CRIMINAL CAPITALI$M

Trumps had role in fraud scheme, former exec testifies at company's trial

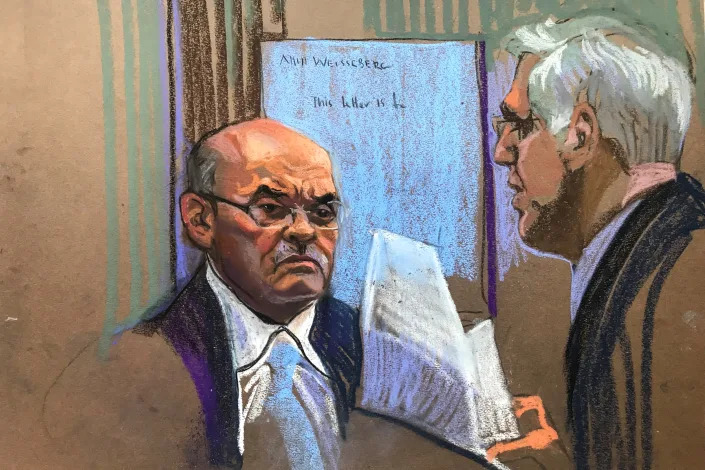

Former Trump Organization chief financial officer Allen Weisselberg testified in court Thursday, describing how Donald Trump and two of his children allegedly participated in a scheme to defraud tax authorities.

Weisselberg said Donald Trump, or at times Eric Trump or Donald Trump Jr., signed checks to pay up to $100,000 for private school tuition for Weisselberg's grandchildren. Weisselberg said he then instructed the company's controller to deduct the $100,000 from his salary, allowing him to report a smaller income. Copies of some of the checks signed by the Trumps have been shown in court.

Weisselberg said the first time Trump signed a tuition check, Weisselberg told him, "Don't forget, I'm going to pay you back for this." The payback, he said, was the salary reduction.

Two Trump Organization entities and Weisselberg are accused of more than a dozen counts of fraud and tax evasion. Weisselberg entered a guilty plea in August, admitting to charges filed by the Manhattan District Attorney's Office accusing him of receiving more than $1.7 million in untaxed compensation.

Weisselberg, who is still on the Trump Organization's payroll, has over the first two days of testimony described a litany of benefits he and several other executives received for which he said their salaries were similarly reduced to avoid paying taxes.

He said for himself and several other executives, the salary reductions were then mitigated by hefty bonus checks paid to the executives as if they were independent contractors for Trump Organization entities.

"Donald Trump always wanted to sign the bonus checks" before he became president in 2017, Weisselberg said.

That practice ceased during the next two years after an internal review led to changes at the company, he said.

"We were going through a company-wide cleanup process, making sure that since Mr. Trump was now president, everything was being done properly," Weisselberg said.

Defense attorney Alan Futerfas later asked Weisselberg, "(Trump) didn't authorize you to commit tax fraud did he?"

"Of course not," Weisselberg replied.

Weisselberg said the funds delivered as independent contractor payments were used to set up Keogh retirement plans, tax-deferred pension accounts designed for people who are self-employed.

Defense attorneys for the Trump Organization have said the company did nothing wrong, and laid the scheme squarely at Weisselberg's feet, saying he hid the salary reductions and independent contractor payments from the Trumps.

Futerfas asked Weisselberg, "What human being did you scheme with?"

Weisselberg replied, "Jeff McConney," referring to the company's controller, who previously testified during the trial. McConney was granted immunity in exchange for grand jury testimony in the case, and blamed Weisselberg for the scheme.

Futerfas continued with questions seeking to differentiate the Trumps from the executives who worked beneath them.

"Did you conspire with any member of the Trump family?" Futerfas asked.

"No," Weisselberg replied.

"Did you scheme with Jeff McConney?" Futerfas asked.

"Yes," Weisselberg replied.

"Did you scheme with any member of the Trump family?" Futerfas asked.

"No," Weisselberg replied.

Later, Futerfas asked, "Aside from family members, you were among the most trusted people they knew. Is that right?"

