Rio Tinto in bailout talks for Australian aluminum smelter, AFR reports

Global miner Rio Tinto is in talks with Australian federal and state governments about a multibillion-dollar bailout for its struggling Tomago aluminum smelter in New South Wales state, the Australian Financial Review reported.

The newspaper, citing sources it did not name, reported late on Friday that talks centred on the smelter’s electricity contract for 2026 to 2029 and federal production tax credits.

Rio and the offices of New South Wales Premier Chris Minns and Prime Minister Anthony Albanese did not immediately respond to Reuters requests for comment on the report.

The future of the facility, majority owned by Rio, has been uncertain for months due in part to spiralling energy costs, according to the report.

In February, Rio, the world’s largest iron ore producer, said it would decide the smelter’s future by mid-year.

The facility about 125 km (80 miles) north of state capital Sydney uses around 10% of New South Wales’ power supply to produce 590,000 tonnes of aluminum per year. In addition to Rio, it is owned by CSR and Hydro Aluminium.

Australia’s centre-left government in January pledged A$2 billion in production credits to help support the country’s four aluminum smelters, including the Tomago facility, switch to renewable power before 2036.

(By Sam McKeith; Editing by William Mallard)

Stausholm dismisses rift rumours as Rio opens $2B mine

Rio Tinto’s (LON: RIO) (ASX:RIO) departing chief executive Jakob Stausholm insists there is no rift between him and chairman Dominic Barton, despite reports that have fuelled speculation about tensions within the board over strategic direction.

Speaking publicly for the first time since the announcement of his departure two weeks ago, Stausholm addressed the rumours at the official opening of Rio’s $2-billion Western Range iron ore joint venture with China’s Baowu in Western Australia’s Pilbara region.

The executive said the management team and board remained “absolutely aligned” on the company’s values, strategy, and performance assessment, downplaying any suggestion of internal division. He also said his successor could “very well be” an internal candidate.

Stausholm, who joined Rio in 2018 and became CEO in 2021, stepped in after the company’s controversial destruction of 46,000-year-old Aboriginal rock shelters. The incident prompted the resignation of then-boss Jean-Sébastien Jacques following investor and Indigenous backlash.

As chief executive, Stausholm pushed Rio beyond its traditional Pilbara iron ore base. He secured approvals for the long-delayed Simandou iron ore project in Guinea, expected to begin production later this year. Under his leadership, Rio also acquired Arcadium for $6.7 billion and launched a $900-million lithium joint venture with Chilean state-owned Codelco.

But while Rio’s workforce has grown by 22% to roughly 60,000 employees since his appointment, annual revenue has declined by nearly $10 billion.

Iron ore prices, for years Rio’s key profit driver, are projected to fall further, prompting the board to demand greater focus on cost discipline and operational efficiency.

Stausholm, who saw himself as a strategic thinker, not a cost-cutter, ultimately agreed to step aside.

The Danish executive also faced mounting shareholder pressure, including a campaign led by Palliser Capital and over 100 investors to revisit the company’s dual listing in London and Sydney. Shareholders rejected the proposal earlier this month.

Some investors questioned Rio’s aggressive expansion into lithium amid a slump in prices. While demand forecasts for the battery metal remain strong into the next decade, the payoff on Stausholm’s bet remains uncertain.

The Western Range launch may be Stausholm’s final visit to the Pilbara as CEO. The new mine has a production capacity of up to 25 million tonnes of iron ore per year and is expected to sustain Rio Tinto’s Paraburdoo mining hub for roughly two decades.

It also marks a milestone in cultural engagement, becoming the company’s first project to implement a co-designed Social, Cultural and Heritage Management Plan with the Yinhawangka traditional owners.

Western Range iron ore mine marks a new beginning, says OUTGOING Rio Tinto CEO

Rio Tinto (LSE/ASX: RIO) chief executive officer Stausholm was in Western Australia’s Pilbara region Friday, attending the opening of the company’s new Western Range iron ore mine.

Stausholm said the opening of the $2 billion Western Range mine represented a new beginning following the scandal surrounding the company’s destruction of the culturally significant Juukan Gorge caves in 2020.

It is also Rio’s first project to feature a co-designed social, cultural and heritage management plan with Traditional Owners.

“I could not be more proud of seeing how we have worked in deep partnership with the Yinhawangka People,” Stausholm said at the event.

“It’s a new way of working together, really taking the guidance from them on how we develop the mines of the future, applying new technology, applying our safe production system.”

Western Range is a joint venture between Rio (54%) and China’s Baowu (46%) and comprised the construction of a primary crusher and 18km-long conveyer system to the existing Paraburdoo plant.

The mine will produce up to 25 million tonnes per annum of iron ore and secures the future of the Paraburdoo hub for up to 20 years.

Western Range is the first of $13 billion of replacement mines planned for Rio’s Pilbara iron ore business.

The $1.8 billion Brockman Syncline 1 project was approved in March, while the Hope Downs 1 and West Angelas projects are progressing through the approvals phase.

Last month, Fortescue (ASX: FMG) chairman Andrew Forrest warned the Pilbara was at risk of becoming a “wasteland” if iron ore miners didn’t decarbonize.

“It is for us as companies to make sure that the Pilbara ore remains relevant,” Stausholm said.

