Silver price shoots above $42 for fresh 14-year high

Silver extended its winning streak for a third straight session on Friday, as an increased likelihood of a Federal Reserve rate cut next week pushed the precious metal higher.

Spot prices rallied another 1.6% to surpass the $42/oz mark. Its intraday high of $42.46 was the highest since 2011.

This takes silver’s weekly gains to over 3%, as a looming Fed decision on interest rates raised the prospects of non-yielding assets like silver.

The latest US jobs data pointing to an economic slowdown further cemented market-wide expectations that a 25-basis-point cut is on the cards.

“Weaker employment and spotty inflation … priced in with the Fed having to cut rates is pushing metals higher because there is the risk of longer-term inflation,” Daniel Pavilonis, senior market strategist at RJO Futures, wrote in a Reuters note.

Over a longer horizon, analysts see further room to run. A new report by Sprott builds a bullish case for precious metals, predicting a strategic shift away from the US dollar and Treasuries under the current environment and into hard assets.

In silver’s case, the case may be even stronger as the metal’s fundamentals are underpinned by powerful structural forces, namely a prolonged supply deficit and a tightening physical market.

In 2025, the silver price has risen by more than 43%, even surpassing gold, making it one of the best-performing assets of the year.

Gold price surpasses inflation-adjusted record high set in 1980

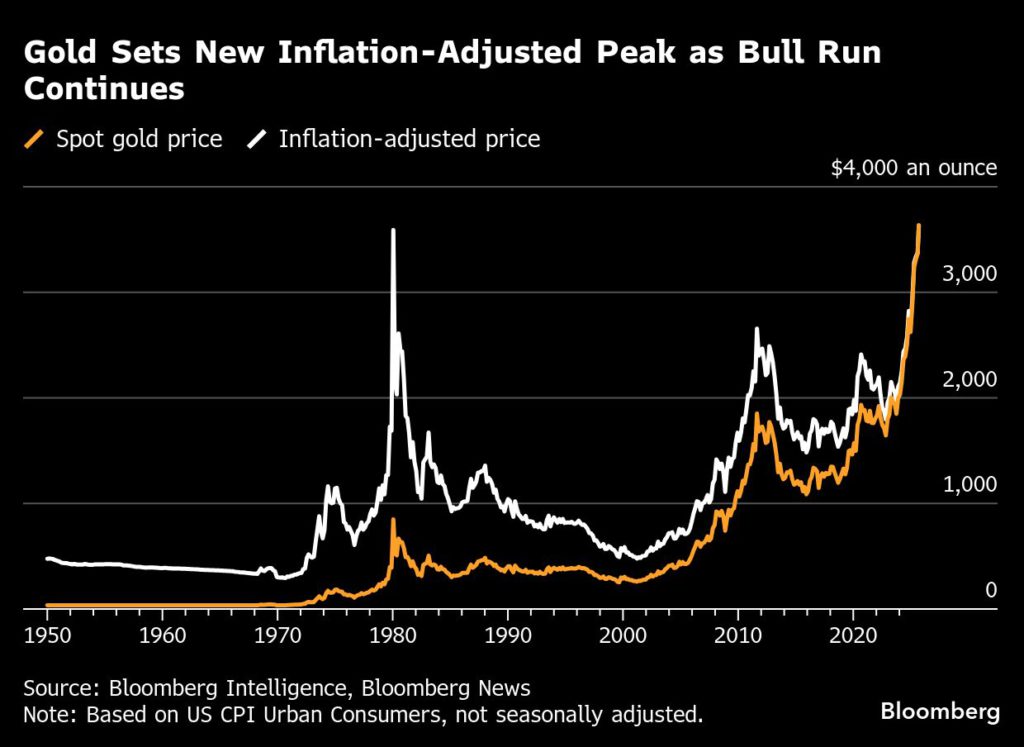

Gold has eclipsed its inflation-adjusted peak set more than 45 years ago, as growing anxiety about the US’s economic trajectory takes bullion’s blistering three-year bull run deeper into uncharted territory.

The spot price of gold has surged about 5% so far this month, with prices hitting an all-time high of $3,674.27 an ounce on Tuesday. It’s set more than 30 nominal records already in 2025, but the latest leg of the rally has also taken it through an inflation-adjusted peak set on Jan. 21, 1980, when prices topped out at $850.

Factoring in decades of consumer price increases, that equates to about $3,590 — although there are multiple methods of adjusting for inflation, and some would put the 1980 peak at lower levels. It’s a moving target, but analysts and investors are in agreement that gold has now shot firmly through it, providing a further fillip for gold’s credentials as an age-old hedge against rising prices and weakening currencies.

