It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Saturday, February 26, 2011

P3 The Unvarnished Truth

for future P3s is somewhat pessimistic. Governments have generally

found it difficult to effectively reduce their financial and budgetary

exposure. Furthermore, in some cases, governments have faced

significant increased political risk rather than reduced risk as they had

hoped. At the same time, their for-profit private sector partners have had

difficulty making adequate rates of return, although this is a tentative

conclusion as they have usually had incentives to publicly emphasize

losses.

In some respects, the somewhat negative findings are not surprising.

The public and private partners in P3s inevitably have conflicting

interests (Teisman & Klijn, 2002; Trailer et al., 2004). Studies have

shown that in other contexts with similar conflicting interests, such as

mixed enterprises that are jointly owned by private shareholders and

government, the result can be “the worst of both worlds”, achieving

neither high profitability nor worthwhile social goals (Eckel & Vining,

1985; Boardman & Vining, 1989). In sum, while the allocation of

decision-making and risk-sharing in P3s can vary widely, if decisionmaking

authority and financial risk-bearing are not appropriately and

clearly matched, incentives will be misaligned and effective outcomes

are unlikely. This raises the question of whether governments can learn,

individually or collectively, to adequately specify contract conditions and

institutional conflict resolution mechanisms ex ante so that the past is not

a prologue for the future.

Thursday, November 27, 2008

WSJ Criticizes Contracting Out

Government by Contractor Is a Disgrace

Many jobs are best left to federal workers.

Back in 1984, the conservative industrialist J. Peter Grace was telling whoever would listen why government was such a wasteful institution.

One reason, which he spelled out in a book chapter on privatization, was that "government-run enterprises lack the driving forces of marketplace competition, which promote tight, efficient operations. This bears repetition," he wrote, "because it is such a profound and important truth."

And repetition is what this truth got. Grace trumpeted it in the recommendations of his famous Grace Commission, set up by President Ronald Reagan to scrutinize government operations looking for ways to save money. It was repeated by leading figures of both political parties, repeated by everyone who understood the godlike omniscience of markets, repeated until its veracity was beyond question. Turn government operations over to the private sector and you get innovation, efficiency, flexibility.

What bears repetition today, however, is the tragic irony of it all. To think that our contractor welfare binge was once rationalized as part of an efficiency crusade. To think that it was supposed to make government smaller.

As the George W. Bush presidency grinds to its close, we can say with some finality that the opposite is closer to the truth. The MBA president came to Washington determined to enshrine the truths of "market-based" government. He gave federal agencies grades that were determined, in part, on how abjectly the outfits abased themselves before the doctrine of "competitive sourcing." And, as the world knows, he puffed federal spending to unprecedented levels without increasing the number of people directly employed by the government.

Instead the expansion went, largely, to private contractors, whose employees by 2005 outnumbered traditional civil servants by four to one, according to estimates by Paul Light of New York University. Consider that in just one category of the federal budget -- spending on intelligence -- apparently 70% now goes to private contractors, according to investigative reporter Tim Shorrock, author of "Spies for Hire: The Secret World of Intelligence Outsourcing."

Today contractors work alongside government employees all across Washington, often for much better pay. There are seminars you can attend where you will learn how to game the contracting system, reduce your competition, and maximize your haul from good ol' open-handed Uncle Sam. ("Why not become an insider and share in this huge pot of gold?" asks an email ad for one that I got yesterday.) There are even, as Danielle Brian of the Project on Government Oversight, a nonpartisan watchdog group in Washington, D.C., told me, "contractor employees -- lots of them -- whose sole responsibility is to dream up things the government needs to buy from them. The pathetic part is that often the government listens -- kind of like a kid watching a cereal commercial."

Some federal contracting, surely, is unobjectionable stuff. But over the past few years it has become almost impossible to open a newspaper and not read of some well-connected and obscenely compensated contractor foisting a colossal botch on the taxpayer. Contractors bungling the occupation of Iraq; contractors spinning the revolving door at the Department of Homeland Security; contractors reveling publicly in their good fortune after Hurricane Katrina.

At its grandest, government by contractor gives us episodes like the Coast Guard's Deepwater program, in which contractors were hired not only to build a new fleet for that service, but also to manage the entire construction process. One of the reasons for this inflated role, according to the New York Times, was the contractors' standing armies of lobbyists, who could persuade Congress to part with more money than the Coast Guard could ever get on its own. Then, with the billions secured, came the inevitable final chapter in 2006, with the contractors delivering radios that were not waterproof and ships that were not seaworthy.

Government by contractor also makes government less accountable to the public. Recall, for example, the insolent response of Erik Prince, CEO of Blackwater, when asked about his company's profits during his celebrated 2007 encounter with the House Oversight Committee: "We're a private company," quoth he, "and there's a key word there -- private."

So you and I don't get to know. We don't get to know about Blackwater's profits, we don't get to know about the effects all this has had on the traditional federal workforce, and we don't really get to know about what goes on elsewhere in the vast private industries to which we have entrusted the people's business.

SEE:

The Failure of Privatization

Another Privatization Failure

Moral Turpitude Is Spelled Blackwater

IRAQ- THIS WAR IS ABOUT PRIVATIZATION

The Neo Liberal Canadian State

Find blog posts, photos, events and more off-site about:

US, military, pentagon, reinventing-goverment, privatization, contracting-out, scandal, waste, pentagon, costoveruns, Iraq, contractor, privatization, Bush, Wolfowitz, Rumsfeld, Cheney, USA, war, KBR, Halliburtona ,infaltion, recession, USeconomy, USA, economy, banks, war, Erik Prince, Iraq, Fallujah, military, Blackwater USA, mercenaries, contractors, Green Zone, economics, Halliburton, Bechtel,

Friday, October 31, 2008

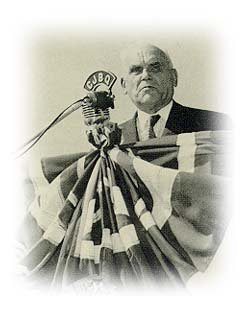

C.D. Howe Canada's Grand Poobah

There is great irony in the fact that one of Canada's foremost establishment right of centre think tanks the C.D. Howe Institute which often promotes a neo-con agenda is named after one of Canada's foremost Pooh-Bahs of State Capitalism.

There is great irony in the fact that one of Canada's foremost establishment right of centre think tanks the C.D. Howe Institute which often promotes a neo-con agenda is named after one of Canada's foremost Pooh-Bahs of State Capitalism. Grand Poobah is a term derived from the name of the haughty character Pooh-Bah

in Gilbert and

Sullivan's The Mikado. In

this comic opera,

Pooh-Bah holds numerous exalted offices, including Lord Chief Justice,

Chancellor of the Exchequer, Master of the Buckhounds, Lord High Auditor, Groom

of the Back Stairs, and Lord High Everything Else. The name has come to be used

as a mocking title for someone self-important or high-ranking and who either

exhibits an inflated self-regard, who acts in several capacities at once, or who

has limited authority while taking impressive titles.NANK. Ko-Ko, the cheap tailor, Lord High Executioner ofTitipu! Why, that's the highest rank a citizen can attain!

