Nuclear News

US nuclear plants face widening uranium supply gap, EIA warns

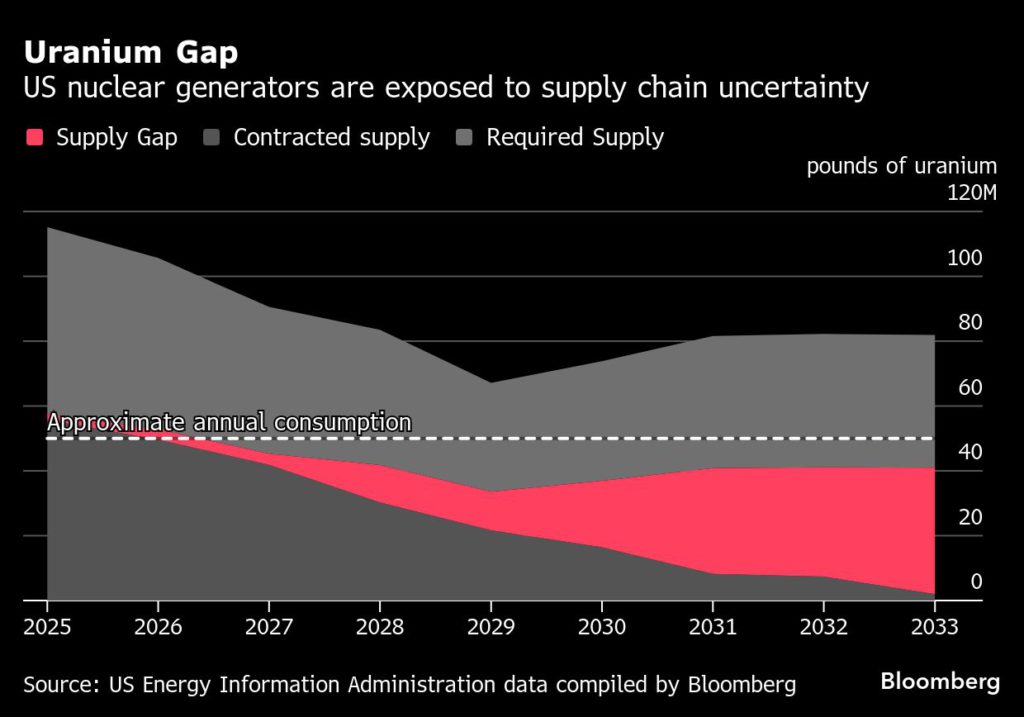

US nuclear utilities face possible uranium shortages over the next decade, the Energy Information Administration warned, underscoring supply chain challenges in the world’s biggest atomic-power market.

Utilities signed fewer contracts for delivery last year as uranium prices surged, a report by the US agency said. High costs are pushing them to delay decisions to cover future fuel requirements, even though less than a tenth of the uranium delivered to US reactors is typically bought on spot markets.

The uranium supply gap is expected to widen over the next decade to a combined 184 million pounds — equivalent to more than three years of consumption. In the absence of long-term supply deals, the EIA report suggests more utilities may need to forge shorter-term arrangements to keep reactors operating.

