The roller-coaster ride of U.S. tariffs has become very taxing in more ways than one as manufacturers, consumers, shippers and port directors alike wonder what's next.

Manufacturers are scratching their heads on exactly how production schedules should proceed, not knowing if consumers will pick up the extra tariff costs added to a new Barbie doll or an electric appliance.

Automobile parts and cars made outside of the U.S. have been hit hard by the extra costs. Parts and automobile imports into the U.S. are faced with a 25 percent tariff, although there are exceptions to parts and vehicles that meet the requirements of the U.S.-Mexico-Canada Agreement.

MONITORING IMPACTS

U.S. ports are feeling the trickle-down effects of tariffs. The port of Baltimore, which handled 749,799 light trucks and cars in 2024, finishing second in the nation with those numbers, is keeping a sharp eye on developments.

"We continue to closely monitor tariff actions and are seeing impacts," says port spokesman Richard Scher. "Some of our auto manufacturing customers are shipping into U.S. ports such as Baltimore but holding their vehicles at the port of entry. Some are adding import fees, and others are absorbing the tariffs." He notes that 85 percent of the vehicles handled at Baltimore are imported.

"Ultimately," he adds, "the impact of tariffs on the port of Baltimore and all ports will depend on the length of time the tariffs are implemented and the decisions of shippers to send their products to the U.S." In the first quarter of 2025, Baltimore's monthly cargo tonnages increased from 259,085 tons in January to 746,958 tons in March. Ro-ro volumes rose from 22,828 tons in January to 85,244 in March.

Meanwhile, in terms of high-and-heavy ro-ro cargo (farm and construction machinery), Baltimore is reconstructing its ro-ro berths to better accommodate larger and heavier pieces of equipment. Last year it handled 848,628 tons and once again finished first among all U.S. ports.

Stacy Lange, Chief Commercial & Public Affairs Officer at Port Hueneme in California, says, "It's premature for the port to speculate on the full impact of these actions or predict how affected parties and the market will respond. The port is closely monitoring the implementation of these tariffs and other shipping rules to assess their effects and remains dedicated to keeping all parties informed as new information becomes available."

Joseph Morris, CEO & Port Director at Port Everglades in Florida, adds, "At this point, Port Everglades' overall trade is insulated but not immune from the current tariffs. Our North-South trade with Latin America and the Caribbean is on the lower end of the impacted nations and goods. Most of our customers' automobile business is focused on exporting used vehicles to the Caribbean, and we're optimistic about that trade not being affected."

WAIT AND SEE

At Galveston Wharves, Port Director & CEO Rodger Rees has taken a wait-and-see approach: "Like all businesses that deal in international trade, the port is waiting to see what, if any, impact tariffs will have on our cargo volumes."

Galveston imports new cars, heavy equipment and general breakbulk, largely from the E.U., England and Mexico. In 2024, ro-ro volumes contributed 445,000 tons to the port's total of 3.4 million tons. Between six and 10 ships from four liner services call on the port monthly.

"As the port marks its 200th anniversary, we're celebrating 30 years with Wallenius Wilhelmsen and 17 years with American Roll-On Roll-Off Carrier," Rees proudly notes. "Ports America Texas has been our ro-ro stevedore for well over a decade. K-Line and NYK also call on the port."

To meet growing demand, the port is investing $77.5 million to expand and improve its West Port cargo complex. Construction work to add berth and laydown areas should be completed in April 2026.

"Roll-on/roll-off is one of our most consistent commodities for several reasons," Rees explains. "We've built strong, long-term relationships with our cargo carriers and stevedores, and we have a great location on the Gulf Coast that's served by rail lines and is just 10 minutes from a major interstate highway."

WEST COAST POWERHOUSE

In fiscal year 2024, the port of San Diego imported approximately 2.4 million metric tons of cargo including approximately 362,000 vehicles. One in eight cars nationwide is processed at the port's National City Marine Terminal (NCMT).

In addition to autos, ro-ro cargo includes military equipment and oversize cargo such as construction equipment as San Diego is one of 18 designated Military Strategic Ports in the U.S.

"Ro-ro is a key market and an anchor portfolio for the port of San Diego's maritime vision," says Joel Valenzuela, the port's Vice President, Operations & Maritime.

"The Tenth Avenue Marine Terminal (TAMT) and NCMT continue to serve as the major strategic cargo hubs for the port," Valenzuela adds, "helping facilitate the movement of goods to and from the western United States. Supporting the transport and movement of goods, which include those transported by ro-ro at TAMT and NCMT, remains a key component of the mobility element in the port's master plan update."

He says the port is completing structural repairs to the south-facing berths at NCMT, including adding shore power capabilities. The port anticipates completing additional infrastructure updates and loop-track extension as part of the National City Balanced Plan.

According to the port's most recent economic impact report, in fiscal year 2023 its maritime trade and cargo-handling sectors generated approximately $4.4 billion in economic activity including ro-ro, bulk, breakbulk and containerized cargoes.

FLORIDA POWERHOUSE

Ro-ro cargo at Port Everglades kicked off the year in fine style, up 27 percent year-over-year (October 2024 to March 2025) with continued growth through 2025, according to CEO Joseph Morris. Currently, Accordia Shipping and Höegh Autoliners are the ro-ro services calling Port Everglades.

"Ro-ro cargo is a business where, in many cases, the impact on people outweighs the measured economic activity," says Morris. "However, we're seeing an uptick in volumes that indicates ro-ro's economic impact could be greater in the near future."

