Trump Signs Flurry Of Rare Earths Deals In Asia

Trump has launched the United States’ most aggressive rare-earth and critical-minerals expansion in more than a decade, signing over $10 billion in supply-chain deals across Australia, Japan, Malaysia, and Thailand in less than a week. The flurry of agreements aims to cut China’s 90 percent grip on global refining capacity and establish a network of Indo-Pacific partners for mining, processing, and stockpiling key materials vital to defense and clean-tech industries.

On Tuesday, the United States and Japan signed an agreement to secure the supply and processing of rare earths in a bid to counter China’s dominance of the global sector. The two trade partners agreed to employ various means to accomplish this goal, including policy tools, trade measures, financial support mechanisms, and critical minerals stockpiling systems, as well as “jointly identify projects of interest to address gaps in supply chains for critical minerals and rare earths, including derivative products such as permanent magnets, batteries, catalysts, and optical materials.” Japan is the United States’ 5th largest trading partner, with the Asian economic giant supplying vehicles, transportation components, industrial equipment, and consumer electronics.

But the Japan rare earths deal is just one of a handful that U.S. President Donald Trump has lately inked in his Asia diplomacy tour. Trump also signed two separate deals with Malaysia and Thailand, looking to further diversify the country’s critical minerals supply chains. Kuala Lumpur was Trump’s first stop in his five-day tour, expected to culminate on Thursday in a meeting with China’s President Xi Jinping in South Korea. Malaysia agreed to refrain from imposing quotas or banning exports of critical minerals to the U.S. Malaysia and also committed to working with American firms to expedite the development of the country’s critical minerals and rare earths sectors, including “granting extended operating licences to create certainty for businesses to increase production capacity.”

Related: Trump Signs Flurry Of Rare Earths Deals In Asia

Malaysia is home to ~16.1 million metric tons of rare earth deposits, but currently lacks the technology to mine and process these resources. Last year, Malaysia banned the export of raw, unprocessed rare earth elements in a bid to encourage domestic processing and value-added activities as it looks to develop its downstream sector. Currently, Australia’s Lynas Rare Earths (OTCPK:LYSCF) is the largest REE company operating in Malaysia. Lynas operates a major processing facility in Kuantan that separates rare earth elements for global markets. The company sources rare earth feedstock from its mine in Australia, but also has agreements to explore potential local ionic clay deposits in Malaysia.

Trump’s next stop was Thailand, where he signed a comprehensive deal for “critical mineral resource exploration, extraction, processing and refining, and recycling and recovery.” A memorandum of understanding shared by the White House includes commitments for investment into Thailand to support the country’s processing industries, “rather than solely exporting raw materials.” However, the deal has been met with considerable pushback by Thailand's opposition party, with leaders warning that granting the U.S. exclusive rights to the country's critical minerals is likely to draw the ire of Beijing, something that could prove costly.

Thailand's economy is heavily dependent on China, with bilateral trade between the two countries reaching $126.3 billion in 2023. Over 40% of Thailand's agricultural exports, such as fruits and rubber, go to China, leaving Thailand vulnerable to fluctuations in China's demand and trade policies. Meanwhile, nearly 80% of China's exports to Thailand are intermediate goods, such as machinery, electrical equipment, and automotive parts, which are essential for Thailand's manufacturing sector. The influx of cheap Chinese goods, including electric vehicles, has heavily impacted local businesses and led to factory closures in industries like automotive, textiles, and electronics.

That said, Trump’s most concrete critical minerals deal so far was with Australia. Last week, the U.S. and Australia signed an $8.5 billion deal to secure the supply of critical minerals, particularly rare earths, needed for technology and defense industries, largely aimed at reducing dependence on Chinese supply chains. The deal includes significant investments and regulatory streamlining, with several projects and companies already identified to receive funding.

The U.S. and Australia will each provide at least $1 billion in financing over six months for projects in their respective countries in a collective effort to accelerate the development of critical mineral projects.The framework prioritizes specific Australian projects to bolster the supply chain.

- Arafura Rare Earths' (OTCPK:ARAFF) Nolans Project: The U.S. Export-Import Bank (EXIM) issued a letter of interest for up to $300 million to support this mine-to-oxide facility in the Northern Territory. The project is expected to supply about 5% of the world's rare earths.

- Alcoa–Sojitz Gallium Recovery Project: Located in Western Australia, this joint venture aims to produce up to 10% of the global gallium supply, which is critical for semiconductors.

Further, the Trump administration has recently taken significant stakes in several Canadian critical minerals companies, including Trilogy Metals (NYSE:TMQ), MP Materials (NYSE:MP) and Lithium Americas (NYSE:LAC).

By Alex Kimani for Oilprice.com

Canada to work with G7 partners to secure critical mineral supply deals, minister says

Canada will focus on securing supplies of critical minerals when it hosts its Group of Seven partners this week at a meeting of energy and environment ministers in Toronto, Natural Resources Minister Tim Hodgson said in an interview on Tuesday.

