FOX 2 Staff

Fri, October 6, 2023

DETROIT (FOX 2) - The united autoworkers union said it would not expand any strikes Friday after announcing a major breakthrough in negotiations with General Motors at the last minute.

President Shawn Fain said GM would write the UAW into its National Master Agreement as it relates to electric vehicle manufacturing and battery plants.

"We've been told for months this is impossible. We've been told the EV future was a race to the bottom. We called their bluff. This cannot be understated," said Fain.

Fain said the breakthrough came minutes before the UAW was prepared to strike major engine plants owned by GM. The UAW's update is the first to come without a major targeted strike - a sign that labor talks between the Detroit 3 and the union are progressing.

Fain said there was still gaps in wages and cost-of-living-adjustments between the two parties, but both were moving in the right direction.

MORE: A look at the UAW's ‘transformative win’ in contract GM negotiations

Wearing an "Eat The Rich" shirt, Fain touted gains its made with Ford, Stellantis, and GM Friday, praising wage increase proposals up to at least 20%, a restoration of COLA protections previously set in 2007 from two of the automakers, and a reduced timeline of reaching full pay status.

"We are making significant progress," Fain said. "In three weeks, we've moved these companies further than anyone thought possible."

The effects from the United Autoworkers Union strike are trickling down into the suppliers, affecting dozens of companies and prompting layoffs from dozens of suppliers and thousands of workers from automaker-owned plants.

But while immediate concerns from the automakers point toward hopes of getting back to building cars and trucks, the union has continually expressed concern about it being left behind as the industry pivots to battery-powered vehicles.

MORE: Here's Stellantis' latest offer to the UAW

GM's breakthrough Friday, which the UAW said came minutes before Fain's announcement that they would call on workers at one of the companies major engine plants, is the first development that involves battery plants.

Ford previously said the UAW was holding a deal hostage over them.

Where negotiations stand

Fain gave general updates about where things stand on negotiations Friday.

Wages

Ford has offered a 23% wage increase to the UAW. They also agreed to a progression to the highest wage of 3 yearsGM and Stellantis are both around 20% wage increases. Both agreed to a wage progression of 4 years

GM and Stellantis are both around 20% wage increases. Both agreed to a wage progression of 4 years

COLA

Both Stellantis and Ford have committed to returning to the 2007 cost-of-living-adjustment formula

GM hasn't yes guaranteed that

Temporary workers

Temporary workers at Ford will make $21 an hour

GM and Stellantis have agreed to pay temps $20 an hour

GM agrees to add EV plant to UAW contract

WLNS Lansing

Fri, October 6, 2023

UAW holds off on expanding strikes against Detroit's Big Three, cites progress with automakers

Fri, October 6, 2023

UAW holds off on expanding strikes against Detroit's Big Three, cites progress with automakers

Breck Dumas

Fri, October 6, 2023 at 12:58 PM MDT·3 min read

4

United Auto Workers President Shawn Fain touted the union's progress in contract negotiations with Detroit's Big Three automakers on Friday in an address to members, and did not name any new targets in its ongoing strike against Ford, General Motors and Stellantis.

Fain was expected to lay out the UAW's next moves in his latest announcement on Facebook, after escalating the strike during his past two weekly addresses.

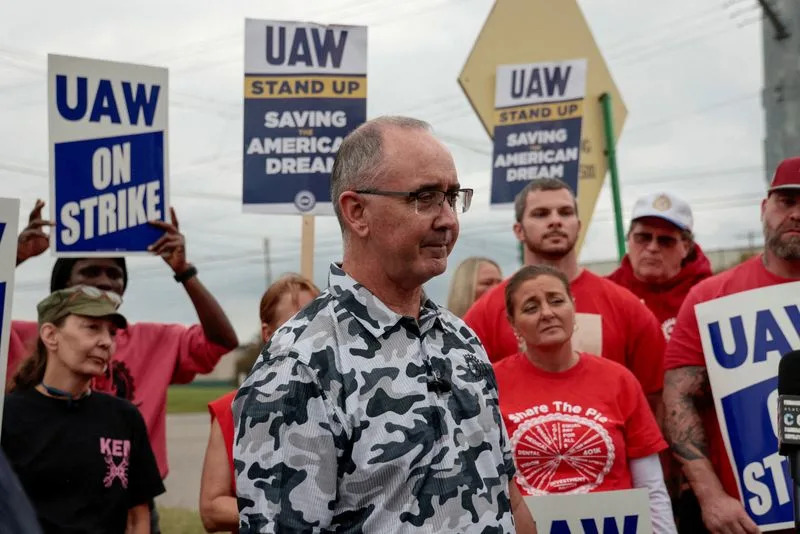

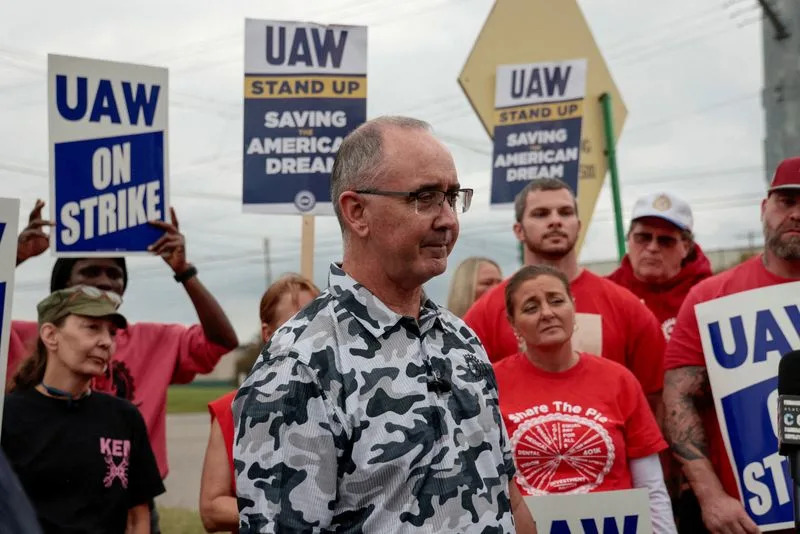

United Automobile Workers (UAW) President Shawn Fain speaks as members and their supporters gather in Warren, Michigan, on August 20, 2023. The union ramped up its incremental strike against the Big Three again on Friday.

The UAW launched a simultaneous but limited strike against all three automakers on Sept. 15, and has vowed to increase strike targets at any automaker that is not making sufficient progress in contract talks from the union's perspective.

STEEL INDUSTRY DENTED BY UAW STRIKE AGAINST DETROIT'S BIG THREE

The union named new facilities to strike at against GM in both prior updates, but spared Ford in the first escalation and Stellantis dodged the second.

Fain signaled Wednesday that a single automaker would be spared from strike escalation this week, once again. In a message on X, formerly known as Twitter, he likened the Big Three's CEOs to contestants on "The Bachelor," teasing his Friday announcement and telling people to tune in and "see who gets the rose!"

Fain said Friday the UAW threatened GM this week with adding one of the company's "biggest and most important plants" to the strike, and it "was that threat that brought GM to the table."

He said GM has now agreed to include electric vehicle battery manufacturing facilities under its national master agreement with the union, saying with the move that the company has "leapfrogged the pack in terms of a just transition" to EVs.

GM ESTIMATES A $200M LOSS SINCE UAW STRIKE BEGAN

The UAW president pointed to progress at other automakers, too. He said Ford has boosted their wage increase offer to 23% over the life the four-year contract, while Stellantis and GM's proposals are around 20%. The union is asking for raises of 40%.

"I wish I were here to announce a tentative agreement with one or more of these companies, but I do want to be really clear: We are making significant progress in just three weeks," Fain said. "We have moved these companies further than anyone thought was possible."

United Auto Workers (UAW) members and supporters on a picket line outside the Ford Motor Co. Chicago Assembly Plant in Chicago, Illinois, US, on Saturday, Sept. 30, 2023.

Currently, around 25,000 of the 150,000 UAW members employed by the Big Three are on strike, and Fain reiterated that the union is willing to expand the strike nationwide if talks drag on.

"The Big Three know we're not messing around and they know if they want to avoid further strikes, then they'll have to pony up," Fain said.

"I've heard members who want to bring down the hammer, strike all the truck plants, hit the Big Three where it hurts – and there is a time and place for that," he continued. "And believe me, if the Big Three don't continue to make progress, that time's going to be coming and real soon. We're not going to wait around forever."

UAW strike: GM agrees to battery plant contract concession

Nicholas Jacobino and Josh Lipton

Fri, October 6, 2023

Auto workers have scored what UAW President Shawn Fain called a "transformative win" in its ongoing negotiations with the big three auto makers - Ford (F), General Motors (GM) and Stellantis (STLA). GM agreed to place their electric battery manufacturing under the union's national master agreement, according to the UAW. The agreement is significant in the negotiations, given that the shift to EV production is one of the big concerns for auto workers.

