Op-Ed: US vs. Puerto Rico banks, who wins?

The Oracle of Ohama Warren Buffet cleverly stated some words that will live forever “Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: “Never bet against America.” This statement was part of Berkshire Hathaway’s annual report letter written by Mr. Buffet that has become a yearly event.

With the mantra “Never bet against America,” we decided to embark on an analytical review of the Top US and Puerto Rico public bank holding companies.

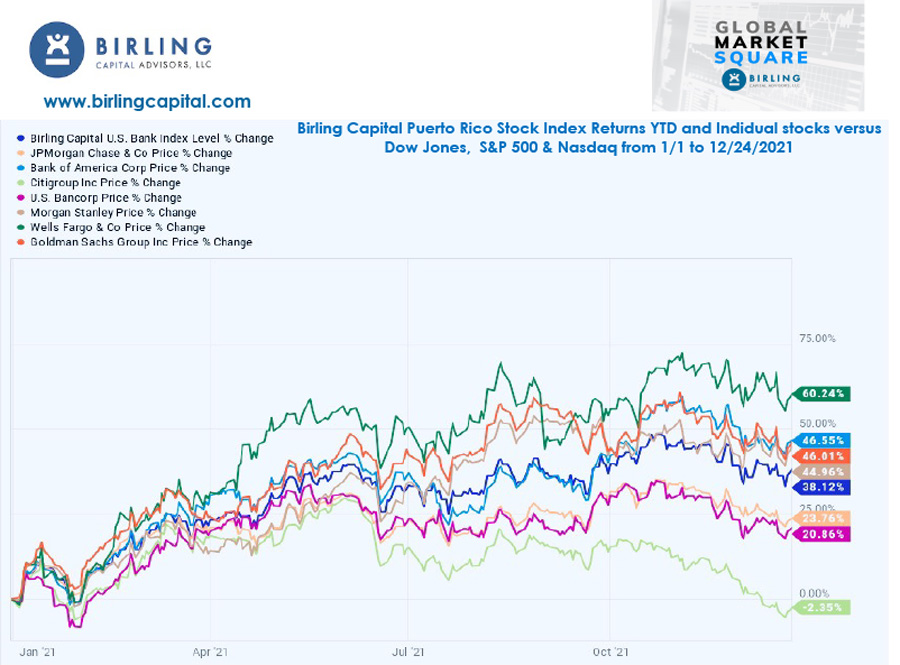

We begin our analysis by examining the top seven US bank holding companies, part of the Birling Capital US Bank Index, which is a market value-weighted index composed of the top seven ank holding companies headquartered and/or with their principal place of business in the United States. All companies trade on NYSE, AMEX, or NASDAQ national stock markets.

This report examines how each bank holding companies’ stock has fared during 2021 from Jan. 1, 2021 to Dec. 24, 2021 and compared to the Dow Jones, S&P 500, Nasdaq and how they have managed against the Birling Capital US Bank Stock Index.

The returns of these four indices have been as follows:

- Dow Jones Industrial Average 17.46%

- S&P 500 25.82%

- Nasdaq Composite 21.45%

- Birling Capital U.S. Bank Index 38.12%

The Birling US Bank Index has a return of 38.12% year to date 2021, and when pegged against the other indexes, it beats them all. Let see how each of the constituents companies in the index has performed individually and against the major indexes.

- Wells Fargo & Co (WFC), Achieved a total return of 60.24%that beats the Dow, S&P, Nasdaq & Birling US Bank Index handsomely. The stock price on Dec. 24, 2021 was $48.36, increasing $18.18 since Jan. 1, 2021.

- Bank of America Corporation (BAC), Achieved a total return of 46.55% that beats the Dow, S&P, Nasdaq & Birling US Bank Index handsomely. The stock price on Dec. 24, 2021 was $44.42, increasing $14.11 since Jan. 1, 2021

- Goldman Sachs Group (GS), Achieved a total return of 46.01% that beats the Dow, S&P, Nasdaq & Birling US Bank Index handsomely. The stock price on Dec. 24, 2021 was $385.04, increasing $121.33 since Jan. 1, 2021.

- Morgan Stanley (MS), Achieved a total return of 44.96% that that beats the Dow, S&P, Nasdaq & Birling US Bank Index handsomely. The stock price on Dec. 24, 2021 was $99.34, increasing $30.81 since Jan. 1, 2021

- JP Morgan Chase & Co. (JPM), Achieved a total return of 23.76% that lags both the Birling U.S.Bank Index and the S&P 500 but beats the Dow Jones and Nasdaq. Dow Jones Industrial Average. The stock price on Dec. 24, 2021 was $157.26, increasing $30.19 since Jan. 1, 2021

- U.S. Bancorp. (USB), Achieved a total return of 20.86% that underperformed the Birling U.S. Bank Index, S&P, Nasdaq and beat the Dow Jones. The stock price on Dec. 24, 2021 was $56.31, increasing $9.72 since Jan. 1, 2021

- Citigroup Inc. (C), Achieved a total return of -2.35%% that underperformed the Birling U.S. Bank Index, Dow Jones, S&P, and Nasdaq. The stock price on Dec. 24, 2021 was $60.21, decreasing $1.45 since Jan. 1, 2021.

As a Group, the Birling Capital US Bank Stock Index companies have a total market capitalization of $1.5 trillion, a $253.2 billion rise during 2021.