POOH. It is. Our logical Mikado, seeing no moraldifference between the dignified judge who condemns a criminal todie, and the industrious mechanic who carries out the sentence,has rolled the two offices into one, and every judge is now hisown executioner.

NANK. But how good of you (for I see that you are anobleman of the highest rank) to condescend to tell all this tome, a mere strolling minstrel!

POOH. Don't mention it. I am, in point of fact, aparticularly haughty and exclusive person, of pre-Adamiteancestral descent. You will understand this when I tell you thatI can trace my ancestry back to a protoplasmal primordial atomicglobule. Consequently, my family pride is somethinginconceivable. I can't help it. I was born sneering. But Istruggle hard to overcome this defect. I mortify my pridecontinually. When all the great officers of State resigned in abody because they were too proud to serve under an ex-tailor, didI not unhesitatingly accept all their posts at once?

PISH. And the salaries attached to them? You did.

POOH. It is consequently my degrading duty to serve thisupstart as First Lord of the Treasury, Lord Chief Justice,Commander-in-Chief, Lord High Admiral, Master of the Buckhounds,Groom of the Back Stairs, Archbishop of Titipu, and Lord Mayor,both acting and elect, all rolled into one. And at a salary! APooh-Bah paid for his services! I a salaried minion! But I doit! It revolts me, but I do it!

NANK. And it does you credit.

POOH. But I don't stop at that. I go and dine withmiddle-class people on reasonable terms. I dance at cheapsuburban parties for a moderate fee. I accept refreshment at anyhands, however lowly. I also retail State secrets at a very lowfigure. For instance, any further information about Yum-Yumwould come under the head of a State secret. (Nanki-Poo takes hishint, and gives him money.) (Aside.) Another insult and, Ithink, a light one!

The C.D.Howe Institute flies in the face of the endeavours of Howe, who as Minister of Everything, oversaw the development of public and crown corporations in Canada. Federally funded, not joint private public partnerships, which of course would have demanded private capital to develop. With the victory of neo con agenda in the ninties promoting privatization of public and government infrastructure the C.D. Howe institute gave establishment legitimacy to the efforts of other right wing lobbyists and thnk tanks like the Fraser Institute and its east coast doppleganger; the Atlantic Institute of Market Studies , and the newly minted Frontier Centre for Public Policy.

The C.D. Howe Institute

(formerly the Howe Research Institute), is a nonprofit policy research

organization established in 1973 by a merger of the Private Planning Association

of Canada, formed in 1958, and the C.D. Howe Memorial Foundation. It is located

in Toronto. Its principal source of funding is the fees contributed by a

membership that includes corporations as well as individuals with a background

in business, the professions or academia. The institute's staff is responsible

for the preparation of the annual Policy Review and Outlook and various other

publications on topical issues. The institute also commissions leading

researchers (academics for the most part) to write papers and monographs on a

wide range of topics such as fiscal and monetary policy, trade policy, social

policy, the environment, federal-provincial relations and constitutional reform.

Although the main focus of the institute's research program is the economy, the

range of topics it has covered over the years is very wide and occasionally

extends to non-economic issues such as culture and ethnicity.

D.G. McFetridge

Professor and Chair,

Department of Economics,

Carleton University

Toronto, October 22, 1997

Sponsored by Dofasco Inc.

The formation of public policy can be viewed from a number of perspectives.

Some see it largely as the outcome of tradeoffs between contending

interest groups; policy changes reflect nothing more than the ascendancy

of one interest group over another. To others, including the

C.D. Howe Institute, ideas matter. A good idea, well explained, can

overcome the power of even an entrenched interest group.

If ideas do matter, there is certainly merit in bringing the evidence

on the economic benefits of privatization to public attention. Privatization

is about more, much more, than selling off the bus company. It is

about institutional design, and in some countries (New Zealand, for

example) it has involved considerable reflection on just what should be

expected of government.

What we have come to call privatization is part of a larger process

of institutional change involving commercialization, contracting out,

and regulatory reform as well as the sale of state-owned enterprises to

the private sector. The literature on this process is vast but of uneven

quality.

governments, is unambiguously positive: it reduces the cost of

providing the services involved. There is more skepticism and less

evidence on the consequences of contracting for social services and for

the joint supply of infrastructure and services (public/private partnerships).

These instruments are likely to present serious—but not necessarily

insoluble — contract design problems. They may require the

government to be an active and strategic purchaser in ways not envisaged

by privatization zealots. Nevertheless, the potential economies,

especially in the accumulation and use of knowledge, make continued

experimentation worthwhile.

With respect to the entire process of commercialization, regulatory

reform, and the sale of state-owned enterprises to the private sector, the

weight of the evidence to date is that it has been beneficial. The precise

contribution of the change in ownership to the gains that have resulted

from the process as a whole is difficult to identify. One can argue,

however, that privatization is an essential part of the process in that it

provides the impetus for commercialization and makes regulatory reform,

especially regulatory forbearance, possible.

Whether or not privatization is a necessary part of the process, once

commercial objectives have been adopted and regulatory reform has

allowed competition or potential competition to exert its disciplining

force, there is little, if anything, to be gained from continued state

ownership — provided that the government sells its interest at a price

equal to the present value of the income it might expect to derive from

continued ownership.

Although the international experience with process ofcommercialization,

regulatory reform, and privatization has been favorable and

there are good conceptual arguments for privatization itself, the case for

individual privatizations must still be made on the merits. The body of

existing evidence is not so strong or so detailed that it can be taken to

imply that, say, the province of Saskatchewan would necessarily realize

significant economic benefits from privatizing its electric power or

telecommunications utilities.

The theoretical and empirical literature on privatization reminds

us to remain open to the potential benefits of employing decentralized

market or market-style incentives in place of hierarchy and command

and control. The ongoing international experimentation in institutional

design has been worthwhile and is clearly worth pursuing further.

The literature also teaches that privatization is frequently not about

pushing a button and getting less government. Unless the political

forces that brought about government intervention disappear (and they

may in some cases), privatization will be about getting different government,

rather than less government. It may involve catering to a different

set of interest groups or catering to the same interest groups in a

different way. It may involve the same or similar political activity

in different forums. It is often not simply a matter of opting for the

invisible hand.

created a national air service, Trans-Canada Airlines (later Air Canada)

created the Canadian Broadcasting Corporation (CBC) as a Crown corporation

created the National Harbours Board

restructured the debt-ridden Canadian National Railway (CNR)

established the St. Lawrence Seaway

established Canada's nuclear industry

initiated the Trans-Canada Pipeline

Professional Career of CD Howe:

Engineer

Taught at Dalhousie University in Halifax

Businessman - designed and built grain elevators

Political Affiliation:

Liberal Party of Canada

Riding (Electoral District):

Port Arthur (Ontario)

Political Career of CD Howe:

C.D. Howe was first elected to the House of Commons in 1935.

