Evolving U.S.-Canada Relations Spark Shift in Strategy

- Recent shifts in US policy have caused Canada to reevaluate its long-standing relationship with its southern neighbor, leading to a focus on economic independence and trade diversification.

- Canadian federal politics have responded to US actions through tariffs and election results, reflecting a national desire for greater autonomy and a need to address regional economic concerns.

- Infrastructure projects and trade relationships are being reassessed in Canada to reduce dependence on the US, with an emphasis on developing internal resources and fostering new international partnerships.

For years, the US has been a stalwart ally to Canada, peacefully sharing the longest international land border in the world. The US and Canada have worked together to develop valuable north-south integration of energy infrastructure that benefits both nations and have partnered to develop common specifications and standards for many products, including petroleum fuels and passenger vehicles.

Recent political events have, however, placed Canada and the US at the cusp of a critical shift in their long and prosperous relationship. The future of the relationship may not yet be clear, but what has become apparent is that Canada is taking proactive steps to be master of its own destiny and reduce dependence on its southern neighbor to achieve prosperity amid the challenges imposed by the current US administration. Some of these actions may be to the detriment of both nations, but perhaps more so to the US. True to their form, Canadians seem to be saying – we are terribly sorry but now must look out for ourselves.

A brief history

Canada and the continental US have been in existence in their current form since 1793 when Britain ceded land to the 13 British North America colonies that led an insurrection known as the American Revolution. The border between the United States of America and what remained of British North America was established by the Treaty of Paris that ended the American Revolution. The border was challenged again during the War of 1812 when the US invaded Canada. This war ended in a stalemate and The Treaty of Ghent, signed in 1814, re-established the border as effectively unchanged. British North America eventually became Canada in 1867 when the confederation was formed.

Since the reconfirmation of the international border in 1814, the relationship between the US and Canada has largely been one of little contention. Some examples of this cooperation are:

- Harmonization of vehicle standards to allow ease of cross-border trade and integrated manufacturing

- Alignment of quality specifications for many fuels

- Harmonized system on hazardous chemicals classification and labelling

- Cooperation on food safety standards and food supply-chain certification

Canada and the US are deeply connected in many ways

Beyond cooperation on standards, Canada and the US are deeply connected by infrastructure, cross-border travel and trade and cultural similarities. From an infrastructure and trade perspective, Quebec, Ontario and British Columbia all have a strong tie to the US, exporting vastly more electricity to the south than what they provide to neighboring provinces. The Great Lakes waterway is a shared resource that enables trade between Canada’s eastern provinces and the US Northeast. Our railway system is closely linked, including CPKC, the only transnational railway in North America connecting Canada, the US, and Mexico. Canada’s petroleum industry has benefitted from having the US as a demand center with most of the nation’s crude oil being exported south via shared infrastructure that has been developed over decades. Western Canada’s natural gas benefits from market access to the Pacific and Rockies regions in the US. The US also benefits from this connectivity through the reliable and ratable supply of energy.

Canadians are a boon to the US tourism industry. In 2024, according to the US International Trade Administration (ITA), 20 million Canadian residents travelled to the US, in effect half of Canada’s population. Perhaps more important, though, is that Canadian visitors comprised almost 30% of the 72 million US international visitor arrivals. For many Canadians, the US offers ease of access, a diversity of travel opportunities from urban destinations to vast tracts of unspoiled wilderness, and an escape from bitter boreal winters.

While culturally very similar, there are some key differences between Canada and the US that makes each nation unique. Canada has always valued a strong social safety net, aiding those in need through government programs while the US values Individual freedom and charitable acts in lieu of government programs. Canadians value our publicly funded health care system and recognize that health outcomes are generally better and at a lower cost to society. Gun ownership is strictly controlled in Canada, with the benefit of having vastly lower per capita gun-related deaths. Access to high quality grade-school education is also valued in Canada, with teachers generally well-paid and schools funded equally based on student population. In sum, Canada has more socialistic values than the US but with perhaps less individual freedom. The gap in political philosophy between the two looks set to be widening further.