Arun Kumar, Alix Partners Managing Director in Automotive & Industrial Practice, joins Yahoo Finance to break down the agreement and what it means for the auto industry at large.

When asked about the significance of the agreement Kumar said "we've been importing [EV] batteries from China. I think having those manufacturing plants into the UAW mix allows expansion of jobs that could've been lost because you have less labor hours required to produce EVs".

For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live.

4

United Auto Workers President Shawn Fain touted the union's progress in contract negotiations with Detroit's Big Three automakers on Friday in an address to members, and did not name any new targets in its ongoing strike against Ford, General Motors and Stellantis.

Fain was expected to lay out the UAW's next moves in his latest announcement on Facebook, after escalating the strike during his past two weekly addresses.

United Automobile Workers (UAW) President Shawn Fain speaks as members and their supporters gather in Warren, Michigan, on August 20, 2023. The union ramped up its incremental strike against the Big Three again on Friday.

The UAW launched a simultaneous but limited strike against all three automakers on Sept. 15, and has vowed to increase strike targets at any automaker that is not making sufficient progress in contract talks from the union's perspective.

STEEL INDUSTRY DENTED BY UAW STRIKE AGAINST DETROIT'S BIG THREE

The union named new facilities to strike at against GM in both prior updates, but spared Ford in the first escalation and Stellantis dodged the second.

Fain signaled Wednesday that a single automaker would be spared from strike escalation this week, once again. In a message on X, formerly known as Twitter, he likened the Big Three's CEOs to contestants on "The Bachelor," teasing his Friday announcement and telling people to tune in and "see who gets the rose!"

Fain said Friday the UAW threatened GM this week with adding one of the company's "biggest and most important plants" to the strike, and it "was that threat that brought GM to the table."

He said GM has now agreed to include electric vehicle battery manufacturing facilities under its national master agreement with the union, saying with the move that the company has "leapfrogged the pack in terms of a just transition" to EVs.

GM ESTIMATES A $200M LOSS SINCE UAW STRIKE BEGAN

The UAW president pointed to progress at other automakers, too. He said Ford has boosted their wage increase offer to 23% over the life the four-year contract, while Stellantis and GM's proposals are around 20%. The union is asking for raises of 40%.

"I wish I were here to announce a tentative agreement with one or more of these companies, but I do want to be really clear: We are making significant progress in just three weeks," Fain said. "We have moved these companies further than anyone thought was possible."

United Auto Workers (UAW) members and supporters on a picket line outside the Ford Motor Co. Chicago Assembly Plant in Chicago, Illinois, US, on Saturday, Sept. 30, 2023.

Currently, around 25,000 of the 150,000 UAW members employed by the Big Three are on strike, and Fain reiterated that the union is willing to expand the strike nationwide if talks drag on.

"The Big Three know we're not messing around and they know if they want to avoid further strikes, then they'll have to pony up," Fain said.

"I've heard members who want to bring down the hammer, strike all the truck plants, hit the Big Three where it hurts – and there is a time and place for that," he continued. "And believe me, if the Big Three don't continue to make progress, that time's going to be coming and real soon. We're not going to wait around forever."

UAW strike: GM agrees to battery plant contract concession

Nicholas Jacobino and Josh Lipton

Fri, October 6, 2023

Auto workers have scored what UAW President Shawn Fain called a "transformative win" in its ongoing negotiations with the big three auto makers - Ford (F), General Motors (GM) and Stellantis (STLA). GM agreed to place their electric battery manufacturing under the union's national master agreement, according to the UAW. The agreement is significant in the negotiations, given that the shift to EV production is one of the big concerns for auto workers.

Arun Kumar, Alix Partners Managing Director in Automotive & Industrial Practice, joins Yahoo Finance to break down the agreement and what it means for the auto industry at large.

When asked about the significance of the agreement Kumar said "we've been importing [EV] batteries from China. I think having those manufacturing plants into the UAW mix allows expansion of jobs that could've been lost because you have less labor hours required to produce EVs".

For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live.

Video Transcript

JOSH LIPTON: Major developments in the negotiations between autoworkers and the United Auto Workers union. UAW president Shawn Fain announced a breakthrough in what he says will dramatically change negotiations. Take a listen.

SHAWN FAIN: We were about to shut down GM'S largest moneymaker in Arlington, Texas. The company knew those members were ready to walk immediately. And just that threat has provided a transformative win. GM has now agreed in writing to place their electric battery manufacturing under our national master agreement.

JOSH LIPTON: And because of the developments, there is no expansion of the strike this week. Automaker stocks trading near the highs of the day. And joining us now to talk about this is Arun Kumar, AlixPartner's managing director in the automotive and industrial practice. So Arun, let me get your take on the news here. Listen, UAW Shawn Fain, you heard him there saying there's been progress, no new strikes this week. Is this maybe a some ray of hope here, Arun, for getting an actual deal done?

ARUN KUMAR: Thanks, Julie and Josh. Great to be on the show. I agree. I think this is a great development for both the auto OEMs, the automakers, as well as the UAW because it allows towards a path where we can actually get back to doing business, which is to produce cars and sell great vehicles that consumers are looking for, which is in great demand.

JULIE HYMAN: I had to laugh-- Josh and I both had to laugh when we saw Shawn Fain's T-shirt that he was wearing as he was making this latest account announcement-- eat the rich. And obviously, his rhetoric has been sort of anti, quote, unquote, "fat cats" or what have you at the top of the automakers. You know, there he is.

We're showing the picture of him in that shirt again. You know, how does that factor? I know a lot of this is performance, Arun, but how does that factor into how this all gets gamed out when all is said and done?

ARUN KUMAR: Well, Julie, at the end of the day, you know, what you say in public is one thing, but what you do in private negotiations is a completely different thing. I think when you look at private negotiations, you're looking at basic facts and data to make decisions. And I think the crux of the matter, if you think about it, is that you know EVs require less labor hours to produce, which means that, you know, the UAW is concerned about how they're going to keep up with that transition to electric vehicles. And you know, the one way of looking at this is if you bring in more manufacturing back into the UAW and into North America, it's going to help them both from producing great vehicles as well as making sure that their labor force is fully participating and is able to earn a living like they've done in the last 30, 40, 50 years.

JOSH LIPTON: And I did want to ask you, Arun, there was some news here today. UAW Shawn Fain saying apparently that they did reach a deal with GM to include workers at a new battery joint venture in a new labor contract. What's the significance of that to you, Arun? Is it meaningful?

ARUN KUMAR: It's pretty meaningful because when you look at a battery electric vehicle, you know, 30% to 40% of the cost is in batteries, you know, cells, modules, and then you have the entire battery pack that goes into the vehicle. It's like an engine and a transmission in an internal combustion engine. So till now most of those battery production has been with a joint venture with other companies like Korean companies, or some Chinese companies, or we've been importing batteries from China.

So I think, you know, having those manufacturing plants into the UAW mix allows expansion of jobs that could have been lost because you have less labor hours required to produce EVs. Now, if you want to make sure that you're not losing more of that, you know, with batteries because if those are outside the master services agreement, as Shawn put it, then you have less and less labor that's required to assemble the rest of the vehicle. So that's been a big concern and a crux that, you know, had to be sorted out. And I think that's a great sign of progress that we have seen with this announcement.

JOSH LIPTON: Major developments in the negotiations between autoworkers and the United Auto Workers union. UAW president Shawn Fain announced a breakthrough in what he says will dramatically change negotiations. Take a listen.

SHAWN FAIN: We were about to shut down GM'S largest moneymaker in Arlington, Texas. The company knew those members were ready to walk immediately. And just that threat has provided a transformative win. GM has now agreed in writing to place their electric battery manufacturing under our national master agreement.

JOSH LIPTON: And because of the developments, there is no expansion of the strike this week. Automaker stocks trading near the highs of the day. And joining us now to talk about this is Arun Kumar, AlixPartner's managing director in the automotive and industrial practice. So Arun, let me get your take on the news here. Listen, UAW Shawn Fain, you heard him there saying there's been progress, no new strikes this week. Is this maybe a some ray of hope here, Arun, for getting an actual deal done?

ARUN KUMAR: Thanks, Julie and Josh. Great to be on the show. I agree. I think this is a great development for both the auto OEMs, the automakers, as well as the UAW because it allows towards a path where we can actually get back to doing business, which is to produce cars and sell great vehicles that consumers are looking for, which is in great demand.

