb/17/japan-economy-heading-for-recession-and-germany-wobbles / “U.S. Economic Growth Flat in Final Three Months of 2019,” CBS News, update January 30, 2020, cbsnews.com/news/us-gdp-flat-in-final-three-months-of-2019. (All these data should, as usual, be taken with a grain of salt, but they serve to indicate trends.)

OECD.org, “Corporate Bond Debt Continues to Pile Up,” February 18, 2020, https://www.oecd.org/corporate/corporate-bond-debt-continues-to-pile-up.htm.

Joseph Baines and Sandy Brian Hager, “COVID-19 and the Coming Corporate Debt Catastrophe,” SBHager.com, March 13, 2020, https://sbhager.com/covid-19-and-the-coming-corporate-debt-catastrophe/.

Ibid.

Ruchir Sharma, “This Is How the Coronavirus Will Destroy the Economy,” New York Times, March 16, 2020, https://www.nytimes.com/2020/03/16/opinion/coronavirus-economy-debt.html?action=click&module=Opinion&pgtype=Homepage.

Paula Blanco, “Pakistani taxi drivers give free rides to Spanish health workers,” Al Jazeera, April 9, 2020, https://www.aljazeera.com/news/2020/04/pakistani-taxi-drivers-give-free-rides-spanish-health-workers-200408120354440.html.

George Monbiot, “The horror films have got it wrong. This virus has turned us into caring neighbors,” The Guardian, March 31, 2020, https://www.theguardian.com/commentisfree/2020/mar/31/virus-neighbours-covid-19.

Josh Eidelson, “Now is the Best and Worst Time for Workers to Go on Strike,” Bloomberg, April 7, 2020, https://www.bloomberg.com/news/articles/2020-04-07/coronavirus-marks-the-best-and-worst-time-for-workers-to-strike.

Edward Ongweso Jr., “General Electric Workers Launch Protest, Demand to Make Ventilators,” Vice, March30, 2020, https://www.vice.com/en_us/article/y3mjxg/general-electric-workers-walk-off-the-job-demand-to-make-ventilators.

Mateo Falcone, “Un McDo marseillais réquisitionné par les travailleurs pour donner de la nourriture dans les quartiers,” Révolution Permanente, April 9, 2020, https://www.revolutionpermanente.fr/Un-McDo-marseillais-requisitionne-par-les-travailleurs-pour-donner-de-la-nourriture-dans-les?fbclid=IwAR3cfJatqaAL_IT-DJyLfcTPEG9Ow8532PKeDRKY7fgG1ig6MjtLbuSWAEs.

World Health Organization, “Air Pollution,” https://www.who.int/health-topics/air-pollution#tab=tab_1.

Marina Koren, “The Pandemic Is Turning the Natural World Upside Down,” The Atlantic, April 2, 2020, https://www.theatlantic.com/science/archive/2020/04/coronavirus-pandemic-earth-pollution-noise/609316/.

Eduardo Porter, “Economists, Too, Are Scrambling to Understand an Upended World,” The New York Times, April 6, 2020, p. B3.

Contributor

Paul Mattick

Paul Mattick is the Field Notes Editor.

The social disruption that has come with the novel coronavirus SARS-CoV-2 has an all too visible side expanding day by day and a more occult one waiting in the near future. First of all, there are the effects of the virus itself: the infection and sickening of millions of people, and then the steps taken to limit these effects. National governments, unprepared for the emergency despite decades of warnings, have reacted, after deadly delays, by limiting social movement to control the infection rate. The economy, thus put into an induced coma, is being kept on life support by way of massive loans to businesses and a small increase in unemployment relief. While the evaporation of stock and bond values is wiping out pensions and nest eggs, along with some percentage of hedge funds, a cascade of business closures is producing mass worklessness on a scale rivaling that of the Great Depression.

