Niger attack endangered uranium stockpile near main airport

Unidentified attackers who staged an assault on Niger’s capital came dangerously close to a stockpile of uranium removed from French company Orano SA’s mine.

Heavy gunfire and explosions erupted near Niamey’s Diori Hamani International Airport early Thursday. The facility is adjacent to an air force base where Agence France-Presse reported the concentrated uranium powder, known as yellowcake, was stored earlier this month.

At least 20 attackers died in the assault, with 11 others wounded and captured, Defense Minister Salifou Modi said in a statement read on state television. Four members of Niger’s security forces were injured, he said.

Islamic State claimed responsibility for the attack via Amaq News Agency, a media outlet linked to the group.

Niger’s military leadership took over Orano’s Somair mine in 2024, after accusing the French nuclear company of planning to halt operations and sell its shares without following proper procedures.

The West African nation later removed uranium from the site, despite an International Centre for Settlement of Investment Disputes arbitration tribunal’s ruling preventing it from taking any such steps. Its actions raised concerns about radioactive material being transported by road through jihadist-controlled regions.

Niger’s government “unilaterally decided to nationalize” the Somair mine in June 2025, leaving Orano without operational control, and the company is unable to comment on its activities, it said in an emailed response to questions.

This week’s attack targeted the airport area and an adjacent military base that involved gunmen on motorbikes and drone strikes. An Air Côte d’Ivoire aircraft parked on the tarmac was hit, the carrier said in a statement. Two Asky Airlines planes waiting on the tarmac were also damaged, according to a government statement.

AFP cited eyewitness as saying shooting began shortly after midnight on Thursday and streaks of light and flames were seen several meters high. Multiple cars were set alight, the news agency said.

A spokesperson for the state-owned Société du Patrimoine Minier du Niger, which manages the country’s interests in mining companies, didn’t respond to phone calls and a text message seeking comment. Phone calls to two government representatives and an army spokesman went unanswered.

Military ruler Abdourahamane Tiani has pivoted Niger toward Russia and cut security ties with former allies, including the US and France, since ousting President Mohamed Bazoum in a 2023 coup.

Niger also quit the regional bloc Ecowas and joined Mali and Burkina Faso in forming the Alliance of Sahel States, a military-led coalition that’s building economic and security cooperation as the three nations battle insurgents linked to Al-Qaeda and Islamic State, that have killed thousands and displaced hundreds of thousands across West Africa’s Sahel region.

Tiani thanked Niger’s Russian partners for “their prompt reaction, which allowed us to completely rout the enemy within 20 minutes.”

(By Katarina Höije and Kamailoudini Tagba)

Uranium entering multi-year structural bull market: report

The global uranium market is entering a “tipping point” where sustained demand for the energy fuel and supply constraints could lead to a significant rally in prices in the coming years, according to analysts at Teniz Capital.

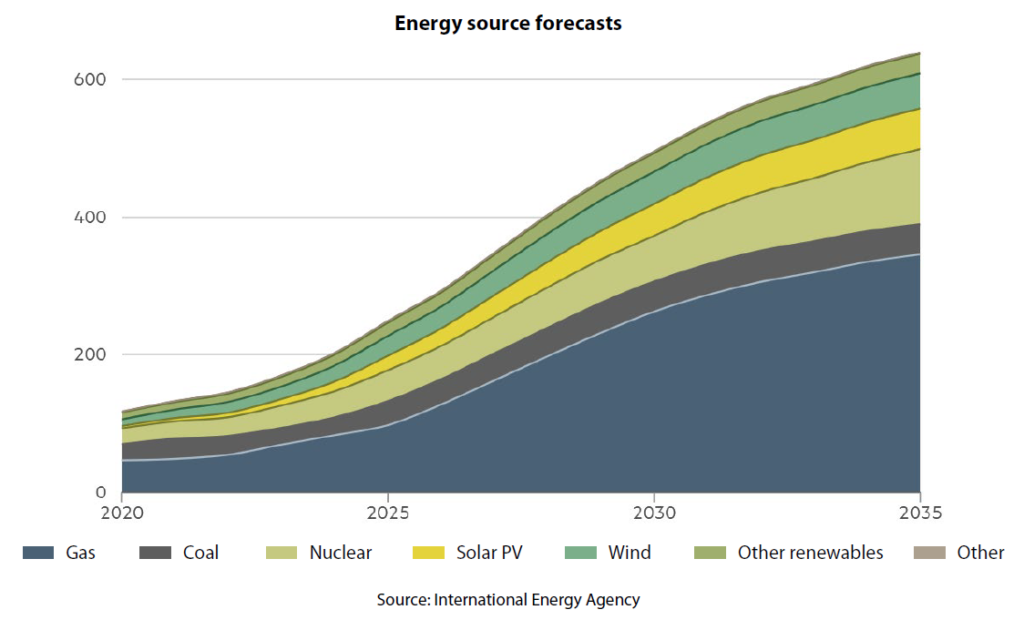

In a research report published this week, the Abu Dhabi-based investment bank said the entire sector is undergoing what they call a “second nuclear renaissance” — where accelerating demand from tech giants for data centers and global energy policy are helping to form a multi-year demand cycle.