Is the Canada-US relationship permanently changed?

US President Donald Trump’s administration appears to be taking a vastly different stance with regards to its relationship with Canada, raising concerns over prosperity and national security for many Canadians. The ‘reciprocal tariffs’ proposed by the US – under the guise of stopping illegal immigration and the flow of fentanyl into the US – puts Canada’s economic growth at risk. Canadians struggle to understand how the US, Mexico, and Canada Agreement (USMCA) negotiated by the former Trump administration is no longer relevant. They also wonder how the almost inconsequential quantity of fentanyl entering the US from Canada could constitute a national emergency that warrants tariffs the likes of which have never been seen before.

The rhetoric on making Canada the 51st state has turned its citizens’ economic angst over the tariffs to anger. The combination of the tariffs and the threat of annexation make some Canadians view the US as waging economic warfare against it. Indeed, former Prime Minister Justin Trudeau publicly stated that President Trump’s threat to annex Canada is real. Canada has vast reserves of critical minerals, desirable access to the north, and an abundant supply of fresh water, all which make it valuable for future development. Canadians recognize the country lacks the might against an imperialistic US to defend its sovereignty if faced with economic warfare, or worse yet an insurrection from the south.

Canadians are taken aback by the abrupt shift in US diplomacy and have had its sense of economic and national security stripped bare. Canada has benefited from having the world’s largest economy on its doorstep and perhaps has not had to work as hard as other nations to develop trade relationships and national defense programs to ensure growth and security. While Canadians may be upset with the current stance of the US federal administration, many see the recent events as an opportunity to rebuild the nation into the confederation it was originally intended to be.

All Canadians are aligned in the hope that the relationship with the US will continue to remain cordial and ultimately return to one of mutual benefit. Still, it would be naïve for Canada to not diversify its trading portfolio and fundamentally change its economic exposure to the US, regardless of the diplomatic relationship returning to status quo. The US administration’s current actions are not aligned with Canada’s understanding of the USMCA and their historical relationship, but the ties between the two are not yet at an impasse. The US will always remain an important neighbor and Canadians hold no ill will for their American neighbors. Still, Canada needs to forge a different path.

First steps towards more Canadian economic autonomy

Canada has taken steps to respond to the US tariffs and the 51st state rhetoric. The federal government imposed 25% reciprocal tariffs on $30 billion of key goods from the US to target states that predominantly supported the Republican ticket, from orange juice and citrus fruit to motorcycles and whiskey. Some provinces removed all US alcohol from government store shelves to boycott the US wine and liquor industry. Some have adopted a buy-anything-but-American strategy, and grocery stores are helping by adding in-store labels to indicate the Canadian alternatives. Perhaps most notable, many are choosing to avoid traveling to the US for business and tourism. Canada’s land border crossings into the US are down 35% in March 2025 versus last year while air travel to the US is down 14%, according to Statistics Canada. Steeper declines are expected for April through August as Canadians choose to spend their travel budgets either within Canada, or to destinations other than the US.

So far, the measures taken by the Canadian government and by individual residents has had an impact on US exporters of goods. Canadian grocery retailer Loblaws reports a 10% increase in sales of Canadian goods so far, while Sobeys Inc. owner Empire Company Ltd. reports that the share of US goods purchases is “rapidly dropping”, according to a report in the Globe and Mail. US tourism is taking a hit with much fewer Canadians booking tours. US suppliers of whiskey, cotton and other materials have reported losing lucrative deals with Canadian retailers and manufacturers because of the tariffs. At least one US governor, Gavin Newsom of California, is attempting to court Canadian tourists to return to his state using a social media campaign.