He was appointed Minister of Railways and Canals and also Minister of Marine. The two departments were soon combined into the Ministry of Transport. C.D. Howe oversaw the reorganization of Canadian National Railways, and the creation of the National Harbours Board and Trans-Canada Airlines, the forerunner of Air Canada.

In 1940, C.D. Howe was appointed Minister of Munitions and Supply in charge of war production for Canada. As head of the War Supply Board, and with the authority of the War Measures Act, C.D. Howe created a huge rearmament program using "dollar-a-year men," business executives called to Ottawa to reorganize the economy. The British Commonwealth Air Training Plan, which created more than 100 aerodromes and landing fields and trained over 130,000 airmen, was one of the results.

In 1944, C.D. Howe was appointed Minister of Reconstruction, and then Minister of Reconstruction and Supply, and began turning the economy toward consumer needs.

C.D. Howe became Minister of Trade and Commerce in 1948.

In 1951, with the growth of the Cold War, C.D. Howe became Minister of Defence Production as well as Trade and Commerce and oversaw the growth of the Canadian aircraft industry.

In 1956, C.D. Howe forced the plan for the Trans-Canada Pipeline, a gas pipeline from Alberta to central Canada, through Parliament but paid heavily when the Liberal government lost the next election and he lost his seat.

C.D. Howe retired from politics in 1957 at the age of 70.

C. D. Howe was known for getting things done.

That made him exactly the type of leader Canadians needed to channel their domestic energies into military might during the Second World War.

Clarence Decatur Howe is best remembered as Prime Minister Mackenzie King's right-hand man. When King decided to meld responsibility for railways, marine transport and civil aviation into one powerful Ministry of Transport in 1936, the prime minister put Howe in charge.

Not only did Howe's achievements in transport help ready Canada's transportation systems for the massive load they would have to carry during the war, but the transportation policy expertise he acquired left him well-prepared to direct the all-important Ministry of Munitions and Supply during the war.

Howe was, as he put it, a "Canadian by choice." A carpenter's son, he was born in Waltham, Mass., in 1886, moving to Canada in 1908 to teach civil engineering at Dalhousie University in Halifax. He later established a consulting engineering firm that specialized in grain elevators.

King brought Howe into politics in 1935 and he immediately began to cut a swath through bureaucracy, refusing to be bound by tradition and red tape, seeing himself much more as an implementer than a policymaker.

Howe was particularly interested in establishing a strong Canadian presence in the growing field of civil aviation.

He was instrumental, before and after the war, in establishing or expanding Trans-Canada Air Lines, the National Harbours Board, Canadian National Railways, the St. Lawrence Seaway, the TransCanada Pipeline and even the CBC.

Canada's first Minister of Transport took over a Canadian transportation system that was fragmented and outdated.

He centralized the administration of ports and reformed the debt-laden CNR, increasing efficiency and accountability that would be so important during the war.

Unemployed workers of the "Dirty '30s" were mobilized to build airstrips across the country and Trans-Canada Air Lines, Air Canada's predecessor, was established as a Crown corporation.

All these measures helped to pull the country's transportation network out of the Depression, preparing it for the incredible challenge that it would face in 1939-45.

When Canada entered the war in September 1939, Howe retained the Transport portfolio but was also asked to take on Munitions and Supply.

One of Britain's first requests was that Canada play host to the British Commonwealth Air Training Plan, which would train nearly 50,000 pilots and groundcrew by war's end.

Howe left Transport to concentrate on Munitions and Supply in July 1940, but continued to prod the transportation sector for the extraordinary performances he was demanding of other Canadian industries.

Before the end of the war in 1945, railway traffic had tripled in Canada as food, munitions and other war supplies were rushed to Atlantic ports.

Howe was criticized for forging ahead with little regard for costs, but the results he engendered soon silenced his critics. Costs wouldn't matter if the war was lost, he told colleagues, and in victory, costs would be forgotten.

The war, of course, was won and the relentless energy of Canada's first Minister of Transport played a major role in the victory.

Canada's other wartime ministers were P. J. A. Cardin, 1940-42; J.-E. Michaud, 1942 - April 1945, and Lionel Chevrier, April 1945 - June 1954.

Friday, September 07, 2007

P3 Myth Busting

Dismissing an independent study on P3's the Alberta Government says it has studied P3's and gives them the big thumbs up.

A landmark study of private-public partnerships around the globe concludes they don’t save taxpayers money, undermine democracy and hurt small business – even as Alberta is making P3s a key component of its long-term plans.Ok let's see the Stelmach government studies. Opp's it appears we can't. It seems it's all anecdotal.But the Alberta government’s public relations department says it’s confident its projects won’t follow that trend and called the study “a nice academic exercise.”

The study, released by the Federation of Canadian Municipalities – the group that represents most communities across Canada – looked at schools, hospitals, road systems, subways systems and waterworks.

It found no cost savings amongst any of the studied projects. Further, when overruns, changes to long-term contracts and shifting public priorities were considered, many cost more money than their publicly funded equivalent.

A key reason was borrowing powers, said researcher Pierre Hamel. All of the projects, whether public or private, were funded with long-term borrowing.

“Promoters of P3s typically answer that by saying that although the borrowing cost is higher, they’re much more efficient. But in fact they simply limit their upfront costs by paying staff less money. And they put that back into their profit margin, not into savings to the public.”

Hamel concluded most P3s end up costing about the same as the public equivalent.

But there are downsides: a lack of political accountability if a project goes awry, because the responsibility has been downloaded to a private company; ironclad contracts that cost a fortune to get out of if public priorities change; and project development plans so complex – and privately guarded by the companies – that future contracts can often only be bid on by the initial P3 operator.

“The biggest company cannot borrow at a cheaper rate than the smallest municipality,” he said.

“Promoters of P3s typically answer that by saying that although the borrowing cost is higher, they’re much more efficient. But in fact they simply limit their upfront costs by paying staff less money. And they put that back into their profit margin, not into savings to the public.”

Hamel concluded most P3s end up costing about the same as the public equivalent.

But there are downsides: a lack of political accountability if a project goes awry, because the responsibility has been downloaded to a private company; ironclad contracts that cost a fortune to get out of if public priorities change; and project development plans so complex – and privately guarded by the companies – that future contracts can often only be bid on by the initial P3 operator.

Alberta has its own research on P3s that supports them, said Jerry Bellikka, with Alberta Infrastructure and Transportation.