“Gold is a very unique asset in its historical ability over hundreds — if not thousands — of years to play that role,” said Robert Mullin, portfolio manager at Marathon Resource Advisors. “Asset allocators are entering a period where they are justifiably concerned about the levels of both deficit spending, as well as questioning central banks’ priorities and willingness to truly fight inflation.”

The precious metal has risen nearly 40% this year as President Donald Trump has cut taxes, expanded his global trade war, and sought unprecedented influence over the Federal Reserve. A selloff in the dollar and long-term US government bonds earlier this year highlighted concerns about waning appetite for American assets, and fueling questions about whether the nation’s debt remains a haven in times of turmoil.

When gold hit $850 in January 1980, the US was grappling with a collapsing currency, a spike in inflation and an unfolding recession. The price had doubled over the previous two months, after US President Jimmy Carter issued a freeze on Iranian assets in response to a hostage crisis in Tehran, raising the perceived risk of holding dollar assets for some foreign central banks.

“Gold is only reflecting the renewed awareness that inflation can be and still is a problem, but also uncertainty about the world,” said Carmen Reinhart, a former senior vice president and chief economist at the World Bank Group. Gold’s “role as an inflation hedge was a stamp of its popularity in the 70s and 80s, but you need to look before the 1980s: Gold has always played an important role when there’s uncertainty.”

Compared with the parabolic surge to the peak in 1980 — and a precipitous collapse that followed — today’s rally has unfolded with far less volatility. That’s partly because today’s market is far more liquid and accessible to investors, and also because it’s attracting a broader base of investors who are offsetting weakness in traditional areas of demand.

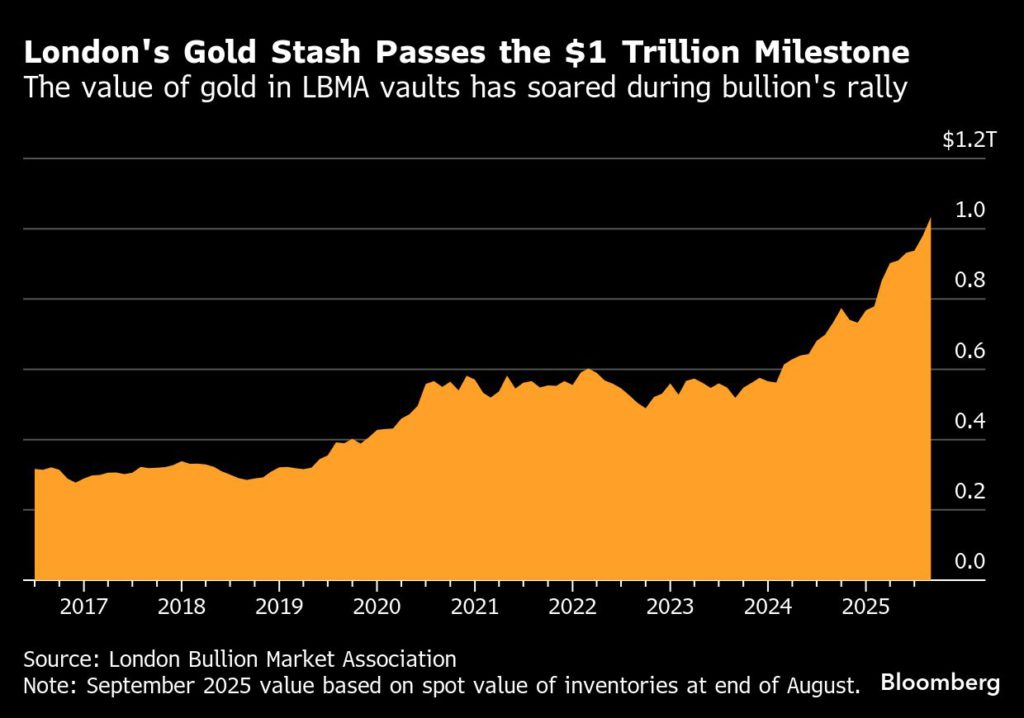

Thanks to the surge in prices, the value of bullion held in London vaults exceeded $1 trillion for the first time last month, and it’s also overtaken the euro as the second-largest asset in global central bank reserves.

Grant Sporre, global head of metals and mining at Bloomberg Intelligence, has overhauled his analytical models to take fuller account of the broad and diverse drivers behind gold’s stellar rally. They suggest gold is over-priced relative to historical norms except in one crucial aspect: Compared to US stocks, gold still looks cheap, and he says prices could vault higher still if equity markets start to creak.