Canadians are emboldened by the noticeable impact that its vast but sparsely populated nation has had so far. The economy and population are both about one-tenth the size of the US, but its land mass is slightly larger and its access to resources is immense. The trade war is not yet over, and while the current US executive branch has authority from Congress and the Supreme Court to impose the broad-brush tariffs, those levies will remain a risk despite any advancement of negotiations.

Canadian federal politics speaks volumes

Canada was due for a federal election no later than October 2025. It seemed a guarantee that the Conservative Party of Canada (CPC) led by Pierre Poilievre would win. After over nine years of a Liberal minority government, Canadians were ready for a change. The CPC platform of smaller government, lower taxes and less regulation resonated with Canadians, while the Trudeau Liberals were viewed as anti-oil, anti-gas and anti-development. Under Trudeau’s guidance, oil infrastructure projects were challenged, with much harsher rules on environmental and greenhouse gas impacts (Bill C-69). The Oil Tanker Moratorium Act was enacted, which prevents the shipment of oil along British Columbia’s west coast, the emissions costs under the Output Based Pricing System (OBPS) and consumer’s carbon tax were set to increase to $170 per tonne by 2030, and the Clean Fuels Regulation (CFR) was introduced. The oil sector emissions cap was also proposed but not yet made law. The challenging regulatory environment certainly led to several key energy and infrastructure projects being cancelled, particularly liquified natural gas export facilities and interprovincial petroleum pipelines.

When President Trump was inaugurated, though, the Canadian political landscape witnessed a sea change. Mark Carney was nominated the head of the Liberal Party to replace Justin Trudeau and called a snap election for 28 April. Carney is the former governor of the Bank of Canada and the Bank of England and is recognized for his experience on economic policy. Meanwhile, Poilievre’s populist rhetoric was sounding a bit too much like that of the new US administration and became viewed as a risk to Canada’s place in the world stage and its ability to protect its economy and borders from the might of the US. In a matter of weeks, the polls shifted to show a Liberal minority government as the likely outcome. Indeed, the Liberals ended up winning 170 electoral districts, only two shy of a majority.

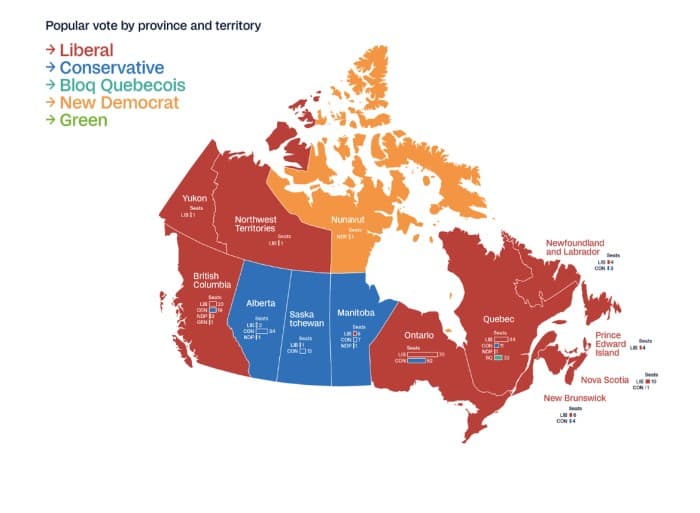

The Canadian federal election results sent several key messages to the politicians. Poilievre lost his seat in his home. The federalist Bloq Quebecois gave up 13 seats, while the New Democratic Party (NDP) lost 17 seats. The Liberals gained 16 seats, and the CPC gained 15 seats. The Bloq losing 37% of their seats, mainly to the Liberals, sends a clear message to the province of Quebec that federalist politics are not supported at this time of national crisis. The NDP losing 70% of its seats implies more pragmatism with respect to greenhouse gas emissions regulations is needed to lower costs for consumers and to create an economic environment that is friendlier to resource extraction and infrastructure investment.