“That’s his clear opinion. We’ve been very clear on all of them that when we look at it, we do a complete business case analysis of every project, and in every example where we have gone to P3s we are confident that we are achieving major cost savings for the taxpayer.”

FCM RELEASES NEW REPORT ON PUBLIC-PRIVATE PARTNERSHIPS

OTTAWA, Aug. 31 – Can public-private partnerships (P3s) meet the infrastructure needs of cities and communities?This question has assumed growing importance, with Canada facing a more than $60-billion municipal infrastructure deficit and the federal government increasingly favouring P3s for infrastructure projects.

A new report by Professor Pierre J. Hamel of Montreal’s INRS-Urbanization looks at specific examples of municipal P3s to determine how, and how well, these projects work. The new report, Public-Private Partnerships and Municipalities: Beyond Principles, a Brief Overview of Practices, presents his findings.

After all the Alberta Tories tried to build a hospital with a P3 back in 2004 and it failed.

And that is the last time anything was posted on Alberta Infrastructures P3 page.

In August, the Calgary Regional Health Authority – normally known for spearheading privatization - cancelled Calgary’s planned P3 hospital and replaced it with plans to build the hospital publicly.

Because 2004 was when Alberta Infrastructure started issuing P3 projects, like the Calgary Court House . Which like Calgary's hospital was another costly mistake.

The Calgary Courthouse P3 boondoggle in 2004 had cost overruns of 67% caused by private partners.

Since then they have been hell bent on doing P3's for three years. I would love to see their more recent study. But it is not posted on their website.

It appears there is no government study, unlike the one done by the FCM, rather it seems the Minister of Education simply read some briefs through partisan glasses.

March 14, 2007 Alberta Hansard

Private/Public Partnerships

The Speaker: The hon. member.

Mr. Chase: Thank you. Obviously, the minister is dealing with a 25-watt bulb. My last question is to the Minister of Education. Why is the minister suggesting that we saddle Alberta taxpayers with a 30-year debt to not only build P3 schools but maintain and operate them privately when we have the money to build them publicly and transparently now? Debt or no debt, Mr. Minister?

Mr. Liepert: Well, Mr. Speaker, first of all, as we discussed earlier, we need schools where kids live. Despite what this hon. member says, we do not have $7 billion laying around to spend on schools. There have been a number of P3 and alternative financing projects around the world that have been successful, and there have been a few that have been unsuccessful. The research I did was that every time a P3 was unsuccessful, it was commenced by a Liberal or a socialist government.

Aha! Of course! The FCM once had Jack Layton as its President, so of course it's nothing but a socialist, Liberal front.

Find blog posts, photos, events and more off-site about:

Alberta,Canada, Pierre J. Hamel, P3, public-private-partnerships, Alberta Infrastructure., Ed Stelmach, Calgary Courthouse, investment, infrastructure, economics,

P3, privatization, public-private-partnerships, Canada, Federation of Canadian Municipalities, FCM, Government, scandal, Calgary

Sunday, August 26, 2007

Infrastructure Collapse

Tunnel ceiling cracks close Montreal streetsThis is the empirical result of the neo-conservative political agenda of reducing taxes and regulations,failing to fund infrastructure and public services, and promoting privatization.

–A large section of downtown Montreal will remain closed for the weekend after two cracks were found in a tunnel that makes up part of the underground city.Montreal police widened a safety perimeter last night to include a number of blocks in the city's downtown core after officials felt there was a real risk of a road collapse following the discovery of cracks in an underground tunnel.

Fire chief Serge Tremblay told reporters last night that a second fissure was also found, but experts haven't been able to conclude what caused the cracks or how long they had been there.

Bridge to Laval latest to undergo repairsSince the collapse last year of the Laval overpass, Quebec's Transport Department has been conducting more thorough inspections of the province's infrastructure.

Last week, responding to fears a 69-year-old north-end Montreal overpass could collapse because its concrete has "weakened," the city barred all trucks from the heavily-used structure and announced plans to demolish and rebuild it next year.

Bridges in Canada have reached 49 per cent of their useful life, according to a 2006 Statistics Canada study, and experts warn our country's roads, wastewater plants and other infrastructure isn't in any better shape.

A Statistics Canada study examining the age of infrastructure in Canada cited wastewater treatment facilities as the oldest, with 63 per cent of their useful life behind them in 2003. Roads and highways had reached 59 per cent of their useful life, and sewer systems 52 per cent.

Of course it is not only occurring in Canada, but also in the U.S. which originated the daft ideology of the neo-cons.

Emergency personnel look over a truck that lies in a hole in the street after a steam explosion in midtown Manhattan, New York, Wednesday, July 18, 2007. (AP Photo/Seth Wenig)

Cataclysmic infrastructure collapse: Who pays?And so the result is the idea that P3's will solve the under investing done by Governments at all levels for the past two decades. Except the so called 'private' partner, ain't. It's your and my pension funds. In other words you and I pay twice, as taxpayers then as Pension Fund participants.

A recent Minneapolis bridge collapse and New York steam pipe explosion, both of which collectively caused the deaths of at least six people and more than US$250 million in damages, has brought infrastructure liability to the fore, according to a report by KPMG.

At issue is whether insurers are on the hook for the cataclysmic failure of a decaying urban infrastructure.

KPMG Insurance Insider quotes Claire Wilkinson, the vice president for global issues at the Insurance Information Institute, on the issue of where liability falls in the event of a massive infrastructure failure.

She notes that, in the United States, federal and local authorities that administer bridges and road can claim "sovereign immunity" to avoid liability. But she adds the common-law defense may no longer apply if the infrastructure was under repair, opening the public entities and contractors to charges of negligence..

"A contractor employed by the state could cause damage where the state would be held liable," KPMG quotes Wilkinson as saying.

And even if a contractor has liability coverage, Wilkinson adds, in a world of multi-million construction projects, the limits would likely be quickly eclipsed. KPMG notes that in the event a state contractor exceeded liability limits, the pubic entity might be held responsible for project liability associated with the costs of reconstruction, casualty, property business interruption and/or workers compensation claims.

The bridge collapse in Minneapolis is giving rise to other concerns. Hundreds of billions is needed to rebuild the nation's infrastructure. It's not just roads and bridges. It's also generation and transmission.Enter infrastructure investing: Public and private pension funds currently invest in varied assets that range from stocks to bonds to real estate. But some are now taking a look at vital infrastructure as a way to earn better-than-average returns as well as to guarantee the longevity of an area's economic growth. If such allocations could provide competitive returns, pension experts say that fiduciaries and trustees would not violate their obligation to act solely in the interest of plan participants.