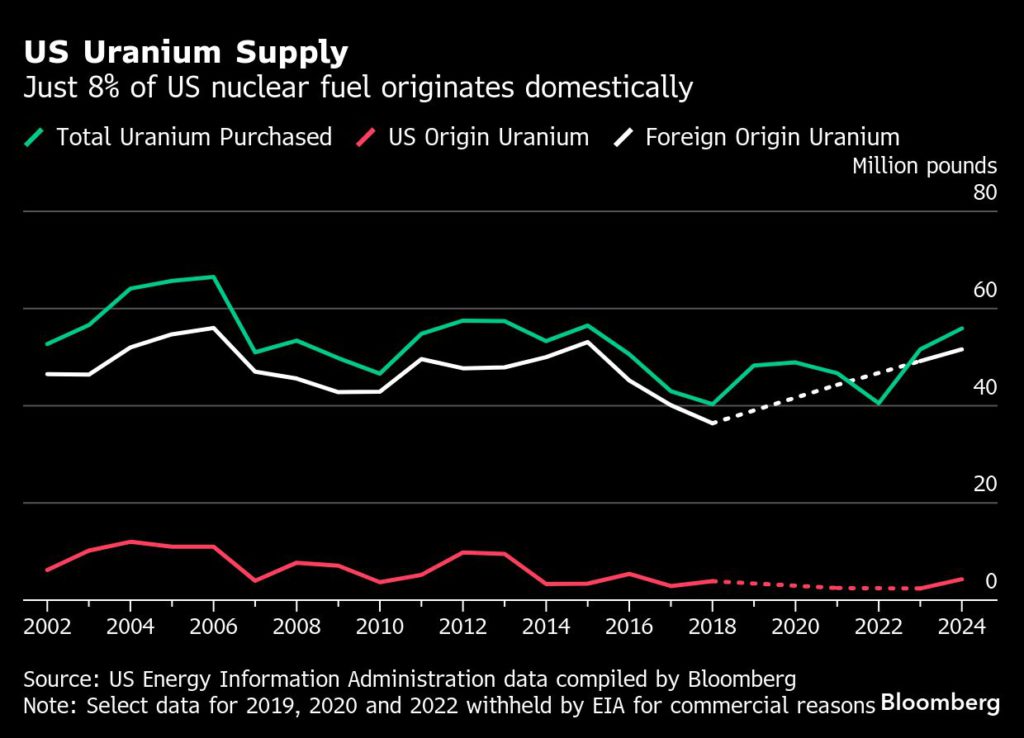

While Silicon Valley investors pour billions of dollars into designing nuclear reactors, the EIA report suggests continued US vulnerability in fuel supply. More than 90% of the uranium consumed by US reactors last year was sourced internationally.

Russia remained the top supplier of nuclear reactor fuel to the US last year, even after a ban on enriched uranium imports from the country took effect in May.

“We’re moving to a place — and we’re not there yet — to no longer use Russian enriched uranium,” US Energy Secretary Wright told Bloomberg News last month, suggesting the US needs to build a bigger uranium buffer.

In 2024, the Biden administration signed into law legislation that requires utilities to shift away from Russian supplies by 2028. Six months later, Russia retaliated by temporarily limiting exports of enriched uranium to the US. The White House issued an executive order in May that’s intended to accelerate the deployment of advanced reactors and fuel.

This year’s EIA report, which tracks global uranium shipments to and from the US, was delayed because of sweeping staff cuts imposed by the Trump administration. The independent energy department unit lost more than 100 of its roughly 350-person workforce amid buyouts and other streamlining efforts spearheaded by the government-efficiency push formerly led by Elon Musk.

(By Jonathan Tirone)

Data centres and energy proposals sought for Savannah River and other US federal sites

Requests for Proposals have been issued to build and power AI data centres at the Savannah River Site and the Oak Ridge Reservation.

Ten tracts of land totalling 3,103 acres (1,256 hectares) at the Savannah River Site have been identified for Artificial Intelligence (AI) infrastructure projects and the National Nuclear Security Administration (NNSA) is seeking applications which integrate innovative energy generation and storage projects with the data centres.

The "US private sector partners will ... be responsible for building, operating, and decommissioning each infrastructure project. Partners must secure utility interconnection agreements. Proposals will be competitively evaluated for technological readiness, financial viability, and detailed plans to complete regulatory and permitting requirements", the NNSA said.

Under Secretary for Nuclear Security and NNSA Administrator Brandon Williams said: "Today's solicitation is a great example of public-private partnership that accelerates scientific research to solve today's challenges and strengthens US leadership in AI and energy infrastructure."

Applications, the Request for Proposals says, "are particularly encouraged to incorporate innovative and/or on-site energy generation, such as advanced nuclear reactor technology, and storage solutions, aligning with DOE's commitment to reliable energy, and energy- and water-efficient operations".

Submissions are required by 5 December at 17:00 EST.