JULIE HYMAN: I had to laugh-- Josh and I both had to laugh when we saw Shawn Fain's T-shirt that he was wearing as he was making this latest account announcement-- eat the rich. And obviously, his rhetoric has been sort of anti, quote, unquote, "fat cats" or what have you at the top of the automakers. You know, there he is.

We're showing the picture of him in that shirt again. You know, how does that factor? I know a lot of this is performance, Arun, but how does that factor into how this all gets gamed out when all is said and done?

ARUN KUMAR: Well, Julie, at the end of the day, you know, what you say in public is one thing, but what you do in private negotiations is a completely different thing. I think when you look at private negotiations, you're looking at basic facts and data to make decisions. And I think the crux of the matter, if you think about it, is that you know EVs require less labor hours to produce, which means that, you know, the UAW is concerned about how they're going to keep up with that transition to electric vehicles. And you know, the one way of looking at this is if you bring in more manufacturing back into the UAW and into North America, it's going to help them both from producing great vehicles as well as making sure that their labor force is fully participating and is able to earn a living like they've done in the last 30, 40, 50 years.

JOSH LIPTON: And I did want to ask you, Arun, there was some news here today. UAW Shawn Fain saying apparently that they did reach a deal with GM to include workers at a new battery joint venture in a new labor contract. What's the significance of that to you, Arun? Is it meaningful?

ARUN KUMAR: It's pretty meaningful because when you look at a battery electric vehicle, you know, 30% to 40% of the cost is in batteries, you know, cells, modules, and then you have the entire battery pack that goes into the vehicle. It's like an engine and a transmission in an internal combustion engine. So till now most of those battery production has been with a joint venture with other companies like Korean companies, or some Chinese companies, or we've been importing batteries from China.

So I think, you know, having those manufacturing plants into the UAW mix allows expansion of jobs that could have been lost because you have less labor hours required to produce EVs. Now, if you want to make sure that you're not losing more of that, you know, with batteries because if those are outside the master services agreement, as Shawn put it, then you have less and less labor that's required to assemble the rest of the vehicle. So that's been a big concern and a crux that, you know, had to be sorted out. And I think that's a great sign of progress that we have seen with this announcement.

UAW president says GM agreed to put battery plants under national agreement; No new targets announced

WXYZ-Detroit Videos

Fri, October 6, 2023

United Auto Workers union President Shawn Fain detailed the latest in the negotiations between the union and the Big Three automakers on Friday, citing breaking developments shortly before his 2 p.m. Facebook Live. Fain said after threatening a possible strike at GM's Arlington Assembly, the automaker reportedly agreed to place electric battery manufacturing under the national agreement.

Battery plants have become a major sticking point in the UAW strike against the Detroit automakers

Associated Press Videos

Fri, October 6, 2023

Battery cell plants proposed by General Motors, Ford, and Jeep maker Stellantis have become a major sticking point in the 3-week-old strike by the UAW against Detroit automakers (Oct. 6)(AP video: Mike Householder)

Associated Press Videos

Fri, October 6, 2023

Battery cell plants proposed by General Motors, Ford, and Jeep maker Stellantis have become a major sticking point in the 3-week-old strike by the UAW against Detroit automakers (Oct. 6)(AP video: Mike Householder)

UAW says its 'strike is working,' holds off on more walkouts

Updated Fri, October 6, 2023

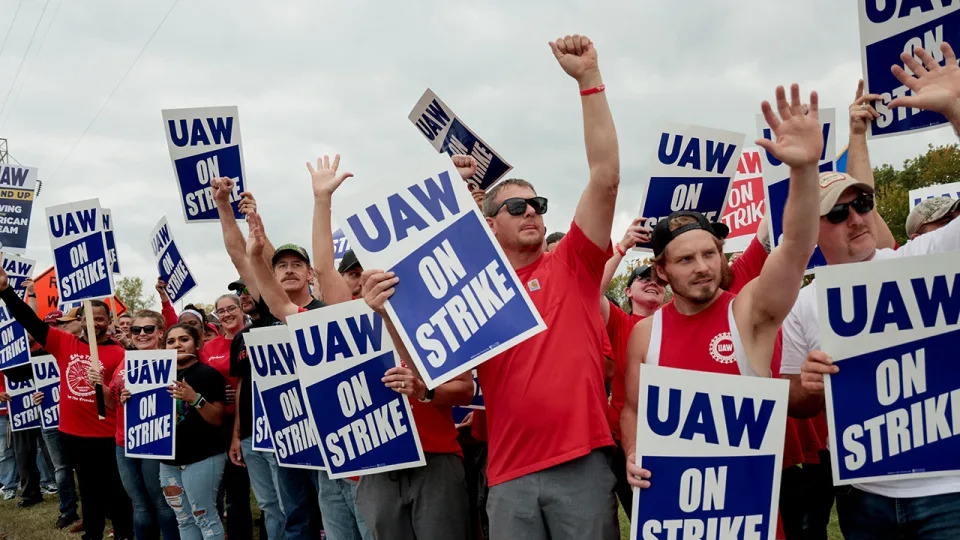

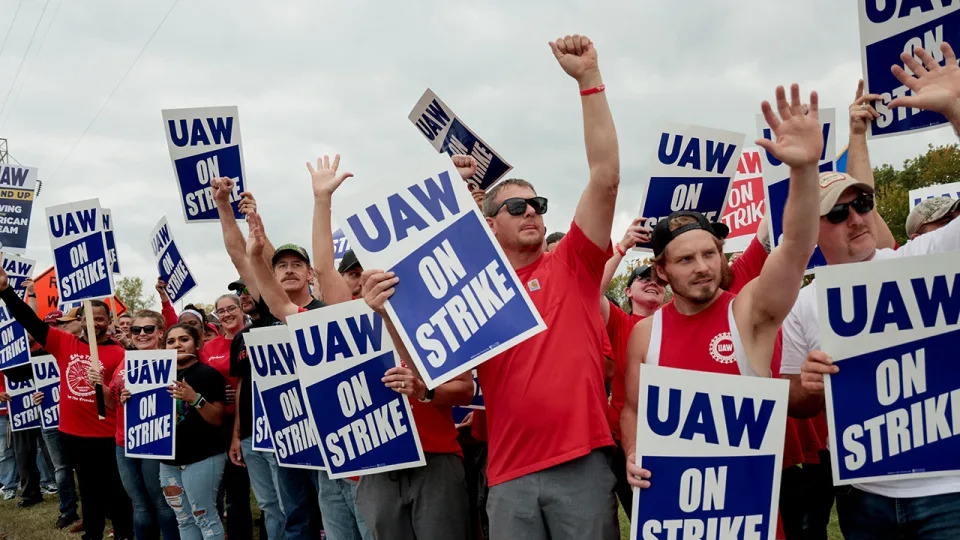

UAW members from the General Motors Lansing Delta Plant picket in Delta Township

By Joseph White and David Shepardson

DETROIT (Reuters) -The United Auto Workers held off on additional strikes against Detroit Three auto plants on Friday, citing General Motors' unexpected willingness to allow workers at joint-venture battery plants to be covered by union contracts.

GM's concession could be critical if rivals Ford Motor and Chrysler parent Stellantis follow suit, potentially clearing the way for final agreements that would shore up the union's position as the industry switches to making electric vehicles.

"Our strike is working, but we’re not there yet," UAW President Shawn Fain said in a livestreamed update on negotiations with the three automakers.

Automakers have more than doubled initial wage hike offers, agreed to raise wages along with inflation, and improved pay for temps, but the union wants higher wages still, the abolishment of a two-tier wage system and the expansion of unions to battery shops at all three companies.

Until Friday, the UAW had ratcheted up action against different automakers weekly to try to get its demands met. Threatening to strike against GM's Arlington, Texas, plant that makes cash-cow SUVs like the Cadillac Escalade spurred GM to agree that EV battery factories would become union plants with UAW contracts, Fain said.

Sales of electric vehicles are growing thanks in part to federal subsidies meant to support a U.S. transition to lower carbon emissions, and the union wants those workers to obtain the same pay and job protections granted other members.

"This is absolutely a big step for all the vehicle manufacturers to get a contract done," said Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions. "This was the last major hurdle."

Fain did not say, however, whether workers at GM's battery plants would earn the same pay as union members at other plants.

GM is building three Ultium joint-venture battery plants with South Korea's LG Energy Solution. In August, Ultium said it did not see any path for workers at its Ohio plant to be covered under a national labor agreement, rejecting a push by Democratic U.S. senators.

GM is building a fourth U.S. battery plant with Samsung SDI in Indiana.

"This defines the transition to EVs," said Harley Shaiken, labor professor at the University of California, Berkeley. "Clearly, GM's concession on the master agreement will positively be matched by Ford and Stellantis."