See:

Minister of P3

Mr. P3

Super P3

Public Pensions Fund Private Partnerships

Pension Fraud Brings Down Japans Government

Find blog posts, photos, events and more off-site about:

bridge collapse, Quebec, failing infrastructure, , Pensions, P3, public-private-partnerships, insurance, CPP, Ontario-Teachers-Fund, OTF, Canada, investment, infrastructure, risk management, shareholders, economics,

P3, privatization, public-private-partnerships, Canada, Government, scandal, Ottawa

New York City, steam, , Big Apple, explosion, Manhattan,

Tuesday, August 21, 2007

Fire Sale

After costing taxpayers an extra $100 million dollars in construction costs due to being a Mulroney government P3 the Federal Building in Edmonton and eight others across Canada are being sold at fire sale prices.

The $400 million they make off this mistake will not cover the 25 year rental cost to taxpayers of $79 million a year. Instead it's going to cost us almost $2 billion to lease back.

So would you sell your house and then rent it back, and agree to invest in upgrades? This is another example of neo-con ideology trumping economic common sense.

The federal government is selling nine office complexes, including two in Ottawa, to a private Vancouver developer for $1.64 billion -- $400 million more than the appraised value for the properties.

At the same time, the union representing many of the federal workers in the buildings labelled the deal "a give-away of colossal proportions."

"In addition to ceding ownership of the nine premium properties, the federal government has, in effect, written a $630-million cheque signed by Canadian taxpayers," said Patty Ducharme, the union's national vice-president.

The union cited its own study, done by Informetric, an Ottawa economic consultant. It valued the nine properties at almost $2.3 billion, Ms. Ducharme said.

The deal involves the sale of government property to Larco Investments Ltd., but also requires the federal government to lease back the office space for 25 years. That substantially reduces the risk to the new private owner.

The lease-back agreement calls for the government to pay base rent of $79 million a year plus operating and maintenance costs, officials said. Rents will be set annually by Public Works and Government Services to cover agreed-upon services, including annual maintenance costs.Of the $1.644-billion purchase price, $1.567-billion will go to the government. Of this, RBC and BMO will each receive commissions of $5.7-million, according to a government official. There will also be up to $500,000 in expenses for the sale.

The remaining $77-million of the sale price will be used to undertake a 10-year capital repair program, while the government will be responsible for other expenses, including maintenance, repairs and other building improvements.

The government has agreed to lease back the nine buildings for 25 years, with payment amounts rising in five-year increments. Lease payments will total $505.3-million over the 25 years, rising from $82.2-million in the first five years, to $122.1-million in years 20 to 25.

See:

Minister of P3

Mr. P3

Super P3

Public Pensions Fund Private Partnerships

Find blog posts, photos, events and more off-site about:

Alberta, Heritage Trust Fund, LAPP, Alberta Investment Management Corporation, Canada, Pensions, P3, public-private-partnerships, OMERS, CPP, Ontario-Teachers-Fund, OTF, Canada, investment, infrastructure, VenCap, shareholders, economics,

P3, privatization, public-private-partnerships, Canada, London, UK, Rotor, Tipple, Harper, Government, scandal, Ottawa

Wednesday, August 08, 2007

Dumb and Dumber

P3's don't save taxpayers money.

This was a costly dumb idea under the Mulroney Conservatives and the Harper Conservatives are going to repeat the same mistake.

And the irony in this is that it will be public sector workers pensions that will probably ending up owning it.

The government has reportedly received advice that Edmonton's Canada Place is the most valuable of the nine buildings being considered for sale. It is worth $265 million if sold under a 25-year lease-back deal.Canada Place was valued at $152 million when the Treasury Board approved its construction in 1984. But in 1988 Kenneth Dye, then the federal auditor general, reported that the new Edmonton home of 3,200 federal civil servants would end up costing taxpayers $100 million too much.

Part of the extra cost was the result of a decision to have Canada Place built privately under a lease-purchase deal instead of having the government build it.

But Dawson wasn't sure how a benefit for business can work for the government.

"They're not in business and they're not necessarily going to re-employ that money at any kind of a return."

As for possible buyers for Canada Place, Dawson said large pension funds may be interested.

See:The Canadian Pension Plan Investment Board (CPPIB) now invests 45% of its assets outside Canada, up from 36% in 2005. Ontario Teachers' Pension Fund increased the percentage of non-Canadian assets in its equities portfolio from 56% in 2005 to 66% in 2006. OMERS has increased its foreign assets from 29% in 2000 to 39% in 2006.

With almost $500-billion in combined assets, the five top Canadian pension funds are getting a bigger piece of the global play book.

Not surprisingly, Canadian pension funds are now viewed as virtual private equity groups, says David Mongeau, of U.K.-based Avington International, a global mergers and acquisitions advisory firm that stickhandled a number of recent deals including the Legacy REIT sale with Caisse de depot, and the BCIMG purchase of the Canadian Hotel Income Properties Real Estate Investment Trust.

Minister of P3

Mr. P3

Super P3

Public Pensions Fund Private Partnerships

Find blog posts, photos, events and more off-site about:

Alberta, Heritage Trust Fund, LAPP, Alberta Investment Management Corporation, Canada, Pensions, P3, public-private-partnerships, OMERS, CPP, Ontario-Teachers-Fund, OTF, Canada, investment, infrastructure, VenCap, shareholders, economics,

P3, privatization, public-private-partnerships, Canada, London, UK, Rotor, Tipple, Harper, Government, scandal, Ottawa

Tuesday, July 24, 2007

Contracting Out Is A Crime

SEE:Ex-federal employee guilty of huge fraud

A former defence bureaucrat, who led a jet-set lifestyle, pleaded guilty today to two charges in a phoney contract billing scheme that bilked $146-million out of the federal government before it was stopped.Paul Champagne, who had been an $80,000-a-year contract manager with the department, pleaded guilty to one count of fraud and one count of breach of trust in an Ottawa courtroom.

He was fired from his job in 2003 after billing irregularities were revealed involving a contract with U.S. computer giant Hewlett-Packard.

After a lengthy RCMP investigation, Champagne, 49, was charged with seven fraud-related crimes. After he pleaded guilty today to two charges, the Crown dropped the remaining five counts.

He will be sentenced in January.

In the late 1990s, the Defence Department issued a series of contracts to Hewlett-Packard (Canada) Inc., eventually paying $159 million for computer maintenance services. The government later discovered it got little or nothing for its money.

The Public Works Department red-flagged the contracts over the four years prior to Champagne's dismissal, but did nothing. A scathing report in 2003 found that managers at the federal government's tendering department failed to appreciate the significance of at least three audits that warned something was terribly wrong with the computer contracts.

After the scandal became public, Hewlett-Packard said it was told by the department to pay a group of subcontractors and their work was deemed secret.

In May 2004, the computer giant repaid $145 million to the federal government, and said its employees did nothing wrong.

Two Ottawa businessmen, Peter Mellon and Ignatius Manso, were also charged, but the Crown said Monday only one case remains to be resolved. A spokesman for the RCMP couldn't say what the status of the cases might be.

