Reuters | September 21, 2022

Mina do Barroso lithium project in northern Portugal.

(Image courtesy of Savannah Resources.)

Portugal will not commit to setting a new date for a long-awaited auction of lithium mining licences as it awaits the conclusion of ongoing environmental impact studies at two sites, Energy Secretary Joao Galamba said on Wednesday.

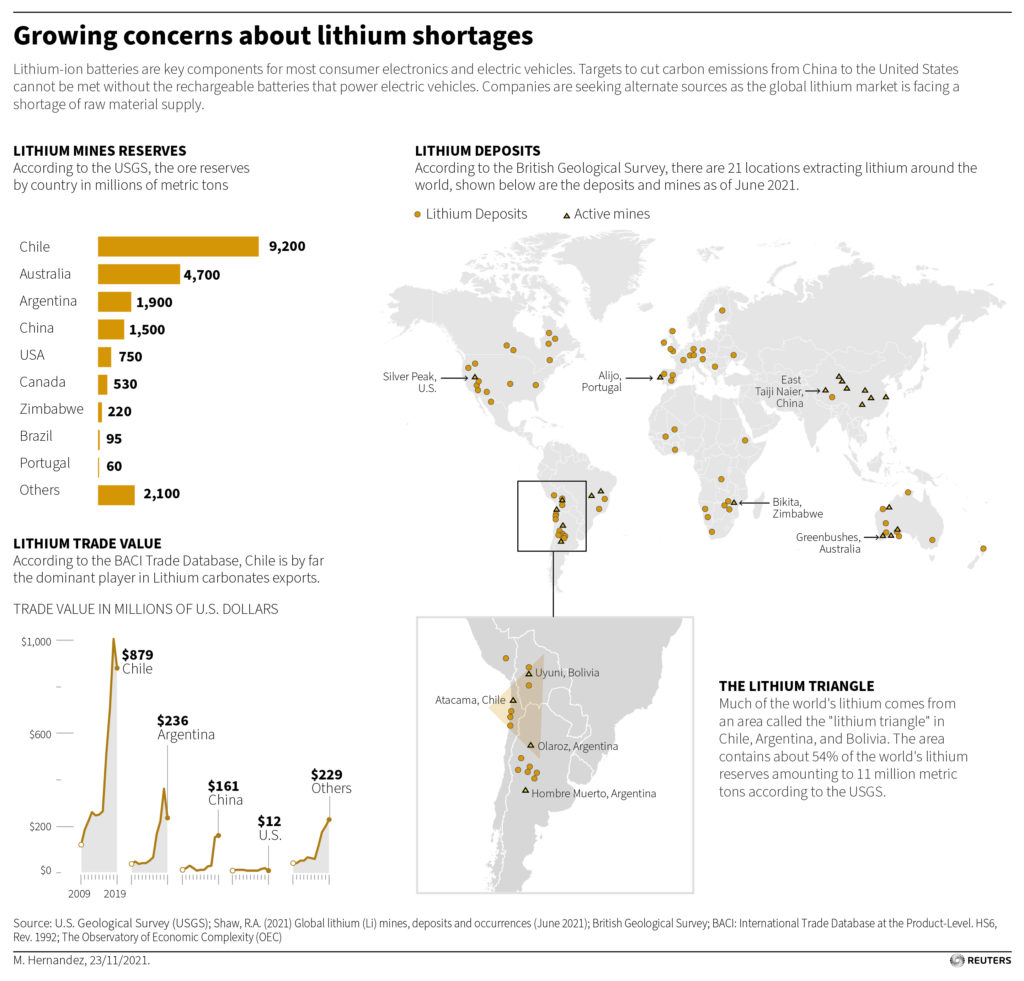

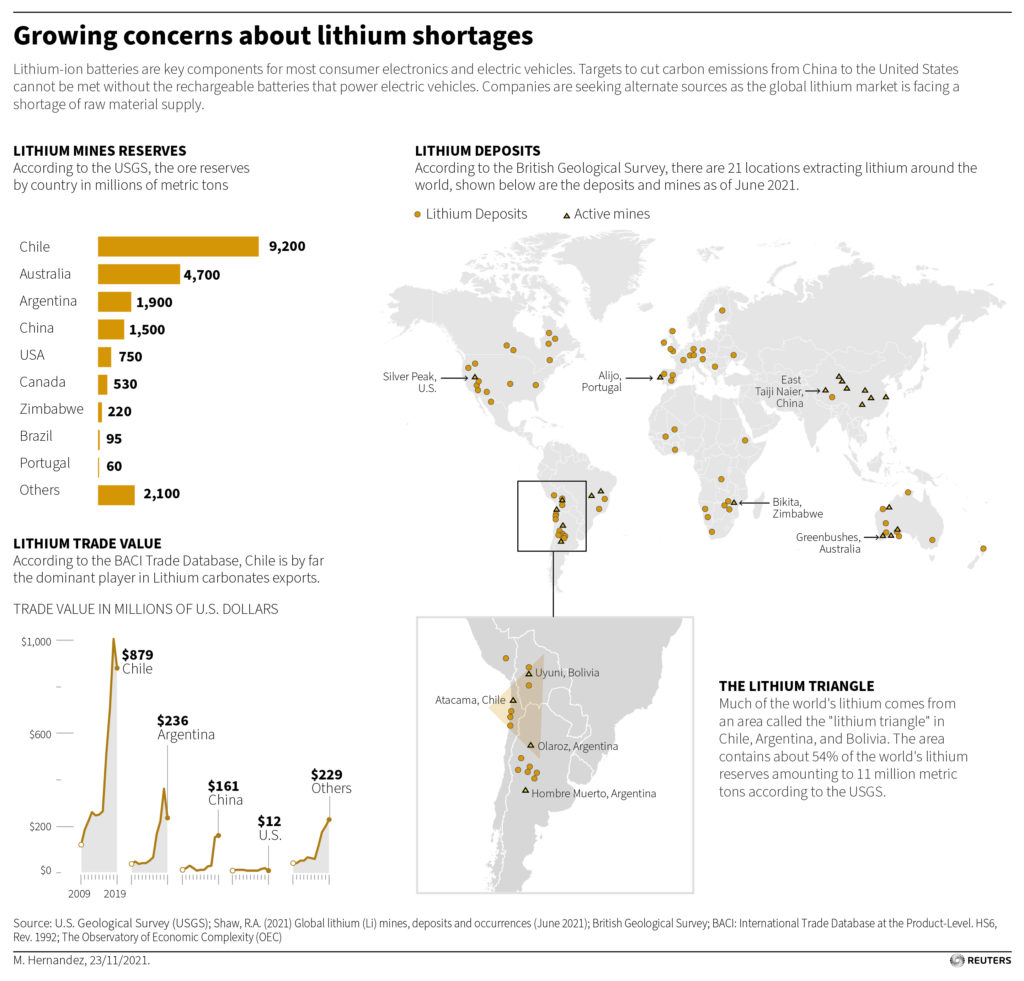

The southern European nation, which has 60,000 tonnes of known lithium reserves, is central to Europe’s bid to secure more of the battery value chain and cut reliance on imports.

Concerns about the potential environmental and social impact of lithium mining from nature preservation groups and local communities have led to multiple delays to the auction, initially planned for 2018.

Galamba told a parliamentary committee that the “government understands that the international auction will benefit from the conclusion of these processes”.

“It doesn’t make much sense to launch an international public auction, when simultaneously these environmental assessment processes are underway” at the Barroso mine and the Montalegre mine, in northern Portugal, he said.

The Barroso mine is owned by London-based mining company Savannah Resources and the Montalegre mine is owned by local company Lusorecursos.

Savannah said in a statement earlier on Wednesday it had “very useful and productive” meetings with Portugal’s environmental agency APA. As a result, it has until March 17 to submit its revised plans to the regulator.

However, APA does not have a deadline to decide on the evaluation process, which could be interrupted if it asks for more data or clarification.

The environment ministry, to which Galamba’s department belongs, has said the assessment conducted by the energy and geology agency analysed eight lithium-rich areas in central and northern Portugal, concluding “there were conditions to move forward in six of them”.

Portugal is Europe’s biggest lithium producer but its miners sell almost exclusively to the ceramics industry and are only now preparing to produce the higher-grade lithium that is in demand globally for use in electric cars and electronic devices.