SARS-CoV-2 is only the latest in the series of pandemics that have accompanied the development of capitalist agriculture and urbanization since before the Industrial Revolution. Its novelty and the rapidity of its spread in a world of global supply chains, international labor migration, and mass tourism—one path was apparently opened for intercontinental transmission, for example, by the use of low-wage Chinese garment workers by Milanese fashion companies—make it stand out against the background of influenza deaths, cancer fatalities due to environmental and workplace pollution, and such mundane killers as automobile and truck accidents. The new virus, easier for the rich to guard against and to treat when stricken, illuminates the depth of social inequality and the general subordination of everyday life, including the requirements of human and animal health, to “the economy,” as we call the system subordinating the production of goods and services to the need of capitalist investors to accumulate profits.

Apart from some generalities, the longer-term effects of the medical crisis-turned-economic-shutdown are still unknown. The eventual production of a vaccine may well help make COVID-19 a part of normalcy, alongside other social ills like lead poisoning, industrial accidents, drug overdoses, starvation, and warfare. In the official discourse of economic policy, the stimulus and bailout measures decreed by governments and set in motion through the money-creating facilities of central banks are intended as relatively short-term efforts. Once the virus runs its course, businesses will supposedly reopen and workers return to their jobs; in theory, at least some of the trillions of dollars of government loans will eventually be repaid. The normal process of concentration and centralization of capital ownership will have been accelerated, along with the general inequality of wealth, as government largesse flows to the largest companies. In theory at least, capitalism will continue on its merry way, spawning little New Zealands of billionaires amidst a sea of growing impoverishment.

In reality—and this is the second aspect of the crisis, nearly hidden from view by the sudden check to economic activity in response to the medical catastrophe—an economic recession was well on the way before the coronavirus tipped us over the edge. During the last quarter of 2019 Japan’s GDP slumped by 6.3% to a growth rate of -1.6%, while Germany’s GDP growth (and this is the world’s fourth-largest economy) fell to zero. Europe as a whole claimed 1.1% growth in 2019. Among the economically stronger countries, China’s growth rate of 6% was the lowest in 30 years, and U.S. GDP, with flat growth in the last quarter, increased by only 2.3% in 2019, the lowest since 2016, and economists were expecting a fall to below 2% in 2020.1

What made such developments especially meaningful was the fact that the debt load of non-financial companies had reached an all-time high by the end of 2019, attesting to their failure to generate profits sufficient for their needs. And 51% of bonds issued that year were classified as BBB, the lowest rating. 25% were junk bonds, unrated because below investment grade.2 Global finance has increased since the 1980s to four times the value of world production; China’s corporate debt alone grew to $20 trillion. “In the United States, against the backdrop of decades-long access to cheap money, non-financial corporations have seen their debt burdens more than double from $3.2 trillion in 2007 to $6.6 trillion in 2019.”3 Many firms turned from public ownership to private equity to avoid financial regulation; today private equity firms have debts equal to 600% of those firms’ annual earnings. The result is a global economy spectacularly threatened by any freezing up of credit—such as that happening in response to the pandemic.

Not surprisingly, inequality reigns among corporations as it does in society at large. The top 10% (in terms of revenue) of non-financial corporations have led in downsizing while increasing shareholder wealth; the bottom 90%, facing stiffer competition than the big firms, still need capital investment to stay in business while satisfying their shareholders.4 The result is large numbers of “zombie” firms, with low or negative profits, maintaining a simulacrum of life thanks to constant infusions of debt via the junk bond market. “Zombies now account for 16 percent of all the publicly traded companies in the United States, and more than 10 percent in Europe, according to the Bank for International Settlements, the bank for central banks.”5 These firms face extinction as credit dries up or becomes expensive.

