Bloomberg News | May 23, 2025 |

Nuclear power generation fusion station reactors in Homestead, Florida. Stock image.

President Donald Trump on Friday signed orders meant to accelerate the construction of nuclear power plants, including small, untested designs that offer the promise of rapid deployment but haven’t yet been built in the US.

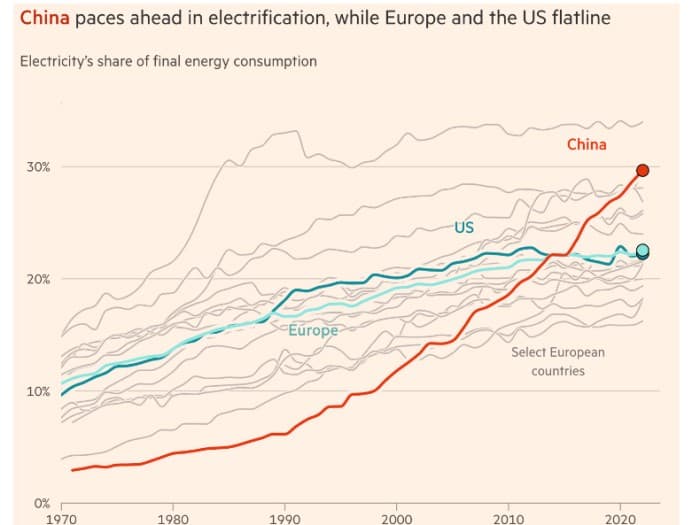

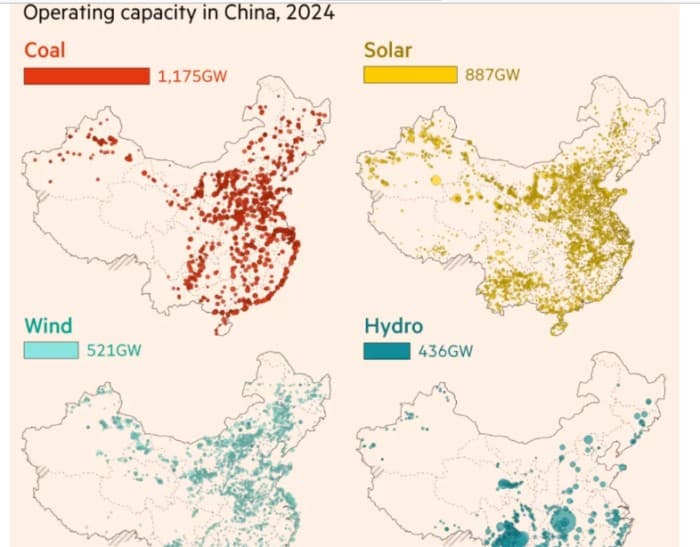

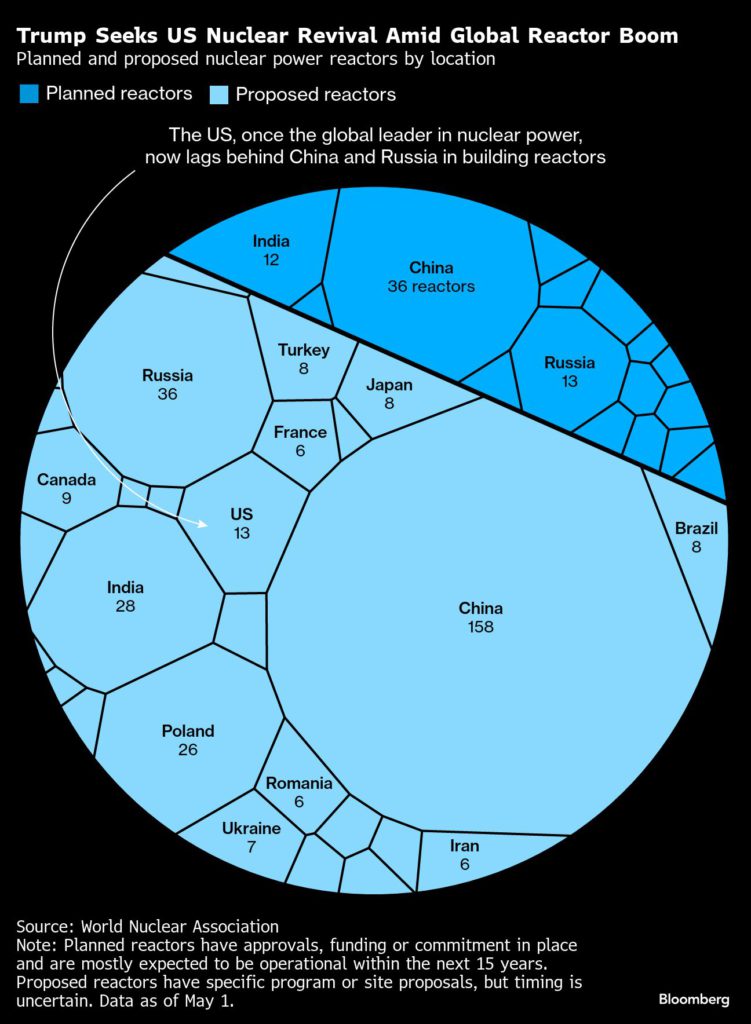

The effort is a bid to meet a coming surge in electricity demand and help the US reclaim its edge in nuclear energy. While the country was once the leader in deploying and producing nuclear power, it’s finished building only two new reactors in the last 30 years and shuttered existing plants, even as China and Russia race to deploy them.

Trump’s initiative to unleash nuclear energy could give a boost to an emission-free source of power that’s championed as a climate-friendly alternative to electricity generated by burning coal and natural gas. However, the president has cast nuclear energy as a complement, rather than a replacement, for fossil fuels.

“We’re signing tremendous executive orders today that really will make us the real power in this industry,” Trump said as he issued the directives in the Oval Office, adding that nuclear technology “has come a long way, both in safety and costs.”

Trump was joined by Interior Secretary Doug Burgum, Defense Secretary Pete Hegseth and energy industry executives including Constellation Energy Corp. CEO Joseph Dominguez and Jake DeWitte of Oklo Inc.

The initiative represents the latest bid by an American president to jump start the domestic nuclear industry, which has languished in recent decades. Former President Joe Biden last year laid out a plan to triple US nuclear capacity by 2050, and Trump’s new plan aims to quadruple it. It also comes as technology companies are clamoring for power to supply energy-hungry data centers.

The effort is likely to give a boost to companies developing small reactors, including Last Energy Inc., Oklo, TerraPower LLC and NuScale Power Corp.

One of the orders also aims to get 10 large, conventional reactors under construction by 2030, potentially benefiting Westinghouse Electric Co., whose gigawatt-scale AP1000 design was the last commercial nuclear unit built in the US and has been embraced worldwide.