The fate of battery plant workers was seen as a major sticking point, with Ford CEO Jim Farley on Sept. 29 saying that Fain was holding the deal "hostage" because of that aspect of the talks.

Separately, Ford said on Friday it will lay off another 495 workers in Ohio and Michigan because of the strike's impact on two of its assembly plants.

The companies up to now have resisted including the battery plants they are building under the master agreement, arguing most were joint-venture factories with other majority owners that have to sign off on such an agreement.

"GM has agreed to lay the foundation for a just transition," Fain said in his live broadcast, adding the Detroit company had "leapfrogged" the pack in negotiations with the UAW.

GM declined to confirm Fain's news, saying only that negotiations continue. "We will continue to work towards finding solutions to address outstanding issues," the company said in statement.

Officials with LG and Samsung could not immediately be reached to comment.

Stellantis' North American chief operating officer, Mark Stewart, said in a letter to employees that the automaker is making progress in the talks, "but there are gaps that still need to be closed." Ford declined to comment.

The pressure is only rising on the three automakers as EV market leader Tesla cut U.S. prices of its Model 3 sedan and Model Y SUV, intensifying its price war and further pressuring profit on all EV models that are forced to match CEO Elon Musk's aggressiveness.

Fain also said on Friday that the UAW could still strike against highly profitable pickup truck plants if progress stalls. So far, the union has avoided walking off the job at those plants.

"We know their pain points, we know their moneymakers and we know the plants they really don't want struck," Fain said. "And they know we've got more cards left to play."

Fain has kept automakers in suspense as to whether he would order additional plants shut down, or give an automaker a pass because they had offered concessions. So far, the union has ordered walkouts at five assembly plants at the three companies and 38 parts depots operated by GM and Stellantis.

Fain said on Friday that Ford had upped its proposed wage hike to 23% through early 2028. Combined with proposed cost-of-living-adjustments, workers could receive pay increases of close to 30%, people familiar with the proposal said.

Fain's Friday video addresses have become must-see events since he launched coordinated strikes at GM, Ford and Stellantis plants shortly after midnight on Sept. 15.

GM shares ended nearly 2% higher on Friday and Ford shares gained 0.8%. Stellantis shares in Milan ended up 1%.

(Reporting by Joe White in Detroit and David Shepardson in Washington, additional reporting by Abhirup Roy, Dan Burns, Ben Klayman, Abhijith Ganapavaram and Shivansh Tiwary Writing by David GaffenEditing by Peter Henderson, Nick Zieminski and Matthew Lewis)

Car workers strike not expanded as concession made

Michael Race - Business reporter, BBC News

Fri, October 6, 2023

The UAW started a strike targeting Detroit's Big Three on 15 September

The United Auto Workers (UAW) union has not expanded its strike action against three of America's biggest car firms, citing "significant" progress in talks.

Union boss Shawn Fain said it would hold off after General Motors had agreed that workers at its electric vehicle battery factories would automatically become union members.

But while it will not stage walk outs at new locations, the strike continues.

"Our strike is working but we're not there yet," said Mr Fain.

Roughly 25,000 car workers at GM, Ford Motor and Chrysler parent Stellantis are currently on the picket line.

The union, which represents roughly 146,000 people at the firms, declared a strike in mid-September, after contracts between the two parties expired.

It is the first industrial action by the UAW to target all three companies at once, but it has remained limited in scope, as the union calls on select locations to participate, wielding the threat of more to try to pressure the companies to agree a deal.

So far, the union has ordered walkouts at five factories and 38 parts depots operated by GM and Stellantis.

This week, the UAW considered a strike at GM's SUV manufacturing plant in Arlington, Texas, but Mr Fain said the company had "leapfrogged" the pack in talks.

GM said in a statement that negotiations were "ongoing", adding the company would "continue to work toward finding solutions to address outstanding issues".

"Our goal remains to reach an agreement that rewards our employees and allows GM to be successful into the future," the car maker said.

Why are US car workers on strike?

The union opened negotiations calling for pay rise of roughly 40% over four years and an end to practices that give newer hires lower pay and fewer benefits, among other demands.

The companies have maintained that the union's requests would impact their ability to invest in the long term. They have countered with pay increase of about 20% and some other concessions.

How workers at battery plants, formed by joint ventures, would be treated had loomed over the talks, as the industry prepares to ramp up electric vehicle production.

US President Joe Biden and former President Donald Trump, who is running for re-election, have both visited Detroit area to address the strikes, which comes as labour tensions simmer across the country.

Mr Fain said the fight for better contracts was about more than workers, saying: "This is the entire working class," at an event in Detroit.

"It's shameful where we are as a nation," he added.

Marick Masters

Fri, October 6, 2023

Believe it or not, the United Auto Workers and the Detroit Three automakers are making progress toward a deal.

This year's unconventional, contentious bargaining, the parties' public statements and postures and the UAW's ongoing strike – last Friday, UAW President Shawn Fain announced a third wave of strikes, now encompassing 25,000 workers across 41 Ford Motor Co., GM and Stellantis sites – can obscure that.

Fain’s announcement came at the end of a week filled with heightened tensions. Ford had paused construction of its battery production plant in Marshall, while two presidential visits had interjected politics into bargaining. As if this were not enough, violence directed at strikers occurred at several sites across the country.

Both sides have grown testy in their public statements. General Motors CEO Mary Barra laid it on the line, saying that the UAW leadership's "plan from the beginning has been to drag their membership into a long, unnecessary strike to further their own personal and political agendas." The UAW retorted on X that "Mary Barra did not show up to bargaining this week."

Despite all of that, the parties aren't that far apart on key issues, particularly at Ford and Stellantis. And reviewing the progress the parties have made provides insight into the path to a final settlement.

Biden says he's the pro-union president. But his policies hurt striking UAW workers.

The UAW and the Detroit 3 automakers have common interests

The United Auto Workers and the Detroit Three bring competing perspectives to the bargaining table.

Autoworkers seek record contracts that reflect record profits and a "fair and just" transition to electric vehicles. Automakers emphasize competitiveness and managerial flexibility. From these vantage points, the parties take specific positions on economic and noneconomic issues.

The union members’ demands fall into three categories.

Job and income security: proposals granting the right to strike plant closures; limitations on outsourcing and income and healthcare for laid off workers.

Increased compensation and pay equity: wage increases (initially 46% over four years), restoration of cost of living, elimination of tiers and expedited paths for temporary employees to transition to full-time status.

Work-life balance: paid time off and a four-day work week.

The UAW has a fourth overarching objective: The union wants the companies to bring planned electric vehicle production, like assembly plants and battery-producing joint ventures, under the union's national master contracts.

For those jobs to become part of the UAW contract would require retooling existing plants to produce electric vehicles and parts, and facilitating union recognition of new assembly and battery sites, including those operating under joint ownership with foreign-based companies. New plants would become a point of contention, with the UAW seeking that union contracts carry over to the new sites, and automakers saying the UAW has to organize those workers.

The Big Three’s proposals have largely responded to the union’s demands, plus the companies' own performance-related considerations, such as Stellantis’ well-publicized efforts to reduce absenteeism on the shop floor.

Analysts estimate that the full cost of the union’s demands would more than double the average hourly labor costs of the companies, which now hover around $65, compared to $55 for the foreign automakers and $45 to $50 an hour for Tesla. Investors flinch at the prospect of such a steep climb, fearing such largesse would return the automakers to the financial precarity of 15 years prior.

UAW to GM president: Show me a Big 3 auto executive who'd work for our union pay

The companies – eager to placate investors by preserving what they view as competitiveness and flexibility – have balked at restoring retiree healthcare and defined benefit pension plans, resisted a 32-hour work week and viewed union representation of joint ventures as a matter for the union to take up with the management at specific sites. In certain cases, the automakers want to keep using temporary employees to maintain staffing flexibility.

Ford, Stellantis are making progress on union's demands

Ford and Stellantis have made offers narrowing the gap on key items. Based on what we know, the greatest divide is between the UAW and GM.

Ford has offered to raise pay by 20% (not compounded); restore the cost of living allowance; eliminate tiers at plants in Rawlinson and Sterling Heights; transition temps to full-time status within three months of continuous service; reduce the time required for employees to move to the top wage rate from eight to four years; grant workers the right to strike over plant closures; increase company contributions to defined contribution plans; grant laid off workers two years of pay with health care; make capital investments in all North American facilities; increase profit-sharing payments by more than 13%; add a paid holiday (Juneteenth); provide two weeks paid parental leave.