"Correct," Weisselberg replied.

Soon after, Futerfas asked, "Are you embarrassed about what you did?"

Choking up, Weisselberg replied, "More than you can imagine."

Earlier Thursday, Weisselberg said under questioning by a prosecutor that other executives at the company were active participants in, and beneficiaries of, similar salary and bonus arrangements.

Weisselberg described arranging for his son Barry's family to live in a newly-renovated apartment on New York's tony Central Park South. He said the location was convenient for Barry Weisselberg's job as manager of an ice rink and carousel run by the Trump Organization in Central Park. Allen Weisselberg said his son paid $500 out of pocket and $500 from his salary per month to rent the apartment, which he described as a "below market" rate.

At the time, Allen Weisselberg and his wife lived in an $8,200 per month company-owned apartment under a lease agreement signed by Donald Trump himself.

Allen Weisselberg said he provided his son's tax paperwork for preparation to the outside accountant who was in charge of the entire Trump Organization's annual tax account. Allen Weisselberg said his son's reported salary at the time "was probably lower than it should have been."

Peter Stambleck, an attorney for Barry Weisselberg, declined to comment.

Ex-Trump Organization CFO says Trump family was in the dark on tax fraud scheme

Former President Donald Trump and his two eldest sons signed the checks the Trump Organization's chief financial officer used to cheat on his taxes, but they didn't know it was fraud, the ex-CFO testified Thursday.

Allen Weisselberg, 75, testified for a second day in the criminal trial of Trump's family business in New York City that the only other person in the company who knew about the tax fraud scheme was its controller, Jeffrey McConney.

Asked by Trump lawyer Alan Futerfas in cross-examination whether Trump or anyone else in the company gave him permission to "commit tax fraud," Weisselberg said, "No."

"Did you conspire with the Trump family?" Futerfas asked. "No," Weisselberg said.

Weisselberg also testified he hadn't been taking off-the-books perks to benefit the company — he said he was doing it for himself.

"Your decision not to pay taxes was solely to benefit Allen Weisselberg?" Futerfas asked. "Correct," Weisselberg answered.

He acknowledged the company benefited financially but said, "It was my own personal greed that led to this."

Weisselberg, the prosecution's key witness, was indicted along with the Trump Organization in April of last year in what the government described as a 15-year scheme to cheat the system out of tax money.

Weisselberg pleaded guilty in August and agreed to testify for a lesser sentence. While he was removed as CFO after he was indicted, he testified Tuesday that his duties are largely the same and that he's still making the same amount of money — about $1 million a year.

Weisselberg received $1.76 million in “indirect employee compensation” through the scheme, including a rent-free apartment, expensive cars, private school tuition for his grandchildren and new furniture, prosecutors said in court filings. Other executives got similar perks and were paid bonuses as independent contractors, saving the company payroll taxes.

Weisselberg said Trump was aware of the perks he was getting because he and then later his sons Donald Trump Jr. and Eric Trump would sign the checks.

Under questioning from Futerfas, Weisselberg said the only person who knew he wasn’t paying the proper taxes on the perks was McConney.

McConney testified last week that Weisselberg as the lone bad actor, calling him a “micromanager” who had to sign off on all financial decisions.

Weisselberg was the only individual charged in the case. Under the terms of his agreement with prosecutors, he agreed to pay nearly $2 million in taxes, interest and penalties and serve five months in jail, followed by five years of probation. He also agreed “to testify truthfully at the upcoming trial of the Trump Organization” or face up to five to 15 years in prison.

He testified earlier Thursday that the Trump Organization cleaned up its business practices after Trump was elected president because of the extra scrutiny it was under.

"Everyone was looking at our company from every different angle you could think of,” including Trump himself, Weisselberg said.

Futerfas asked him whether he'd broken the family's trust with the fraud. "Yes," Weisselberg answered.

Asked whether he was ashamed of his actions, he replied, "More than you can imagine."

