Enbridge advances Gulf Coast strategy with US$3B Moda Midstream purchase

By Staff The Canadian Press

Posted September 7, 2021

By Staff The Canadian Press

Posted September 7, 2021

In this file photo taken on March 11, 2019 a refinery near the

Corpus Christi Ship Channel is pictured in Corpus Christi, Texas.

LOREN Elliott/AFP via Getty Images

Enbridge Inc. has signed a US$3-billion deal to purchase a U.S.-based terminal and logistics company

The Canadian pipeline giant says it will buy Moda Midstream Operating LLC from private-equity firm EnCap Flatrock Midstream.

READ MORE: Energy exodus — Life in the Lone Star State for Canadians

As part of the deal, Enbridge will acquire the Ingleside Energy Center located near Corpus Christi, Texas.

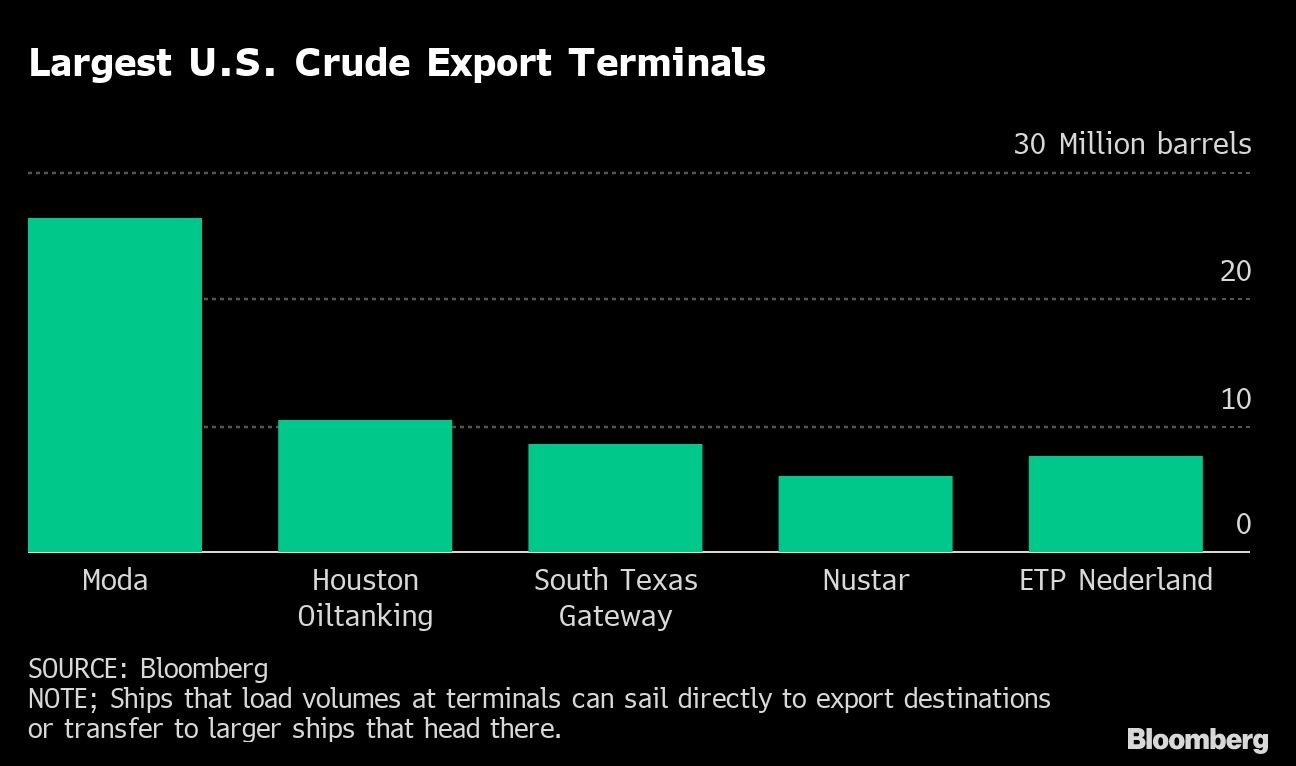

Ingleside is North America’s largest crude export terminal. It loaded 25 per cent of all U.S. Gulf Coast crude exports in 2020.

READ MORE: Alberta budget benefits from oil prices no one had bargained for

The deal also gives Enbridge access to other crude export assets in the Gulf Coast region, including the Cactus II Pipeline, the Viola Pipeline and the Taft terminal.

Enbridge says the purchase will advance its U.S. Gulf Coast export strategy.