The CPC gains were primarily made in Eastern Canada, reflecting a clear shift towards the center. The Liberal Party’s platform, spearheaded by Mark Carney, appeased more swing voters to retain the majority of Eastern Canada and in turn caused Poilievre to lose his seat in his home riding in Ottawa. Among those is a generational divide, with young voters who are concerned about housing unaffordability, crime and the cost-of-living coalescing around the Conservatives. It's a reversal from 2015, when youth voted in record numbers, helping sweep Carney's predecessor Justin Trudeau to power.

The country provincial leaders appear united once again as a confederation to support the economic recovery of Canada in the face of severe challenges from the US. Infrastructure projects thought to be long dead are now being discussed again. Oil pipelines across the nation, liquified natural gas (LNG) export facilities, mining developments and the removal of interprovincial trade barriers are all topics that are again on the table. The CPC supporters are, however, concerned that this new government is simply a continuation of past Liberal governments, and the development of the energy economy will continue to face significant barriers.

Is it an alienation of the West, energy industry or none of the above?

Canadian federal elections almost always show a clear political division with British Columbia often supporting the leftist parties (NDP and Green Party), Alberta and Saskatchewan invariably being deeply CPC, and the rest of the country, save Quebec, being mixed. Quebec oscillates between Liberal and Bloq, the Bloq being a federalist party that only runs candidates in Quebec.

With the re-election of the Liberal Party, there is a vocal group in Western Canada that is decrying Western alienation and is raising the alarm on the beleaguered energy industry. The previous Liberal government adopted strong greenhouse gas (GHG) emissions reduction policies. Western Canada’s primary source of revenue is oil and gas and saw these federal policies as particularly restrictive to economic growth and are likely fearing more of the same.

ell the frustration to ensure the conservative vote in Alberta sees economic opportunity.

Carney struck down the consumers’ carbon price on 1 April, thus lowering the cost of all fuels for homes and vehicles. The industrial pricing policy is still in place, and he has discussed strengthening it, which may make Canada an even more challenging country to invest in when it comes to major resource extraction projects. Before the election, Carney indicated he will not repeal the controversial Bill C-69, the federal impact assessment act that has been blamed for stalling many energy and infrastructure projects and is particularly contentious with Alberta’s conservative population.

Even so, if Carney is to be successful in his goal of reinvigorating Canada’s economy and developing new trade relationships with countries beyond the US, infrastructure will be needed. Canada is a large country with ocean access on three borders and no cross-Canada infrastructure other than roads and rail. He has stated his commitment to the expedited approval of infrastructure projects and included the concept of an energy corridor across the nation in his platform. Carney’s latest comments now indicate a willingness to change environmental legislation to enable investment in the country’s economic growth, perhaps a sign that his stance on Bill C-69 may be softening.

Actions Canada can take to decouple itself from the US as its dominant trade partner will require significant investment. The federal government can support this development by reducing regulatory burden and partnering with the provinces and First Nations on development corridors and approval processes. The opportunities are boundless and include:

- Petroleum pipelines to support the growth of crude oil supply and the export of crude oil, natural gas liquids (NGLs) and refined petroleum products to foreign markets.

- Upstream natural gas development, natural gas pipelines and liquefaction facilities to provide export outlets for Canada’s vast natural gas reserves.

- Critical mineral mining projects to harvest Canada’s resources.

- Rail infrastructure to debottleneck transportation across the nation to enable higher volumes of dry bulk exports.

- Polyethylene and polypropylene production facilities to compete in export markets.

- East/west electricity transmission to decouple exports from the US and keep made-in-Canada power in Canada.

Canada has cautious optimism for the future

While Canadians hold no ill will for their friends to the south, the political environment has shifted. The threat to its sovereignty and its economy from the current US executive branch has united Canada more than any event in the past excepting the World Wars.

The strong alignment in economic development across all provinces in the face of external risks is arming Canada with a new purpose. Made-in-Canada solutions and new trade relationships are now being sought, which could usher in a new era of economic prosperity. It is Canada’s time to grab its opportunities to ensure a bright future for the entire confederation.