But just exactly what that growth might be is difficult to predict.

"We're optimistic our cargo customers will continue to see their businesses grow in ways that are beneficial to our port, the environment and the community," Morris adds.

AUTOMOTIVE GATEWAY

The port of Hueneme ("hoo-NAY-mee") has established itself as an important automotive gateway to the U.S. West Coast, and its ro-ro business will continue to be a core focus of future port development and modernization. The port also remains committed to its environmental suitability.

As part of its sustainability commitment, the port and NYK Line in February signed a Memorandum of Understanding (MOU) to establish a Green Automotive Shipping Corridor between Japan and Southern California. The MOU solidifies the commitment of both parties to explore innovative and sustainable shipping practices with an emphasis on reducing greenhouse gas (GHG) emissions, advancing energy efficiency and promoting the use of alternative fuels and zero-emission technologies.

In addition to strong partnerships, the port's modernization plan includes funding to complete an important North Terminal shoreside power project designed to create vital infrastructure and reduce vessel emissions.

With vehicles representing 46 percent of total yearly revenue, the port's economic impact provides significant contributions to the local and regional communities. The port has experienced consistent growth in vehicle imports, which have gone from 230,000 in 2008 to 415,000 in 2024.

"As a premier automotive gateway on the West Coast, the port of Hueneme remains committed to the continued growth of ro-ro cargo through strategic modernization and sustainability initiatives," says Chief Commercial & Public Affairs Officer Stacy Lange. "While it's too early to determine the full impact of emerging trade tariffs, our investments in shore power infrastructure and our groundbreaking Green Automotive Shipping Corridor with NYK Line position us to navigate future challenges and drive economic and environmental benefits for our region."

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

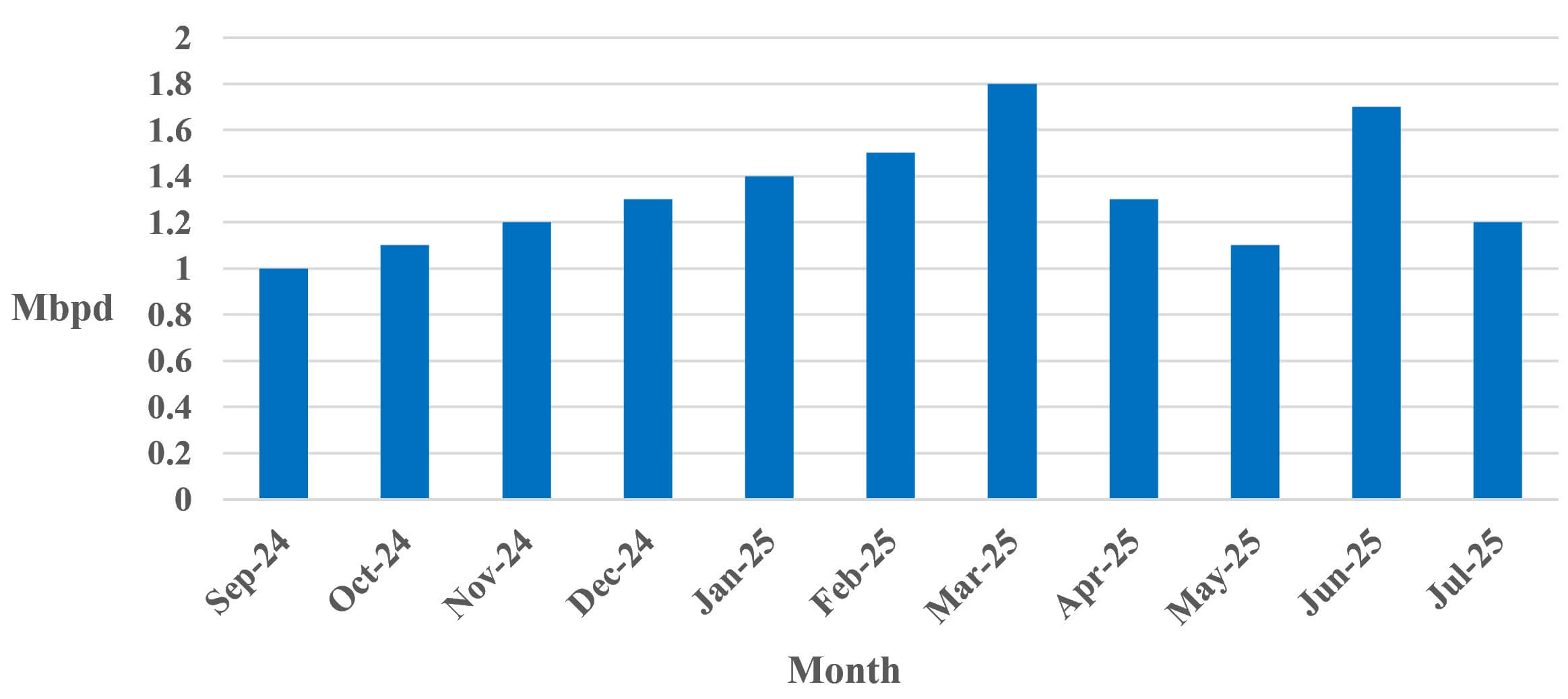

Iranian crude exports to China derived from Kpler and Vortexa analysis (CJRC)

Iranian crude exports to China derived from Kpler and Vortexa analysis (CJRC)