Had any investor invested $10,000 on Jan. 1, 2021, these would have been the results:

| Company | Total Value | Total Gain/Loss |

| 1. Wells Fargo & Co | $ 16,024 | $6,024 |

| 2. Bank of America | $14,655 | $4,655 |

| 3. Goldman Sachs | $14,601 | $4,601 |

| 4. Morgan Stanley | $14,496 | $4,496 |

| 5. JPMorgan Chase | $12,376 | $2,376 |

| 6. U.S. Bancorp. | $12,086 | $2,086 |

| 7. Citigroup Inc. | $9,765 | ($235) |

These are pretty outstanding results; however, the story takes quite a different turn than the Birling Puerto Rico Bank Index.

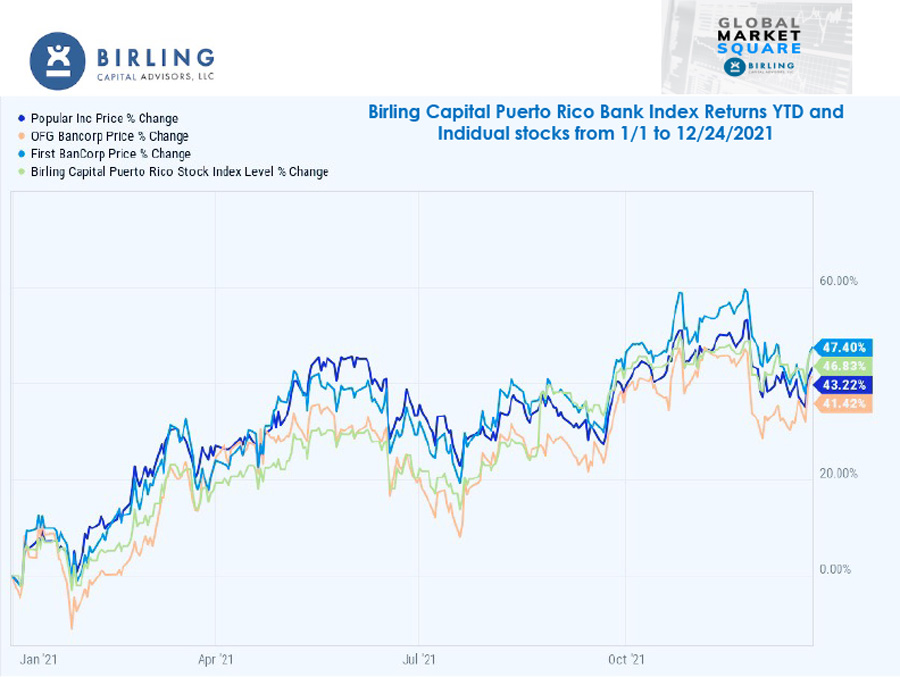

The Birling Capital Puerto Rico Bank Index began 2021 much more robust than anyone anticipated. The three bank holding companies that make up the index have risen to lofty levels as most are viewed as in a much better position as we put the pandemic behind them.

We review each of the banks in that light, analyzing their performance from Jan. 1, 2021 to Dec. 24, 2021.

Birling Capital Puerto Rico Stock Index has a return of 46.83%, which, when compared to the other indexes it beat them all. The Dow Jones has 17.46%, S&P 500 25.82%, Nasdaq Composite 21.45%, and Birling Capital US Bank Index 38.12%

The 46.83% year-to-date return translates into 166.49% more than the Dow Jones, 81.37% more than the S&P 500, 118.59% more than the Nasdaq, and 22.85% more than the Birling U.S. Bank Index.

Now let’s take a look at each stock and its returns.

- Firstbank Corp.(FBP), Achieved a total return of 47.40%that beats the Dow, S&P, Nasdaq & Birling US Bank Index and Birling P.R. Stock Index handsomely. The Stock price on Dec. 24, 2021 was $13.59, increasing $4.37 since Jan. 1, 2021.

- Popular, Inc. (BPOP), Achieved a total return of 43.22%that beats the Dow, S&P, Nasdaq & Birling US Bank Index and lags the Birling P.R. Stock Index. The Stock price on Dec. 24, 2021 was $80.66, increasing $24.34 since Jan. 1, 2021.

- OFG Bancorp. (OFG), Achieved a total return of 41.42%that beats the Dow, S&P, Nasdaq & Birling US Bank Index and lags the Birling P.R. Stock Index. The Stock price on Dec. 24, 2021 was $26.22, increasing $7.68 since Jan. 1, 2021.

The Birling Capital Puerto Rico Bank Index companies have a total market capitalization of $10.6 billion, a $2.9 billion increase during 2021.

Had any investor invested $10,000 on January 1, 2021, these would have been the results:

| Company | Total Value | Total Gain/Loss |

| Firstbank | $14,740 | $4,740 |

| Popular Inc. | $14,322 | $4,322 |

| Oriental | $14,141 | $4,142 |

We must remind ourselves that the Birling Capital Puerto Rico Stock index had the worst close on Mar. 23, 2020, with a return of -53.80%, so seeing it returning 46.83% is an extraordinary turnaround story.

Our review demonstrated how both US & Puerto Rico banks’ management have successfully navigated through one of the worst economic exogenous shock periods in several generations. It has had a sustained and spectacular recovery.

No comments:

Post a Comment