Trump’s nuclear initiative also would encourage the use of government financing to support the restart of shuttered nuclear plants, target 5 gigawatts worth of upgrades at existing sites and help spur the completion of others — potentially aiding South Carolina utility Santee Cooper’s bid to resume building two reactors at its V.C. Summer plant, where soaring costs prompted the company to halt construction in 2017.

However, Trump’s nuclear push comes as lawmakers move to phase out a government subsidy that’s seen as critical to helping propel construction of new reactors and support existing plants. Developers have said the change would create a significant barrier to building nuclear plants.

Under a bill that passed the House early Thursday, new and expanded advanced nuclear projects would be eligible to receive clean energy tax credits only as long as they begin construction by the end of 2028, while tax credits for existing nuclear power plants would expire at the end of 2031.

Trump’s initiative aims to spur construction of at least one reactor at US military installations. That would allow nuclear energy to power and operate critical defense facilities and AI data centers, a senior White House official said. And, because that approach doesn’t involve commercial plants, it lets developers bypass the customary approval process through the Nuclear Regulatory Commission.

In the meantime, the NRC would also get an overhaul. Trump is ordering a reorganization of the agency and a culling of its workforce in consultation with the president’s Department of Government Efficiency cost-cutting program, along with fixed timelines for license approvals and “a wholesale revision” of its regulations.

While some developers have decried the lengthy and expensive process to secure NRC approval for proposed designs and renew licenses for existing facilities, some nuclear power advocates worry the effort may backfire by sparking regulatory upheaval and uncertainty. If new reactor designs can’t be fully vetted within the president’s proposed 18-month deadline, they warn, the models could even be rejected altogether, an outcome that would likely undermine Trump’s deployment goals.

Trump is also ordering the NRC reconsider radiation limits, saying its reliance on safety models assuming there is no safe exposure threshold has led to “a myopic policy of minimizing even trivial risks.”