Meanwhile, the supply side has reached what analysts believe to be an “acute” structural deficit that’s incapable of meeting this demand due to the slow pace of mine development. This situation, as the report warns, would only worsen, with demand projected to rise 28% by the end of this decade and double by 2040.

Drawing historical parallels with the mid-2000s, analysts at Teniz Capital sees uranium as one of the “most promising plays” in the energy sector, forecasting prices to rise by three or even four-fold.

‘Structurally short’

According to the bank, the world’s supply of primary uranium is falling “structurally short” of nuclear reactor demand due to years of underinvestment. It is estimated that mines can only cover about 74-90% of current needs, and that deficit would likely grow as countries continue to vie for energy security.

In the past, that gap could be filled by secondary sources — commercial inventories and reprocessing — but now these have largely been depleted as well, Teniz Capital said.

This situation is that the current project pipeline is effectively exhausted and development of new mines could take at least 10 to 15 years, it added.

As such, analysts said that uranium has now entered a “long-duration structural bull market” that they believe is time-embedded rather than cyclical. This, as they point out in the report, is reflected in the rally in prices, which bottomed at around $18 per lb. in 2016–2017 then surged to a 17-year high of $106 in early 2024, before stabilizing in the $73–80 range by year-end.

“The supply deficit in the 2030s is already programmed. It cannot be eliminated by any political decisions or investments. The physical constraints of time are insurmountable,” the report said, warning that even higher uranium prices would not offer a quick fix.

“This uranium cycle differs materially from past commodity upswings because supply elasticity is structurally low while demand is policy-driven and non-discretionary,” Ben Elvidge, product lead at Uranium.io, said in an email to MINING.COM.

Kazatomprom uniquely positioned

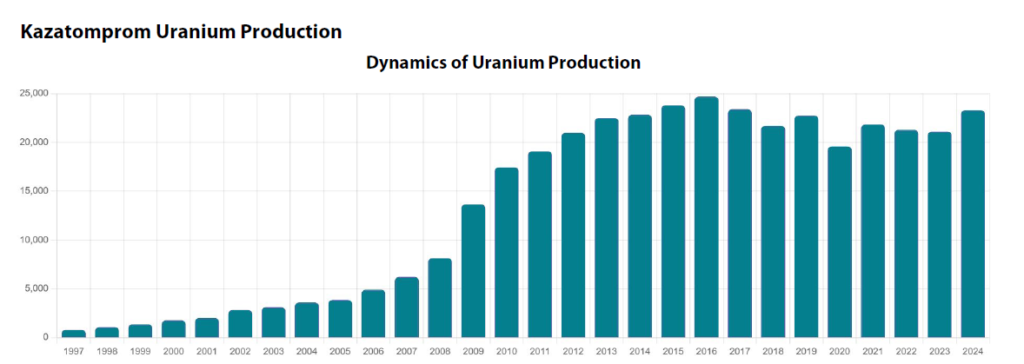

Against this backdrop, Teniz Capital has identified Kazatomprom (LSE: KAP), the world’s largest producer and seller of natural uranium, as a key player that holds a “unique and effectively irreplaceable position” in the global supply chain.

In its report, the bank highlighted the Kazakh company as the industry’s single-largest resource holder, accounting for about 39-43% of the world’s production. In addition, the Central Asian nation has more than 65% of global reserves suitable for in-situ recovery (ISR), the world’s lowest-cost extraction method.

In addition, a review of the global development pipeline shows that no project in Canada, Africa or elsewhere approaches Kazatomprom’s scale or economic efficiency. The most advanced alternatives are either too small, too costly, or too early-stage to materially alter the supply outlook, according to the report.

The analysis also highlighted that the London-listed Kazatomprom offers diversification opportunities through its involvement in uranium projects with other major players, such as Cameco (TSX: CCO; NYSE: CCJ) and France’s Orano.

“Within this framework, Kazatomprom represents a rare example of a systemically critical producer for which no comparable global alternative exists over the next two decades,” analysts said.

No comments:

Post a Comment