The Savannah River Site is a 310-square-mile (803-square-kilometre) site in Aiken, South Carolina, which was focused on the production of plutonium and tritium for use in the manufacture of nuclear weapons from the early 1950s until the end of the Cold War. In 1992, the focus at SRS turned to environmental cleanup, nuclear materials management, and research and development activities. It is home to Savannah River National Laboratory.

Oak Ridge proposals

In a separate announcement, the US Department of Energy Office of Environmental Management and Office of Science today issued a Request for Proposals from companies to build and power AI data centres at the Department's Oak Ridge Reservation. Two sites are available for consideration: one at the East Tennessee Technology Park and the other on land adjacent to Oak Ridge National Laboratory.

The offices are seeking companies to potentially enter into one or more long-term leasing agreements at the site that would be solely funded by the applicants. Applicants will be responsible for building, operating, and decommissioning each infrastructure project and must secure utility interconnection agreements for new power generation and storage systems. Proposals will be competitively evaluated for technological readiness, financial viability, and detailed plans to complete regulatory and permitting requirements.

Proposals are due by 1 December.

"This RFP represents more than a ground lease for AI data centre development, it offers US companies a potential chance to anchor their partnership with one of our nation's greatest assets, our National Labs," Under Secretary for Science Darío Gil said.

Savannah River and Oak Ridge are two of the four sites - from an initial list of 16 - selected by the US Department of Energy to move forward with plans to invite private sector partners to develop AI data centre and energy generation projects, in line with Executive Orders issued by the US President earlier in the year. The other selected sites are Idaho National Laboratory - for which the Department of Energy issued a Request for Proposals in September - and the Paducah Gaseous Diffusion Plant.

Power fully restored to Chernobyl site

Rafael Mariano Grossi, Director General of the International Atomic Energy Agency (IAEA) said the loss of power to the Chernobyl site "once again underlines risks to nuclear safety during the military conflict".

According to the IAEA, posting on its X account on Wednesday evening, the Chernobyl nuclear power plant lost connection to its Slavutych substation 330 kV line earlier in the day. "The site swiftly switched to alternate lines and power was restored, except for the New Safe Confinement (NSC), which covers the old sarcophagus built after the 1986 Chernobyl accident. Two emergency diesel generators are now supplying the NSC with electricity," the post said.

On Thursday morning it posted an update saying off-site power was restored to the New Safe Confinement at 08:33 local time on Thursday.

The New Safe Confinement

Chernobyl unit 4 was destroyed in the April 1986 accident (you can read more about it in the World Nuclear Association's Chernobyl Accident information paper) with a shelter (also known as the sarcophagus) constructed in a matter of months to encase the damaged unit, which allowed the other units at the plant to continue operating. It still contains the molten core of the reactor and an estimated 200 tonnes of highly radioactive material.

However it was not designed for the very long-term, and so the New Safe Confinement - the largest moveable land-based structure ever built - was constructed to cover a much larger area including the original shelter. The New Safe Confinement has a span of 257 metres, a length of 162 metres, a height of 108 metres and a total weight of 36,000 tonnes and was designed for a lifetime of about 100 years. It was built nearby in two halves which were moved on specially constructed rail tracks to the current position, where it was completed in 2019.

It was designed to allow for the eventual dismantling of the ageing makeshift shelter from 1986 and the management and containment of radioactive waste. It is also designed to withstand temperatures ranging from -43°C to +45°C, a class-three tornado, and an earthquake with a magnitude of 6 on the Richter scale. It is currently being temporarily repaired for the winter following damage caused by a drone strike in February - read more details about the repairs here.

The loss of external power to Chernobyl and its need to rely on emergency back-up diesel generators comes as the Zaporizhzhia Nuclear Power Plant is into its second week without external power supply, with it having to rely on its fleet of emergency diesel generators. Read more: IAEA talking to both sides as Zaporizhzhia power loss continues

Urenco USA given go-ahead for 10% enrichment

Urenco USA has received authorisation from US regulators to produce uranium enriched up to 10% and says it will be the first commercial uranium enricher to produce so-called LEU+.