Over 10 years, starting in 1993, five contracts worth a total of $250 million were signed with the Compaq Computer Corp., Digital Equipment and Hewlett-Packard, which eventually bought Compaq.

Audits conducted by Public Works in 1999 and 2000 raised concerns about three of the contracts, but in 2001 a further review found unauthorized billing and "evidence of contractual funding appropriated for other purposes."

After Champagne was fired, National Defence did its own internal review of contracts and discovered problems with two dozen other projects. Today, the Defence Department did not respond to requests for comment about what safeguards have been put in place to prevent a repeat of the fiasco.

At the time of his arrest Champagne was a multimillionaire, who insisted his wealth and homes in exclusive districts of Ottawa, Florida and the Turks and Caicos were the results of shrewd investment in high-tech stocks during the tech boom of the late 1990s.

Defense Lobbyist Now Minister

Find blog posts, photos, events and more off-site about:

P3, privatization, public-private-partnerships, Canada, London, UK, Rotor, Tipple, Harper, Government, scandal, Ottawa, MacDonald Commission, Canada, Liberals, free trade, Trudeau, Emerson, Conservatives, Harper, Government, investment, politics, trade

Tags

Politics

Canada

government

P3's

contracting out'

privatization

DND

computers

technology

fraud

Crime

RCMP

Monday, June 18, 2007

How The MacDonald Commission Changed Canada

Tracing the roots of Canada’s contemporary involvement in North American free trade back to the Royal Commission on the Economic Union and Development Prospects for Canada in 1985 – also known as the Macdonald Commission – Gregory J. Inwood offers a critical examination of the commission and how its findings affected Canada’s political and economic landscape, including its present-day reverberations.

In this case the recommendations that led to the reinvention of the Liberal government as a Neo-Liberal government began with the Commission they set up under Donald MacDonald.

Macdonald represented the Toronto-Rosedale riding for 16 years as a federal member of parliament. He served nine years as cabinet minister in portfolios such as national defence, finance and energy, mines and resources. He was high commissioner for Canada to the United Kingdom from 1988 to 1991, and from 1982 to 1985, he chaired the Royal Commission on the Economic Development Prospects for Canada (known as the Macdonald Commission).

What the Liberals didn't do was follow the MacDonald Commission recommendations on UI/EI.

Moreover, instead of following the Commission’s recommendation for increasing federal contributions to UI during recessionary periods, the government eliminated all contributions to the program by 1990. And there is no evidence that the government has seriously considered proposals made by the Commission and others for experience-rating the program’s financing.

The intensity rule and benefit clawback of 1996 were sold as “worker-side experience rating” (see Nakamura and Diewert (2000)), but they proved as politically unpalatable as employer-side experience rating of premiums. Indeed, since the mid-1990s and continuing today, the feds’ most notable attitude toward EI is that the program is a handy, covert source of net funds for other governmental purposes.

Nor did they follow the Commissions recommendations for a Guaranteed Annual Income.

The Universal Income Security Program (UISP) was the Commission’s other major recommendation for reforming income security. In essence, the UISP was a guaranteed income scheme that would have replaced other programs such as the Guaranteed Income Supplement, Family Allowances, the refundable child tax credit, child and marital tax exemptions, federal social housing programs, federal transfers to the provinces for Social Assistance (SA), and the income support functions of UI. UISP payments were to be made on an income-tested basis, with a tax-back rate of 20 percent applied to all income in addition to the normal personal income tax rates. The Report stated, “The UISP seems to Commissioners to be the essential building block for social security programs in the twenty-first century.

Instead they applied a neo-liberal approach of tax credits, which increased the taxable income of those who received government supplements. So in effect the working poor, paid for a benefit they received from the government. The Federal government let the provinces off the hook by paying their share, and allowing them to cut Social Assistance on the promise that the savings would go back into broad based public programs for the working poor.

The reality was a claw back of provincial benefits, real cash in your pocket, for a credit chit from the Feds, your tax dollars at work. The ensuing benefit not being taxed, meant that the working poor moved up the income tax scale. Not unlike the current Conservative Child benefit; their so called universal child care program.

Second, beginning in 1998 the National Child Benefit (NCB) System subsumed the CTB and replaced its earnings-related benefit with a substantial cash supplement for lower income households with children. Under agreements with the federal government, most provincial governments reduced their SA benefit rates for children by amounts equivalent to the NCB supplement. Again, this scheme pursued a Commission goal of reducing the disincentives for welfare beneficiaries to seek or return to work. These changes also reduced the break-even

income levels for welfare beneficiaries, though the provinces have not reduced phase-out rates for their own benefits. The “reinvestment” of provincial savings from reduced SA cash benefits into in-kind benefits for the working poor and welfare beneficiaries promoted the lowering of the welfare wall, but the benefit phase-outs further aggravated disincentives for the working poor.

Despite the visible positives from the NCB initiative, the scheme also mirrored the

hidden deficiencies of the Commission’s UISP scheme. That is, the NCB supplement phase-out sharply raised the effective marginal tax rates faced by many working poor and near-poor families. The NCB scheme did reduce the “welfare wall” but simultaneously erected a higher “success wall” keeping the working poor and near-poor from advancing to higher earnings.

What made the MacDonald Commission unique was the near unanimty of the political economists who agreed that Free Trade was the panacea for Canada's stagnating economy. An economy that was no worse off nor better off than any other at the time of global recession. However dissident voices were not to be found amongst the Academics of the day who promoted Free Trade saying There Is No Alternative. And so the Liberals led the push for Free Trade despite John Turners tearful denials in his debate with Mulroney and Broadbent.

Policy makers who want a policy initiative in place may well foster the research to support the initiative. This fostering could come in various forms: commissioning background studies from sources known to favor the initiatives; designing the terms of reference in ways that will yield favorable results; “advertising” favorable results while “burying” unfavorable results; or, reviewing the research with suggestions tilted towards influencing the results or having them presented favorably.

In Canada, the signature recommendation of the Macdonald Royal Commission of 1985, was for a bilateral free trade agreement between Canada and the U.S. That recommendation led to the Canada-U.S. Free Trade Agreement (FTA), negotiated between 1985 and 1987 and implemented January 1, 1989. The research of the Commission was extensive, involving 280 studies done mainly by 300 different academics in 70 volumes.

The importance of academic research to the Commission is also illustrated by the fact that 84 percent of the 1,014 references in the final report are to research studies (67 percent from the academic literature and 17 percent from the background research studies of the Commission which tended to synthesize the academic research). Only 10 percent of the references were to briefs formally presented to the Commission and 6 percent from references to transcripts of the public hearings (calculations from data in Inwood, 2005:181).

The fact that the academic research generally favored free trade while the briefs and public hearings generally involved advocacy positions opposed to free trade, suggests that the research also had a greater impact (Inwood, 1998:18).

