Russia's Long-Term Oil Growth at Risk From Service Firms’ Pullback

, Bloomberg News

(Bloomberg) -- The decision by the world’s largest providers of oil services to stop taking on new business in Russia won’t affect the nation’s current crude output, but is a threat to its longer-term production growth.

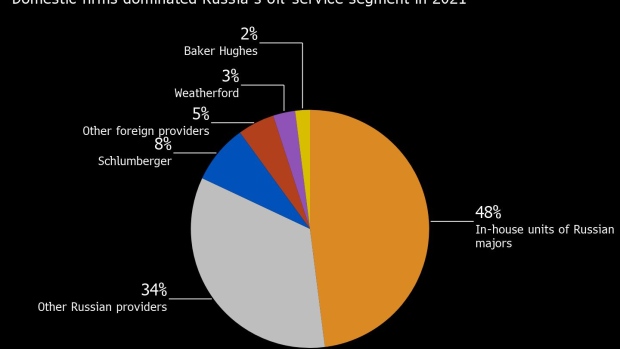

The top U.S. providers -- Baker Hughes Co., Halliburton Co. to Schlumberger Ltd. -- accounted for only 15% of Russia’s total oil-services segment last year, according to Moscow-based Vygon Consulting. The nation’s largest producers have demonstrated they can do their own well-drilling, exploration and production.

This means “an exit by global service companies won’t have much of an impact in practical terms,” analysts from Rystad Energy A/S said in a note to clients.

Oil-market watchers across the world are trying to gauge the impact on oil flows of a combination of financial sanctions, the withdrawal of major energy companies and buyers’ reluctance to take Russian cargoes. The International Energy Agency predicts Russia’s oil output will slump by a quarter next month, while Deputy Prime Minister Alexander Novak said output will remain steady.

The in-house units of top producers like Rosneft PJSC, Lukoil PJSC and Surgutneftegas PJSC carry out most technical work on Russian oil fields. Yet the country’s key Soviet-era fields are depleting and major new discoveries rare, so it has relied on international services firms for expertise in improving oil recovery and developing more technically challenging kinds of reserves, including viscous crude and shale.

These hard-to-recover oil resources underpin Russia’s output growth plans. Shale oil horizons alone could generate an extra 45 million tons of crude per year by 2030, Novak estimated last year. That’s equivalent to roughly 9% of Russia’s total production of 524 million tons in 2021.

The quality of Russian oil reserves is so poor that within the next 10 years nearly 100% of them could be considered hard to recover, Deputy Energy Minister Pavel Sorokin said in November, according to Interfax news agency. This will require the nation’s producers to develop techniques used in American shale fields, notably hydraulic fracturing, he said.

It’s these areas where the pullback of the global oil-services giants will be most keenly felt. They accounted for just over half the provision of technology used in Russia to boost recovery rates from existing fields, and about 60% of the market for high-end field-modeling software used to optimize drilling and production, according to Vygon.

“We can’t help but think that current Russian oil production levels might start to come under pressure over a longer-term time horizon,” analysts at Houston-based Tudor Pickering Holt & Co. said Monday in a note to investors.

©2022 Bloomberg L.P.

No comments:

Post a Comment