“And how do we do that? We do that in partnership, like you see today, with Baowu, working on how we can decarbonize the supply chain. If we find the right solutions – and we will – then the Pilbara will be the source for many, many decades.”

Succession plan

The opening comes after Rio announced the shock departure of Stausholm last month.

Stausholm has disputed reports of a rift between him and chairman Dominic Barton, saying there was no “dis-alignment”.

“It’s very important to say, we in the management team and the whole board is absolutely aligned around the values of Rio Tinto, about pursuing the four objectives, about our strategy and the strategic choices, and about the assessment of our performance, so there is no dis-alignment,” he told reporters.

One of the major strategic changes during Stausholm’s tenure has been the move into the lithium sector. Stausholm said the board was “absolutely aligned” on lithium, describing it as a “next pillar” for Rio.

“Think about it, some visionary people 50, 60 years ago said Rio Tinto should go into iron ore,” he said.

Market focus shift?

Much of the iron ore market’s attention has shifted from Australia’s Pilbara region the Simandou project in Guinea. The massive mine is set to begin exports in November and forecast to reshape global iron ore flows, but analyst say the launch of Western Range is a timely reminder of the Pilbara’s enduring importance.

Predictions of its decline, made by some observers and politicians, seem premature.

Rio Tinto plans to invest $13.3 billion in the Pilbara over the next five years. This capital will fund both maintenance of current operations and the development of new mines capable of delivering 130 million tonnes of annual output. That figure nearly mirrors Simandou’s planned production of 120 million tonnes per year by 2030, but at significantly lower cost and lower geopolitical risk.

Rio awarded last week a $157 million contract to construction and mining firm NRW Holdings, a move widely seen as a precursor to formal board approval for the Hope Downs 2 and Bedded Hilltop projects. A final investment decision is expected as early as July.

By comparison, Simandou’s development will require $23.2 billion, about 70% more than Rio’s Pilbara spend, for less output and in a jurisdiction fraught with political instability.

The Pilbara’s established infrastructure (railways, ports, car dumpers, and shiploaders) offers a decisive advantage. Despite Australia’s rising labour costs and shifting industrial relations landscape, the region remains the world’s lowest-cost source of large-scale iron ore supply.

Even with a leadership transition ahead, the financial case for staying the course is compelling. Rio’s $20 billion wave of Pilbara investment is unlikely to be reversed.

The world’s second largest miner is not alone. BHP, Fortescue and Hancock Prospecting are also preparing to replace aging mines.

Meanwhile, the push toward green iron, championed by Fortescue’s Andrew Forrest, adds another layer of opportunity.

August 2026 will mark 60 years since the first shipment of iron ore left the Pilbara for Japan. It may have been built on the past, but the Pilbara looks set to shape the future.

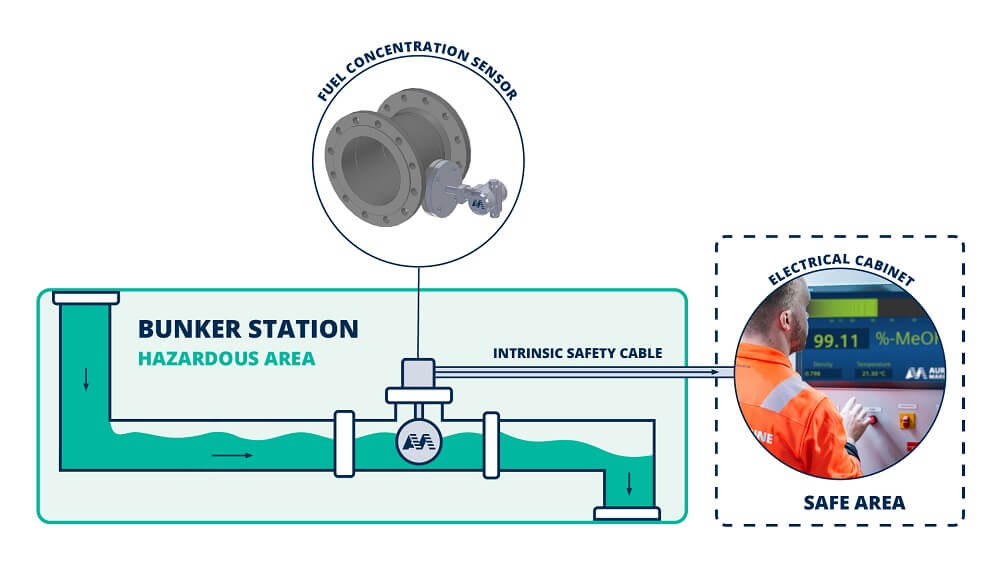

Put into the context of the energy transition, consider a ro/ro vessel using 27,000 tonnes of green methanol annually. With green methanol priced around €1,196 per tonne, a 5% water contamination could lead to losses exceeding €1.6 million over the course of a year. Detecting and responding to such issues early can prevent both cost overruns and operational delays.

Put into the context of the energy transition, consider a ro/ro vessel using 27,000 tonnes of green methanol annually. With green methanol priced around €1,196 per tonne, a 5% water contamination could lead to losses exceeding €1.6 million over the course of a year. Detecting and responding to such issues early can prevent both cost overruns and operational delays.