It says the deal is expected to close in the fourth quarter and will immediately add to the company’s earnings.

Enbridge Inc. has signed a US$3-billion deal to purchase a U.S.-based terminal and logistics company

The Canadian pipeline giant says it will buy Moda Midstream Operating LLC from private-equity firm EnCap Flatrock Midstream.

READ MORE: Energy exodus — Life in the Lone Star State for Canadians

As part of the deal, Enbridge will acquire the Ingleside Energy Center located near Corpus Christi, Texas.

Ingleside is North America’s largest crude export terminal. It loaded 25 per cent of all U.S. Gulf Coast crude exports in 2020.

READ MORE: Alberta budget benefits from oil prices no one had bargained for

The deal also gives Enbridge access to other crude export assets in the Gulf Coast region, including the Cactus II Pipeline, the Viola Pipeline and the Taft terminal.

Enbridge says the purchase will advance its U.S. Gulf Coast export strategy.

It says the deal is expected to close in the fourth quarter and will immediately add to the company’s earnings.

Enbridge Inc., the Canadian pipeline giant, agreed to acquire a smaller U.S. rival to add export capacity on the Gulf Coast.

The company is buying Moda Midstream Operating LLC for US$3 billion in cash from EnCap Flatrock Midstream, Enbridge said Tuesday in a statement. Enbridge’s stock price rose as much as 50 cents to CUS$50.62 in Toronto, the highest since March 2020, before erasing gains.

The deal marks a shift in focus toward the U.S. market for Enbridge as it wraps up construction of the Line 3 oil sands export line after years of regulatory and legal battles to build the project. The company, which already handles about a quarter of all crude produced in North America, is betting on a strong outlook for exports of oil pumped from the Permian and Eagle Ford shale basins in Texas.

The fracking revolution has not only revived U.S. oil production over the past decade, it has turned the country into one of the largest shippers of the commodity. The deal includes Ingleside Energy Center, near Corpus Christi, Texas. Built in 2018, it’s North America’s largest crude export terminal, which loaded 25 per cent of all U.S. Gulf Coast crude exports last year.

“Our strategy is driven by the important role that low cost, sustainable North America energy supply will play in meeting growing global demand,” Enbridge Chief Executive Officer Al Monaco said in the statement.

Enbridge will also acquire a 20 per cent stake the Cactus II Pipeline, which connects the Permian with the Gulf Coast, plus the Viola pipeline and the Taft Terminal.

Enbridge seeks to increase its dividend and cash flow, and the Moda Midstream acquisition is a quick way to advance that strategy at a low price, Matthew Taylor, an analyst at Tudor Pickering & Holt, said by phone. Still, some investors would have wanted the company to pay down debt or invest in core assets instead, he said.

“I think the spreadsheet math makes a lot of sense but it’s not what investors were looking for at this time,” he said. Shareholders “want to see growth and returns but in a way that reduces emissions intensity and attracts new investors.”

Enbridge said the acquisition will be initially funded with current liquidity, and that the deal -- which is expected to close in the fourth quarter -- will immediately add to earnings.

Barclays Plc is Enbridge’s financial adviser on the deal. Sidley Austin LLP is the company’s legal counsel in its purchase agreement with Encap Flatrock Midstream to acquire Moda Midstream.

Simon Casey and Robert Tuttle, Bloomberg News

Enbridge's US$3 billion Moda Midstream purchase raises questions about terminal for Canadian producers

Enbridge's deal in Texas expands the company’s footprint in the heart of the largest oilfield in the U.S.

Author of the article:Geoffrey Morgan

Publishing date:Sep 07, 2021 •

Enbridge's deal in Texas expands the company’s footprint in the heart of the largest oilfield in the U.S.

Author of the article:Geoffrey Morgan

Publishing date:Sep 07, 2021 •

Pipelines run to Enbridge Inc.'s crude oil storage tanks at their tank farm in Cushing, Oklahoma, March 24, 2016.

PHOTO BY NICK OXFORD/REUTERS FILE PHOTO

CALGARY – Enbridge Inc., North America’s largest pipeline company, is spending US$3 billion to buy North America’s largest oil export terminal and expand its customer base among Texas oil producers, leaving questions about the future of an export terminal designed for Canadian oil producers.

“We’re very excited about acquiring North America’s premium, very large crude carrier (VLCC) capable crude export terminal,” Enbridge president and CEO Al Monaco said in a release Tuesday, announcing a deal with San Antonio, Tx.-based EnCap Flatrock Midstream to buy Moda Midstream Operating LLC and its Ingleside Energy Centre port near Corpus Christi for US$3 billion in cash.

