What Does Trump’s Sudden Shift Mean For Russia’s War On Ukraine? – Analysis

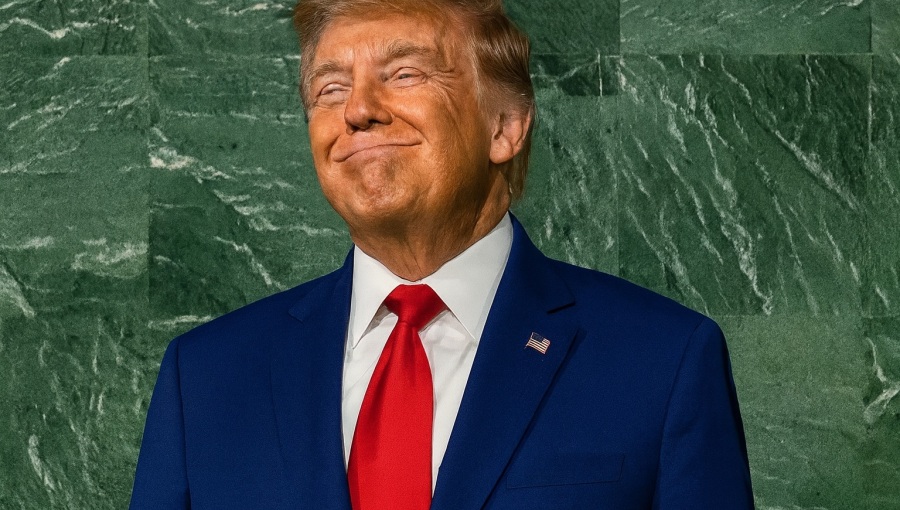

Ukraine's President Volodymyr Zelensky with U.S. President Donald Trump. Photo Credit: The White House, X

By RFE RL

By Steve Gutterman

In a sudden shift, US President Donald Trump said Ukraine could win back all of its Russian-occupied territory with the help of its European backers.

His remarks in a social media post on September 23, after talks with Ukrainian President Volodymyr Zelenskyy on the sidelines of the UN General Assembly in New York, quickly made waves: In the past, Trump and other US officials have strongly suggested Ukraine would have to cede some land to Russia in any peace deal.

In a tense meeting at the White House in February, Trump told Zelenskyy that Ukraine doesn’t “have the cards” to win the war.

But the post raised crucial questions that it didn’t answer.

Will Trump walk away from his efforts to end the war? Are new US sanctions against Russia still on the table? Could the rhetorical shift change the Kremlin’s calculus when it comes to the war in Ukraine?

Here’s what to watch.

Are Sanctions Still On The Table?

“Putin and Russia are in BIG economic trouble,” Trump wrote in his Truth Social post, suggesting that the country’s money problems were one of the main reasons for his newly voiced confidence that Ukraine could restore control over its borders with “time, patience, and the financial support of Europe and, in particular, NATO.”

While he has threatened repeatedly to impose new sanctions on Russia and countries that help fuel its invasion of Ukraine, in order to further undermine Moscow’s capacity to fight, he made no mention of punitive measures in the post. Some observers read his remarks as a sign that no new US sanctions are in the offing.

In his address to the General Assembly hours earlier, however, Trump said the United States was “fully prepared to impose a very strong round of powerful tariffs” if Russia isn’t “ready to make a deal to end the war. ” But he repeated his recent condition that Europe take similar action, saying that “for those tariffs to be effective, European nations…would have to join us in adopting the exact same measures.”

Easing Pressure On Ukraine?

For Ukraine, a big concern has been that Trump, who made ending the war a priority when he started his second presidential term in January of this year, might pressure Kyiv to accept a peace agreement that would leave Russia in control of sizable pieces of its territory.

Russia now occupies about 20 percent of Ukraine, and baselessly claims the parts of the Donetsk, Luhansk, Zaporizhzhya, and Kherson regions that it does not control.

Trump’s new remarks suggest that Washington is not about to push Ukraine to make territorial concessions.

Trump “hasn’t said anything like this before,” Sam Greene, a professor of Russian politics at Kings College London, told RFE/RL. “And if it does indeed suggest that he’s willing to countenance an end to this war that does not involve Ukraine making compromises on its sovereignty and territorial integrity, that’s significant.”

Will Trump Walk Away?

On the other hand, Trump’s post was hardly a promise of robust US backing for any bid by Kyiv to recapture Russian-occupied territory. He put the onus on Ukraine and Europe, specifically mentioning the United States only to vow that it “will continue to supply weapons to NATO for NATO to do what they want with them” – an apparent reference to an existing arrangement for NATO members to buy US weapons and deliver them to Ukraine.

“One can certainly interpret that to mean that the US is comfortable with those allies providing more weapons to Ukraine, which isn’t really a change,” Olga Oliker, program director for Europe and Central Asia at the International Crisis Group, told RFE/RL in an e-mailed comment. “A change would be a commitment to get more Patriots…to the Ukrainians and for the US to provide more weapons…to Kyiv.”

The accent on Europe and Ukraine, and the emphasis on what would amount to a potential military solution to the war, led some observers to conclude that the United States may be walking away from its efforts to broker a peace deal.

Parts of Trump’s social media post seemed valedictory: He wrote, “In any event, I wish both Countries well,” and ended by wishing “Good luck to all!” Separately, he told reporters he had thought the war would be easy to end “because of my relationship with Putin, but unfortunately that relationship didn’t mean anything.” And, in other comments on September 23, he said NATO nations should shoot down Russian warplanes that violate their airspace.

But he did not say he was abandoning his efforts to end the war. “I’ll let you know in about a month from now,” he said when asked if he still trusted Putin, suggesting he hasn’t given up his push for peace.

Trump is “clearly not saying the US is prepared to wash its hands of this situation completely and wouldn’t be happy to see the Ukrainians win,” Greene said.

Will Russia Budge?

Predictably, Russia made a show of shrugging off Trump’s comments and suggested they would not lead to a change in its strategy or tactics. Analysts say Putin seems determined to subjugate Ukraine and has shown no interest in a negotiated end to the war on anything other than Russia’s terms.

Putin’s spokesman, Dmitry Peskov, sought to dismiss Trump’s suggestion that Ukraine could regain territory Russia has occupied, saying the battlefield dynamics “show that for those who are unwilling to negotiate now, the position will be much worse tomorrow and the day after.”

Trump has been inconsistent on “which side is to blame, who has the upper hand, and what the US might to do to end the war,” so Russia will likely be watching what Washington does more closely that what it says, said Nigel Gould-Davies, senior fellow for Russia and Eurasia at the International Institute for Strategic Studies.

European leaders, meanwhile, may welcome Trump’s comments “as a signal that if they were to continue to find the fiscal means to support the Ukrainians, the US would allow American arms to be purchased by Europe and provided to the Ukrainians, and that the US would not impede Europe in trying to provide that kind of support to Ukraine,” Greene said.

“But I think that Europe will worry, as will the Ukrainians, that…things could pivot again.”

- Steve Gutterman is the editor of the Russia/Ukraine/Belarus Desk in RFE/RL’s Central Newsroom in Prague and the author of The Week In Russia newsletter. He lived and worked in Russia and the former Soviet Union for nearly 20 years between 1989 and 2014, including postings in Moscow with the AP and Reuters. He has also reported from Afghanistan and Pakistan as well as other parts of Asia, Europe, and the United States.