For Liang Zhu, who runs an aluminum factory about 100 kilometers north of Hong Kong, there is only one way out of China’s vicious spiral of excessive competition: shift away from inexpensive metal for window frames and door handles, and toward the specialized alternatives needed for iPads and airplanes.

Guangdong province has long been a powerhouse of light manufacturing. Today, though, many companies like Liang’s are battling to survive in the era of “involution”, a term commonly used to describe the country’s intense, self-harming industrial race. China’s property boom is over, and has left behind small to medium-sized manufacturers saddled with overcapacity, evaporating margins and a relentless struggle for customers.

“Without sufficient profits, there will be no funds to invest in innovation, research or in finding solutions for society,” said Liang, general manager at Guangdong Mingzhu Metal Material Technology Co., a company he founded after returning from a spell working in Australia. “That’s a dilemma for us, so we look for ways to get out of this so-called involution.”

Producers of aluminum to be used in railings or furniture thrived in Guangdong from the early reform years of the 1980s up until the country’s real estate crisis began in earnest five years ago. Since then, the region has seen a wave of consolidation.

In July, Mingzhu Metal started up its first production line making items with “7-series” aluminum, a more complex product that’s harder to rework and weld, more resistant to heat and easier to crack when cooling. Most importantly, it has lucrative buyers in China’s emerging higher-value industries — from aerospace to electric vehicles and consumer goods.

Aluminum is arguably the world’s most versatile metal because it’s lightweight, durable and doesn’t rust. Extruders, as companies like Liang’s outfit are known, take thick bars of semi-finished metal and work it through several phases to form different shapes and profiles, from car frames to supports for solar panels.

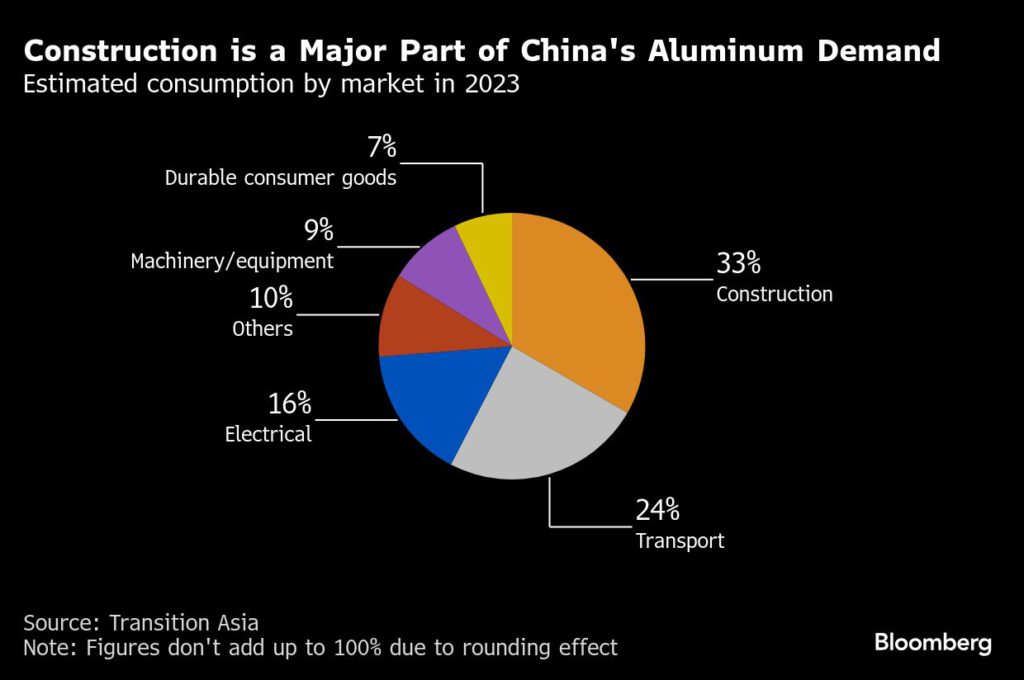

This corner of the sector has long relied on real estate and infrastructure, so the collapse of construction activity since the start of the pandemic has been devastating. Operating rates for aluminum processors are at about 60% to 70% for the best-performing companies, and at only 40% to 50% for the weaker ones, according to researcher Shanghai Metals Market, or SMM. Both are below the 80% level deemed a healthy minimum.

Midstream aluminum producers are “facing complex situations such as weak domestic demand, increased uncertainty in foreign trade, and intensified internal competition in the industry,” the China Nonferrous Metals Industry Association said in July. “The price competition situation is quite severe, and overall processing fees have reached an historic low.”

Shandong Nanshan Aluminum Co., a major producer of extrusions in eastern China, is a case in point. The firm said last week it’ll close 120,000 tons of its total 320,000 tons of capacity after recording utilization rates of just 59%. It plans to shift its focus to higher-end products for industry and autos.

President Xi Jinping has said he wants to “break involution,” which means reducing the excessive competition and capacity levels blamed both for a cycle of domestic deflation and raising tensions with trade partners.

The campaign is taking different forms across industries. Nationwide coal output declined in July from a year ago, after government inspectors targeted mines that produce too much. Oil refining and petrochemicals are set for a sweeping overhaul. And bosses from electric vehicle companies and some tech giants have been called before regulators and warned about over-competition.

An hour’s drive from Mingzhu Metal is China’s “aluminum capital” of Foshan, known for its panoply of extruders, fabricators and wholesale markets. Here, Foshan Golden Source Precision Manufacturing Co. has passed through several phases of specialization and technological upgrades since it was founded in the early 1990s.

Its showroom exhibits include trailer ramps and bathroom fittings to hard disk components and parts for the Harmony trains that pioneered China’s high-speed rail. The firm has hewn closely to the technological path prescribed by Xi’s Made in China 2025 plan that was launched a decade ago.

Most recently, Golden Source has developed components for EV charging points and lightweight fittings for airplane trolleys. When General Manager Rain Tam took over the business from her father, its founder, she raised spending on technological research in order to cut costs and to improve product quality.

Even then, there is intense competition.

“Technological innovation helps profit margins for some products, but overall our margins will be a lot worse this year than last,” said Wang Shunli, deputy general manager. “Right now, when it comes to pricing, I feel the pressure is extremely high.”

China’s last round of industrial supply reforms after 2015 heralded changes across the sector, from the smelters that produce aluminum to the factories that handle the metal. For extruders, strict new controls on carbon emissions and energy consumption put the squeeze on smaller, less efficient firms.

That’s left an environment that is complex, but also modestly positive. Chinese demand for the metal is set to grow 3.4% this year, according to Bloomberg Intelligence. China Hongqiao Group Co., the biggest primary aluminum producer, gave an upbeat outlook after it reported a rise in first-half earnings.

“Overall aluminum consumption is trending upward, but the main issues are rapid capacity expansion and severe product homogenization,” said SMM analyst Liu Xiaolei. “The aluminum industry is shifting toward new energy sectors, but these are also experiencing clear overcapacity.”

In Guangdong, managers and factory workers are settling in for a long battle. Unlike Xi’s last round of supply-side reforms, there’s little prospect of massive stimulus or a renewed construction boom to restore the growth rates of the past.

“The whole industry is experiencing a test,” said Golden Precision’s Wang. “For now, we need to survive first, so that we can advance more in five, seven, eight years.”