This article was originally published on NBCNews.com

Trump Ex-CFO Tells Jury He and Others Committed Tax Fraud

Thu, November 17, 2022

(Bloomberg) -- The Trump Organization’s longtime chief financial officer, Allen Weisselberg, testified that greed fueled a tax fraud scheme he says he engaged in with the firm’s controller and the two Trump companies standing trial.

Weisselberg, the prosecution’s star witness against the two business units, told a jury in Manhattan on Thursday that the scheme, which spanned more than a decade, was driven by the simple determination to evade taxes.

“It was my own personal greed that led to this,” the 75-year-old former CFO said on his second day on the witness stand in New York state court.

Alan Futerfas, a lawyer for Trump Payroll Corp., one of the two units, tried to show during his cross-examination that Weisselberg’s machinations were concealed from Donald Trump and his family. Weisselberg, who is still drawing his $640,000 annual salary at the Trump Organization even after pleading guilty in the case this summer, grew emotional when Futerfas asked if he had betrayed the family, for whom he has worked for almost 50 years.

Linchpin of Case

Weisselberg’s admission that he committed his crimes together with the Trump companies is the linchpin of Manhattan District Attorney Alvin Bragg’s case against them. Donald Trump himself, who isn’t charged, has called the trial a baseless vendetta.

“Given that you were getting about $200,000 in expenses, without it being taxed, wasn’t this a savings to the Trump Corporation, because they saved themselves from having to give you a double raise?” Executive Assistant DA Susan Hoffinger asked Weisselberg.

“The Trump Corporation saved some payroll taxes, yes,” he said. Weisselberg later acknowledged that Trump Corp., the other company of the pair, would have had to award him at least $400,000 more to make up for the taxes he’d owe if his compensation weren’t hidden within perks like luxury cars and high-end housing.

Read More: Trump Firm’s Tax Fraud Trial Promises Ex-CFO as Star Witness

“I committed those crimes with Jeff McConney, who I dealt with directly, and Trump Payroll and the Trump Corporation,” Weisselberg told the jury under questioning by Hoffinger.

Trump Organization Controller Jeffrey McConney, who was the prosecution’s first witness, was granted immunity in exchange for his testimony but proved so evasive on the stand that he was declared a hostile witness.

What About the Trumps?

Weisselberg told the jurors Thursday the scam was already in place when he began working for Trump in 1986.

“Did you scheme with any member of the Trump family?” Futerfas asked in his cross-examination.

“No,” Weisselberg said.

Read More: Trump CFO Got Demotion, ‘Small Birthday Cake’ After His Plea

Weisselberg has admitted that Donald Trump personally paid hundreds of thousands of dollars in private school tuition for the executive’s grandchildren. The former CFO and his wife each got a Mercedes-Benz and an apartment paid for by the Trump companies. Prosecutors say these perks were all part of the fraud.

At one point Weisselberg appeared to help the prosecution significantly when Futerfas asked him whether the Trump companies had benefited from the fraud -- a crucial part of the DA’s case.

“I didn’t do the analysis,” Weisselberg said, “but I knew there was a benefit to the company.”

Yet when asked whether not paying taxes on the perks was his decision alone and solely for his own benefit, Weisselberg said yes.

Emotional Testimony

He grew emotional when Futerfas asked if he had lived up to the trust the Trump Organization had placed in him.

“Did you betray that trust?” Futerfas asked.

“Yes,” Weisselberg said.

“And you did it for your own personal gain?” the lawyer asked.

“Correct,” Weisselberg said.

Read More: Trump Firm’s Fraud Trial Sees Drama as Witness Declared Hostile

The executive -- who has worked for three generations of Trumps, starting under Donald Trump’s father, Fred -- then grew teary, his voice cracking.

“Are you embarrassed by what you did?” Futerfas asked.

“More than you can imagine,” Weisselberg said.

“Ashamed?” the attorney pressed.

“Yes, very much so,” Weisselberg said, his face reddening.

He continues his testimony when the trial resumes Friday.

The case is People v. Trump Organization, 01473-2021, New York State Supreme Court (Manhattan).

No comments:

Post a Comment