The research on trade had a number of important characteristics that likely facilitated its

impact on public policy. It was high quality research done by top researchers in the country and coordinated by a prolific and respected trade economist. The computable general equilibrium models were particularly influential, especially because they captured the indirect productivity enhancing effects of the restructuring that would occur because of the economies of scale for producing for a large market. The research of the Commission generally involved a synthesis of the cumulative stock of existing research, the vast majority of which favored free trade. The near consensus perspective favoring free trade is illustrated by the fact that “only one academic could be found to make the anti-free trade case out of the approximately three hundred hired by the Commission” (Inwood, 1998:35).

This homogeneity of perspectives within economics and the rigor with which they are advanced made economics prominent as a source of policy advice to the Commission (Simeon, 1987). Brooks and Gagnon (1988:109) conclude that this is a more general phenomenon: “There can be little doubt that economists remain pre-eminent among social scientists in their integration with the policy process.”

The research also had champions who made the case for free trade to the Commissioners and to the politicians, and who defended it in the heated public debates that ensued. Trade unions strongly opposed the FTA and organized public forums against it. In countering this, Macdonald (2005:11) acknowledges the important role played by an Industrial Relations academic, John Crispo, for “his robust platform technique which ultimately frightened away the union leaders from contested meetings where initially it was they who had brandished the verbal brass knuckles.”

There were certainly attacks on the research and on the academic case for free trade. However, the attacks tended to be polemic and based on more nationalistic denunciations of free market economics in general. They tended not to provide alternatives based on different methodologies, and the work was generally simply presented at conferences or published in forums of contemporary opinion as opposed to peer-reviewed academic journals (Inwood, 1998:5).

The term neo-liberal was coined in this period to note the shift that mainstream political economists were making in calling for Free Trade, reductions in social benefits, reinventing government, contracting out services and privatization. All these went hand in hand, and while promoted by neo-cons elsewhere in Canada they truly were policies of the New Liberals; neo-liberalism.

Begun by Trudeau and MacDonald they were then carried through in the nineties by Chretien and Martin. The current Conservatives are the beneficiaries of the Liberal restructuring of the state.

While free trade was the signature recommendation of the Macdonald Commission, numerous other recommendations were made backed by labor and social policy research. As Riddell (2005) indicates, many of these

recommendations were implemented into policy, including unemployment insurance reforms; active adjustment assistance policies; income supplements to the working poor; national testing of student achievement; and deemphasizing minimum wages.

In his overall assessment, Bradford (1999/2000:158, 159) concludes: “The Macdonald Commission report remains the essential component reference point for the host of era-defining policy innovations, ranging from continental free trade to restrictions on unemployment insurance and retrenchment of the federal role in social assistance, legislated between 1985 and 1997 by successive Conservative and Liberal governments.”

Freer trade was also regarded as a potentially effective way for the federal government to pressure provincial governments to adopt market-oriented reforms given the substantial control they have over policy initiatives in Canada’s system. This was especially the case since there was a backlash against the nationalist and government interventionist policies that prevailed during the 1960s and 1970s, including wage-price controls, energy price fixing, foreign investment restrictions, government procurement policies, and a state trading corporation to

assist smaller Canadian firms to sell to centrally planned economies (Chant, 2005:14). Such policies were often regarded as contributing to the worst recession Canada experienced since the Great Depression of the 1930s.

Interestingly, while he was previously in political office, Macdonald himself presided over many of these interventionist strategies including a national oil policy, a state-owned petroleum company, government investment in oil developments that were avoided by the private sector, price controls on uranium exports, and the wage-price control program. He attributes his conversion to free trade and less government intervention to: “My experience in the private sector after my departure from government made it clear that state-controlled programs

had failed to achieve the rates of growth to which we all aspire” (Macdonald, 2005:9).

This rejection of nationalist-interventionist policies also occurred for Prime Minister Trudeau who had earlier instituted many of the policies in the 1970s. By 1982, he indicated: “Personally, I remain convinced that the primary engine of economic development must be a dynamic private sector and that the marketplace is in most circumstances the best allocator of scarce resources”

The Liberal reinvention of government in this period meant the whole scale contracting out of government services, in particular computer based IT as well as P3 programs and the sell off and lease back of government buildings. Which has resulted in the the various scandals and boondoggles from the Gun Registry to the RCMP pension fund scandal.

That the Conservatives could get former Liberal Industry Minister David Emerson to cross the floor days after his election to occupy his old cabinet seat shows how interchangeable the two parties are when in power. After all Emerson is simply following through on Liberal policy even as a Conservative.

Find blog posts, photos, events and more off-site about:

MacDonald Commission, Canada, Liberals, free trade, Trudeau, Emerson, Conservatives, Harper, Government, investment, politics, trade

Friday, April 27, 2007

Minister of P3

Greg Weston of the Sun chain has an excellent piece exposing the insider deals in Public Works to sell off government buildings, which began under the Liberals, and then lease them back. Which makes about as much sense as selling your house and then paying rent.

It was only a matter of time.The moment Stephen Harper appointed a corporate investment banker to be public works minister in charge of government contracting with thousands of Canadian corporations, political controversy was sure to follow.

The inevitable storm engulfed senator-minister Michael Fortier this past week after a company publicly complained about losing a $400-million contract bid to one of Fortier's former investment banking clients.

While there is no evidence of fiddling by Fortier or his team, the opposition parties are justifiably asking that the newly created Integrity Office review the contract award, if only to lift all suspicion from the minister and reassure the public.

For all the same reasons of probity and protecting reputations, maybe the ethics folks might also want to review what could be the largest government real estate deal in decades.

Fortier announced in March that public works is ready to sell $1.5 billion of federal office buildings that the government would then lease back for the next 25 years.

Last September, Fortier's department awarded the contract for the real estate sell-off to the investment banking arms of the Royal Bank (RBC) and the Bank of Montreal (BMO), a deal expected to generate at least $6 million in commissions.

The key player in BMO's winning bid, for instance, was Rick Byers, managing director of the firm's government investment banking group.

Byers is highly qualified for the job as an expert in government privatizations, having had lead roles in projects such as the $1.5-billion spinoff of the air traffic control services at Canadian airports.

But Byers also happens to have been a prominent Conservative party fundraiser and organizer who has twice run for a federal seat under the Tory banner in the Ontario riding of Oakville, and is a candidate for the Ontario PCs in the provincial election this fall.

Byers' political ties to the current public works minister go back to the 1998 Conservative leadership race when Fortier ran against Joe Clark and lost by a mile.

In 2003, the two investment bankers backed Scott Brison's bid for the PC leadership -- Byers was the campaign chairman for Ontario, Fortier assumed the same role for Quebec.

One of Brison's chief fundraisers was another highly respected investment banker named Michael Norris, then head of RBC's investment banking operations and now the firm's deputy chairman.

It all begins with the appointment of investment Banker Michael Fortier to the Senate as the unelected Minister of Public Works and goes downhill from there.

