Tesla loses 2 years of gains amid Twitter saga, demand fears

, Bloomberg News

Elon Musk’s latest sale of Tesla Inc. stocks, following repeated denials that he planned to offload more shares, is helping to wipe out the last vestiges of a rally in the electric carmaker over the past two years.

The stock dropped as much as 2.2 per cent in morning trading in New York on Wednesday. If the decline holds, the shares will be back at the level they traded at in November 2020.

Tesla investors had remained suspicious that Musk would unload more shares in the carmaker, despite his denials. Those fears were confirmed Tuesday in a regulatory filing that disclosed the sale of shares worth US$3.95 billion, bringing his total proceeds over the past year to about US$36 billion. He still owns about 14 per cent, according to Bloomberg data.

“Musk selling stock again after saying he wouldn’t can only leave the door open to more going forward,” said Mark Taylor, a sales trader at Mirabaud Securities.

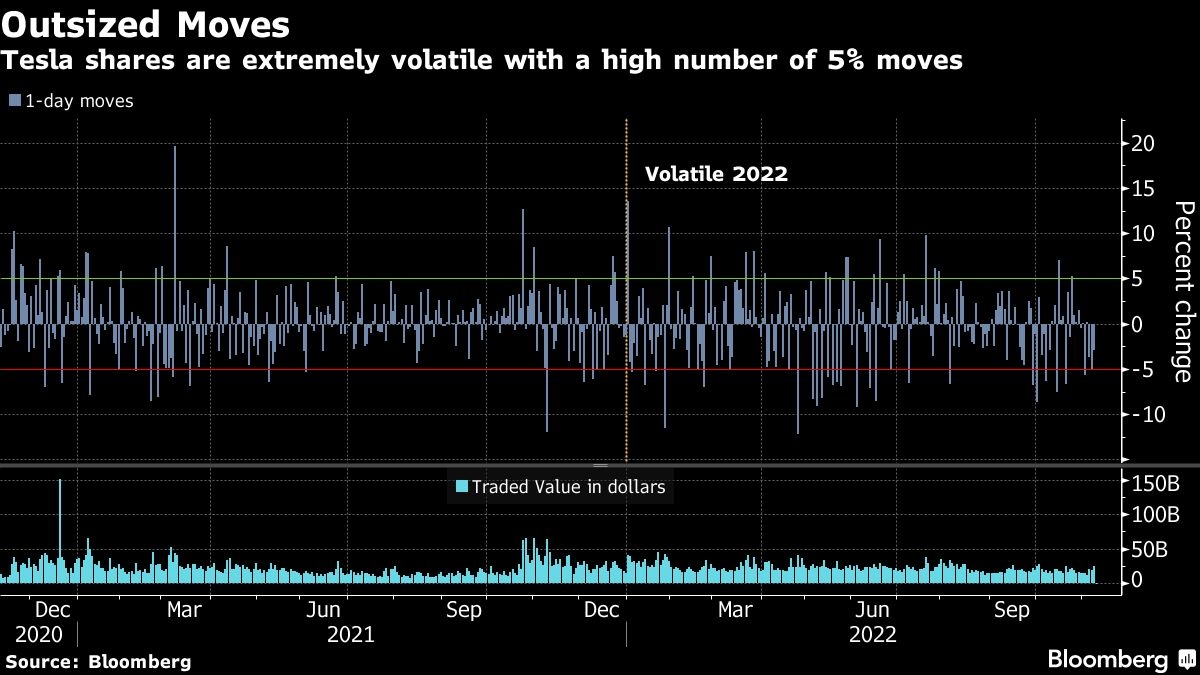

Still, investors in Tesla have had to contend with far more than just the CEO’s mercurial takeover of the social-media platform Twitter. The EV maker has struggled with supply-chain shortages and rising raw material costs along with the rest of the global automotive industry, with new concerns emerging about demand for its vehicles taking a hit as inflation-stung consumers tighten their purse strings.

The stock has also been swept up in the broader trend of investors exiting pricey growth stocks in favor of more stable companies as an economic recession looms large.

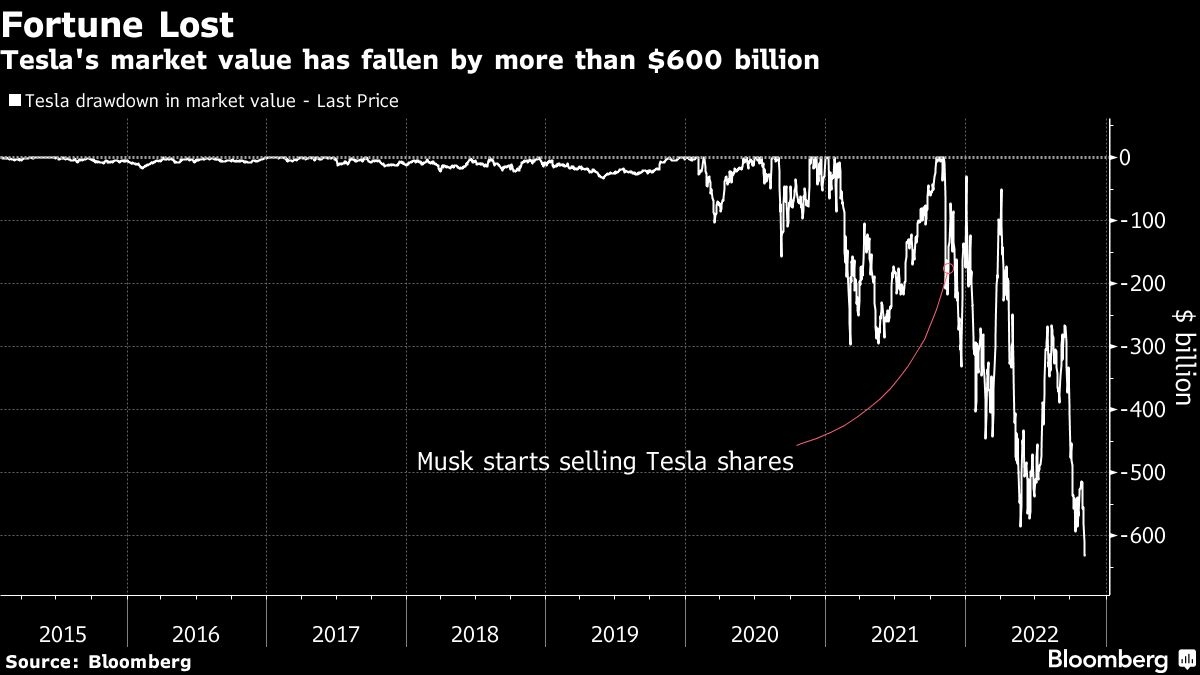

Tesla’s share price has declined for three straight months and November is proving even worse, with the stock falling almost 17 per cent so far. Its Relative Strength Index is back in oversold territory, and the stock has lost over US$635 billion in market capitalization since peaking last November.

Tesla analysts warned that while the latest stake sale by Musk can bring some temporary relief for the EV maker’s investors, the company still has plenty of challenges that can hold back the shares.

While overhang from the share sale by Musk may be gone, the threat “from a rising wave of competition and plenty of good alternatives for equity investment” are still around, Roth Capital Partners analyst Craig Irwin said.

No comments:

Post a Comment