“Gold’s eye-wateringly expensive, but the market is happy to pay the price in order to secure that insurance,” Sporre said.

Gold’s comeback

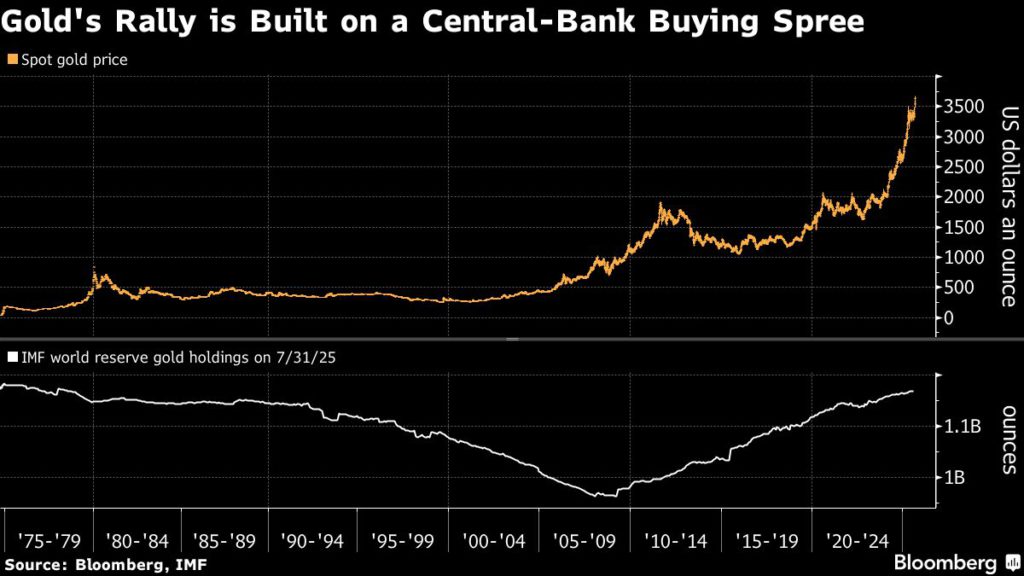

It’s a striking comeback for an asset that was derided by central bankers throughout the 1990s and 2000s, as the end of the Cold War, the birth of the eurozone, and China’s accession to the World Trade Organization ushered in a new era of globalization underpinned by the dollar. As stock markets took off, many private investors turned their back on gold too.

This time, many central banks are again buying gold to diversify their foreign exchange holdings from the dollar, and insulate themselves from sanctions targeting America’s adversaries. Prices have almost doubled since Russia’s invasion of Ukraine and a resulting freeze on the Kremlin’s overseas assets, with the rally broadening out as institutional investors started loading up in the wake of Trump’s inauguration.

Sporadic buying sprees in China and a resurgence in the popularity of exchange-traded funds — which have made gold more accessible to retail investors — have also lent support along the way.

“The movement from a unipolar world to a multipolar world I think has accelerated the view of gold as being an asset that central banks want to own,” said Greg Sharenow, a portfolio manager at Pacific Investment Management Co. “High net worth individuals have been viewing it similarly, and gold has been a big beneficiary of the broadening and the diversification of assets.”

Over the past two weeks, prices have erupted higher again, shooting clear of all-time nominal highs set in April after a spell of range-bound trading. The latest breakout has come as investors across financial markets bet that the Fed will soon start lowering interest rates off to head off a slowdown in hiring and and a potential economic downturn.

Historically, rate cuts have boosted gold’s appeal relative to yield-bearing assets like Treasuries, while also putting pressure on the dollar. And with Trump staging an unprecedented assault on the Fed’s independence, gold bulls are also increasingly alert to the possibility that the central bank could be compelled to cut rates aggressively even in the face of rising inflation risks.

When similar dynamics took hold in the early 1970s — with the dollar slumping as then-President Richard Nixon pressured the Fed to keep rates low in the face of inflation risks — it helped kick-start a colossal rally in gold, with the twin oil shocks of that decade helping to ultimately lift it to its $850 peak.

“I could read what was happening in the world: Every country was building up huge debt, every country was printing money and debasing their currency,” said Jim Rogers, the co-founder of the Quantum Fund alongside George Soros, who began buying bullion in the early 1970s. “And I also read enough to know that gold and silver were a way to protect yourself in times like that.”

(By Yvonne Yue Li, Yihui Xie, Jack Ryan and Sybilla Gross)