Initial production of LEU+ will take place this year, with the first product deliveries to a fuel fabricator planned for 2026.

The company said it received the authorisation from the US Nuclear Regulatory Commission (NRC) on 30 September, after successfully implementing changes in its plant systems and procedures and completing an operational readiness review.

Urenco USA Managing Director John Kirkpatrick said the new capability will benefit its current and future customers and support the long-term success of the US nuclear industry. "With LEU+ as an option for fuelling America's reactors, current nuclear plant operators can realise new gains in operations and efficiencies that will support even stronger performance by the country's existing reactor fleet, and advanced reactor developers will have a reliable option to fuel their new designs," he said.

Two isotopes are found in natural uranium: uranium-235 (U-235) and uranium-238. Only U-235 is fissile - but this makes up less than 1% of natural uranium. Enrichment increases the percentage of U-235 by making use of the very slight difference in mass between the fissile and non-fissile isotopes to separate them. Most commercial nuclear reactors currently in operation use fuel fabricated with low-enriched uranium - or LEU - which has been enriched to contain 3-5% U-235.

LEU+ containing 5-10% U-235 will create new opportunities for the current reactor fleet by allowing for longer operating cycles with fewer refuelling outages, reducing operations and maintenance costs, Urenco said. Many advanced reactor technologies currently planned for deployment will also be able to use LEU+ as fuel.

LEU+ can also provide a feedstock for the high-assay low-enriched uranium - or HALEU - containing up to 20% U-235 that will be needed to fuel future advanced reactors and many small modular reactor designs.

Urenco USA's enrichment facility in Eunice, New Mexico, is the only operational commercial enrichment plant in the USA today.

More than 100,000 hours of work have gone into preparations for the new enrichment levels, with significant emphasis on engineering, the development of new procedures, and the implementation of more than 30 new IROFS (Items Relied on for Safety). The process also involved more than 250 modifications to licence basis and programme documents, Urenco USA said. It received licence amendments from the NRC in December 2024 and August 2025 to accommodate the increased levels. All the plant's existing and future cascades will be licensed to produce both LEU and LEU+.

The company recently completed the second phase of a major project to add 700,000 separative work units (SWU) of new capacity at its National Enrichment Facility between 2025-2027, increasing the plant's capacity by 15%.

Uzbek mining joint venture enters next phase

The members of the Nurlikum Mining joint venture have "completed the evolution" of their partnership, paving the way for the start of development at the South Djengeldi uranium project in Uzbekistan.

_16207.jpg)

The structure of the joint venture between French nuclear materials group Orano, state-owned Uzbek uranium producer Navoiyuran, and Japanese company ITOCHU Corporation has now been updated, with Orano and Navoiyuran each holding a 45% stake and ITOCHU holding the remaining share. According to the joint venture agreement signed in March, "this new phase paves the way for the industrial development" of the uranium deposit, the companies said.

The project is in the Tomdi district of the Navoi region. It will be integrated into the local production base of Navoiyuran, which will serve as the operator, leveraging synergies through the existing infrastructure with the aim of reducing production costs and increasing efficiency.

The South Djengeldi deposit is expected to provide stable production for 10 years. Average annual uranium production is expected to be 500 tU, with a peak of up to 700 tU. Geological exploration under a 2022 strategic cooperation programme between Orano and the Government of the Republic of Uzbekistan aims to "at least" double the volume of mineral resources.

Uzbekistan's estimated uranium output in 2024 was 4000 tU, according to information from World Nuclear Association, making it the fifth largest uranium producer in the world behind Kazakhstan, Canada, Namibia and Australia.

Czech Republic seeks EC funding approval for second new nuclear unit

The Czech Ministry of Trade and Industry said: "The country has already obtained EC approval for state aid for one unit in the past, but after the decision to build two units, it must apply for an extension of the approval for public support to the sixth unit (there are four existing Dukovany units). As part of the notification, the Commission will assess the compliance of the proposed support with European Union rules. Providing public support for this project is necessary, as it is in other countries or for other low-carbon sources."