The Public Works changes now throw into disarray the procurement-reform process, which is intended to generate savings of $2.5-billion over five years. The savings have already been built into the government's books and Prime Minister Stephen Harper mandated Mr. Fortier to find the savings.But before more reforms are made, the minister wants answers on two issues raised by The Globe and Mail this week, a senior Public Works official said: a trip to London by two high-ranking advisers that was marred by missed and cancelled meetings; and a consulting contract with A.T. Kearney Ltd. that was supposed to be worth $15-million over four years but has cost $24-million in only nine months.

“The minister has asked for a full report on the A.T. Kearney contract to see whether we obtained value for money,” the official said. “Why did we spend more in one year than what we had planned over four years? There was obviously a management problem.”

The contract was awarded in November by the previous Liberal government, but most of the cost increases occurred after the Conservatives came to power this year.

The Liberals began the overhaul at Public Works, an initiative known as The Way Forward, which is supposed to save $3.5 billion over five years. The Harper government endorsed the reforms, but Mr. Fortier took a different course from the Liberals, who considered selling much of the government's real estate holdings, and issued a tender call for advisers on how to manage the portfolio. That contract will be awarded soon.

The Tories continued the course started by the Liberals for procurement reform until Mr. Fortier faced a near revolt from small suppliers over a tender call for temporary help agencies that called for the use of reverse auctions.

It turns out that this is another case of the Government commissioning a study that it does not want to share. The study being done by party pals of the government,and Minister Fortier, who would benefit from the sale and leasing of these buildings. It replaces the previous Liberal contract with A.T. Kearny and the Tipple Rotor non report.

The two consultants hired by Fortier will profit from this for their employers, two of Canada's biggest banks, the lucrative fees they make kick backs to stalwart Conservative political operatives.

Public Works Minister Michael Fortier rejected demands from opposition members yesterday to refer a controversial plan to sell off nine federal buildings to the newly created Integrity Office.

Fortier also refused to release a report from two banks giving advice on the prospective sale and lease-back of the buildings, estimated to be worth $1.5 billion.

Those two banks would also earn a commission on the future sale of the federal buildings, Fortier confirmed to a Commons committee yesterday.

Officials would not disclose the details of that commission.

Like the guys who went to England to learn from New Labours P3 failures paid for secretly by the PMO, were hired as government consultants. And thanks to the power of the PMO, their report paid for by taxpayers also remains secret.

Hon. Michael Fortier: Let's deal with the gentlemen and the visit

to London. I had a report from the deputy on what the business trip

was about, and I'll let him talk about this in a second.

With respect to A.T. Kearney, there is no report. They were hired,

as you pointed out earlier, more than 18 months ago through a fair

RFP open process. Big numbers. I totally agree with you. Where I

come from, $19,000 is a lot of money. The original contract was for

$19 million with the ability to go to $24 million. The media reports

talk about the contract being seven or eight or nine or ten times what

it was supposed to be. The reality is it was signed by the former

minister, and the number that he authorized is the number that was

spent.Ms. Peggy Nash: Excuse me, Mr. Minister, you say there was no

written report that came out of this $24 million contract. What did

come out of it?Hon. Michael Fortier: They were advising the department in

three or four specific areas. One was to actually look at these savings

and see how they could be generated. They were looking at $20

billion of procurement through 50 to 60 departments, and they were

helping the department literally collect data and strategize on the

reform itself.The reform is not just about saving money. We've talked about it.

It's about proceeding with procurement in a smarter and more

transparent fashion.Ms. Peggy Nash: When there were reports of the two

Hon. Michael Fortier: I spoke with the deputy. The deputy

representatives who spent a week in London and cancelled

meetings—I don't know if they actually succeeded in meeting with

anyone there—the media reported that you had asked for a report.

Did that happen?

reported to me on what the situation was.

This is not "New", the Harper Government of Canada really is becoming all too tiresome in its predictability for autarchy and secrecy.

During an appearance before the Standing Committee on Government Operations and Estimates, the Minister refused repeated requests by opposition Members of Parliament for an investigation into this apparent conflict of interest. The review would be conducted by the Public Service Integrity Office, an office created by the minority Conservative government as one of its new "accountability" measures.

"This government talks a good game about accountability, but they apparently forgot to send the memo to their Senator-Minister, who apparently believes he is above oversight," said Mr. Rodriguez.

Kathryn May, The Ottawa Citizen

Published: Wednesday, April 25, 2007Public Works Minister Michael Fortier says he won't ask the integrity office to investigate complaints that he was in a conflict of interest over the awarding of a $400-million technology contract because he has never been involved in the selection of bidders since he took the job.

"I have not directly or indirectly been involved in the selection and awarding of any contract, not just this contract, since I was sworn in as minister of public works in February 2006," he told the Commons government operations committee yesterday.

Last week, Ottawa-based TPG Technology Consulting raised concerns that Mr. Fortier may be in a conflict of interest over a $400-million contract it lost to competing bidder CGI Group Inc., for which Mr. Fortier worked during his previous career as an investment banker. TPG alleges the bidding process was stacked in favour of CGI, even though it offered the lowest price.

TPG Concerned that Minister Fortier Doesn't Support an Investigation into Suspicious Contract

OTTAWA, April 25 /CNW Telbec/ - TPG Technology Consulting Ltd.'s

president, Mr. Don Powell, is concerned that a number of recent statements

made by Mr. Michael Fortier, Minister of Public Works and Government Services

Canada (PWGSC), suggest the Minister is turning a blind eye to the

circumstances surrounding the pending award of a $400 million contract for

technical services. Otherwise, his department would be more willing to

investigate the potential conflicts of interests and possible breaches of

protocol surrounding this process.

"The Minister keeps stating that nothing went wrong and that he doesn't

want an inquiry into the process, but an inquiry would give other individuals

the opportunity to come forward and state once and for all what happened,"

said Mr. Powell.

"We thought this new government would welcome whistle-blowers and be

ready to investigate their claims to ensure the fairness and transparency of

the process, but the opposite seems to be happening!" Mr. Powell said.

"How can they say there's nothing wrong without even looking at what we

have? We thought the 'shoot, shovel and shut up policy' wouldn't be part of

the Conservative's agenda."

Mr. Powell said PWGSC has not seen the evidence obtained by TPG, but has

worked hard to discredit TPG's concerns.

Where is the accountability?

Mr. Powell states that he is ready to divulge information to an

independent body that will offer protection to involved individuals so that

they can feel safe in coming forward to share their concerns about this

process.

An independent inquiry is the only way to determine whether this contract

process was conducted in a fair, open and transparent manner.See:

Find blog posts, photos, events and more off-site about:

P3, privatization, public-private-partnerships, Canada, London, UK, Rotor, Tipple, Harper, Government, scandal, Ottawa