Ingleside, which will soon be renamed Enbridge Ingleside, is the largest crude export terminal on the continent and is capable of moving 1.5 million barrels of oil per day off the U.S. Gulf Coast. The facility can also store 15.6 million barrels of oil on site.

Calgary-based Enbridge’s deal in Texas also expands the company’s footprint in the heart of the largest oilfield in the United States. The pipeline giant is also buying the 3000,000-bpd Viola pipeline, a 20 per cent stake in the 670,000-bpd Cactus 2 pipeline and a storage terminal to move oil from the prolific Permian Basin in West Texas to export markets.

“With close proximity to world-class Permian reserves, and with cost effective and efficient export infrastructure, our new Enbridge Ingleside terminal will be critical to capitalizing on North America’s energy advantage,” Monaco said in a statement.

Enbridge released a map showing the close proximity between the Ingleside facility and its existing pipelines, including Flanagan South and the Seaway Twin, which move heavy oil from Canada to the Gulf Coast, but analysts expect the Ingleside facility to be primarily used to export American crude from Texas given its location.

“Ingleside is not connected to our existing assets but adds a complementary light value chain with sustainable competitive advantages,” the company said in a statement. “It’s expected the majority of North American crude exports will be light barrels from the Permian and Eagle Ford, with estimates suggesting Permian could comprise about 80 per cent of U.S. exports by 2035.”

Enbridge had also been working alongside Enterprise Products Partners LP to build the Sea Port Oil Terminal in the Houston region and some analysts now question how quickly Enbridge will develop that project, which would more directly to serve heavy oil proucers in Western Canada, following its Tuesday’s deal for the Ingleside terminal.

Enbridge’s commitment to funding the SPOT terminal “could be modest” given Tuesday’s deal to buy the Ingelside terminal, National Bank analyst Patrick Kenny wrote in a research note Tuesday.

SPOT is a proposed 2 million bpd export terminal in the Houston area that is directly connected to Enbridge’s existing south-bound pipelines Flanagan South and Seaway Twin and is designed to handle both heavy and light oil exports, making it an ideal export facility for Western Canadian oil producers. The company is expecting approvals of that project in the second half of 2021.

Kenny called Tuesday’s acquisition of Ingleside a continuation of the company’s “buy-over-build crude oil export growth strategy.”

Enbridge also has regulatory approvals in place to expand the Ingleside terminal to ship 1.9 million bpd and to expand the shipping berths at the facility to handle Suezmax crude oil tankers.

The Ingleside terminal in Corpus Christi is positioned to export crude oil from the Permian and Eagle Ford oil plays in Texas, “almost exclusively,” said John Coleman, research director at Wood Mackenzie in Houston.

“It gives them a much stronger presence in probably the lone growth region for the Lower 48 (oil) supply going forward. The Permian Basin is really the lone growth engine of the Lower 48, so if you’re going to increase your long-haul presence that’s not a bad place to do it,” Coleman said.

MORE ON THIS TOPIC

Enbridge buys Moda Midstream for $3 billion in cash to bolster presence in U.S. Gulf Coast

Enbridge to start moving oilsands crude in the new Line 3 in October

“It’s kind of a no brainer for Enbridge to go for that,” Coleman said.

But Enbridge could likely pursue both port projects at the same time, offering capacity at Ingleside primarily to U.S. producers and at SPOT to Canadian producers.

“I think the SPOT terminal is really going to be a strong solution for what I would call their bread and butter customers,” he said. “Just because they bought a highly attractive export terminal in the Corpus Christ market, it doesn’t preclude them from moving forward with the SPOT terminal because it gives them solutions for a more prevalent part of their client base.”

Tuesday’s US$3-billion acquisition, which is expected to close in the fourth quarter, will not put a financial strain on Enbridge, according to one analyst.

“We do not expect Enbridge will require equity to finance the acquisition,” Bank of Montreal analyst Ben Pham said in a research note Tuesday, adding the company has between $5 billion and $6 billion in annual financial capacity, $9 billion in balance sheet liquidity and “lots of breathing room” on its credit rating.

• Email: gmorgan@nationalpost.com | Twitter: geoffreymorgan

CALGARY – Enbridge Inc., North America’s largest pipeline company, is spending US$3 billion to buy North America’s largest oil export terminal and expand its customer base among Texas oil producers, leaving questions about the future of an export terminal designed for Canadian oil producers.