This row of dominoes was not set up in a year, or in four years. The recession of the early 1970s brought an end to the 30 years of post-war prosperity that had seemed to promise a henceforth crisis-free economy. Since then, through the ups and downs of the business cycle, each recovery has been weaker, and rates of investment in plant and equipment declined. It was this that led to the steady increase of debt, which had tripled by the eve of the collapse of 2008, to keep the world economy growing after 1980. Central banks responded to the Great Recession with an especially large flood of newly-created money, to replace the debt vaporized in the crash. This easy money went, however, not into an expansion of production—in fact, large firms increasingly downsized—but into buying stocks, bonds, and other speculative assets.

Government borrowing grew alongside private debt, in efforts to contain the damage done by recurrent recessions and financial crises. The inability of the economy to grow as a productive mechanism did not, however, inspire governments to step into the workboots left empty by the private sector, with infrastructure projects, say, or the expansion of health-care facilities or low-income housing. Instead, government money flowed through financial institutions to corporations which recycled it, via stock buybacks and acquisitions, into fortifying the income and wealth of their owners.

Though the stock and bond values vaporized in periodic crashes like the present one can be replenished by central banks, what keeps capitalist society going over time is the steady production of goods and services that can be sold to yield profits reinvested in plant, equipment, and labor able to generate yet more value and profit. Financial instruments represent claims on the profits of future production; for those claims to be realized, goods must be produced and sold. That investors understand this on some level, however much they may believe in the magic of creative finance, shows in the collapse of the stock and bond markets in response to the economic freeze.

It might be asked: when is the perpetually postponed reckoning coming due? The answer is that it has been coming due for decades, with the steady worsening of working and living conditions of the world’s wage workers, allowing for the concentration of wealth—real and fictitious—in a diminishing percentage of hands, despite a stagnant economy. The coming depression will simply be an acceleration of this tendency, even as some of the money generated in the last go-round is burned off. The new trillions poured out by the state will be intended as an accompaniment to austerity, not an alternative to it.

Despite official optimism, there has already been talk in Washington about a jobs program, no doubt intended to evoke the New Deal Works Progress Administration. That such a thing is even discussed testifies to the fear, felt by the more rational among the ruling elite, of economic collapse and social unrest, already on view in the many small strikes and sick-outs over hazardous working conditions and disappearing paychecks. It was, of course, the Democrats who floated this idea, with its redolence of the glorious past along with its difficulty of realization under present circumstances, a day or so after Trump dismissed talk of invoking the War Powers Act to compel corporations to produce ventilators and other needed equipment by reminding us that “you know, we’re a country not based on nationalizing our business. Call a person over in Venezuela, ask them how did nationalization of their businesses work out? Not too well.” European elites have historically been less squeamish about nationalization, but they, too, are mainly concerned to support private companies with public funds.

It should be remembered that the WPA and related programs (just like Hitler’s similar efforts) did not do much to bring the American economy out of the depression; full employment (at least a lowering of the unemployment rate to 4.7%) came only with the onset of full-scale war production in 1942. To deal with what is shaping up to be an even deeper crisis, and certainly one affecting a larger portion of the world’s population than that of the 1930s, would take government intervention on a scale actually amounting to nationalization of the economy. At the moment, a government busy using the coronavirus months to finish the gutting of the weak environmental protections still in place is more likely to try to save the oil and coal industries, home to many zombie firms. Even the Democrats admit the jobs program talk was more an electoral-season stunt than a serious proposal, and have turned their attention to making sure that the airline companies, fresh from enhancing their stock values with buybacks, can participate fully in the federal bailout program.

In addition to the immediate effects of the coronavirus and the underlying economic weakness, there is a third aspect to the ongoing disruption of social order, potentially the most significant. The coincident health emergency and economic shutdown have transformed daily life with a previously unexperienced suddenness and scale. Millions who went to work every day find themselves at home; children unregimented by schools must, with the adults around them, learn to occupy their own time. The consumer activities that are the normal compensation for the stresses of middle-income working life—the going to restaurants, bars, concerts, gyms, shopping of all sorts—are mostly unavailable. Those who were already dependent on food banks for survival are finding them overwhelmed from one day to the next. Everyone is forced to rethink what life is about, not to mention how to keep it going. The question, for instance, whether housing is some kind of a right even when there is no money to pay the rent has suddenly become a practical one for millions not used to thinking about the conflict between human needs and private property. People have been thrown out of accepted patterns onto their own resources.