Some energy experts have expressed alarm about the president’s plan to strengthen the domestic supply chain for nuclear fuel, potentially creating a market for reprocessed radioactive material and surplus plutonium stockpiles. Former US Energy Secretary Ernest Moniz this week warned that the proposal may lead “to the creation of additional stocks of weapons-usable materials.”

China makes thorium-based nuclear energy breakthrough using past US work

The president is also embracing the Energy Department’s Loan Programs Office as a potential source of financing for nuclear projects. Under Trump’s orders, the office would be directed to prioritize activities and resources for restarting shuttered plants, increasing output at existing sites, completing construction of unfinished reactors and building new advanced-nuclear units.

Constellation’s Dominguez said current permitting processes waste time, especially as data center operators and hyperscalers seek out 24/7 power supply. “We need to do this for America,” he said alongside Trump.

Reactors currently supply almost a tenth of the world’s power, including about 100 gigawatts of capacity in the US. Advocates say the industry needs to grow threefold by 2050 to help avoid the most catastrophic consequences of climate change. Like wind and solar plants, nuclear generates electricity without producing the greenhouse gas emissions that drive global warming. But reactors also have the advantage of running around the clock, delivering the non-stop power that’s in-demand from artificial intelligence companies and data center operators.

The US was at the vanguard of installing nuclear power plants for decades, but China is now the world’s top builder, with roughly 30 reactors under construction. Russia, meanwhile, has spent years honing its own technology and has exported reactors to buyers in India, Iran and elsewhere.

(By Jennifer A. Dlouhy)

Nuclear Stocks Surge on Trump Reactor Approval Plans

- President Trump is expected to sign executive orders to streamline the approval process for new nuclear reactors and to strengthen U.S. nuclear fuel supply chains, aiming to boost the industry.

- News of these potential orders has caused nuclear stocks, such as NuScale and Oklo, to surge significantly in after-hours trading.

- The White House is considering various measures to increase U.S. nuclear capacity to 400 GW by 2050, including overhauling NRC licensing and authorizing reactor deployments on military and DOE property.

President Donald Trump is expected to sign executive orders as early as Friday to boost the nuclear energy industry by streamlining reactor approvals and reinforcing fuel supply chains, Reuters reported on Thursday afternoon.

Four sources familiar with the matter told Reuters that the forthcoming orders aim to simplify the regulatory process for approving new nuclear reactors and to strengthen nuclear fuel supply chains amid mounting concerns over U.S. dependence on foreign suppliers.

The news sent nuclear stocks soaring in the after hours session, with names like NuScale and Oklo up 13% and 17%, respectively.

As we noted less than a week ago, both names are moving forward with SMR permitting and plans. Sam Altman-backed Oklo says it is navigating what CEO Jacob DeWitte calls “good uncertainty” as potential Trump administration executive orders could accelerate Nuclear Regulatory Commission (NRC) licensing, expand military and Department of Energy (DOE) nuclear roles, and boost U.S. nuclear fuel supply chains, according to UtilityDive.

On Oklo’s Q1 2025 earnings call, DeWitte confirmed the company is engaged in a “pre-application readiness assessment” with the NRC, aiming to smooth its formal license submission for a newly upsized 75-MW reactor design in Q4 2025. The company still targets late 2027 or early 2028 for first power production at its Idaho National Laboratory (INL) site.

DeWitte noted the recent departure of OpenAI CEO Sam Altman as Oklo board chair removes a potential conflict of interest should OpenAI become a future power customer. Oklo already holds about 14 GW in nonbinding agreements with data centers and industrial operators.

The White House is weighing four nuclear-related executive orders, including directives to overhaul NRC licensing with an 18-month deadline for new applications, reconsider radiation exposure limits, and authorize military and DOE property for reactor deployments—potentially bypassing standard NRC approvals.

These efforts aim to boost U.S. nuclear capacity to 400 GW by 2050, up from about 100 GW today. While the NRC is already implementing changes from last year’s ADVANCE Act, further reforms could shorten Oklo’s expected 24- to 30-month licensing timeline.

The UtilityDive report says that Zero Hedge favorite Oklo is also among eight companies eligible for the military’s Advanced Nuclear Power for Installations program, enabling on-base reactor deployments. It’s developing nuclear fuel fabrication facilities capable of reusing spent fuel that would otherwise sit in long-term storage.

Meanwhile, as we noted on X this evening, OKLO is now up 9x since Jim Cramer said "I can't even look at it" back in October 2024.

By Zerohedge.com