Bloomberg News | March 6, 2024

Stock Image

South Africa’s platinum producers are in crisis, as slumping metal prices force jobs cuts and erode profits.

The nation’s platinum sector — which accounts for about 70% of global output — has been a key export industry and generates jobs for hundreds of thousands of people in a country with one of the world’s highest unemployment rates.

Over the past two weeks, the four biggest producers — Sibanye Stillwater Ltd., Anglo American Platinum Ltd., Impala Platinum Holdings Ltd. and Northam Platinum Ltd. — have all released sobering earnings reports. Those results have helped us learn the following:

Jobs threat

The miners are trimming their workforces in South Africa – a politically sensitive move as the ruling African National Congress prepares for its sternest electoral test later this year.

Amplats, the platinum business of Anglo American Plc, has opened discussions with labor unions that may affect 3,700 jobs. Sibanye already cut 2,600 employees and contractors following similar consultations and Implats said it shed more than 1,000 jobs in the second half of last year.

Producers of platinum-group metals – used to curb emissions from gasoline and diesel vehicles – directly employed almost 182,000 people in 2023, according to the Minerals Council of South Africa.

Shrinking profits

Just two years ago, profits were at all-time highs as automaker demand pushed the price of rhodium and palladium – mined alongside platinum in South Africa – to record levels. Since the start of 2023, the price of palladium and rhodium has tumbled 44% and 63%, respectively, hit by inventory destocking and a subdued global economy.

While the decline of platinum has been more modest, the overall collapse in the PGMs has been devastating for miners’ bottom line: full-year profit at Amplats slumped 73%, while earnings at Implats and Northam for the six months through December plunged about 90%. Sibanye reported a $2 billion loss on Tuesday.

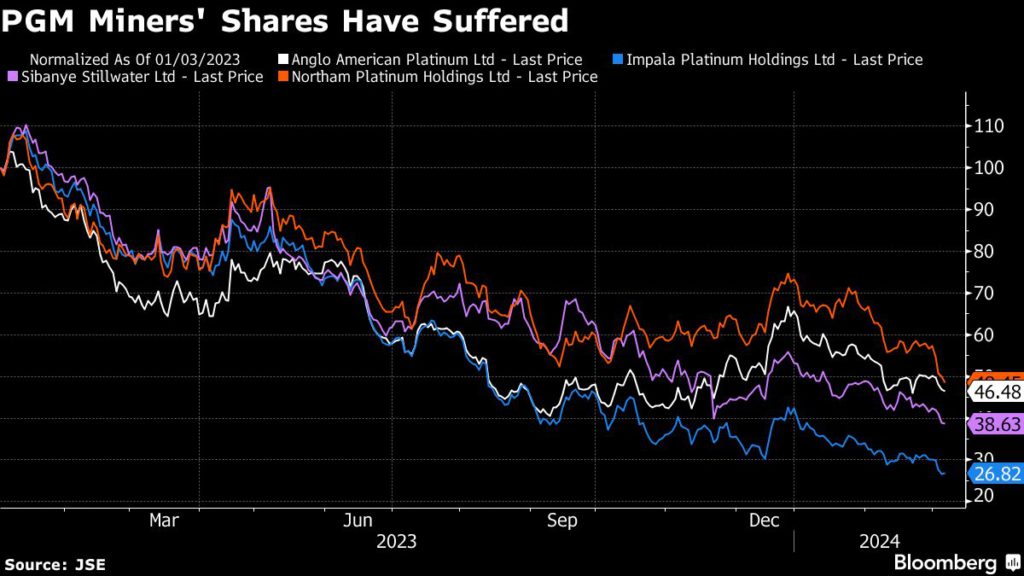

The shares of all four companies have lost more than half their value since the beginning of last year.

Cost cutting

The producers have reacted to what Northam chief executive officer Paul Dunne describes as the “worst crisis” in three decades by cutting costs and curbing spending.

Amplats is targeting savings of 5 billion rand ($261 million), while Implats plans to cut its expenditure by more than half a billion dollars over the next five years across its operations in Canada, Zimbabwe and South Africa. Sibanye and Implats are both hobbled by high-cost palladium assets in North America, where the firms have axed an expansion project and shortened the life of a mine.

The miners are bracing for a prolonged period of pain, with CEO Dunne expecting the “depressed pricing environment” to continue for as long as two years.

Output risks

By the end of 2023, as much as half of PGM production — excluding the Russian mines that are the world’s largest source of palladium — was unprofitable, according to estimates by Rene Hochreiter, an analyst at Noah Capital Markets in Johannesburg.

While that figure improves to about 15% when metals mined alongside the PGMs, such as chrome and copper, were factored in, the situation is set to deteriorate this year. Stripping out those byproducts, up to two-thirds of output will lose money, Hochreiter said.

While expansion projects have been set aside, the biggest platinum miners have yet to announce significant production cuts. They point out that the markets for the three main metals were all in deficit last year and retain confidence in the long-term prospects for their portfolios, despite the rise of electric vehicles.

However, that may change if the current squeeze continues, according to Heraeus Precious Metals. “If PGM prices do not recover, then shaft closures may become inevitable,” the Germany-based trader and refiner said last month.