(By Sergio Goncalves; Editing by Andrei Khalip and Lisa Shumaker)

Portugal will not commit to setting a new date for a long-awaited auction of lithium mining licences as it awaits the conclusion of ongoing environmental impact studies at two sites, Energy Secretary Joao Galamba said on Wednesday.

The southern European nation, which has 60,000 tonnes of known lithium reserves, is central to Europe’s bid to secure more of the battery value chain and cut reliance on imports.

Concerns about the potential environmental and social impact of lithium mining from nature preservation groups and local communities have led to multiple delays to the auction, initially planned for 2018.

Galamba told a parliamentary committee that the “government understands that the international auction will benefit from the conclusion of these processes”.

“It doesn’t make much sense to launch an international public auction, when simultaneously these environmental assessment processes are underway” at the Barroso mine and the Montalegre mine, in northern Portugal, he said.

The Barroso mine is owned by London-based mining company Savannah Resources and the Montalegre mine is owned by local company Lusorecursos.

Savannah said in a statement earlier on Wednesday it had “very useful and productive” meetings with Portugal’s environmental agency APA. As a result, it has until March 17 to submit its revised plans to the regulator.

However, APA does not have a deadline to decide on the evaluation process, which could be interrupted if it asks for more data or clarification.

The environment ministry, to which Galamba’s department belongs, has said the assessment conducted by the energy and geology agency analysed eight lithium-rich areas in central and northern Portugal, concluding “there were conditions to move forward in six of them”.

Portugal is Europe’s biggest lithium producer but its miners sell almost exclusively to the ceramics industry and are only now preparing to produce the higher-grade lithium that is in demand globally for use in electric cars and electronic devices.

(By Sergio Goncalves; Editing by Andrei Khalip and Lisa Shumaker)

No comments:

Post a Comment