G7 countries, except Japan, are heavily or exclusively reliant on China for a range of materials from rare earth magnets to battery metals.

“We will see this week many examples of us moving beyond talks to firm commitments to fund several types of tools (to secure critical minerals),” Hodgson said. The G7 meeting will be held from October 30 to October 31.

Earlier this year G7 officials met in Chicago and discussed price floors backed by government subsidies, which the US recently introduced to encourage domestic production of critical minerals.

Canada will also aim to cement offtake agreements, or financing deals where a buyer agrees to purchase a producer’s output in the future for a predetermined price.

“What you will see on Friday is a number of concrete announcements demonstrating that a multilateral approach to securing supply chains and energy supplies works,” Hodgson sai

He said Canada intended to be a leader in securing supply chains for all of its key allies, to reduce reliance on China. Canada produces several critical metals such as nickel, copper and cobalt.

Some of the announcements expected this week from the G7 meeting will be on stockpiling of critical minerals and investments in new mining and processing operations, Hodgson said.

US President Donald Trump called off trade talks with Canada this week that had been focusing on US tariffs on Canadian steel, aluminum and autos. Hodgson reiterated that Canada and the US had also been in talks over the revival of the Keystone XL oil pipeline as part of an eventual deal, but said it was unclear when both countries would re-engage on the issue.

“When the Americans are ready to talk, we are ready to talk,” he said.

(By Divya Rajagopal; Editing by Caroline Stauffer and Mark Potter)

US official meets mining executives in Brazil to discuss rare earths

The US Charge d’Affaires in Brazil, Gabriel Escobar, held meetings with mining executives during an industry event on Tuesday to discuss rare earths, three sources familiar with the matter said.

The meetings were held on the sidelines of an event in Salvador, in the northeastern state of Bahia, according to the sources, who spoke on condition of anonymity.

The topic of rare earths is expected to be raised in negotiations between the US and Brazil aimed at removing tariffs imposed by President Donald Trump on Brazilian goods.

The discussions also indicate how the US is working to find alternative suppliers amid trade disputes with China, which dominates the rare earths market, one of the sources said.

According to this source, who attended the meeting, Escobar discussed partnerships that could be formed between US companies and miners already operating in Brazil to explore rare earths.

Despite little production, Brazil has vast reserves of these minerals, which are essential for high-tech equipment manufacturing.

Another source said Australia’s St George Mining, which has a rare earths project in Minas Gerais state, was at the meeting with the US official.

Julio Nery, director of mining lobby group Ibram, confirmed that Escobar met with representatives from the sector, but did not provide details about the discussions.

“He already met with Ibram three or four times and requested a meeting with Raul Jungmann,” Nery added, referring to Ibram’s president.

(By Lisandra Paraguassu, Marta Nogueira and Fernando Cardoso; Editing by Natalia Siniawski and Jamie Freed)

Malaysia’s ban on raw rare earths exports remains despite US deal

Malaysia will maintain a ban on the export of raw rare earths to protect its domestic resources, despite signing a critical minerals deal with the United States this week, the trade minister said on Wednesday.

Speaking in parliament, Minister Tengku Zafrul Aziz dismissed allegations that Malaysia will allow the export of critical minerals and rare earths to the United States in pursuit of immediate profits or strategic goals.

“We no longer want to be a country that only digs and ships out cheap raw materials like in the past,” Tengku Zafrul said, reiterating that Malaysia will instead encourage foreign investment and technology sharing for the mining and processing of raw rare earths.

“Our policy is not to prevent trade forever,” he said. “Our policy is to prevent the export of cheap unprocessed raw materials so that value is added to Malaysia.”

Malaysia has some 16.1 million metric tons of rare earth deposits, according to government estimates, but lacks the technology to mine and process them. Rare earth materials are essential for high-tech manufacturing, including electric vehicles, semiconductors and missiles.

Reuters reported earlier this month that Malaysia was in talks with China on rare earths processing, saying Malaysian sovereign wealth fund Khazanah Nasional would partner with a Chinese firm to build a refinery in Malaysia.

The United States signed separate deals with Malaysia and Thailand during US President Donald Trump’s visit to Kuala Lumpur on Sunday, seeking cooperation to diversify critical minerals supply chains amid competing efforts from China.

According to a joint statement by the United States and Malaysia, the Southeast Asian country agreed to refrain from banning or imposing quotas on exports of critical minerals or rare earth elements to the United States.

(By Danial Azhar; Editing by David Stanway)

EU urged to boost critical minerals push amid China curbs

The European Union must ramp up support for its critical minerals sector and allow greater state intervention to counter China’s rare earth export curbs, the European Initiative for Energy Security (EIES) said Wednesday.

In a new report, the EIES urged the EU to earmark “substantial, dedicated” funding for critical minerals in its next budget, drawing from existing energy and decarbonization lines. The group warned that Europe risks falling behind China and the United States, both of which are advancing state-backed mineral strategies.