(By William Clowes)

Read More: Platinum deficit in 2024 to be deeper than expected – WPIC

The producers have reacted to what Northam chief executive officer Paul Dunne describes as the “worst crisis” in three decades by cutting costs and curbing spending.

Amplats is targeting savings of 5 billion rand ($261 million), while Implats plans to cut its expenditure by more than half a billion dollars over the next five years across its operations in Canada, Zimbabwe and South Africa. Sibanye and Implats are both hobbled by high-cost palladium assets in North America, where the firms have axed an expansion project and shortened the life of a mine.

The miners are bracing for a prolonged period of pain, with CEO Dunne expecting the “depressed pricing environment” to continue for as long as two years.

Output risks

By the end of 2023, as much as half of PGM production — excluding the Russian mines that are the world’s largest source of palladium — was unprofitable, according to estimates by Rene Hochreiter, an analyst at Noah Capital Markets in Johannesburg.

While that figure improves to about 15% when metals mined alongside the PGMs, such as chrome and copper, were factored in, the situation is set to deteriorate this year. Stripping out those byproducts, up to two-thirds of output will lose money, Hochreiter said.

While expansion projects have been set aside, the biggest platinum miners have yet to announce significant production cuts. They point out that the markets for the three main metals were all in deficit last year and retain confidence in the long-term prospects for their portfolios, despite the rise of electric vehicles.

However, that may change if the current squeeze continues, according to Heraeus Precious Metals. “If PGM prices do not recover, then shaft closures may become inevitable,” the Germany-based trader and refiner said last month.

(By William Clowes)

Read More: Platinum deficit in 2024 to be deeper than expected – WPIC

Sibanye falls to $2 billion loss, weighs capital raise if metal prices worsen

Reuters | March 5, 2024 |

Credit: Sibanye Stillwater

Sibanye Stillwater on Tuesday reported a $2 billion annual loss and scrapped its final dividend, hurt by a slump in platinum group metal (PGM) prices that is forcing South African mining companies to restructure and cut jobs.

The hit on Sibanye’s income comes as the company advances projects including a lithium mine in Finland and plans to develop another one in the US.

CEO Neal Froneman said Sibanye may consider a capital raise if the lower metal prices persist for longer, but he ruled out a rights issue.

“We are going to raise additional capital, but this perception that it’s going to be a rights issue is completely wrong,” he said during a results call.

The precious metals producer swung to the loss last year from a $1.2 billion profit the previous year and record earnings in 2021, when prices for rhodium and palladium rallied.

It reported impairments of $2.6 billion at its US palladium mines, a nickel operation in France and a gold mine in South Africa due in part to the significant decline in metal prices and an uncertain outlook.

The loss comes after Sibanye embarked on a deal spree, buying battery metal assets in France, Finland, Australia and the US.

The fall in prices for PGMs, mostly used by automakers to curb toxic emissions, is forcing South African mining companies to restructure and cut jobs.

Froneman said in a statement that more restructuring might be required, especially at Sibanye’s US PGM operations and the Sandouville nickel refinery in France.

“We recognize however that if low commodity prices persist, earnings are going to remain under pressure and, with ongoing inflationary cost pressure, there may be further restructuring required,” Froneman said.

Sibanye’s peers Anglo American Platinum and Impala Platinum are also restructuring loss-making operations and cutting costs, a process which will cost thousands of jobs.

(By Nelson Banya and Felix Njini; Editing by Jason Neely, Jan Harvey and David Evans)

Reuters | March 5, 2024 |

Credit: Sibanye Stillwater

Sibanye Stillwater on Tuesday reported a $2 billion annual loss and scrapped its final dividend, hurt by a slump in platinum group metal (PGM) prices that is forcing South African mining companies to restructure and cut jobs.

The hit on Sibanye’s income comes as the company advances projects including a lithium mine in Finland and plans to develop another one in the US.

CEO Neal Froneman said Sibanye may consider a capital raise if the lower metal prices persist for longer, but he ruled out a rights issue.

“We are going to raise additional capital, but this perception that it’s going to be a rights issue is completely wrong,” he said during a results call.

The precious metals producer swung to the loss last year from a $1.2 billion profit the previous year and record earnings in 2021, when prices for rhodium and palladium rallied.

It reported impairments of $2.6 billion at its US palladium mines, a nickel operation in France and a gold mine in South Africa due in part to the significant decline in metal prices and an uncertain outlook.

The loss comes after Sibanye embarked on a deal spree, buying battery metal assets in France, Finland, Australia and the US.

The fall in prices for PGMs, mostly used by automakers to curb toxic emissions, is forcing South African mining companies to restructure and cut jobs.

Froneman said in a statement that more restructuring might be required, especially at Sibanye’s US PGM operations and the Sandouville nickel refinery in France.

“We recognize however that if low commodity prices persist, earnings are going to remain under pressure and, with ongoing inflationary cost pressure, there may be further restructuring required,” Froneman said.

Sibanye’s peers Anglo American Platinum and Impala Platinum are also restructuring loss-making operations and cutting costs, a process which will cost thousands of jobs.

(By Nelson Banya and Felix Njini; Editing by Jason Neely, Jan Harvey and David Evans)

No comments:

Post a Comment