“We’re very excited about acquiring North America’s premium, very large crude carrier (VLCC) capable crude export terminal,” Enbridge president and CEO Al Monaco said in a release Tuesday, announcing a deal with San Antonio, Tx.-based EnCap Flatrock Midstream to buy Moda Midstream Operating LLC and its Ingleside Energy Centre port near Corpus Christi for US$3 billion in cash.

Ingleside, which will soon be renamed Enbridge Ingleside, is the largest crude export terminal on the continent and is capable of moving 1.5 million barrels of oil per day off the U.S. Gulf Coast. The facility can also store 15.6 million barrels of oil on site.

Calgary-based Enbridge’s deal in Texas also expands the company’s footprint in the heart of the largest oilfield in the United States. The pipeline giant is also buying the 3000,000-bpd Viola pipeline, a 20 per cent stake in the 670,000-bpd Cactus 2 pipeline and a storage terminal to move oil from the prolific Permian Basin in West Texas to export markets.

“With close proximity to world-class Permian reserves, and with cost effective and efficient export infrastructure, our new Enbridge Ingleside terminal will be critical to capitalizing on North America’s energy advantage,” Monaco said in a statement.

Enbridge released a map showing the close proximity between the Ingleside facility and its existing pipelines, including Flanagan South and the Seaway Twin, which move heavy oil from Canada to the Gulf Coast, but analysts expect the Ingleside facility to be primarily used to export American crude from Texas given its location.

“Ingleside is not connected to our existing assets but adds a complementary light value chain with sustainable competitive advantages,” the company said in a statement. “It’s expected the majority of North American crude exports will be light barrels from the Permian and Eagle Ford, with estimates suggesting Permian could comprise about 80 per cent of U.S. exports by 2035.”

Enbridge had also been working alongside Enterprise Products Partners LP to build the Sea Port Oil Terminal in the Houston region and some analysts now question how quickly Enbridge will develop that project, which would more directly to serve heavy oil proucers in Western Canada, following its Tuesday’s deal for the Ingleside terminal.

Enbridge’s commitment to funding the SPOT terminal “could be modest” given Tuesday’s deal to buy the Ingelside terminal, National Bank analyst Patrick Kenny wrote in a research note Tuesday.

SPOT is a proposed 2 million bpd export terminal in the Houston area that is directly connected to Enbridge’s existing south-bound pipelines Flanagan South and Seaway Twin and is designed to handle both heavy and light oil exports, making it an ideal export facility for Western Canadian oil producers. The company is expecting approvals of that project in the second half of 2021.

Kenny called Tuesday’s acquisition of Ingleside a continuation of the company’s “buy-over-build crude oil export growth strategy.”

Enbridge also has regulatory approvals in place to expand the Ingleside terminal to ship 1.9 million bpd and to expand the shipping berths at the facility to handle Suezmax crude oil tankers.

The Ingleside terminal in Corpus Christi is positioned to export crude oil from the Permian and Eagle Ford oil plays in Texas, “almost exclusively,” said John Coleman, research director at Wood Mackenzie in Houston.

“It gives them a much stronger presence in probably the lone growth region for the Lower 48 (oil) supply going forward. The Permian Basin is really the lone growth engine of the Lower 48, so if you’re going to increase your long-haul presence that’s not a bad place to do it,” Coleman said.

Enbridge buys Moda Midstream for $3 billion in cash to bolster presence in U.S. Gulf Coast

Enbridge to start moving oilsands crude in the new Line 3 in October

“It’s kind of a no brainer for Enbridge to go for that,” Coleman said.

But Enbridge could likely pursue both port projects at the same time, offering capacity at Ingleside primarily to U.S. producers and at SPOT to Canadian producers.

“I think the SPOT terminal is really going to be a strong solution for what I would call their bread and butter customers,” he said. “Just because they bought a highly attractive export terminal in the Corpus Christ market, it doesn’t preclude them from moving forward with the SPOT terminal because it gives them solutions for a more prevalent part of their client base.”

Tuesday’s US$3-billion acquisition, which is expected to close in the fourth quarter, will not put a financial strain on Enbridge, according to one analyst.

“We do not expect Enbridge will require equity to finance the acquisition,” Bank of Montreal analyst Ben Pham said in a research note Tuesday, adding the company has between $5 billion and $6 billion in annual financial capacity, $9 billion in balance sheet liquidity and “lots of breathing room” on its credit rating.

• Email: gmorgan@nationalpost.com | Twitter: geoffreymorgan

No comments:

Post a Comment