Stellantis has offered to raise pay by 20% (not compounded); provide for a cost of living allowance if the Consumer Price Index, the government's measure of inflation, exceeds 3%; eliminate tiers at MOPAR (the company's parts, service, and customer care division); grant workers the right to strike over plant closures and impose moratoriums on outsourcing; grant workers the right to not cross picket lines; give workers the ability to purchase an annuity guaranteeing lifetime income payments; add the Juneteenth paid holiday; allow employees to contribute up to 6% (on top of the company’s 6%) to defined contribution plans that would be matched by the company at 50%; contribute $1 per hour for healthcare to defined contribution plans.

Opinion alerts: Get columns from your favorite columnists + expert analysis on top issues, delivered straight to your device through the USA TODAY app. Don't have the app? Download it for free from your app store.

GM has offered to eliminate tiers at its Customer Service and Aftersales and Components Holding units; shorten the move from the bottom to top wage tier from eight to four years; raise wages by 20% (not compounded); provide for cost of living adjustments if inflation exceeds workers’ wage increases; provide majority pay for limited time for laid off workers; raise temp wages to $20 per hour; make a $1,000 additional contribution to defined contribution plans; provide a 25% increase in retirement healthcare contribution to defined contribution plans; provide two weeks parental paid leave; add the Juneteenth holiday; make a $500 payment to retirees. The expanded right to strike, cost of living adjustments, job security protections and a path to full employment for temporary workers remain points of contention.

Breck Dumas

Fri, October 6, 2023

United Auto Workers President Sean Fain is set to deliver his weekly address to members via Facebook live on Friday at 2 p.m. ET, at which time he is expected to announce the union's next moves in its ongoing simultaneous strike against Ford, General Motors and Stellantis.

The union's strategy of striking at certain plants and incrementally adding more targets against any of Detroit's Big Three as negotiations continue comes with an element of surprise and is designed to put pressure against the automakers and play them against each other.

Shawn Fain, president of the United Auto Workers (UAW), speaks during a UAW rally in Detroit on Sept. 15, 2023. Fain is slated to make his next address to members on Oct. 6, 2023, at 2 p.m. ET.

Since the strike began on Sept. 15 at one facility owned by each manufacturer, the UAW has expanded the strike twice, with Fain delivering the updates in his Friday video messages. GM was hit harder by the union both times while Ford was spared from the first escalation and Stellantis dodged the second.

Fain has vowed to increase strike targets at any automaker that is not making sufficient progress in contract talks from the UAW's perspective.

GM ESTIMATES $200M LOSS SINCE UAW STRIKE BEGAN

GM said Thursday it had delivered its sixth proposal to the UAW, marking its second offer this week after saying that "significant gaps remain" between the two sides as of Monday.

With the General Motors world headquarters in the background, United Auto Workers members attend a solidarity rally as the union strikes against the Big Three automakers on Sept. 15, 2023, in Detroit.

Sources told Reuters that progress was made this week in the UAW's negotiations with both Ford and Stellantis.

Currently, around 25,000 of the 150,000 UAW members employed by the Big Three are on strike, and the union has not ruled out expanding the strike nationwide if talks drag on.

Striking United Auto Workers members from the General Motors Lansing Delta Plant picket in Delta Township, Michigan, on Sept. 29, 2023.

GM said Thursday that the strike has cost the automaker around $200 million so far, and the company confirmed it secured a $6 billion line of credit the day before. Ford and Stellantis declined to provide estimates of losses when asked by FOX Business.

Data from Michigan economic consulting firm Anderson Economic Group show the UAW's strike against the Big Three cost the U.S. economy $3.95 billion in its first two weeks.

FOX Business' Joe Toppe and Reuters contributed to this report.

UAW Strike Against Detroit 3 Enters Day 21: Impact & Insights

Rimmi Singhi

The Intensifying Strike

The strike had initially affected three plants—GM's Wentzville Assembly plant in Missouri, Ford's Michigan Assembly plant in Wayne and Stellantis' Toledo Assembly Complex in Ohio. A week later, with no new labor contract in place, the UAW extended strikes to 38 parts and distribution centers across 20 states, primarily focusing on General Motors and Stellantis. Last Friday, UAW president Shawn Fain further expanded the historic strike to include a GM facility in Lansing, MI (which manufactures the Chevrolet Traverse and Buick Enclave) and a Ford assembly plant in Chicago (where Explorer and Lincoln Aviator models are built).

The historic strike began with around 13,000 autoworkers walking off initially. Another 5,600 workers at 38 GM and Stellantis-owned parts distribution centers in 20 states left their jobs last month. The union expanded its work stoppage last Friday, bringing the total number of striking autoworkers to 25,000, or 17% of the UAW's roughly 146,000 members.

Increasing Layoffs

Amid a tense standoff, the Big 3 Detroit automakers are also laying off thousands of workers.

On Tuesday, GM disclosed that it had furloughed 163 UAW workers at its Toledo Propulsion Systems plant, responsible for manufacturing transmissions for GM's Missouri and Lansing Delta Township assembly plants, which are currently impacted by the strike. In total, GM has been compelled to lay off 2,100 workers at five facilities across four states. Stellantis, the parent organization encompassing Chrysler, Dodge, Jeep, and Ram, has furloughed approximately 370 employees.

On Monday, Ford furloughed 330 employees in Chicago and Lima, OH. This is in addition to the 600 layoffs that the company executed just last month at an assembly plant in Wayne, MI. Yesterday, Ford announced an additional round of layoffs affecting 400 employees in the Detroit area, per Automotive News. The auto biggie specified that approximately 350 workers at Livonia Transmission and 50 workers at Sterling Axle have been informed not to report to work starting Thursday. In total, Ford has now laid off a total of 1,330 employees due to the strike.

Demands & Proposals

The UAW’s list of demands is extensive, including a 36% pay increase over four years, annual cost-of-living adjustments, pension benefits for all employees, enhanced job security measures, constraints on the use of temporary workers and a transition to a four-day work week among others. They also call for the elimination of the two-tiered wage system, which was adopted post the 2008 financial crisis.

The automakers, while acknowledging workers' concerns, argue that the UAW’s demands could potentially hamper their competitiveness in the global market. They have expressed their willingness to negotiate further to resolve the issues at hand.

This week, Ford presented its seventh and most robust offer to the union aiming to resolve crucial economic matters. In this offer, Ford has outlined remarkable enhancements in terms of wages, positioning its employees among the top 25% in the United States, encompassing both hourly and salaried positions, while also providing substantial benefits, product commitments for all UAW factories, and a strong commitment to job security. Simultaneously, the proposal ensures Ford's capability to invest and expand its operations.

The offer includes a notable wage increase to $21 per hour, a significant 26% raise for temporary workers, and the conversion of all temporary employees with at least three months of service to permanent status upon ratification. However, the UAW is yet to respond to this latest proposition.

On Monday, after an 11-day interval, the union presented its first comprehensive counteroffer to GM. Additionally, the UAW engaged in a fresh round of negotiations with Stellantis.

The High Stakes of UAW Strike

As the deadlock prolongs, the repercussions are being felt deeply across the industry.

The strike cost the auto industry $3.9 billion in the first two weeks, according to an assessment by the Michigan-based consulting firm Anderson Economic Group. This financial toll encompasses $325 million in worker wages, $1.12 billion in losses incurred by the automakers, $1.29 billion for parts suppliers, and $1.2 billion in dealer and customer losses. Such a financial strain in an already competitive market puts a significant burden on the auto industry.

The ripple effects are being felt across the auto parts manufacturers. Nearly 30% of auto parts manufacturers surveyed by the Motor Equipment Manufacturers Association have reported laying off some employees. An additional 60% anticipate further layoffs by mid-October if the strikes persist.

In anticipation of a prolonged strike, GM has secured a new $6 billion line of credit extending through October 2024. This move is seen as a strategic step to ensure financial stability amid the uncertainty surrounding the strike’s resolution. GM currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The industry awaits the UAW’s update on the negotiation status tomorrow, with the union either expanding the strike further (as it has done on the previous two Fridays) or announcing significant progress in the talks.

Conclusion

The UAW strike against the Detroit 3 automakers has evolved into a significant labor dispute with far-reaching implications for the industry and economy. As both sides stand their ground, the financial toll continues to mount, affecting not only automakers and workers but also parts suppliers and others in the automotive ecosystem.

Complex dynamics are at play as both parties navigate through the negotiations, striving to find a common ground amid contrasting economic and operational aspirations. The outcome of these negotiations will not only determine the fate of thousands of autoworkers but also shape the future of the American auto industry.

Once the strike is over Hardick says parts delivery will pick up again.

"Because I'm sure they would do things to try to expedite parts," he said.

Every day the strike goes on the backlog builds for vehicles needing repairs.

"We need that strike to end," Hardick said.