Minister of Industry and Trade Lukáš Vlček said the submission had come "after weeks of intensive negotiations and preparations between my team and the European Commission". He said: "We have already overcome hundreds of obstacles, many more are still ahead of us, and obtaining notification is essential for the successful continuation of the entire project. The issue of notification was also the subject of my discussions with European Commission Vice-President Teresa Ribera in Brussels this week. We expect the Commission's final approval by the end of 2026."

A European Commission spokesperson said: "We can confirm that this measure was notified. The Commission is assessing it according to standard procedures."

The Czech Republic currently gets about one-third of its electricity from the four VVER-440 units at Dukovany, which began operating between 1985 and 1987, and the two VVER-1000 units in operation at Temelín, which came into operation in 2000 and 2002.

Background

In October 2023, Westinghouse, EDF and Korea Hydro & Nuclear Power (KHNP) submitted binding bids for a fifth unit at the Dukovany nuclear power plant, and non-binding offers for up to three more units - another one at Dukovany and two at the Temelin nuclear power plant. Westinghouse was proposing its AP1000, EDF was proposing its EPR1200 reactor, KHNP was proposing its APR1000. But in February 2024 the Czech government announced it was changing the tender to be binding offers for four new units, with Westinghouse not included because it "did not meet the necessary conditions".

Prime Minister Petr Fiala explained at the time that the decision to switch to binding offers for all four units was the result of the original tender suggesting that contracting for four units, rather than having separate processes, could have a 25% benefit in terms of costs. In July 2024 he announced KHNP as the preferred bidder, with contract negotiations to begin. He said the winning tender "based on the evaluation of experts, offered better conditions in most of the evaluated criteria, including the price". The KHNP bid was for a cost of around CZK200 billion (USD8.6 billion) per unit, if two units were contracted.

The contract, for two new units, was signed in June this year following the culmination of legal challenges by EDF, whose objections to the tender process included the belief that the KHNP offer price and the inclusion of a guarantee that the construction would not be delayed or become more expensive, would be "unfeasible without illegal state aid given the prices in the nuclear industry". EDF says that if their rival bidder had state support it would breach European Union rules. KHNP rejected EDF's claims and said "we emphasise that we have not received any subsidies that could damage or distort fair competition in relation to the project".

The European Commission approved the Czech Republic's proposed public support package for the first new unit - fifth overall - at Dukovany, in April 2024 - after a series of modifications were made to address their concerns during an inquiry which began in June 2022.

The Czech Republic plans to grant direct price support in the form of a power purchasing contract with a state-owned special purpose vehicle, ensuring stable revenues for the planned new nuclear unit at Dukovany for 40 years, with a subsidised state loan to cover a majority of construction costs as well as a "protection mechanism against unforeseen events or policy changes".

The European Commission (EC), in announcing its decision, said that to "ensure that the aid is proportionate and does not unduly distort the functioning of the electricity market" the country had "introduced a remuneration formula akin to a two-way contract-for-difference, which provides revenue stability and limits excess remuneration through a yearly ex-post settlement". This effectively means that if electricity prices are below the agreed level, the nuclear project will receive a subsidy to make it up to the agreed price, and if electricity prices are above the agreed price, the nuclear project would pay money back to the government.

The EC also said the period of direct price support had been cut from 60 years to 40 years and the strike price was being set "on the basis of a discounted cash flow model ensuring that the total aid amount, taking into account the subsidised loan, is limited to the funding gap of the project ... EDU II's shareholders will get a rate of return equal to the market return that investors would require on a similar investment".

There will also be a clawback mechanism lasting for the operational lifetime of the plant to ensure "additional gains generated by the project will be shared with the Czech state" and "to avoid market concentration and remove the risk that the measure provides an advantage to certain electricity consumers, Czechia has committed to ensure that at least 70% of the power output will be sold on the open power exchange - namely, day-ahead, intraday and futures markets - over the entire lifetime of the power plant. The rest of output can be sold on objective, transparent and non-discriminatory terms by way of auctions".