Those resources, as always in times of disaster, are shared. There has been an explosion of mutual aid in myriad forms, from amateur mask-making to bringing food to health workers to something as complex as improvising a computerized health-care system (in Cape Town, South Africa). In Spain 200 taxi drivers, many of them from Pakistan, organized themselves to provide free transportation for doctors and other medical workers.6 As George Monbiot put it concisely, “All over the world, communities have mobilized where governments have failed.”7 Unusual (in the US) forms of action have reappeared, as groups of workers—from delivery drivers and postal workers to doctors and nurses—strike or take other actions, often in defiance of union efforts to tamp things down, to demand some consideration for their health and welfare from their employers. In the words of Josh Eidelson, “By giving workers something bigger to fear than their boss, and rechristening often-forgotten workers as essential, the coronavirus has laid the groundwork for a new worker rebellion.”8 One of the most striking examples was the protest by General Electric workers in Lynn, Massachusetts, due to be laid off, who asked that the company, instead of firing them as planned, convert its jet engine factories to make ventilators.9 This raised the idea of mutual aid to a level threatening the institution of corporate property itself, with workers demanding to control not just the pay for and the conditions of their work, but its goal. In a neighborhood of Marseilles, France, workers at a McDonald’s restaurant took this step by occupying the premises—of course, against the protests of the company—to prepare meals for local people, using supplies donated by shopkeepers, residents, and food banks.10

The shutdown of business as usual has had other positive effects: blue skies over Beijing; dolphins in the canals of Venice; a relatively traffic- and smog-free Los Angeles. Due to the decrease of pollutants usually produced by various industries, many thousands of lives statistically doomed to what is called “premature death” have already been saved. According to the World Health Organization, “Air pollution kills an estimated seven million people worldwide every year.”11 Within China alone, calculates Marshall Burke, a professor in Stanford’s Earth-system science department, “a pandemic-related reduction in particulate matter in the atmosphere—the deadliest form of air pollution—likely saved the lives of 4,000 young children and 73,000 elderly adults . . . over two months this year.”12

The businesspeople and policymakers dreaming of a swift revival of the economy once the medical emergency has come under control no doubt do not specifically regret the longer lives of Chinese and other children. In the weird, upside-down world of economic theory, such matters can be considered unsentimentally, in terms of dollars and cents: Economist Michael Greenstone of the University of Chicago has calculated—on the basis of EPA estimates of the monetary value of human life—that the value of lives saved from COVID-19 by the shutdown “amounted to $7.9 trillion, or roughly $60,000 per U.S. household.”13 Unfortunately, these trillions, unlike those manufactured by the Federal Reserve Bank, will remain purely imaginary. To make real money, industry will have to grind into action again; cars, trucks, ships, and planes will have to move. Fossil fuels will be extracted and burned. (The Canadian shale-oil company behind the XL Keystone project has not even waited for the end of the emergency to recommence building the pipeline.) To the extent that the economy recovers, the death rates from pollution will return to normal and the catastrophe of climate change will get back up to speed.

Most people who have to work for a living are understandably eager to get back to being paid for their time, whatever the ecologically destructive byproducts of their labor. But it is not unthinkable that if the economic breakdown is deep and long enough people may be inspired or even forced to invent new social arrangements for meeting the requirements of existence, when waged labor has become hard to come by. After all, even if jobs are scarce, work still needs to be done, and the resources to do it with still exist. Without the pressure of wealth preservation and profitability, decisions favoring the survival of humanity rather than that of corporate capital might get the upper hand. Perhaps a lasting disruption of business as usual will open ways to considering the long-term welfare of humanity even while people fight for day-to-day survival.

