CAPITALI$M 101

Column: Critical minerals are stuck between demand hopes and oversupply reality

Definitions vary as to which minerals and metals are genuinely critical, but one thing is certain. The prices of many of them are currently weak and not reflecting their supposed importance to the global energy transition.

The contrast between the current soft pricing for metals such as lithium, nickel, cobalt and copper and the still widespread expectations of a demand surge in the next decade was a key feature of an industry gathering last week on the Indonesian island of Bali.

The International Critical Minerals and Metals Summit heard that demand for key energy transition metals is expected to increase fourfold in the decade from now to 2035.

Demand for the battery metals lithium, graphite, nickel, manganese and cobalt is expected to rise from around a combined three million metric tons this year to 12 million by 2035, Fastmarkets analyst Olivier Masson told the conference.

Copper is also viewed as essential to the energy transition and Masson said the market would need 909,000 tons of additional capacity by 2035 to meet demand for electric vehicles and renewable technologies such as wind and solar.

This all sounds very bullish for energy transition metals, but Masson’s data also held some sobering realities.

Looking specifically at copper, Fastmarkets expects the global market to record a small surplus this year, a slightly larger surplus of just under 200,000 tons in 2026, and a tiny deficit in 2027.

It is only in 2033 and 2034 that significant shortfalls of copper are expected by Fastmarkets.

The caveat to long-term forecasts is that they are inherently risky as market dynamics can shift, new technologies can alter demand profiles and geopolitics and resource nationalism can increasingly interfere with trade and investment decisions.

But working on the assumption that ultimately the energy transition will result in higher demand, the question becomes how should the market respond now?

Is it a good idea to seek new copper deposits and commit vast sums of capital to building a new mine in the hope that demand will be strong enough in 2040 to 2050 when it is likely production will actually commence?

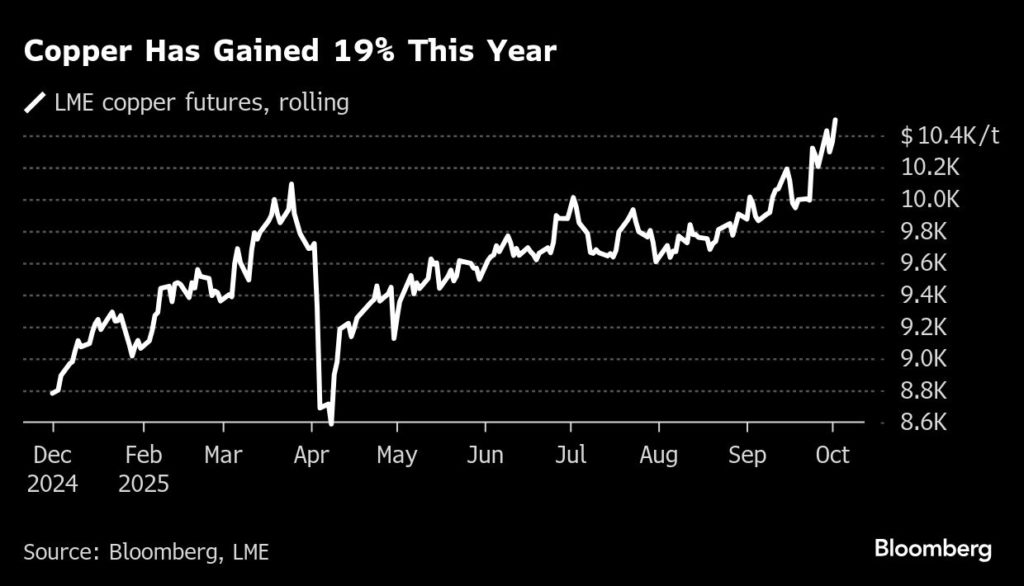

Despite widespread and sustained forecasts for a shortfall of copper, the price of the industrial metal has barely shifted in recent years.

Benchmark London contracts ended at $10,181.50 a ton on September 26, much the same price as they were for much of 2021.

Effectively the copper market is roughly in balance currently and is range-trading driven by short-term news events rather than any longer-term views on fundamentals.

Waiting for demand

Other markets are in even worse shape, largely because of over-investment in new supply, either in expectations that demand growth would arrive faster than it has, or as part of government industrial policy.

Examples of policy-driven excess capacity are rife in China, which has overbuilt refining for metals such as lithium and cobalt.

Indonesia’s policy to encourage investment in midstream and downstream processing has helped to achieve dominance in global nickel markets, but at the cost of significant oversupply and weak prices.

London nickel futures dropped to the lowest in nearly five years in May this year and at the close of $15,175 a ton on September 26 they are a third of the 15-year peak reached in March 2022.

The pattern of weak prices amid oversupply extends to other critical minerals, and leaves producers in the unenvious position of having to navigate to try to contain costs and hang on long enough for the anticipated demand to arrive.

If there is some comfort for these miners it is that their situation largely mirrors what happened in iron ore in the last decade, when the major miners in Australia and Brazil expanded output of the key steel raw material faster than Chinese demand was rising.

After prices crashed to multi-year lows they did recover to reach record highs as China ramped up steel output to 1 billion tons a year by 2020, a level it has largely maintained since and one that gives it about a 50% share of global production.

Producers of energy transition metals probably hope for a similar pattern to iron ore, but they also face other complicating factors, such as efforts by Western nations to develop supply chains outside of Chinese control.

If these prove successful it may add more supply to certain markets, which could depress prices further, or lead to policy measures to enforce using higher-cost metal from non-Chinese suppliers.

(The views expressed here are those of the author, Clyde Russell, a columnist for Reuters.)

(Editing by Kate Mayberry)