“As China and the US pursue capital-backed political critical minerals agendas, the absence of a comprehensive European financial architecture exposes the continent’s limitations in catalyzing necessary investment in critical mineral value chains,” the report says.

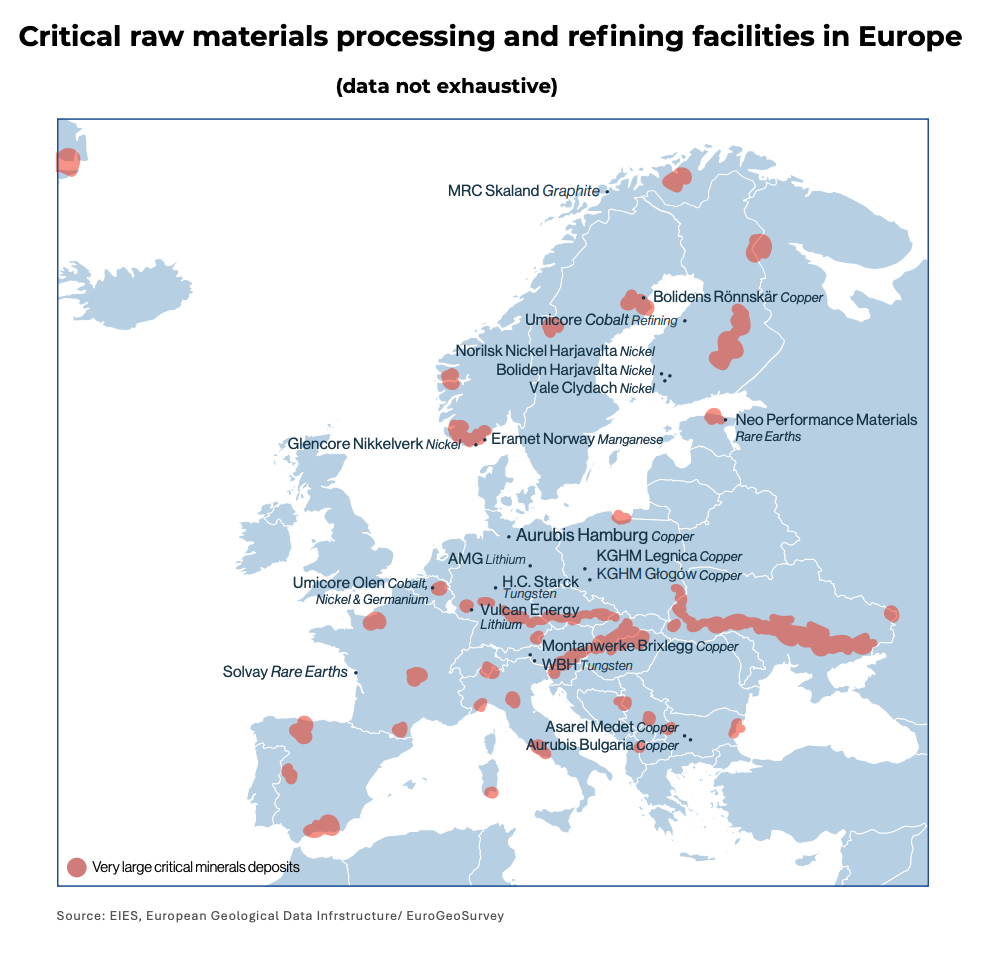

Europe’s limited mining and refining capacity leaves it vulnerable as Beijing tightens exports of materials vital for both defence and clean technology, from magnets and batteries to wind turbines. China’s restrictions come as the EU steps up rearmament in response to Russia’s war in Ukraine.

To close the investment gap, the EIES proposed creating a European Minerals Investment Network (E-MIN) — a permanent platform connecting investors, industrial buyers, and project developers across Europe and allied nations. The network would coordinate financing and risk-sharing, bridging the divide between policy goals and private-sector appetite for risk.

“We can no longer afford a piecemeal approach,” executive director Albéric Mongrenier said in a statement. “E-MIN would turn policy ambitions into impactful projects and secure Europe’s strategic autonomy.”

EIES Head of Research and Policy Petya Barzilska added that even sound projects struggle to close due to financial, political, and regulatory barriers. Greater transparency and coordination, she said, would help build trust and unlock capital for these critical supply chains.

Need to match rivals

The group called on European institutions such as the European Bank for Reconstruction and Development and the European Investment Bank to take larger equity stakes in mining projects, following the US government’s recent investment in rare earths producer MP Materials (NYSE: MP).

China tightened its grip on rare earth exports in April, adding seven elements and related products to its control list. Exporters must now secure government licences regardless of the buyer’s nationality, leading to customs delays and growing concern among EU manufacturers.

In response, Brussels has identified 13 strategic projects to source critical minerals from outside the bloc and plans to build a strategic reserve modelled on its oil and gas stockpiles. Yet implementation has lagged, prompting EIES’s call for immediate, coordinated financial action.