The workplace actions that have responded to the sudden shock of societal semi-collapse and the incompetence demonstrated by those who currently dominate social decision-making demonstrate people’s capacity to grasp when their lives are in danger and to understand the weapons at hand for defending them. Whatever their views on the coming presidential election, those GE workers understood clearly the importance of turning their skills to the building of ventilators. If, as seems likely, the slow-moving depression we have gotten used to calling a stagnant economy speeds up and deepens even as the medical emergency comes under control, such experiences can provide the basis for further-reaching responses to the social crisis that lies ahead.

Phillip Inman, “Japan's Economy Heading for Recession, and Germany Wobbles,” The Guardian, February 17, 2020, https://www.theguardian.com/business/2020/feb/17/japan-economy-heading-for-recession-and-germany-wobbles / “U.S. Economic Growth Flat in Final Three Months of 2019,” CBS News, update January 30, 2020, cbsnews.com/news/us-gdp-flat-in-final-three-months-of-2019. (All these data should, as usual, be taken with a grain of salt, but they serve to indicate trends.)

OECD.org, “Corporate Bond Debt Continues to Pile Up,” February 18, 2020, https://www.oecd.org/corporate/corporate-bond-debt-continues-to-pile-up.htm.

Joseph Baines and Sandy Brian Hager, “COVID-19 and the Coming Corporate Debt Catastrophe,” SBHager.com, March 13, 2020, https://sbhager.com/covid-19-and-the-coming-corporate-debt-catastrophe/.

Ibid.

Ruchir Sharma, “This Is How the Coronavirus Will Destroy the Economy,” New York Times, March 16, 2020, https://www.nytimes.com/2020/03/16/opinion/coronavirus-economy-debt.html?action=click&module=Opinion&pgtype=Homepage.

Paula Blanco, “Pakistani taxi drivers give free rides to Spanish health workers,” Al Jazeera, April 9, 2020, https://www.aljazeera.com/news/2020/04/pakistani-taxi-drivers-give-free-rides-spanish-health-workers-200408120354440.html.

George Monbiot, “The horror films have got it wrong. This virus has turned us into caring neighbors,” The Guardian, March 31, 2020, https://www.theguardian.com/commentisfree/2020/mar/31/virus-neighbours-covid-19.

Josh Eidelson, “Now is the Best and Worst Time for Workers to Go on Strike,” Bloomberg, April 7, 2020, https://www.bloomberg.com/news/articles/2020-04-07/coronavirus-marks-the-best-and-worst-time-for-workers-to-strike.

Edward Ongweso Jr., “General Electric Workers Launch Protest, Demand to Make Ventilators,” Vice, March30, 2020, https://www.vice.com/en_us/article/y3mjxg/general-electric-workers-walk-off-the-job-demand-to-make-ventilators.

Mateo Falcone, “Un McDo marseillais réquisitionné par les travailleurs pour donner de la nourriture dans les quartiers,” Révolution Permanente, April 9, 2020, https://www.revolutionpermanente.fr/Un-McDo-marseillais-requisitionne-par-les-travailleurs-pour-donner-de-la-nourriture-dans-les?fbclid=IwAR3cfJatqaAL_IT-DJyLfcTPEG9Ow8532PKeDRKY7fgG1ig6MjtLbuSWAEs.

World Health Organization, “Air Pollution,” https://www.who.int/health-topics/air-pollution#tab=tab_1.

Marina Koren, “The Pandemic Is Turning the Natural World Upside Down,” The Atlantic, April 2, 2020, https://www.theatlantic.com/science/archive/2020/04/coronavirus-pandemic-earth-pollution-noise/609316/.

Eduardo Porter, “Economists, Too, Are Scrambling to Understand an Upended World,” The New York Times, April 6, 2020, p. B3.

Contributor

Paul Mattick

Paul Mattick is the Field Notes Editor.

No comments:

Post a Comment