It is not just dealerships being impacted, after-market locations are having a hard time finding parts people need as well.

As for the strike, both sides are coming together, but have not reached a deal.

Updated Fri, October 6, 2023

UAW members from the General Motors Lansing Delta Plant picket in Delta Township

By Joseph White and David Shepardson

DETROIT (Reuters) -The United Auto Workers held off on additional strikes against Detroit Three auto plants on Friday, citing General Motors' unexpected willingness to allow workers at joint-venture battery plants to be covered by union contracts.

GM's concession could be critical if rivals Ford Motor and Chrysler parent Stellantis follow suit, potentially clearing the way for final agreements that would shore up the union's position as the industry switches to making electric vehicles.

"Our strike is working, but we’re not there yet," UAW President Shawn Fain said in a livestreamed update on negotiations with the three automakers.

Automakers have more than doubled initial wage hike offers, agreed to raise wages along with inflation, and improved pay for temps, but the union wants higher wages still, the abolishment of a two-tier wage system and the expansion of unions to battery shops at all three companies.

Until Friday, the UAW had ratcheted up action against different automakers weekly to try to get its demands met. Threatening to strike against GM's Arlington, Texas, plant that makes cash-cow SUVs like the Cadillac Escalade spurred GM to agree that EV battery factories would become union plants with UAW contracts, Fain said.

Sales of electric vehicles are growing thanks in part to federal subsidies meant to support a U.S. transition to lower carbon emissions, and the union wants those workers to obtain the same pay and job protections granted other members.

"This is absolutely a big step for all the vehicle manufacturers to get a contract done," said Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions. "This was the last major hurdle."

Fain did not say, however, whether workers at GM's battery plants would earn the same pay as union members at other plants.

GM is building three Ultium joint-venture battery plants with South Korea's LG Energy Solution. In August, Ultium said it did not see any path for workers at its Ohio plant to be covered under a national labor agreement, rejecting a push by Democratic U.S. senators.

GM is building a fourth U.S. battery plant with Samsung SDI in Indiana.

"This defines the transition to EVs," said Harley Shaiken, labor professor at the University of California, Berkeley. "Clearly, GM's concession on the master agreement will positively be matched by Ford and Stellantis."

The fate of battery plant workers was seen as a major sticking point, with Ford CEO Jim Farley on Sept. 29 saying that Fain was holding the deal "hostage" because of that aspect of the talks.

Separately, Ford said on Friday it will lay off another 495 workers in Ohio and Michigan because of the strike's impact on two of its assembly plants.

The companies up to now have resisted including the battery plants they are building under the master agreement, arguing most were joint-venture factories with other majority owners that have to sign off on such an agreement.

"GM has agreed to lay the foundation for a just transition," Fain said in his live broadcast, adding the Detroit company had "leapfrogged" the pack in negotiations with the UAW.

GM declined to confirm Fain's news, saying only that negotiations continue. "We will continue to work towards finding solutions to address outstanding issues," the company said in statement.

Officials with LG and Samsung could not immediately be reached to comment.

Stellantis' North American chief operating officer, Mark Stewart, said in a letter to employees that the automaker is making progress in the talks, "but there are gaps that still need to be closed." Ford declined to comment.

The pressure is only rising on the three automakers as EV market leader Tesla cut U.S. prices of its Model 3 sedan and Model Y SUV, intensifying its price war and further pressuring profit on all EV models that are forced to match CEO Elon Musk's aggressiveness.

Fain also said on Friday that the UAW could still strike against highly profitable pickup truck plants if progress stalls. So far, the union has avoided walking off the job at those plants.

"We know their pain points, we know their moneymakers and we know the plants they really don't want struck," Fain said. "And they know we've got more cards left to play."

Fain has kept automakers in suspense as to whether he would order additional plants shut down, or give an automaker a pass because they had offered concessions. So far, the union has ordered walkouts at five assembly plants at the three companies and 38 parts depots operated by GM and Stellantis.

Fain said on Friday that Ford had upped its proposed wage hike to 23% through early 2028. Combined with proposed cost-of-living-adjustments, workers could receive pay increases of close to 30%, people familiar with the proposal said.

Fain's Friday video addresses have become must-see events since he launched coordinated strikes at GM, Ford and Stellantis plants shortly after midnight on Sept. 15.

GM shares ended nearly 2% higher on Friday and Ford shares gained 0.8%. Stellantis shares in Milan ended up 1%.

(Reporting by Joe White in Detroit and David Shepardson in Washington, additional reporting by Abhirup Roy, Dan Burns, Ben Klayman, Abhijith Ganapavaram and Shivansh Tiwary Writing by David GaffenEditing by Peter Henderson, Nick Zieminski and Matthew Lewis)

Car workers strike not expanded as concession made

Michael Race - Business reporter, BBC News

Fri, October 6, 2023

The UAW started a strike targeting Detroit's Big Three on 15 September

The United Auto Workers (UAW) union has not expanded its strike action against three of America's biggest car firms, citing "significant" progress in talks.

Union boss Shawn Fain said it would hold off after General Motors had agreed that workers at its electric vehicle battery factories would automatically become union members.

But while it will not stage walk outs at new locations, the strike continues.

"Our strike is working but we're not there yet," said Mr Fain.

Roughly 25,000 car workers at GM, Ford Motor and Chrysler parent Stellantis are currently on the picket line.

The union, which represents roughly 146,000 people at the firms, declared a strike in mid-September, after contracts between the two parties expired.

It is the first industrial action by the UAW to target all three companies at once, but it has remained limited in scope, as the union calls on select locations to participate, wielding the threat of more to try to pressure the companies to agree a deal.

So far, the union has ordered walkouts at five factories and 38 parts depots operated by GM and Stellantis.

This week, the UAW considered a strike at GM's SUV manufacturing plant in Arlington, Texas, but Mr Fain said the company had "leapfrogged" the pack in talks.

GM said in a statement that negotiations were "ongoing", adding the company would "continue to work toward finding solutions to address outstanding issues".

"Our goal remains to reach an agreement that rewards our employees and allows GM to be successful into the future," the car maker said.

Why are US car workers on strike?

The union opened negotiations calling for pay rise of roughly 40% over four years and an end to practices that give newer hires lower pay and fewer benefits, among other demands.

The companies have maintained that the union's requests would impact their ability to invest in the long term. They have countered with pay increase of about 20% and some other concessions.

How workers at battery plants, formed by joint ventures, would be treated had loomed over the talks, as the industry prepares to ramp up electric vehicle production.

US President Joe Biden and former President Donald Trump, who is running for re-election, have both visited Detroit area to address the strikes, which comes as labour tensions simmer across the country.

Mr Fain said the fight for better contracts was about more than workers, saying: "This is the entire working class," at an event in Detroit.

"It's shameful where we are as a nation," he added.

UAW strike talks show progress with Ford, Stellantis. A deal may be closer than we think.

Marick Masters

Fri, October 6, 2023

Believe it or not, the United Auto Workers and the Detroit Three automakers are making progress toward a deal.

This year's unconventional, contentious bargaining, the parties' public statements and postures and the UAW's ongoing strike – last Friday, UAW President Shawn Fain announced a third wave of strikes, now encompassing 25,000 workers across 41 Ford Motor Co., GM and Stellantis sites – can obscure that.

Fain’s announcement came at the end of a week filled with heightened tensions. Ford had paused construction of its battery production plant in Marshall, while two presidential visits had interjected politics into bargaining. As if this were not enough, violence directed at strikers occurred at several sites across the country.

Both sides have grown testy in their public statements. General Motors CEO Mary Barra laid it on the line, saying that the UAW leadership's "plan from the beginning has been to drag their membership into a long, unnecessary strike to further their own personal and political agendas." The UAW retorted on X that "Mary Barra did not show up to bargaining this week."

Despite all of that, the parties aren't that far apart on key issues, particularly at Ford and Stellantis. And reviewing the progress the parties have made provides insight into the path to a final settlement.

Biden says he's the pro-union president. But his policies hurt striking UAW workers.

The UAW and the Detroit 3 automakers have common interests

The United Auto Workers and the Detroit Three bring competing perspectives to the bargaining table.

Autoworkers seek record contracts that reflect record profits and a "fair and just" transition to electric vehicles. Automakers emphasize competitiveness and managerial flexibility. From these vantage points, the parties take specific positions on economic and noneconomic issues.

The union members’ demands fall into three categories.

Job and income security: proposals granting the right to strike plant closures; limitations on outsourcing and income and healthcare for laid off workers.

Increased compensation and pay equity: wage increases (initially 46% over four years), restoration of cost of living, elimination of tiers and expedited paths for temporary employees to transition to full-time status.

Work-life balance: paid time off and a four-day work week.

The UAW has a fourth overarching objective: The union wants the companies to bring planned electric vehicle production, like assembly plants and battery-producing joint ventures, under the union's national master contracts.

For those jobs to become part of the UAW contract would require retooling existing plants to produce electric vehicles and parts, and facilitating union recognition of new assembly and battery sites, including those operating under joint ownership with foreign-based companies. New plants would become a point of contention, with the UAW seeking that union contracts carry over to the new sites, and automakers saying the UAW has to organize those workers.

The Big Three’s proposals have largely responded to the union’s demands, plus the companies' own performance-related considerations, such as Stellantis’ well-publicized efforts to reduce absenteeism on the shop floor.

Analysts estimate that the full cost of the union’s demands would more than double the average hourly labor costs of the companies, which now hover around $65, compared to $55 for the foreign automakers and $45 to $50 an hour for Tesla. Investors flinch at the prospect of such a steep climb, fearing such largesse would return the automakers to the financial precarity of 15 years prior.

UAW to GM president: Show me a Big 3 auto executive who'd work for our union pay

The companies – eager to placate investors by preserving what they view as competitiveness and flexibility – have balked at restoring retiree healthcare and defined benefit pension plans, resisted a 32-hour work week and viewed union representation of joint ventures as a matter for the union to take up with the management at specific sites. In certain cases, the automakers want to keep using temporary employees to maintain staffing flexibility.

Ford, Stellantis are making progress on union's demands

Ford and Stellantis have made offers narrowing the gap on key items. Based on what we know, the greatest divide is between the UAW and GM.

Ford has offered to raise pay by 20% (not compounded); restore the cost of living allowance; eliminate tiers at plants in Rawlinson and Sterling Heights; transition temps to full-time status within three months of continuous service; reduce the time required for employees to move to the top wage rate from eight to four years; grant workers the right to strike over plant closures; increase company contributions to defined contribution plans; grant laid off workers two years of pay with health care; make capital investments in all North American facilities; increase profit-sharing payments by more than 13%; add a paid holiday (Juneteenth); provide two weeks paid parental leave.

Stellantis has offered to raise pay by 20% (not compounded); provide for a cost of living allowance if the Consumer Price Index, the government's measure of inflation, exceeds 3%; eliminate tiers at MOPAR (the company's parts, service, and customer care division); grant workers the right to strike over plant closures and impose moratoriums on outsourcing; grant workers the right to not cross picket lines; give workers the ability to purchase an annuity guaranteeing lifetime income payments; add the Juneteenth paid holiday; allow employees to contribute up to 6% (on top of the company’s 6%) to defined contribution plans that would be matched by the company at 50%; contribute $1 per hour for healthcare to defined contribution plans.

Opinion alerts: Get columns from your favorite columnists + expert analysis on top issues, delivered straight to your device through the USA TODAY app. Don't have the app? Download it for free from your app store.

GM has offered to eliminate tiers at its Customer Service and Aftersales and Components Holding units; shorten the move from the bottom to top wage tier from eight to four years; raise wages by 20% (not compounded); provide for cost of living adjustments if inflation exceeds workers’ wage increases; provide majority pay for limited time for laid off workers; raise temp wages to $20 per hour; make a $1,000 additional contribution to defined contribution plans; provide a 25% increase in retirement healthcare contribution to defined contribution plans; provide two weeks parental paid leave; add the Juneteenth holiday; make a $500 payment to retirees. The expanded right to strike, cost of living adjustments, job security protections and a path to full employment for temporary workers remain points of contention.

Getting to a deal

How can the parties now close the deal?

By focusing on their common interest: Ensuring the businesses are successful enough to invest plentifully in the future.

There are options to close the gaps.

These include making multiple offers with evident tradeoffs between them to reveal the other side’s preferences for an overall package. The parties might also consider contingency contracts that tie increasing retirement funds to earned profits. In addition, they may agree that the companies would recognize the UAW at planned EV plants operated by the companies. Finally, both sides may agree to pilot programs to experiment with alternative work weeks.

In other words, to succeed, the parties must exhibit a certain degree of flexibility, and give-and-take. But such is the nature of collective bargaining – and despite each side's fiery rhetoric, compromise remains possible.

Marick F. Masters is a professor of business at Wayne State University in Michigan. This column first published in the Detroit Free Press.

United Auto Workers union boss set to announce next moves in strike against Ford, GM, Stellantis

How can the parties now close the deal?

By focusing on their common interest: Ensuring the businesses are successful enough to invest plentifully in the future.

There are options to close the gaps.

These include making multiple offers with evident tradeoffs between them to reveal the other side’s preferences for an overall package. The parties might also consider contingency contracts that tie increasing retirement funds to earned profits. In addition, they may agree that the companies would recognize the UAW at planned EV plants operated by the companies. Finally, both sides may agree to pilot programs to experiment with alternative work weeks.

In other words, to succeed, the parties must exhibit a certain degree of flexibility, and give-and-take. But such is the nature of collective bargaining – and despite each side's fiery rhetoric, compromise remains possible.

Marick F. Masters is a professor of business at Wayne State University in Michigan. This column first published in the Detroit Free Press.

United Auto Workers union boss set to announce next moves in strike against Ford, GM, Stellantis

Breck Dumas

Fri, October 6, 2023

United Auto Workers President Sean Fain is set to deliver his weekly address to members via Facebook live on Friday at 2 p.m. ET, at which time he is expected to announce the union's next moves in its ongoing simultaneous strike against Ford, General Motors and Stellantis.

The union's strategy of striking at certain plants and incrementally adding more targets against any of Detroit's Big Three as negotiations continue comes with an element of surprise and is designed to put pressure against the automakers and play them against each other.

Shawn Fain, president of the United Auto Workers (UAW), speaks during a UAW rally in Detroit on Sept. 15, 2023. Fain is slated to make his next address to members on Oct. 6, 2023, at 2 p.m. ET.

Since the strike began on Sept. 15 at one facility owned by each manufacturer, the UAW has expanded the strike twice, with Fain delivering the updates in his Friday video messages. GM was hit harder by the union both times while Ford was spared from the first escalation and Stellantis dodged the second.

Fain has vowed to increase strike targets at any automaker that is not making sufficient progress in contract talks from the UAW's perspective.

GM ESTIMATES $200M LOSS SINCE UAW STRIKE BEGAN

GM said Thursday it had delivered its sixth proposal to the UAW, marking its second offer this week after saying that "significant gaps remain" between the two sides as of Monday.

With the General Motors world headquarters in the background, United Auto Workers members attend a solidarity rally as the union strikes against the Big Three automakers on Sept. 15, 2023, in Detroit.

Sources told Reuters that progress was made this week in the UAW's negotiations with both Ford and Stellantis.

Currently, around 25,000 of the 150,000 UAW members employed by the Big Three are on strike, and the union has not ruled out expanding the strike nationwide if talks drag on.

Striking United Auto Workers members from the General Motors Lansing Delta Plant picket in Delta Township, Michigan, on Sept. 29, 2023.

GM said Thursday that the strike has cost the automaker around $200 million so far, and the company confirmed it secured a $6 billion line of credit the day before. Ford and Stellantis declined to provide estimates of losses when asked by FOX Business.

Data from Michigan economic consulting firm Anderson Economic Group show the UAW's strike against the Big Three cost the U.S. economy $3.95 billion in its first two weeks.

FOX Business' Joe Toppe and Reuters contributed to this report.

UAW Strike Against Detroit 3 Enters Day 21: Impact & Insights

Rimmi Singhi

ZACKS

Thu, October 5, 2023

The ongoing strike by the United Auto Workers (UAW) union continues to draw attention as it enters its 21st day. The UAW had initiated an unprecedented simultaneous strike against the Detroit 3 automakers — General Motors GM, Ford F and Stellantis STLA — after the contract expired on Sep 14 at midnight.

Thu, October 5, 2023

The ongoing strike by the United Auto Workers (UAW) union continues to draw attention as it enters its 21st day. The UAW had initiated an unprecedented simultaneous strike against the Detroit 3 automakers — General Motors GM, Ford F and Stellantis STLA — after the contract expired on Sep 14 at midnight.

The Intensifying Strike

The strike had initially affected three plants—GM's Wentzville Assembly plant in Missouri, Ford's Michigan Assembly plant in Wayne and Stellantis' Toledo Assembly Complex in Ohio. A week later, with no new labor contract in place, the UAW extended strikes to 38 parts and distribution centers across 20 states, primarily focusing on General Motors and Stellantis. Last Friday, UAW president Shawn Fain further expanded the historic strike to include a GM facility in Lansing, MI (which manufactures the Chevrolet Traverse and Buick Enclave) and a Ford assembly plant in Chicago (where Explorer and Lincoln Aviator models are built).

The historic strike began with around 13,000 autoworkers walking off initially. Another 5,600 workers at 38 GM and Stellantis-owned parts distribution centers in 20 states left their jobs last month. The union expanded its work stoppage last Friday, bringing the total number of striking autoworkers to 25,000, or 17% of the UAW's roughly 146,000 members.

Increasing Layoffs

Amid a tense standoff, the Big 3 Detroit automakers are also laying off thousands of workers.

On Tuesday, GM disclosed that it had furloughed 163 UAW workers at its Toledo Propulsion Systems plant, responsible for manufacturing transmissions for GM's Missouri and Lansing Delta Township assembly plants, which are currently impacted by the strike. In total, GM has been compelled to lay off 2,100 workers at five facilities across four states. Stellantis, the parent organization encompassing Chrysler, Dodge, Jeep, and Ram, has furloughed approximately 370 employees.

On Monday, Ford furloughed 330 employees in Chicago and Lima, OH. This is in addition to the 600 layoffs that the company executed just last month at an assembly plant in Wayne, MI. Yesterday, Ford announced an additional round of layoffs affecting 400 employees in the Detroit area, per Automotive News. The auto biggie specified that approximately 350 workers at Livonia Transmission and 50 workers at Sterling Axle have been informed not to report to work starting Thursday. In total, Ford has now laid off a total of 1,330 employees due to the strike.

Demands & Proposals

The UAW’s list of demands is extensive, including a 36% pay increase over four years, annual cost-of-living adjustments, pension benefits for all employees, enhanced job security measures, constraints on the use of temporary workers and a transition to a four-day work week among others. They also call for the elimination of the two-tiered wage system, which was adopted post the 2008 financial crisis.

The automakers, while acknowledging workers' concerns, argue that the UAW’s demands could potentially hamper their competitiveness in the global market. They have expressed their willingness to negotiate further to resolve the issues at hand.

This week, Ford presented its seventh and most robust offer to the union aiming to resolve crucial economic matters. In this offer, Ford has outlined remarkable enhancements in terms of wages, positioning its employees among the top 25% in the United States, encompassing both hourly and salaried positions, while also providing substantial benefits, product commitments for all UAW factories, and a strong commitment to job security. Simultaneously, the proposal ensures Ford's capability to invest and expand its operations.

The offer includes a notable wage increase to $21 per hour, a significant 26% raise for temporary workers, and the conversion of all temporary employees with at least three months of service to permanent status upon ratification. However, the UAW is yet to respond to this latest proposition.

On Monday, after an 11-day interval, the union presented its first comprehensive counteroffer to GM. Additionally, the UAW engaged in a fresh round of negotiations with Stellantis.

The High Stakes of UAW Strike

As the deadlock prolongs, the repercussions are being felt deeply across the industry.

The strike cost the auto industry $3.9 billion in the first two weeks, according to an assessment by the Michigan-based consulting firm Anderson Economic Group. This financial toll encompasses $325 million in worker wages, $1.12 billion in losses incurred by the automakers, $1.29 billion for parts suppliers, and $1.2 billion in dealer and customer losses. Such a financial strain in an already competitive market puts a significant burden on the auto industry.

The ripple effects are being felt across the auto parts manufacturers. Nearly 30% of auto parts manufacturers surveyed by the Motor Equipment Manufacturers Association have reported laying off some employees. An additional 60% anticipate further layoffs by mid-October if the strikes persist.

In anticipation of a prolonged strike, GM has secured a new $6 billion line of credit extending through October 2024. This move is seen as a strategic step to ensure financial stability amid the uncertainty surrounding the strike’s resolution. GM currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The industry awaits the UAW’s update on the negotiation status tomorrow, with the union either expanding the strike further (as it has done on the previous two Fridays) or announcing significant progress in the talks.

Conclusion

The UAW strike against the Detroit 3 automakers has evolved into a significant labor dispute with far-reaching implications for the industry and economy. As both sides stand their ground, the financial toll continues to mount, affecting not only automakers and workers but also parts suppliers and others in the automotive ecosystem.

Complex dynamics are at play as both parties navigate through the negotiations, striving to find a common ground amid contrasting economic and operational aspirations. The outcome of these negotiations will not only determine the fate of thousands of autoworkers but also shape the future of the American auto industry.

UAW strike leading to car parts shortage

Shaun Rabb

Fri, October 6, 2023

FORT WORTH, Texas - Car dealers across Dallas-Fort Worth are feeling the impact of the United Auto Workers strike as they deal with a parts shortage.

UAW President Shawn Fain said on Friday that he started to call the Arlington GM plant to strike, but the automaker agreed to some concessions.

While the plant in Arlington is still running, dealerships say they are struggling to find much needed parts.

Jim Hardick, the general manager at Moritz Chevrolet in Fort Worth, says he's been talking to other dealers with the same problem.

"We're all affected, you know. Our daily parts orders, we're not getting those in," he said.

A week ago two North Texas parts distribution plants along with 18 others nationwide took to the picket line.

"We took these cars in the last couple of three days. We have a lot back in the back and those are all cars waiting on parts a lot of them," said Hardick. "We got customers that come in, their car is under warranty, and you need parts and a lot of these parts we're not able to get. So, you know, we park their cars until we get that part is in."

The strategic strike by UAW against the Big Three, GM, Ford and Stellantis, has caused more than 30 percent of parts suppliers to make some layoffs.

"If we see this continue in the manner it has already started in, we expect that over 60 percent of suppliers will have some form of layoffs occur by mid-October," said Julie Fream from MEMA, the Vehicle Suppliers Association.

Moritz's new vehicle inventory has not seen a drop since the strike started.

"Because we had a build up a little bit of inventory prior to the strike, but as we get deeper into it, yeah, and again it's going to be every dealer," Hardick said.

Fri, October 6, 2023

FORT WORTH, Texas - Car dealers across Dallas-Fort Worth are feeling the impact of the United Auto Workers strike as they deal with a parts shortage.

UAW President Shawn Fain said on Friday that he started to call the Arlington GM plant to strike, but the automaker agreed to some concessions.

While the plant in Arlington is still running, dealerships say they are struggling to find much needed parts.

Jim Hardick, the general manager at Moritz Chevrolet in Fort Worth, says he's been talking to other dealers with the same problem.

"We're all affected, you know. Our daily parts orders, we're not getting those in," he said.

A week ago two North Texas parts distribution plants along with 18 others nationwide took to the picket line.

"We took these cars in the last couple of three days. We have a lot back in the back and those are all cars waiting on parts a lot of them," said Hardick. "We got customers that come in, their car is under warranty, and you need parts and a lot of these parts we're not able to get. So, you know, we park their cars until we get that part is in."

The strategic strike by UAW against the Big Three, GM, Ford and Stellantis, has caused more than 30 percent of parts suppliers to make some layoffs.

"If we see this continue in the manner it has already started in, we expect that over 60 percent of suppliers will have some form of layoffs occur by mid-October," said Julie Fream from MEMA, the Vehicle Suppliers Association.

Moritz's new vehicle inventory has not seen a drop since the strike started.

"Because we had a build up a little bit of inventory prior to the strike, but as we get deeper into it, yeah, and again it's going to be every dealer," Hardick said.

Once the strike is over Hardick says parts delivery will pick up again.

"Because I'm sure they would do things to try to expedite parts," he said.

Every day the strike goes on the backlog builds for vehicles needing repairs.

"We need that strike to end," Hardick said.

It is not just dealerships being impacted, after-market locations are having a hard time finding parts people need as well.

As for the strike, both sides are coming together, but have not reached a deal.

UAW Strike map: Here's where autoworkers have walked out

FOX 2 Staff

Fri, October 6, 2023

DETROIT (FOX 2) - The UAW strike is in its third week with no end in sight and, on Friday, union President Shawn Fain is expected to announce more striking locations. But which of the Big Three will be targeted remains to be seen.

Fain called a 2 p.m. update which will be streamed live on social media and in the player at the top of this page.

The UAW called the update but said little else about the nature of the update. Around 4:45 p.m. on Thursday, Fain indicated that more locations could one strike while perhaps one could be spared. Fain posted a meme on X that featured an edited photo from The Bachelor that replaced faces with the names of General Motors, Ford, and Stellantis with the caption "'Tune into @UAW's Facebook page at 2pm on Friday, October 6th to see who gets the rose!"

UAW members have made it clear through picketing: They're not giving in. Their requests for higher pay and the end of tiers have rung out through the U.S. over the past three weeks as union President Shawn Fain's multi-pronged approach to slowly call on local union chapters to strike against Ford, GM, and Stellantis is starting to affect the big three.